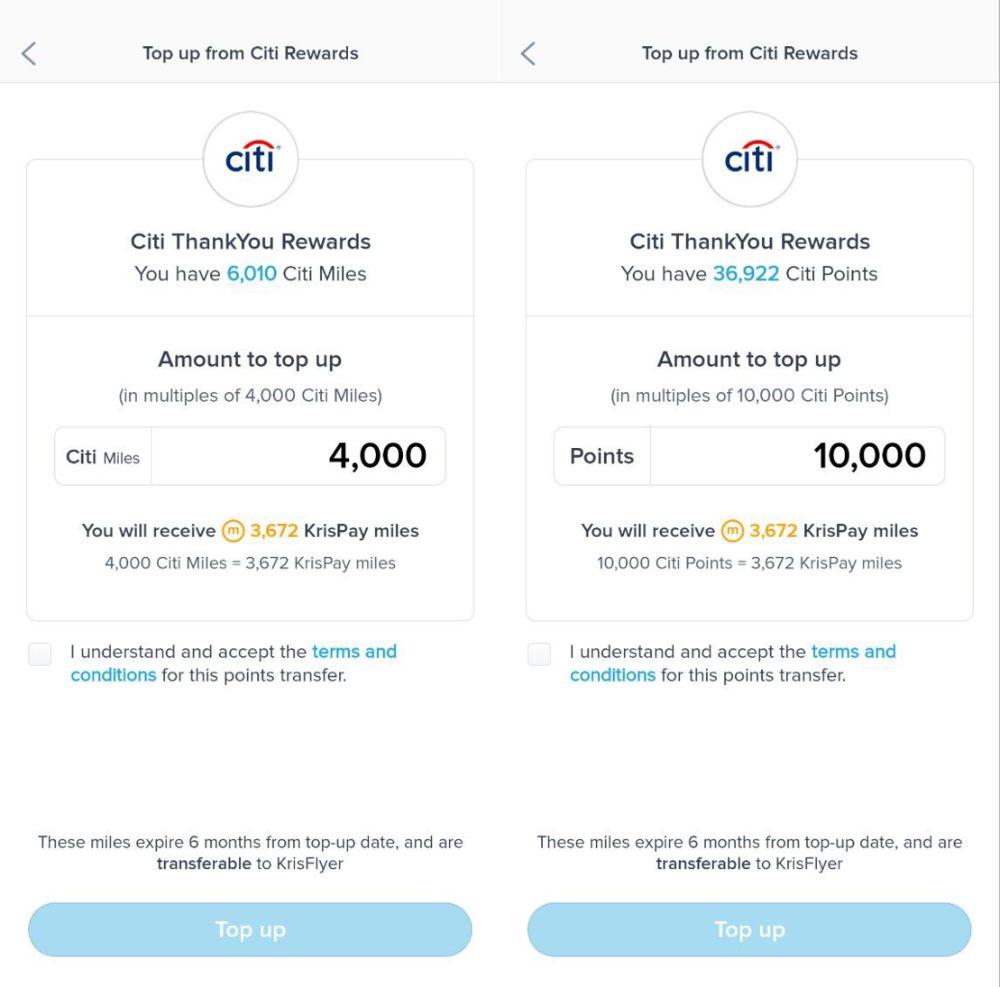

In October 2021, Kris+ added Citi as transfer partner, allowing cardholders to convert Citi Miles and ThankYou points into KrisPay (and KrisFlyer) miles instantly, with no conversion fees.

It’s generally not a good idea to transfer credit card points via Kris+, however, due to the haircut involved. That said, the option may be useful to those with orphan points balances, or who just need a small, instant top-up to redeem an award flight.

And if you find yourself in this situation, there’s now an 8% conversion bonus for Citi Miles & ThankYou points, valid till 18 February 2025.

Convert credit card points via Kris+ with an 8% bonus

From 18 December 2024 to 18 February 2025, Citi cardholders will receive an 8% bonus for every conversion of at least 10,000 ThankYou points or 4,000 Citi Miles.

|

||

| Citi Miles/ TY Points | KrisPay Miles | |

| 4,000 Citi Miles | ⇒ | 3,672 miles |

| 10,000 TY Points | 3,672 miles |

|

There is no cap on the number of transfers you can make, nor the bonus miles you can receive.

