Here’s The MileLion’s review of the Maybank Visa Infinite, which once upon a time was probably the best-kept secret of the $120K segment. Cardholders received unlimited airport lounge visits and a generous limo benefit- with the first year’s fee waived.

But fast forward to today, and even though the first year’s fee is still waived, both the airport lounge and limo benefits have been nerfed considerably. And while the Maybank Horizon Visa Signature and World Mastercard have both received permanent buffs to air ticket and FCY spending, the Maybank Visa Infinite has been strangely neglected. The only thing cardholders received was a brief three month boost that has yet to return.

So the only thing this card really has going for it is the ability to earn rewards on insurance premiums, but that’s simply not enough to justify its hefty S$654 annual fee on an ongoing basis.

Maybank Visa Infinite Maybank Visa Infinite |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

|

| What do these ratings mean? |

|

| The Maybank Visa Infinite has little to offer for its S$654 annual fee, and is easily outclassed by its Horizon and World Mastercard brethren. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Maybank Visa Infinite

Let’s start this review by looking at the key features of the Maybank Visa Infinite.

|

|||

| Apply Here | |||

| Income Req. | S$150,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$654 (FYF) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and MAS, 2,000 points for Air Asia |

|||

Maybank actually offers two different Visa Infinite cards: the plain vanilla one (which is the focus of this article), and the Visa Infinite Diamanté (you know it’s fancy because of the accent).

The latter is reserved for Maybank Private Clients who maintain a minimum AUM of US$1 million, with perks such as 12 no-spend limo rides, six JetQuay Quayside services, six meet and greet services, and unlimited lounge access.

However, regardless of which card you end up with, there’ll be no metal cardstock for you- both cards come in regular, down-to-earth plastic!

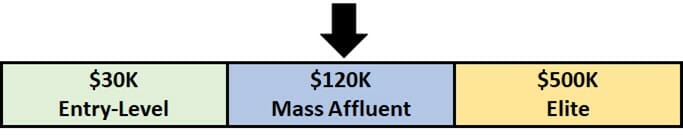

How much must I earn to qualify for a Maybank Visa Infinite?

When the Maybank Visa Infinite first launched in 2012, it had a minimum income requirement of S$200,000 per year. That’s now been cut to S$150,000, which is still 25% higher than the usual S$120,000 you’d expect for cards in this segment. It’s not clear how strictly Maybank enforces this requirement, however.

In case you were wondering whether it’d be possible to qualify with an income of S$30,000 p.a. provided you’re a Maybank Privilege Banking customer, the answer is no. Maybank Privilege Banking customers get the Maybank Privilege Horizon Visa Signature Card instead, a very different type of product.

How much is the Maybank Visa Infinite’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Waived | Free |

| Subsequent | S$654 | Free |

It may surprise you to know that when the Maybank Visa Infinite first launched, it had an eye-popping annual fee of S$1,400. That’s now come down to S$654 which, unusually for its segment, is waived in the first year.

No miles are offered upon approval or renewing this card. The subsequent years’ annual fees will be automatically waived with a minimum total spend of S$60,000 in a membership year.

All supplementary cards are free.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 2 mpd | N/A |

SGD/FCY Spend

Maybank Visa Infinite Cardholders earn:

- 3 TREATS points for every S$1 spent in Singapore Dollars

- 5 TREATS points for every S$1 spent in foreign currency (FCY)

5 points are worth 2 airline miles, so that’s an equivalent earn rate of 1.2 mpd for local spend and 2 mpd for overseas spend. It’s fairly pedestrian stuff for its segment, and even worse once you factor in the S$5 earning blocks (see below).

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd# | 3 mpd# |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2 mpd^ |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank #With minimum S$2K spend per statement month. Otherwise 1 mpd for both |

||

All FCY transactions are subject to a 3.25% fee, which means using your Maybank Visa Infinite Card overseas represents buying miles at 1.63 cents apiece.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

When are TREATS Points credited?

TREATS Points are credited when your transaction posts, which generally takes 1-3 working days.

How are TREATS Points calculated?

