The UOB Lady’s Cards are among the most versatile rewards cards on the market, offering 4 mpd on a choice of up to two bonus categories. Cardholders can further boost their earnings by stacking an additional 2-6 mpd from the UOB Lady’s Savings Account, achieving a total of 6-10 mpd.

While not nearly as easy-to-use as blacklist cards like the DBS Woman’s World Card or the UOB Preferred Platinum Visa, the UOB Lady’s Solitaire Card still features heavily in my overall credit card strategy, and I regularly max out its bonus cap each month.

| Card | Income Req. | Annual Fee |

UOB Lady’s Card UOB Lady’s CardApply |

S$30K | S$196.20 (FYF) |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire CardApply |

S$120K | S$414.20 (FYF) |

If you’re just getting started, here’s a complete guide to everything you should know.

| 💳 UOB Lady’s Cards FAQs |

| Note: When I say “UOB Lady’s Cards” (plural) in this post, I’m referring to all three versions: the UOB Lady’s Card, UOB Lady’s Solitaire Card, and UOB Lady’s Solitaire Metal Card. |

Applying for the UOB Lady’s Cards

Can men apply for this card?

Yes. The UOB Lady’s Cards used to accept female applicants only, but that policy was reversed in July 2023.

Are there any sign-up offers for the UOB Lady’s Cards?

Yes, but UOB’s offers tend to be their usual “first X” nonsense which caps the number of eligible applicants. You really have no way of knowing if the cap is met at the time you apply, making it a gamble more than anything else.

However, SingSaver occasionally offers an uncapped S$60 cash gift for new-to-bank applications, defined as customers who:

- Do not currently hold a principal UOB credit card

- Have not cancelled a principal UOB credit card in the past 6 months

Subscribe to MileLion Roars to get notified the next time such an offer goes live.

Can I apply for the UOB Lady’s Solitaire Card if I don’t meet the minimum income requirement?

Historically speaking, UOB was not very strict with enforcing the S$120,000 minimum income requirement, especially for existing UOB cardholders.

However, recent data points have suggested that UOB is now enforcing this requirement more strictly. There are reports of approvals in the S$80,000-100,000 range, though it’s far from guaranteed.

You should still try to apply regardless, as the worst they can say is no.

If you do not meet the minimum income requirement for the UOB Lady’s Solitaire Card, you can open a fixed deposit with UOB and place S$30,000 to get a secured version of the card. Visit any UOB branch for details.

Can I hold both the UOB Lady’s Card and UOB Lady’s Solitaire Card?

By right, you can only hold one or the other.

UOB says (at point 20 of the T&Cs) that any existing card will be automatically terminated within one month of upgrading (from UOB Lady’s Card to Lady’s Solitaire Card) or downgrading (UOB Lady’s Solitaire Card to UOB Lady’s Card).

In practice, some customers fly under the radar and end up holding both, even after one month from upgrading/downgrading has elapsed. But even if that happens, there is no upside, as the terms of the more recently approved card will take precedence.

You won’t be able to enjoy additional bonus caps or additional bonus categories by having more than one card.

Do I need to wait for the physical card to arrive before I can start spending?

