One of the best perks of American Express cards that tends to fly under the radar are AMEX Offers, which give cardholders extra KrisFlyer miles, Membership Rewards points, or statement credits at selected merchants or for certain categories of spend.

Manual registration is required for AMEX Offers, but if you’re diligent enough and the offers happen to match your spending patterns, you can often recoup significant amounts of your annual fee, if not turn a profit altogether.

In fact, some AMEX Offers are almost as good as free money, so it’s definitely something you’ll want to pay attention to.

What are AMEX Offers?

Unlike other card issuers, which typically have “passive” offers that don’t require registration (e.g. pay with your card at Restaurant A and get 15% off the bill), AMEX has both “passive” and “active” offers.

As the name suggests, “active” offers require the cardholder to register in advance of spending, but don’t let that put you off- it takes just a couple of seconds.

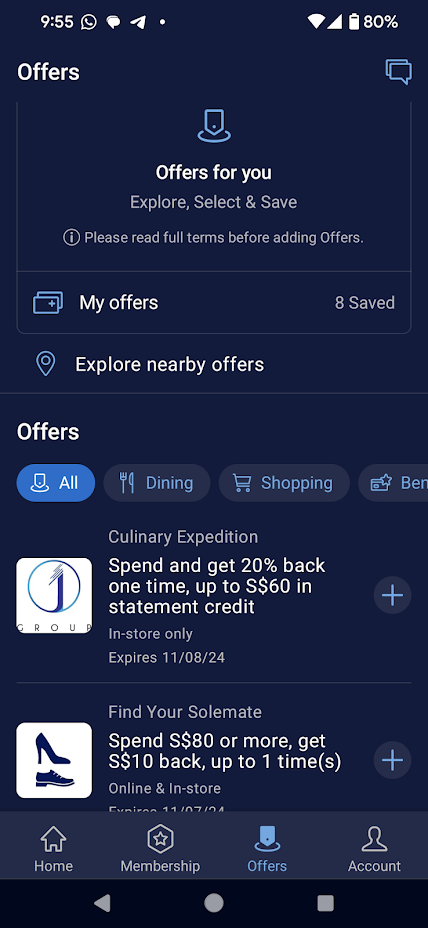

AMEX cardholders can register for offers via the Amex Singapore app (Android | iOS) or desktop banking portal.

- On the app, select your card and tap on Offers at the bottom to see available offers

- On the desktop banking portal, select your card and scroll to the bottom to see available offers

Offers are targeted, so there’s no guarantee you’ll receive the same ones as everyone else. In fact, there’s no guarantee all your AMEX cards will receive the same offer; it’s not uncommon to see an offer on AMEX Card A that isn’t available on AMEX Card B.

Each offer has its own set of T&Cs, and it’s important to read them carefully for key details such as:

- Whether there’s an overall registration cap

- How many times the offer can be used

- Whether the minimum spend for an offer must be made in a single transaction, or can be over multiple transactions

- Which outlets are participating

- Whether the offer is only for in-store spending, or can be used online too

Once registration is done, you can proceed to transact at the participating merchant. Any bonus miles, points, or statement credits from AMEX Offers will usually appear within 15 business days from qualifying spend, but in practice they post much faster. I usually see them within five business days at most.

Now let’s tackle some FAQs about AMEX Offers

Do AMEX Offers stack?

Yes. AMEX Offers stack with one another, as well as with any statement credits you may have.

Here’s an example of a recent stack I did at Basilico in Conrad Singapore Orchard, where the bill came up to S$489.

My Hilton Diamond membership reduced the bill by 25%, resulting in a net charge of S$366.89 to my AMEX Platinum Charge, where I had the following statement credits and AMEX Offers saved:

- S$105 off a min. spend of S$350 (AMEX Offer for Conrad Singapore Orchard)

- S$60 off a min. spend of S$300 (AMEX Offer for Hilton properties in Singapore)

- S$200 local dining credits (AMEX Platinum Charge annual statement credits)

Thanks to this, I paid just S$1.89 for my meal!

In terms of interaction between offers, all that matters is the total spend charged to your card.