Here’s how you can work out the TREATS Points earned on your Maybank Visa Infinite Card.

| Local Spend (3X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 15 |

| FCY Spend (5X) |

Round down transaction to the nearest S$5, divide by 5, then multiply by 25 |

The minimum spend to earn points would be S$5, whether in local or foreign currency.

These S$5 earning blocks further compound its already lower-than-average earn rates, causing the Maybank Visa Infinite to perform significantly poorer than competitors, especially on smaller transactions.

Maybank Visa Infinite Maybank Visa Infinite1.2 mpd |

Citi Prestige Citi Prestige1.3 mpd |

|

| S$5 | 6 miles | 6.4 miles |

| S$9.99 | 6 miles | 11.6 miles |

| S$15 | 18 miles | 19.6 miles |

| S$19.99 | 18 miles | 24.8 miles |

| S$25 | 30 miles | 32.4 miles |

| S$29.99 | 30 miles | 37.6 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X/5,0)*15,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X/5,0)*25,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for TREATS Points?

A full list of transactions that do not earn points can be found in the T&Cs at point 2.2.

I’ve highlighted a few noteworthy categories below:

- Betting and gambling transactions

- Brokerage and securities transactions

- Government services

- Prepaid account top-ups, e.g. GrabPay and YouTrip

It’s a refreshingly brief list actually, and for avoidance of doubt, you will earn points on commonly-excluded transactions, such as hospitals, charitable donations, education, and even up to S$3,000 of insurance premiums per calendar month.

Is that reason enough to get this card? Not unless you spend a lot on these categories, and in SGD.

To illustrate, here’s how the Maybank Visa Infinite measures up to the Maybank Horizon Visa Signature. Notice how the Horizon out-earns the Visa Infinite for any spend in FCY, thanks to its 3.2 mpd earn rate (remember, it requires a minimum spend of S$800 per calendar month).

|

|

|

| Maybank Visa Infinite | Maybank Horizon | |

| Charitable Donations | 1.2 mpd 2 mpd | 0.24 mpd 3.2 mpd |

| Hospitals | 1.2 mpd 2 mpd | 0.24 mpd 3.2 mpd |

| Education | 1.2 mpd 2 mpd | 0.24 mpd 3.2 mpd |

| Insurance Premiums | 1.2 mpd 2 mpd | 0.24 mpd 3.2 mpd |

| Utilities | 1.2 mpd 2 mpd | 0.24 mpd 3.2 mpd |

| Local Earn FCY Earn | ||

The Visa Infinite performs better in SGD, but the incremental earn rate is 0.96 mpd. Assuming you value a mile at 1.5 cents, you’d need to spend more than S$45,417 on these categories just to breakeven on the S$654 annual fee (working: 654/0.015/0.96)!

What do I need to know about TREATS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

N/A |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 4 | 1-3 working days (to KF) |

Expiry

While TREATS Points normally expire after one year, Maybank Visa Infinite Cardholders are automatically enrolled into the Rewards Infinite programme. This means their TREATS Points never expire.

Pooling

TREATS Points pool with other Maybank cards. If you have 20,000 TREATS Points on the Maybank Visa Infinite, and 5,000 TREATS Points on the Maybank Horizon Visa Signature, you can redeem 25,000 TREATS Points at one go.

This also means that if you cancel your Maybank Visa Infinite Card, you won’t lose your accumulated TREATS Points unless it happens to be your very last TREATS-earning card.

Transfer Partners & Fees

TREATS Points can be transferred to the following partners:

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000: 10,000* | |

| 12,500: 5,000 | |

|

12,500: 5,000 |

|

4,000: 2,000 |

| *You must convert KrisFlyer miles via the TREATS SG app (Android | iOS) to enjoy this rate. Manual conversion receive an inferior rate of 30,000 points = 10,000 miles | |

Conversion fees are waived for Maybank Visa Infinite Cardholders, and since TREATS Points pool, you can use the Maybank Visa Infinite Card as a conduit to convert TREATS Points earned on other Maybank cards for free.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-3 working days.

Other card perks

Four complimentary lounge visits

The Maybank Visa Infinite used to offer unlimited Priority Pass lounge visits. However, from 1 August 2023 that allowance was cut to just four. Four!