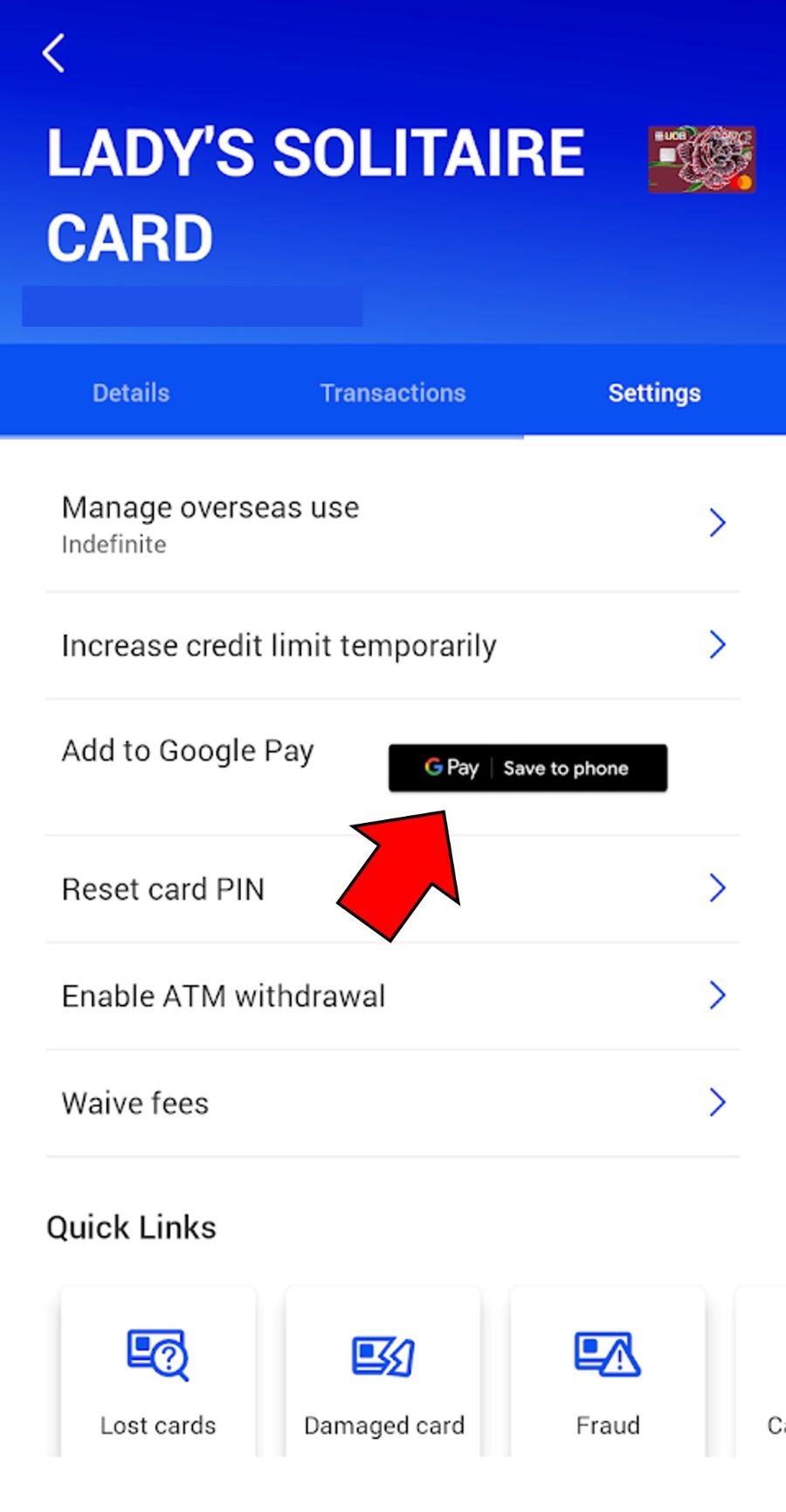

No. You can add your card to your mobile wallet instantly via the UOB TMRW app.

Open the UOB TMRW app, tap on Accounts, then look for your Lady’s Card. Tap on Settings, then Add to Google Pay (or Apple Pay, as appropriate).

Once that’s done, you can use your UOB Lady’s Card anywhere contactless payments are accepted.

How do I apply for the UOB Lady’s Solitaire Metal Card?

You don’t. It’s by invitation only, and you need to spend at least S$45,000 on a UOB Lady’s Solitaire Card within a 3-month period to be considered.

For what it’s worth, I’m not convinced it’s worth paying the (non-waivable) S$598.99 annual fee for the UOB Lady’s Solitaire Metal Card, because there are other $120K cards that offer more benefits at that price point.

Refer to the article below for more information.

Annual Fees

Do the UOB Lady’s Cards offer the first year free?

Both the UOB Lady’s Card and UOB Lady’s Solitaire Card offer a waiver of the first year annual fee.

Can subsequent year’s annual fees be waived?

I cannot promise the same will apply in your situation, but from personal experience both the UOB Lady’s Card and UOB Lady’s Solitaire Card annual fees can be waived.

Don’t forget that UOB’s default behaviour is to deduct UNI$ from your account for a “fee waiver”, so be sure to monitor your balance around your card’s anniversary date and request a waiver when that happens.

Earning 4 mpd (10X UNI$)

How is the 4 mpd awarded?

UOB Lady’s Cardholders who spend on their bonus category/categories will earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

Base UNI$ will be awarded at the time the transaction posts.

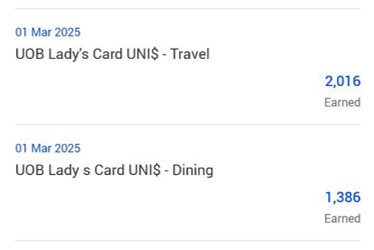

The bonus 9 UNI$ will be awarded at the start of the following calendar month. You will see a lump sum for your bonus category or categories.

You can check the breakdown via the UOB TMRW app. Instructions are provided in this post.

Is any minimum spend required to enjoy the 4 mpd?

No.

Do I need to pay by any particular method to enjoy the 4 mpd?

No. The bonus rate is valid regardless of whether you pay with the physical card or a virtual card on your mobile wallet.

Is the 4 mpd rate valid for online and offline spend?

The bonus rate is valid for both online and offline spend. All that matters is the MCC.

Is the 4 mpd rate valid for local and overseas spend?

The bonus rate is valid for both local and overseas spend. All that matters is the MCC.

