Citi has launched a new overseas spending promotion for its Prestige cardholders, which offers up to 4.5 mpd on foreign currency (FCY) spending from now till 31 January 2024.

There’s an S$8,000 minimum spend required each month (which can be in any currency), and a S$5,000 monthly cap on FCY bonus miles.

There’s also a registration cap of 3,000 cardholders, unlike the concurrently-launched one for the Citi PremierMiles Card, though for what it’s worth the Prestige offer includes online and in-person transactions while the PremierMiles only rewards in-person transactions.

I’ve covered that in a separate article, which can be found below.

Earn up to 4.5 mpd on FCY spending

Registration

To register for this offer, the principal cardholder must send the following SMS to 72484.

|

| 📱 SMS to 72484 |

| CITIPRESFX<space>Last 4 digits of your Citi Prestige Card e.g. CITIPRESFX 1234 |

Registration is capped at the first 3,000 Citi Prestige Cardholders. You are only considered enrolled once you receive a confirmation SMS from Citi.

Once registration is completed, you will be eligible to participate from the start of that month onwards (e.g. registration on 15 December 2023 means that your spending from 1 December 2023 to 31 January 2024 will be entitled to earn up to 4.5 mpd).

Minimum spend

Once registered, Citi Prestige Cardholders must spend at least S$8,000 in a given calendar month to qualify for the 4.5 mpd FCY earn rate in that calendar month.

The minimum spend consists of all SGD and FCY retail purchases, whether online or offline, excluding the following:

| ❌ Excluded Transactions |

| (i) any Equal Payment Plan (EPP) purchases; (ii) refunded/disputed/unauthorised/fraudulent retail purchases; (iii) Quick Cash and other instalment loans; (iv) Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes; (v) bill payments made using the Eligible Card as a source of funds; (vi) late payment fees; (vii) any other form of service/ miscellaneous fees; or (viii) Citi Payall transactions where the customer is not charged the Citi Payall service fee |

For avoidance of doubt, Citi PayAll transactions will count towards the minimum spend, provided you pay the service fee. Citi PayAll is currently running a promotion till 29 February 2024 which offers 1.8 mpd on all payments, reducing the cost per mile to 1.2 cents. You can read more about that in the post below.

Citi PayAll offering 1.8 mpd on all payments; buy miles at 1.2 cents each

You can choose to participate in all three months of this offer by meeting the minimum spend in each month, or just selected months if you wish.

Qualifying spend

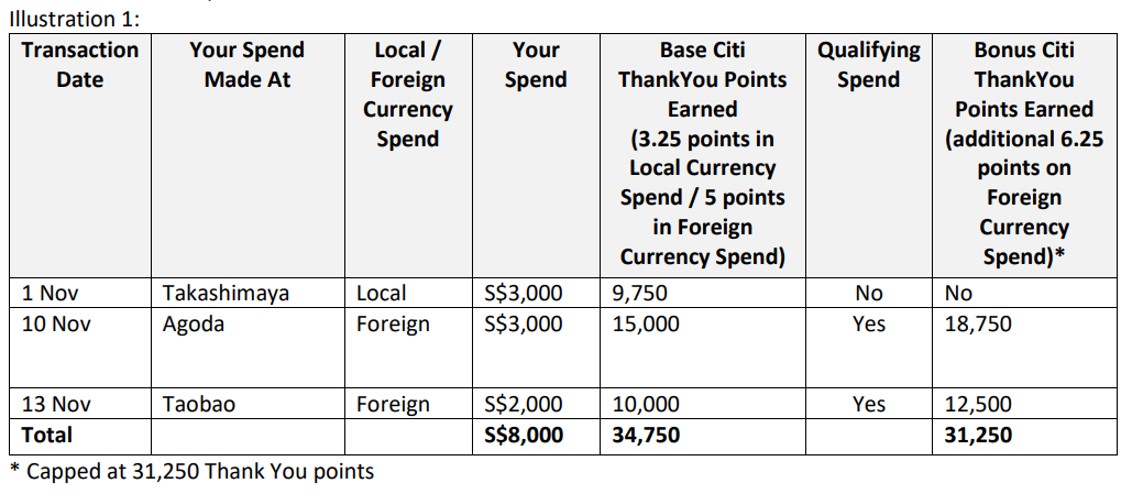

Citi Prestige Cardholders who meet the minimum spend will earn an extra 2.5 mpd (in the form of an extra 6.25 ThankYou points per S$1) on all qualifying FCY transactions. This, combined with the regular base rate of 2 mpd, gives a total of 4.5 mpd.

| Base | Bonus | Total | |

| FCY Spend | 2 mpd | 2.5 mpd | 4.5 mpd |

The bonus component is capped at 31,250 ThankYou points (12,500 miles) per calendar month, which means you’d max out the offer with a monthly spend of S$5,000.