Lounge visits are issued to principal cardholders only, and cannot be shared with guests. This is simply not good enough compared to other cards in the $120K segment.

| 💳 Airport Lounge Benefits (income req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE OCBC VOYAGE |

Dragon Pass | ∞ | 2 |

Citi Prestige Citi Prestige |

Priority Pass | ∞ + 1 guest | N/A |

UOB VI Metal Card UOB VI Metal Card |

Dragon Pass | ∞ + 1 guest | N/A |

DBS Vantage DBS Vantage |

Priority Pass | 10 | N/A |

SCB Visa Infinite SCB Visa Infinite |

Priority Pass | 6 | N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A | N/A |

To apply for your Priority Pass membership, look in the eCoupon section of the TREATS SG app for a unique registration code, which you’ll need to register via this link.

Complimentary airport limo, JetQuay or hotel day-pass

Principal Maybank Visa Infinite Cardholders who spend at least S$3,000 in a given calendar month will be entitled to book either:

- 1 complimentary one-way airport limo transfers, or

- 1 complimentary Quayside service at JetQuay, or

- 1 complimentary day-pass to gym and pool at PARKROYAL COLLECTION Marina Bay

A maximum of eight limo or JetQuay services, or six day-passes can be booked per calendar year.

Prior reservations are required:

- Limo transfer/JetQuay: At least three days and up to two months before

- Day-pass: At least two weeks before

Airport limo

In my opinion, the airport limo transfer is the most useful benefit, and prior to July 2023, S$3,000 spending would be enough to unlock two limo rides!

That’s now been reduced to one ride, but all things considered, the Maybank Visa Infinite still offers one of the lowest spending requirements on the market.

JetQuay

Alternatively, Maybank Visa Infinite Cardholders can opt for Quayside service at JetQuay, which includes check-in at a private terminal and the use of lounge facilities before being driven to their gate in an electric buggy.

I visited the JetQuay back in 2019 and was roundly unimpressed. It’s old and tired, the F&B selection is poor (think instant noodles and prepackaged snacks), and while the service is good, there’s no reason why you should choose to stay here over, say, the SilverKris Lounge or any oneworld lounge at Changi for that matter.

For what it’s worth, there are plans to redevelop JetQuay into a “premium travel hub” by 2025, and all I can say is “it’s about time”. The current space is just miserable, and completely not worth the S$400 asking price.

Hotel day-pass

Day-passes are valid for use at the PARKROYAL COLLECTION Marina Bay, and grant access to the pool and gym for a day.

However, the requirement to make a booking at least two weeks in advance means you can’t use this as a spur-of-the-moment thing, which greatly diminishes its usefulness.

Golf benefits

The Maybank Regional Golf programme offers principal Maybank Visa Infinite Cardholders complimentary green fees at more than 100 participating golf clubs across 19 countries.

Cardholders must spend at least S$2,000 in the previous calendar month to enjoy this benefit, and can book a maximum of two flights per month per cardholder. In Singapore, the participating clubs are:

- Sembawang Country Club

- Warren Golf & Country Club

- Orchid Country Club

- 2 additional “premium golf clubs” (not named)

Golf perks offered by other credit cards normally require a paying guest, but no such requirement exists for Maybank Visa Infinite Cardholders who book clubs in Singapore, Malaysia, Indonesia and the Philippines.

The T&Cs of the Maybank Regional Golf programme can be found here.

For avoidance of doubt, this is a separate perk from the generic Visa Infinite golf benefit, which has no minimum spend requirement.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | N/A |

| Others | Missed Connection :S$400 Luggage Delay: S$400 Lost Luggage: S$1,000 |

| Policy Wording | |

Maybank Visa Infinite Cardholders receive complimentary travel insurance when they charge their full travel fares to their card. Unfortunately, coverage will not apply in situations where you redeem miles for an award ticket, and charge the taxes and fees to your Maybank Visa Infinite Card.

This features up to S$1,000,000 coverage for accidental death or total permanent disablement, S$400 for luggage delays or missed connections, and S$1,000 for luggage loss.

