Well, that was a fun weekend.

On Friday, UOB Reserve Cardholders received an SMS alerting them to some upcoming rewards exclusions, including hospitals, utilities and yes, Amaze. Since there was no similar alert for other cardholders, there was some hope that the damage would be limited only to UOB’s top-tier card, but that was, in my opinion, pure, weapons-grade copium.

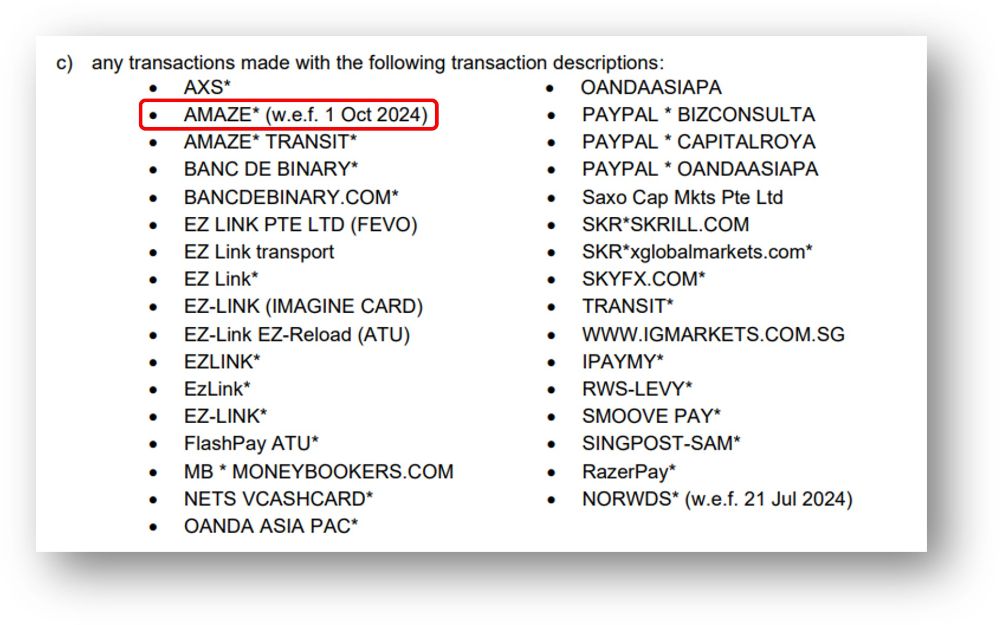

Sure enough, the T&Cs for UOB’s mass market cards were updated the following day, and long story short, Amaze becomes a UOB-wide exclusion from 1 October 2024.

There is a lot to be said here, and the dust will take some time to settle. But here’s what I’m thinking right now, in terms of implications and potential workarounds- none of them perfect.

Uncapped 3 mpd with KrisFlyer UOB Credit Card becomes harder to earn

One of the best features of the KrisFlyer UOB Credit Card is its uncapped 3 mpd on online shopping, provided you spend at least S$800 with the SIA Group (Singapore Airlines, Scoot, KrisShop) in a membership year.

The definition of shopping merchants is extensive, including big-ticket MCCs like jewellery and watches (MCC 5944), luxury bags (MCC 5948) and electronics (MCC 5732).

| Category | MCCs |

| Online Shopping | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5661, 5691, 5699, 5732, 5733, 5735, 5912, 5942, 5944-5949, 5999, 7278 (only for Shopee, Lazada and Qoo10) |

Now, not everything can be bought online, but with Amaze it didn’t matter, because Amaze converts offline spend into online spend while preserving the MCC.

That meant that if you were buying a S$10,000 engagement ring, for example, you could pair Amaze with your KrisFlyer UOB Credit Card to earn 3 mpd on the entire amount- much better than a 4 mpd card with a S$1,000 to S$2,000 cap.

Sadly, this has been nerfed in two big ways. The first came in April 2024, when Amaze added a 1% fee on SGD transactions in excess of S$1,000.

