With year-end travel now underway, the Citi Prestige Card has launched a new foreign currency (FCY) spending promotion that upsizes the earn rate from the usual 2 mpd to 4.5 mpd, from now till 28 February 2025.

You might recall we saw a similar offer towards the end of 2023, but there’s some big changes this year— most notably the minimum spend requirement, which is now a hefty S$28,000!

| 💳 Citi Prestige Card Year-End FCY Promo | ||

| 2023 Offer | 2024 Offer | |

| Duration | 1 Nov 23 to 31 Jan 24 | 1 Dec 24 to 28 Feb 25 |

| Earn Rate | 4.5 mpd | 4.5 mpd |

| Min. Spend | S$8,000 per month | S$28,000 for entire promo period |

| Bonus Cap | S$5,000 per month | S$8,000 for entire promo period |

| Registration Cap | 3,000 customers | 6,000 customers |

S$28,000 is an intimidating figure for sure, and I almost feel bad for making fun of the DCS Imperium for requiring a minimum spend of S$25,000 to unlock an uncapped 4 mpd on FCY spend!

There’s also a 6,000 cap on registrations, and an S$8,000 cap on bonus miles, so read on for the full details.

Citi Prestige offering 4.5 mpd on FCY spending

From 1 December 2024 to 28 February 2025, Citi Prestige Cardholders can earn 4.5 mpd on both in-person and overseas FCY spending.

Registration is required, and can be done via the Citi Mobile App. Tap on ‘For You’ and scroll down until you see the banner for Citi Prestige Card Foreign Currency Promotion.

Enrolment is capped at the first 6,000 registrations. You will receive a push notification confirming your enrolment. Supplementary cardholders need not register; any spending they make will be added to the main cardholder’s in computing the minimum spend and bonus points.

Once registered, cardholders must spend at least S$28,000 during the entire promotion period (see next section for details on minimum spend), to trigger an extra 2.5 mpd on all qualifying FCY transactions. This, combined with the regular base rate of 2 mpd, gives a total of 4.5 mpd.

| Base | Bonus | Total |

| 2 mpd No cap |

2.5 mpd Cap at S$8K |

4.5 mpd |

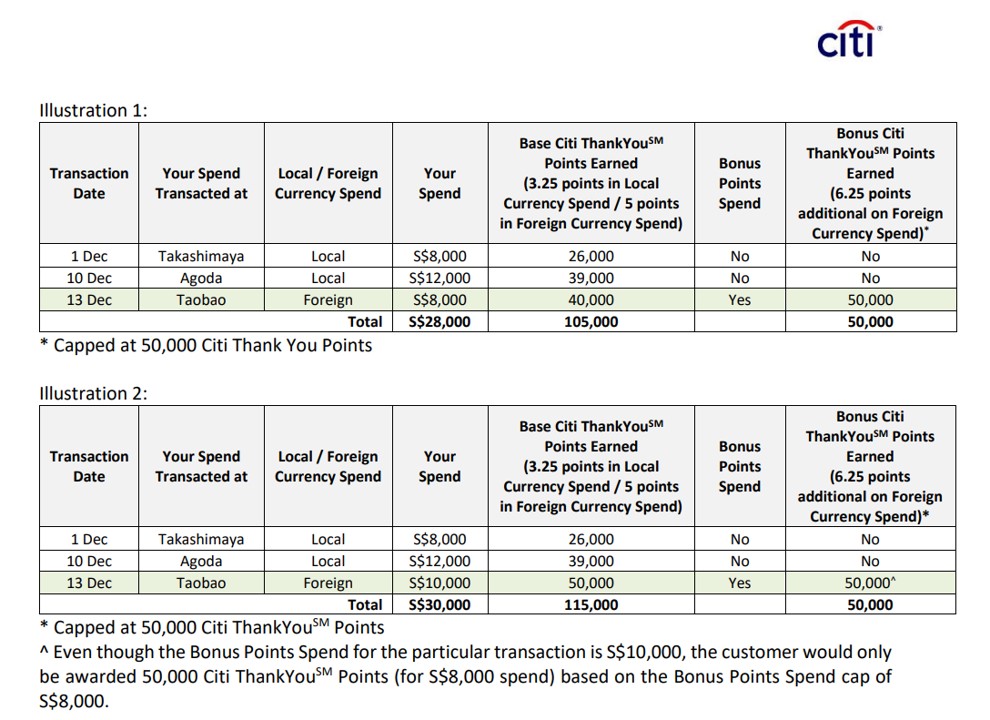

Both in-person and online FCY spend is eligible for the bonus, and Citi has provided the following illustrations.

For the avoidance of doubt, the extra 2.5 mpd will apply to all eligible FCY transactions made during the promotion period, not just from the time the minimum spend was met.

The bonus component is capped at S$8,000, which means the maximum bonus you can earn is capped at 20,000 miles for the entire promotion period (or 36,000 miles once the base is factored in).

Is it worth it?

The Citi Prestige Card has an FCY transaction fee of 3.25%, so given a 4.5 mpd earn rate, the approximate cost per mile is 0.72 cents. Do note that the cost per mile will be increased if you use a fee-paying service like Citi PayAll to make up the minimum spend.

That would be a reasonable price to pay for most people, though it should be noted that pairing the Citi Rewards Card with Amaze will give 4 mpd with an implicit FCY fee of 2%, so I’d focus on exhausting the S$1,000 cap on that pairing before turning elsewhere.

How does the minimum spend work?

Citi Prestige Cardholders must spend at least S$28,000 during the entire promotion period to qualify for the 4.5 mpd FCY earn rate.