However, there is no coverage for medical expenses or emergency medical evacuation. Because of this, I highly advise that you purchase comprehensive travel insurance elsewhere.

Visa Infinite benefits

As a Visa Infinite card, Maybank Visa Infinite cardholders enjoy the following additional perks:

- Avis President’s Club status

- 50% off weekday golf at 50 participating golf clubs across Southeast Asia

- 50% off weekday golf at Sentosa Golf Club

- Visa Luxury Hotel Collection

More details on these benefits can be found in the post below.

Terms & Conditions

Summary Review: Maybank Visa Infinite

|

|||

| Apply Here |

I realise the Maybank Visa Infinite has its fans, but I can’t say I’m one of them. With the airport lounge and limo benefit nerfed last year, low earn rates, S$5 earning blocks and limited transfer partners, the only reason I could think for getting this card is if you spend big (ideally at least S$60,000 so you get the fee waived) on commonly-excluded transactions like insurance premiums, hospital bills, education and donations, in SGD.

That last part is important– in SGD. If you’re spending in FCY, you might as well get a Maybank World Mastercard or Maybank Horizon Visa Signature, which earn up to 3.2 mpd on those transactions without the need for a hefty annual fee.

Otherwise, it’s just very difficult to make a case for the Maybank Visa Infinite when you could get a Citi Prestige with much better perks for a 10% lower annual fee.

“^From second year onwards, with min S$50,000 spend in the previous membership year, otherwise (or if first year) 1 mpd (SGD) and 2 mpd (FCY)”

The minimum spend is $60,000 in membership year.

incorrect. the min spend for those rates is $50k per membership year- refer to hsbc website.

Sadly, another nerf for complimentary parking at JetQuay, as per https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/vi-privilege-tnc.pdf

“complimentary car parking will be temporarily unavailable after September 2024.”

Maybank just changed their benefits for VI. Probably need to revise your article.

yup, saw it! those benefits only take effect from 1 january 2025, so will leave it till then.

however, my quick take is that nothing has changed. this merely means the Maybank VI now matches the maybank world mastercard, but that should have been the bare minimum. I still don’t see any reason to pay the annual fee

Latest nerf: No more complimentary limos for insurance spend wef 1 Jan 2025. Triple confirmed by CSO when I tried to book a limo last month, even though the new T&Cs still hasn’t been uploaded and the current version on Maybank’s website (Nov 2024 version) still provides otherwise.

However the CSO said that insurance spend still accrues TREATS points, at the base rate of 1.2mpd (and remains capped at $3k per mth).

https://www.maybank2u.com.my/maybank2u/malaysia/en/personal/announcements/2024/april/airmiles-conversion-revision.page I think you’d need to update your blog. Since last May, it’s 10 points for 1 mile, nowhere near 1.2mpd!

Hi Aaron,

How do you get 1.2 MPD when this Maybank website says its 10,000 points to 1,000 miles since May 2024?

https://www.maybank2u.com.my/maybank2u/malaysia/en/personal/announcements/2024/april/airmiles-conversion-revision.page

Thanks

James

hint: check the URL.

LOL

Jetquay benefit has been axed as of 1Jan 2025

They waived off my annual fee for my 2nd year but they said I won’t get the 4x lounge access because they waived. So still worth to get it for insurance premiums.

This is a saver, I don’t mind trading my lounge access for annual fees.

Looks like they’ve recently excluded charitable donations and insurance premiums from points / miles eligibility.

Continued nerfing underway:

https://www.maybank2u.com.sg/en/personal/about_us/important-notices/2025/revision-maybank-tp-rewards-programme-general-tnc.page

“With effect from 1 April 2025, Maybank TREATS Points Rewards Programme General Terms and Conditions will be revised. The key revisions are summarised below:

A S$25 conversion fee will be applicable for Maybank World Mastercard and Visa Infinite Cardmembers for redemption of air miles.

Frequent Flyer Program (FFP) fee waiver will continue to be applicable to Maybank Diamanté Metal Visa Infinite and Maybank Diamanté Visa Infinite Cardmembers.

S$25 FFP fee will be applicable for all other cards.”