Both in-person and online spending counts here- Citi makes this clear in its illustrations which include Agoda and Taobao.

Qualifying spend excludes the usual suspects such as charitable donations, education, and insurance premiums.

Excluded spend

i. annual fees, interest charges, late payment charges, GST, cash advances, instalment/easy/extended/equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by Citibank);

ii. funds transfers using the card as source of funds;

iii. bill payments (including via Citibank Online or via any other channel or agent);

iv. payments to educational institutions;

v. payments to government institutions and services (including but not limited to court

cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra government purchases);

vi. payments to insurance companies (sales, underwriting, and premiums);

vii. payments to financial institutions (including banks and brokerages);

viii. payments to non-profit organizations;

ix. betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel;

x. any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts;

xi. transit-related transactions;

xii. transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank, as sent out in www.citibank.com.sg/rwdexcl (this list of excluded Merchant Categories or merchants may be updated from time to time at our discretion and Eligible Cardmembers shall refer to this list for any updates); OR

xiii. Dynamic Currency Conversion transactions, which refers to card transactions (including online and overseas transactions) where final transaction amount is converted into Singapore dollars via dynamic currency conversion (a service offered at certain ATMs and merchants which allows a cardmember to convert a transaction denominated in a foreign currency to Singapore Dollars at the point of withdrawal/sale).

| ⚠️ It won’t work with Amaze |

| Amaze converts all FCY transactions into SGD, so you will not earn the bonus on Amaze transactions charged to your Citi Prestige Card. However, Amaze transactions will count towards the S$8,000 minimum spend. |

Minimum spend and qualifying spend is determined by transaction date based on Singapore timing (GMT+8), so exercise caution if you’re spending overseas on the last day of the month!

Minimum spend vs qualifying spend

Since these two concepts are sometimes confused, I figured it be good to have a brief section explaining the difference between minimum spend and qualifying spend.

The S$8,000 minimum spend required to unlock this offer can also be part of qualifying spend. For example, if I were to spend the equivalent of S$8,000 overseas, I would earn 4.5 mpd on S$5,000, and 2 mpd on the remaining S$3,000 (since the cap is busted)

However, minimum spend may also not be part of qualifying spend. For example, if I were to spend S$8,000 in Singapore, I would then qualify to earn 4.5 mpd on up to S$5,000 of FCY spending- but not on the S$8,000 already spent (since it’s non-qualifying)

While supplementary cardholders don’t enjoy a separate bonus cap, their spending will be combined with that of the principal cardholder in determining minimum and qualifying spend.

When will bonus points be credited?

Citi Prestige Cardholders will initially receive the regular 2 mpd earn rate for all FCY transactions.

The bonus 2.5 mpd awarded under this promotion will be credited (in the form of ThankYou points) within 3 months from the end of the promotion period, i.e. by 30 April 2024.

In a nod to their sometimes tardy fulfilment, there’s a wry line in the T&Cs saying “Citibank may extend the date of crediting with notice”!

Terms & Conditions

The T&Cs for this offer can be found here.

What can I do with ThankYou points?

ThankYou points earned on the Citi Prestige Card never expire, and can be transferred to a total of 11 different transfer partners.

Points can be transferred to miles in blocks of 25,000 Thank You points (10,000 miles). There are some great sweet spots with programmes like British Airways Executive Club, Turkish Miles&Smiles, and Qatar Privilege Club.

| Partner | Transfer Ratio (ThankYou Points: Miles) |

|

25,000:10,000 |

| 25,000:10,000 | |

| 25,000:10,000 | |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

|

25,000:10,000 |

| 25,000:10,000 |

Transfers cost a flat S$27, regardless of the number of points converted.

Citibank does not pool points across cards, so if you have both a Citi Prestige and Citi Rewards, for example, you’ll need to pay two conversion fees.

Conclusion

|

|||

| Apply Here |

From now till 31 January 2024, Citi Prestige Cardholders can register to earn up to 4.5 mpd on FCY spending. A minimum spend of S$8,000 per month is required, and there’s a cap of S$5,000 per month to take note of.

Citi has also decided to cap the maximum number of eligible cardholders at 3,000, so I’d highly recommend taking a couple of seconds to register now, just in case.

Thanks Aaron, register done.

Are there any review for this year F1 Krisflyer experience? saw you there haha.

Around 0.669723353 cents cost per mile, not bad, considering 3.25% as extra pay

There is a typo in the article above. The bonus points should be credited 3 month, from the end of the promotion period, i.e. by 30 April 2023. (not 2023)

thanks jeff, i have fixed that.

Great 👍. . So buying airline tickets online on foreign airlines counts. Your post is so much clearer than another miles website!

Does eligible transactions include youtrip topups?

If i spend 3k local and 5k foreign currency to make up to the minimum 8k spend, does it trigger the 4.5miles on the 5k of FCY spend?

That’s exactly what the entire article is about. Did you not read?