But that wasn’t fatal, insofar as FCY transactions of any amount were still fee free, and even where SGD transactions were concerned, one could argue that paying an extra 1% would justify the extra 1.8 mpd (when comparing Amaze x KrisFlyer UOB to a naked KrisFlyer UOB).

What is fatal is the exclusion of all Amaze transactions, which will make it much harder to tap the uncapped 3 mpd going forward (I believe that’s the idea!).

| ❓ What about pending transactions? |

|

As you probably already know, the KrisFlyer UOB Credit Card only awards 1.2 mpd upfront. The remaining 1.8 mpd (ironically called “accelerated miles”) is credited within two months after the end of the membership year. From what I gather, there’s some concern among cardholders that Amaze transactions posted before 1 October 2024 will nonetheless not earn the bonus 1.8 mpd if the accelerated miles are credited after 1 October 2024. I can’t read the mind of UOB, but I wouldn’t lose too much sleep over this. I think the T&Cs are very clear: so long as your transaction posts before 1 October 2024, Amaze transactions still count. |

Workarounds

If there’s an item you want to buy but it’s only available in-store, three workarounds I can suggest to turn it into an online transaction include:

- Paying with a BNPL service like Atome (MCC 5999)

- Buying gift cards online at a platform like Wogi (MCC 5947) or HeyMax (MCC 5311) before spending in-store

- Paying with ShopBack Pay, which preserves the underlying MCC but makes the transaction online

No more Amaze option for airlines, cruises and hotels

A UOB Lady’s Cardholder who chose Travel as his/her quarterly bonus category would be able to earn 4 mpd on airlines, cruises and hotels, among other things. That was extremely useful to have, given that these transactions are often in FCY.

The Amaze nerf kills this off, and what makes it worse is that there aren’t any viable alternatives. The Citi Rewards Card blacklists travel-related transactions, while the OCBC Rewards Card only whitelists shopping-related transactions like department stores.

Workarounds

Sorry, there’s no real workaround here.

Once October rolls around, the best you’ll be able to do is 4 mpd with a 3.25% FCY fee, using cards like the DBS Woman’s World Card (if online) or UOB Visa Signature (if in FCY). If it’s any consolation, there’s also a limited-time 5 mpd offer on the DBS Altitude with an FCY fee of 3-3.25%, so I’d certainly consider that too.

In the cold light of day, these aren’t terrible options. With Amaze x UOB Lady’s Card, you’re looking at 4 mpd with a 2% FCY fee (Amaze has no explicit FCY fee, but it does have a ~2% spread over Mastercard), or 0.5 cents per mile.

With a 4 mpd card and a 3.25% FCY fee, the cost per mile increases to 0.81 cents, obviously not as good as before but hardly game-ending. And if you can hop onboard the DBS Altitude promotion, the cost per mile can be as low as 0.6 cents (3% FCY fee on the Altitude AMEX with 5 mpd).

UOB$ merchant workaround no longer possible

Another use case for pairing Amaze with UOB was to circumvent the UOB$ merchant problem. For the uninitiated, UOB$ is UOB’s card-wide cashback rewards scheme, and swiping your cards at UOB$ merchants earns you same-merchant return cashback (usually at a terrible rate) instead of UNI$.

The simple solution was to pair your UOB card with Amaze, because this took UOB$ out of the picture altogether. That won’t be possible from 1 October 2024 onwards.

To be fair, the utility of this workaround was always marginal at best, for two reasons:

- UOB Lady’s Cards still earn 3.6 mpd at UOB$ merchants (base UNI$ aren’t awarded, but bonus UNI$ are)

- UOB$ merchants are all in Singapore

Therefore, all the Amaze pairing did was allow you to earn an incremental 0.4 mpd, while at the same time eating into your S$1,000 monthly domestic transaction cap (which you really should be saving for the Citi Rewards).