Do note that even though the wording of the T&Cs suggests a flat bonus of 272 miles, regardless of the number of points transferred, it’s actually 272 miles per 10,000 ThankYou points/4,000 Citi Miles. In other words, there’s no need to break up your transfers.

The bonus will be reflected on the Kris+ app at the point of transfer, so you can check the final amounts before confirming.

Do remember that transferring Citi credit card points into KrisFlyer miles via Kris+ is a two-step process. Once you’ve done the first conversion, you will need to tap another “transfer now” button to convert the KrisPay miles into KrisFlyer miles at a 1:1 ratio.

If you:

- Wait longer than 21 days, or

- Spend any portion of the converted KrisPay miles via Kris+

The remaining balance will be stuck in KrisPay, where they can only be spent at a measly 0.67 cents/mile, and expire after six months.

Is it worth converting?

The first thing I’d mention is that this isn’t the largest conversion bonus we’ve ever seen for Citi credit card points to KrisPay miles. Back in May 2022, there was a 15% bonus, and in October 2022, we saw a 10% bonus. However, both data points are rather dated, and an 8% bonus is the best we’ve seen this year.

Second, there is a baseline haircut involved in every conversion of Citi credit card points to KrisPay miles via Kris+.

If you converted Citi credit card points via the Citibank rewards portal, you’d enjoy a rate of:

- 10,000 Citi Miles = 10,000 KrisFlyer miles

- 25,000 ThankYou points = 10,000 KrisFlyer miles

This means that 4,000 Citi Miles or 10,000 ThankYou points could get you 4,000 KrisFlyer miles, and the 3,672 miles received is a haircut of 8.2%. Mind you, that’s still better than the usual haircut of 15% incurred outside the conversion bonus.

So what’s the case for transferring Citi credit card points via Kris+?

- Transfers via Kris+ are free, while transfers via the Citibank rewards portal have a S$27.25 fee

- Transfers via Kris+ are instant, while transfers via the Citibank rewards portal usually require 24-48 hours

- Transfers via Kris+ have a minimum block of 4,000 Citi Miles/10,000 TY points, while transfers via the Citibank rewards portal require a minimum block of 10,000 Citi Miles/25,000 TY points

Therefore, if you find yourself in a situation where you have orphan points, or needing a small, instant top-up to book an award ticket, transfers via Kris+ might be sensible.

| ❓ Haircut vs Transfer Fees |

| The more points you transfer, the more significant the haircut (in absolute terms). There will come a point where the loss in miles more than offsets the S$27.25 savings in conversion fees, but that depends on how much you value a mile. |

All the same, I wouldn’t transfer more points than necessary, as Citi credit card points are very valuable. Cardholders can choose from 11 different transfer partners, so there’s no point putting all your eggs in one basket.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

What about expiry?

When it comes to Citi credit card points:

- Citi Miles never expire

- Citi ThankYou points earned on the Citi Rewards Card are valid for up to five years

- Citi ThankYou points earned on the Citi Prestige and Citi ULTIMA never expire

KrisFlyer miles will expire three years after accrual, so by converting points to miles, you might be putting time pressure on yourself to spend them.

Since KrisFlyer miles expire at the end of the month, you could stretch the validity period by delaying the conversion from KrisPay to KrisFlyer. For example, you might transfer your Citi credit card points to Kris+ on 17 February 2025 to enjoy the bonus, but wait until 1 March 2025 to convert them to KrisFlyer (thereby getting validity all the way till 31 March 2028 instead of 28 February 2028 had you transferred in February).

However, this runs the risk of forgetting, so I’d highly recommend setting a calendar reminder!

Terms and Conditions

The T&Cs of the conversion bonus can be found here.

Conclusion

Kris+ is offering an 8% conversion bonus on Citi Miles & ThankYou points from now till 18 February 2025.

While it’s normally not a good idea to convert miles via Kris+, due to the haircut involved, it might still make sense for those with an orphan balance, or who have an immediate need for miles.

I’ve having trouble approving it after getting the sms pin, it doesn’t let me proceed

The kris+ app is a joke. It just went looping and looping upon connecting with citi. Spoke to Kris+ cs led to nowhere as well!

Waste of time!

Is this for Singaporean only? I am in Australia, cannot log in to Citi.