Can I earn the 4 mpd rate with Amaze?

No. From 1 October 2024, UOB cards no longer earn miles with Amaze.

Is the 4 mpd rate valid with Kris+?

Yes. You will earn 4 mpd with Kris+, subject to the MCC falling within your selected bonus category or categories.

Is the 4 mpd earn rate capped?

Yes.

- UOB Lady’s Cardholders: Maximum of 1,800 bonus UNI$ per calendar month (equivalent to S$1,000 spend)

- UOB Lady’s Solitaire Cardholders: Maximum of 1,350 bonus UNI$ per category per calendar month (equivalent to S$750 spend per category)

- UOB Lady’s Solitaire Metal Cardholders: Maximum of 3,600 bonus UNI$ per calendar month (equivalent to S$2,000 spend; this is can be shared between the two bonus categories in any proportion)

Any spending beyond the cap will earn just 1 UNI$ per S$5, i.e. 0.4 mpd.

Is the 4 mpd rate capped by calendar month or statement month?

Calendar month.

Can I double my bonus cap by getting a supplementary card?

No. A supplementary card shares the same bonus cap as the principal card, as well as the same bonus categories.

What happens if I upgrade from the UOB Lady’s Card to the UOB Lady’s Solitaire Card?

When upgrading from the UOB Lady’s Card to the UOB Lady’s Solitaire, the additional bonus category will only apply from the following quarter.

The revised bonus cap will apply immediately.

For example, suppose I currently hold the UOB Lady’s Card, with ‘Family’ selected as my bonus category. On 15 September 2025, I am approved for a UOB Lady’s Solitaire Card. I will be able to earn 4 mpd on up to S$750 of Family transactions for the month of September 2025, and any spend above that S$750 is “wasted”.

What happens if I downgrade from the UOB Lady’s Solitaire Card to the UOB Lady’s Card?

When downgrading from the UOB Lady’s Solitaire to the UOB Lady’s Card, you will need to manually re-select your bonus category once again. Contact UOB customer service to get this done. The new bonus category will go into effect as soon as it is chosen.

The revised bonus cap will only apply from the following calendar month.

For example, if I had Travel and Dining as the bonus categories on my Solitaire, and downgrade to the UOB Lady’s Card with Dining as my bonus category, my cap for Dining in the current calendar month will still be S$750.

Bonus categories

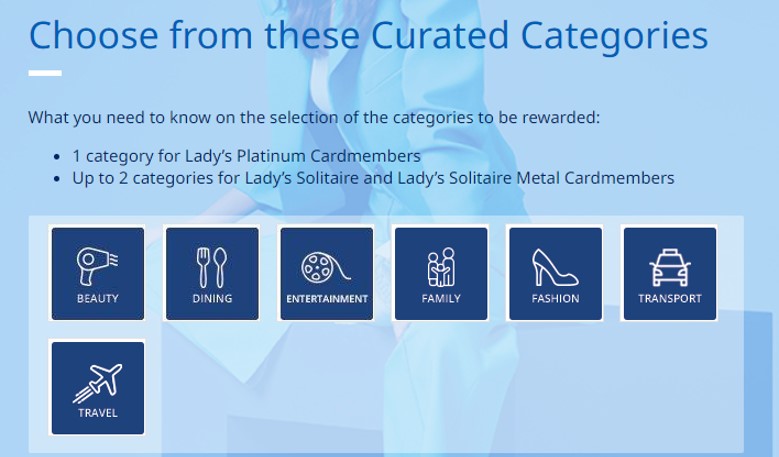

How are bonus categories defined?

UOB Lady’s Cardholders can choose from seven bonus categories, defined by the following MCCs.

| 💳 UOB Lady’s Card Bonus Categories | |

| Category | MCCs |

| 💆 Beauty & Wellness | 5912 Drug Stores & Pharmacies 5977 Cosmetic Stores 7230 Barber & Beauty Shops 7231 Beauty, Barber Shop & Gyms 7297 Massage Parlours 7298 Health & Beauty Spas |

| 🍽️ Dining | 5811 Caterers 5812 Restaurants 5814 Fast Food 5499 Misc. Food Stores |

| 📽️ Entertainment | 5813 Bars, Lounges, Discos, Nightclubs 7832 Motion Picture Theatres 7922 Theatrical Producers, Ticketing Agencies |

| 🛒 Family | 5411 Grocery Stores & Supermarkets 5641 Children’s and Infant’s Wear Stores |

| 👗 Fashion | 5311 Department Stores 5611 Men & Boy’s Clothing and Accessories 5621 Women’s Ready to Wear 5631 Women’s Accessories 5651 Family Clothing Stores 5655 Sports Apparel Stores 5661 Shoe Stores 5691 Men’s and Women’s Clothing Stores 5699 Accessory and Apparel Stores 5948 Leather Goods & Luggage Stores |

| 🚕 Transport | 4111 Transportation Suburban & Local Commuter 4121 Taxis and Limos 4789 Transportation Services Not Elsewhere Classified 5541 Petrol Stations 5542 Automated Petrol Stations |

| ✈️ Travel [Refer here for details] |

3000-3299 4511 4582 Airlines 4411 Cruise Liners 4722 Travel Agencies 5309 Duty-free Stores 3500-3999 7011 Hotels |

| Bonuses are valid for both local and foreign currency spending, both online or offline | |

How is ‘Travel’ defined?