Workarounds

In the absence of Amaze, the main workarounds I can think of for UOB$ merchants are:

- Buying items online, instead of in the physical store (since UOB$ are only awarded for in-store purchases)

- Paying with Kris+

- Paying with ShopBack Pay

What Amaze options are left?

With UOB out of the picture (and DBS throwing in the towel back in June 2022), there are only two specialised spending cards left to pair with Amaze.

| 💳 Potential Amaze Pairings |

||

| Card | Earn Rate | Cap |

Citi Rewards Citi RewardsApply |

4 mpd1 | S$1K per s. month |

OCBC Rewards OCBC RewardsApply |

4 mpd2 | S$1.1K per c. month |

| 1. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 2. Clothes, bags, shoes and shopping (T&Cs) |

||

You could, of course, pair Amaze with general spending Mastercards too like the HSBC TravelOne (1.2 mpd) or Citi Prestige (1.3 mpd), but if you ask me the math doesn’t make sense.

For example, if your options were:

- Citi Prestige & Amaze for 1.3 mpd and 2% FCY fees

- UOB Visa Signature for 4 mpd and 3.25% FCY fees

You wouldn’t pick (1) unless you valued a mile at less than 0.46 cents, and if that were the case, you’d be collecting cashback instead of miles in the first place.

I’ll probably need to write a separate post on my post-nerf Amaze strategy, but it looks like Citi Rewards will have to hard carry most of it, with OCBC Rewards chipping in occasionally for department stores, fashion boutiques and outlet mall shopping.

Conclusion

UOB will be nerfing rewards for Amaze transactions from 1 October 2024, and while this wasn’t entirely unexpected, it still stings nonetheless.

For what it’s worth, it’s not completely game over for Amaze- though I do feel I’ve been saying that a lot over the past 12 months, as both Instarem and banks tighten their belts. I don’t think it should surprise anyone if Citi leaves the Amaze party by the end of this year, and with the OCBC Rewards Card’s appeal so narrow, that would more or less be it.

I’d be quite concerned right now, if I were Instarem.

So from October, UOB Lady’s with travel as bonus category will be 4mpd with 3.25% FCY fee right? Ie. same as DBS WWMC

UOB lady can include offline transactions at up to 2k/month. WWMC is online only max 1.5k/month.

Actually there isn’t much impact on uob lady card. just use it directly. With Amaze you can save a bit on FCY fees that’s all.

Not sure that Instarem executes well enough to understand the impact on its business. I have been trying to link my Citi Rewards card to Amaze for a month. I got the run around by the online Instarem staff, telling me it’s a Citi problem. Citibank confirmed it wasn’t their problem and I definitely saw an “approve” on my Citi app, so I agree it isn’t likely to be Citibank’s problem. So back to Instarem I go, and the customer rep gives me the same message for weeks, that their IT team is urgently attending to it and will get… Read more »

Citi’s team isn’t very good either, neither is the app fully reliable. I’ve had transactions where the app tells me approved and on the machine prints declined, and the money didn’t go through.

In your case I wouldn’t know where the problem really is but I wouldn’t put it past Citi.

I was from Nium. It is a shithole of a company so no surprises there.

is the miles game dead now ?

Pretty much, yes. Milelion might be going back to a normal job again soon!

Damn… my amaze+UOB KF for NTUC grocery going bye soon lol

Have you ever tried linking your card Fairprice app?

Paying it via fairprice app is considered online transaction.

It is way worse than what the article says. Until now you could get 4mpd using Amaze / UOB Lady’s card on literally all spend. That was $2k / month and 8,000 miles or 12,000 miles if depositing $10k in the UOB Lady’s Savings Account, gone – apart from any remaining spend that actually fits within the categories. So a loss of a free 144,000 miles per year, less a bit. Certainly over 100,000 free miles a year gone. The miles “game” is at death’s door.