For example, you might be worried that after the S$105 statement credit for Conrad Singapore Orchard is deducted from my S$366.89 bill, the remaining amount of S$261.89 is insufficient to trigger the S$60 statement credit for Hilton properties in Singapore. But it doesn’t matter- the system looks at your total spend of S$366.89, and that’s what triggers both the Conrad and Hilton offers simultaneously.

Any remaining amount charged to your card after the AMEX Offers are deducted is then offset by the AMEX Platinum Charge annual statement credits, if any.

How many times can I use an AMEX Offer?

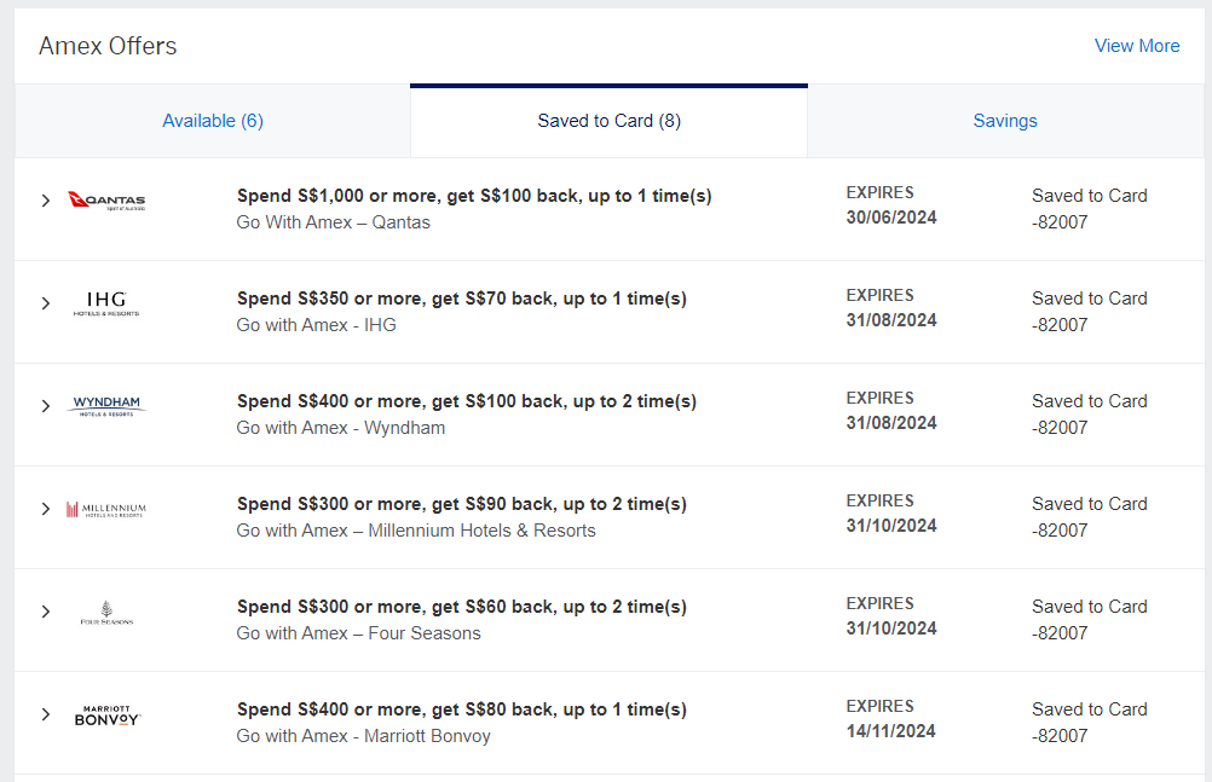

AMEX Offers will state how many times they can be used, but that limit applies per card.

If you have multiple AMEX cards, and they’ve all been targeted for the same AMEX Offer, there’s nothing stopping you from registering all of them and enjoying the offer multiple times.

Do AMEX Offers result in a clawback of points?

No. AMEX Offers act like a credit to your account, not a contra to the transaction that triggered it. This means you’ll earn points on the full amount of spend.