The minimum spend consists of all SGD and FCY retail purchases, whether online or offline, excluding the following:

| ❌ Excluded Transactions |

| (i) any Equal Payment Plan (EPP) purchases; (ii) refunded/disputed/unauthorised/fraudulent retail purchases; (iii) Quick Cash and other instalment loans; (iv) Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes; (v) bill payments made using the Eligible Card as a source of funds; (vi) late payment fees; (vii) any other form of service/ miscellaneous fees; or (viii) Citi Payall transactions where the customer is not charged the Citi Payall service fee |

Citi PayAll will count towards the minimum spend, provided the service fee is paid. There is currently a promotion that offers 1.75 mpd on all Citi PayAll transactions till 28 February 2025, subject to a minimum spend of S$5,000. This reduces the cost per mile to 1.49 cents, and while it’s not as generous as before, might still be worth considering.

Citi PayAll launches 1.75 mpd promotion; buy miles at 1.49 cents

It’s also worth noting that even though transactions like education, insurance premiums, charitable donations and GrabPay top-ups will not earn base points, they will still count towards minimum spend. If you can’t earn points with these on any other cards, you might as well put them on the Citi Prestige to help meet the minimum spend.

What transactions are excluded?

Citi has provided a list of transactions which will not be eligible to earn 4.5 mpd under the FCY spend promotion.

Excluded spend

i. annual fees, interest charges, late payment charges, GST, cash advances, instalment/easy/extended/equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by Citibank);

ii. funds transfers using the card as source of funds;

iii. bill payments (including via Citibank Online or via any other channel or agent);

iv. payments to educational institutions;

v. payments to government institutions and services (including but not limited to court

cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra government purchases);

vi. payments to insurance companies (sales, underwriting, and premiums);

vii. payments to financial institutions (including banks and brokerages);

viii. payments to non-profit organizations;

ix. betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel;

x. any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts;

xi. transit-related transactions;

xii. transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank, as sent out in www.citibank.com.sg/rwdexcl (this list of excluded Merchant Categories or merchants may be updated from time to time at our discretion and Eligible Cardmembers shall refer to this list for any updates); OR

xiii. Dynamic Currency Conversion transactions, which refers to card transactions (including online and overseas transactions) where final transaction amount is converted into Singapore dollars via dynamic currency conversion (a service offered at certain ATMs and merchants which allows a cardmember to convert a transaction denominated in a foreign currency to Singapore Dollars at the point of withdrawal/sale).

| ⚠️ It won’t work with Amaze |

| Amaze converts all FCY transactions into SGD, so you will not earn the bonus on Amaze transactions charged to your Citi Prestige Card. However, Amaze transactions will count towards the minimum spend. |

To reiterate, some of these transactions (such as education and insurance) can count as minimum spend to help you reach the S$28,000 mark, but they won’t be eligible to earn any points whether base or bonus.

Minimum spend vs qualifying spend

Since these two concepts are sometimes confused, it might be good to have a brief section explaining the difference between minimum spend and qualifying spend.

The S$28,000 minimum spend required to unlock this offer can also be part of qualifying spend. For example, if I were to spend the equivalent of S$28,000 in FCY, I would earn 4.5 mpd on S$8,000, and 2 mpd on the remaining S$20,000 (since the cap is busted).

However, minimum spend may also not be part of qualifying spend. For example, if I were to spend S$28,000 in SGD, I would then qualify to earn 4.5 mpd on up to S$8,000 of FCY spending, but not on the S$28,000 already spent (since it’s non-qualifying).

In all likelihood, most cardholders will have a mixture of the two, especially if they’re planning to use Citi PayAll to meet the threshold.

When will bonus points be credited?

Citi Prestige Cardholders will initially receive the regular 2 mpd earn rate for all FCY transactions.

The bonus 2.5 mpd will be credited (in the form of ThankYou points) within three months from the end of the promotion period, i.e. by 31 May 2025.

In a nod to their sometimes tardy fulfilment, there’s a wry line in the T&Cs saying “Citibank may extend the date of crediting with notice”!

Terms & Conditions

The T&Cs for this offer can be found here.

What can I do with ThankYou points?

ThankYou points earned on the Citi Prestige Card never expire, and can be transferred to a total of 11 different transfer partners at the ratios below.

| Partner | Transfer Ratio (ThankYou Points: Miles) |

|

25,000:10,000 |

| 25,000:10,000 | |

| 25,000:10,000 | |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

| 25,000:10,000 |

Transfers cost a flat S$27.25, regardless of the number of points converted.

Conclusion

|

|||

| Apply |

Citi Prestige Cardholders can now earn 4.5 mpd on FCY spending from now till 28 February 2025. The main hurdle here is the hefty minimum spend of S$28,000, though you can use Citi PayAll to help meet it.

Citi has also decided to cap the maximum number of eligible cardholders at 6,000, so I’d highly recommend taking a couple of seconds to register now, just in case.

I would then qualify to earn 4.5 mpd on up to S$5,000 of FCY spending, but not on the S$28,000 already spent (since it’s non-qualifying).

Why up to S$5,000 FCY and not the S$8,000 cap?

typo

8k, will correct that

Will purchase of Marriott points consider as Foreign spend by Citi Prestige for this promo listed? Please advise

Hi Aaron, would Card Up transactions also qualify for the 28K minimum spend, or only Citi PayAll?

Hang on- it’s a foreign currency promo but the cap on foreign spend is 8k? So the rest needs to be in Singapore? That’s mad – what kind of non promotion is this?

Oh another point related to Prestige- their concierge is absolutely horrendous. Worse serve I’ve had compared to any other type of concierge. They should really not advertise it.

Tell me about. The most dreaded work I need to perform in order to get that 1 night hotel rebates.