How do you get lady’s on all spend

he basically defrauded them (and has been boasting about it on other article comment threads). select travel as bonus category, make a refundable reservation for $2k, then switch to wallet and cancel the booking. funds come back to amaze wallet. it’s because of people like this that uob nerfed amaze.

UOB should claw back these UNI$ from these abusers. And Amaze needs to improve their refund process to prevent such frauds.

Not just claw back, but straight away terminate their accounts and put them on blacklist permanently, refusing to do business with them.

They are the ones who did excessive manufactured spending this way, affecting the rest of us legitimate players who play by the rules.

And do you also think Citibank is being defrauded when you link their Rewards card to Amaze and then do a transaction in-person but have it processed as online? I guess it is using your logic.

Citibank CRMC case is not defraud – It is just a loophole to earn 10X on offline transactions which was converted to online by AMAZE.

UOB case is just straight obvious manufactured spending, which is against the T&Cs – the part where you refund the travel bookings to the Amaze wallet, cashing out Amazing wallet to GrabPay wallet, and then cashing out GrabPay wallet to bank account.

This one is really defrauding UOB through manufactured spend – Cashing out the refunded bookings to AMAZE and GrabPay wallets and then to bank accounts while getting 10X rewards.

Who says it is cashed out? It is spent via the wallet. No manufactured spend at all. Funny how u consider one case a loophole. So who defines a loophole then? Seems to me both cases are loopholes…..

Doesn’t matter whether if one cashes out anot. When the eWallet has an option to cashout, it will always be open to manufactured spend abuse.

Amaze wallet -> Grabpay wallet

Grabpay wallet -> Bank account

Amaze x Citi 10X online there is no cashout mechanism hence it is really normal spend. Nothing wrong with that.

anyone with an ounce of common sense and intellectual honesty will see clearly that the citi x amaze pairing is a completely different situation from making an artificial transaction with the sole purpose of manufacturing spend.

There is no manufactured spend. It is a way to top up the wallet and earn miles. Then spending is from the wallet. Do explain how that differs from the Amaze/Citi pairing

There is manufactured spend here.

1 – UOB Lady’s Credit Card (Travel category)

2 – Book travel via Amaze card link to UOB card

3 – Refund travel to Amaze wallet

4 – Cashout Amaze wallet to Grabpay wallet

5 – Cashout Grabpay wallet to Bank Account.

6 – Pay credit card bill from bank account

Step 5 is manufactured spending right here! Cashing out wallet to bank account!

Absolute Rubbish. You seem to be unaware that Amaze has added significant fees to cashing out from the Amaze wallet and no one with any brain would intentionally put money in the wallet with the intent to cash it out given those fees.

So no, there is not a manufactured spend. I suspect you are just annoyed that you were not smart enough to identify this loophole before it was closed.

But continue to use your Amaze/Citi loophole in the meantime. That will likely get closed in due course too…………..

I suspect you are just annoyed that you were not smart enough to identify this loophole before it was closed. FYI I never even think of using AMAZE in the first place because Citi is already aware of this loophole – Citi will exclude it sooner or later no matter what. CRMC has other ways to make transactions online like Wogi, FP app, Shopback etc. I don’t need AMAZE at all based on my use case. You seem to be unaware that Amaze has added significant fees to cashing out from the Amaze wallet and no one with any brain… Read more »

Shame. Was getting excited now that Apple Pay has finally rolled out.

Oh no.. this is really disappointing . I was pairing UOB Ladys and Citi Rewars which gives me $3k per mth to play with when I travel… now I’m down to $1k on Citi rewards..

UOB$ – Workaround should be to apply for a yuu card. Covers it well enough.

I know you are Mile-lion but would you do how Amaze can work with Cashback cards, if so, what are the options?

Maybank Family and Friends MC

Lol at these commenters saying the miles game is dead. The Amaze card is literally less than three years old. I wonder how people earned miles before that hmmm

overreactions? on the internet?? no way!!!

when one door closed, another door opened, like Fevo, Imagine and now Amaze