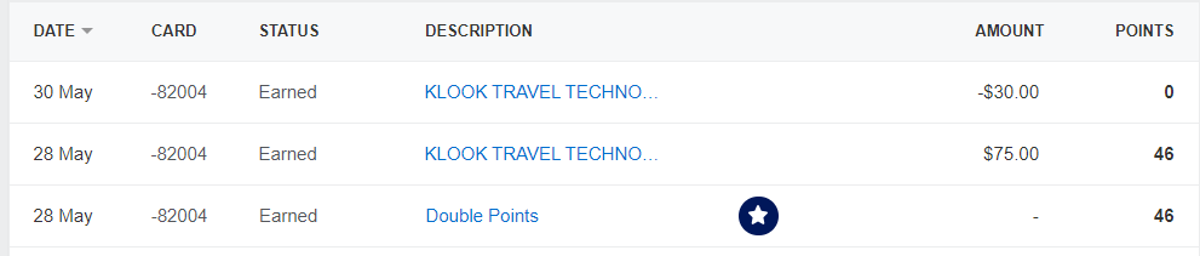

For example, I spent S$75 at Klook, which triggered an AMEX Offer giving me S$30 back. I earned a total of 92 points on this transaction (S$75 @ 2 points per S$1.60), with no clawback for the S$30 credit.

Do AMEX Offers count towards minimum spend for welcome offers?

By that same token, AMEX Offers do not act as a contra to the minimum spend for welcome offers.

For example, suppose I need to spend S$8,000 for my AMEX Platinum Charge welcome offer. I spend S$400 on my card and receive a S$100 statement credit from an AMEX Offer. The full S$400 will count towards my S$8,000 minimum spend.

Are AMEX Offers available to DBS/UOB AMEX cardholders?

AMEX Offers are usually reserved for American Express issued AMEX cards only, but there are a handful of offers open to holders of DBS/UOB issued AMEX cards too.

For example, the annual AMEX Shop Small campaign is open to registration for all AMEX cardholders in Singapore. DBS and UOB AMEX cardholders register via a separate landing page, since they can’t do so via the AMEX app.

Why don’t I see any AMEX Offers?

If you’ve just been approved for an AMEX card, it’s normal you don’t see anything in your AMEX Offers section. Offers usually take about one week to start populating.

If you know of an ongoing offer you’d like to register for, you can try to give customer service a call and see if they can manually register you.

Are AMEX Offers available to supplementary cardholders?

Yes. Supplementary cardholders can register for whatever AMEX Offers they see on their AMEX mobile app.

In fact, if you’re an AMEX Platinum Charge cardholder with an A/C card, your A/C card is also eligible to receive AMEX Offers. That’s one of the main reasons why people get an A/C card in the first place.

What if I forget to register?

Too bad. Any spending made prior to registration will not count towards attainment of the offer. Please don’t clog up the phone lines calling up and asking for an exception.

Conclusion

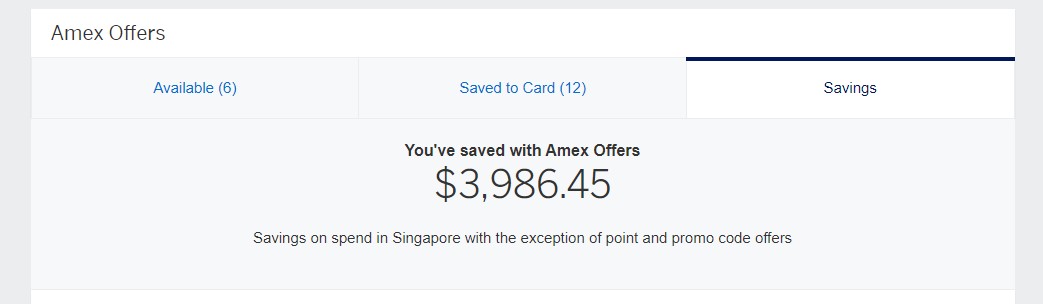

While I don’t normally use AMEX cards for general spending on account of their middling earn rates, the extra miles, points or savings from AMEX Offers can make it worthwhile.

Not every AMEX Offer is advertised via eDM or push notification, so it pays to check back every now and then to see if anything new has been added. I’ll usually write about the bigger ones, though you can also subscribe to MileLion Roars to learn about the smaller offers that are potentially useful, but don’t meet the threshold for a dedicated article

Hi Aaron, suggest to consider starting a whatsapp channel for milelion roars.