‘Travel’ is the only bonus category not defined by a explicit MCC range.

However, I previously received confirmation from UOB regarding which MCCs qualify:

- Airlines (MCC 3000-3299)

- Cruise liners (MCC 4411)

- Duty-free stores (MCC 5309)

- Hotels (MCC 3500-3999, 7011)

- Online and offline travel agencies (MCC 4722)

Bus liners, rental cars, trains and private hire cars are not included in travel.

With regards to airlines, do note that the following MCCs are not included. This feels like an oversight, but has not been corrected yet:

- MCC 3300 Azul Brazilian Airlines

- MCC 3301 Wizz Air

- MCC 3302 Flybe (defunct)

- MCC 3303 Tigerair (still active in Taiwan)

- MCC 3308 China Southern

If you’re buying tickets with these carriers, use a different card!

For more information, refer to the post below.

Explained: Which MCCs are included in the UOB Lady’s Card “Travel” category

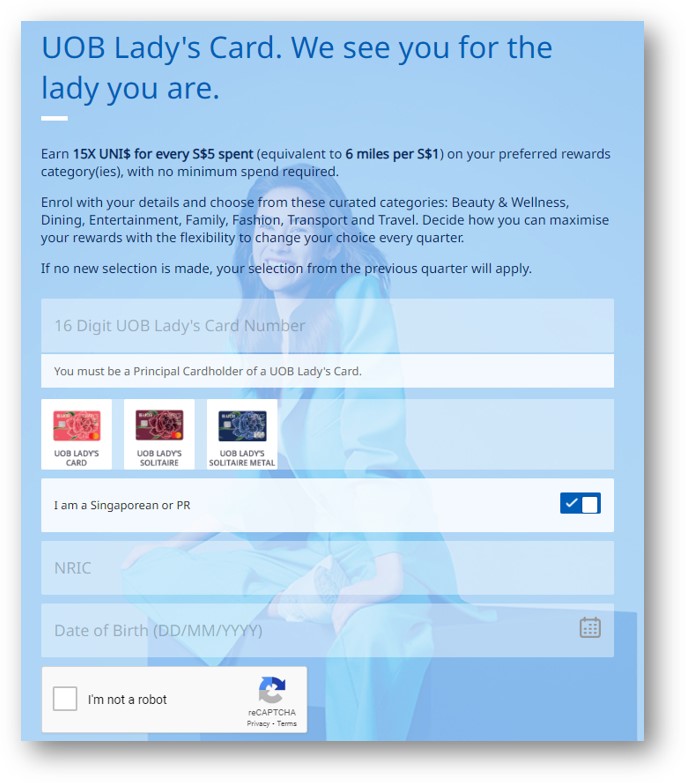

How do I select my bonus categories?

To select your bonus categories, visit this webpage.

Selecting bonus categories requires entering your 16-digit card number. Even if you don’t have the physical card yet, you can obtain this from your internet banking or the UOB TMRW app. However, if you were recently approved (<24 hours) the system may show an error message when registering your bonus categories. Try again after 24 hours.

Once your details have been entered, you’ll receive an OTP. After that, you can submit your bonus category selections.

Do I start enjoying my bonus categories immediately?

The first time you choose your bonus categories, they are effective immediately.

Any subsequent selections will be effective from the first day of the following quarter.

For example, if I’m approved for my UOB Lady’s Card on 2 July 2025 and choose ‘Family’ as my bonus category, I will enjoy 4 mpd on supermarket spend immediately.

If on 5 August 2025 I change my bonus category to ‘Dining’, I will need to wait till 1 October 2025 to start enjoying 4 mpd on restaurants. In other words, the ‘Family’ selection is valid till the end of the current quarter (30 September 2025)

What’s the deadline for selecting bonus categories?

Bonus categories can be selected up till 2359 hours (SGT) the day before the first calendar date of the following calendar quarter.

For example, I can submit my bonus categories up till 2359 hours on 30 September 2025, which will then be effective from 1 October to 31 December 2025 (Q4).

Can I change my bonus selection?

Bonus categories can be re-selected at any time, but the new selection will only take effect from the start of the following calendar quarter.

What If I change my mind regarding my selections?

If you’ve changed your mind, simply resubmit your selections. UOB will take your most recent selection as the binding one.

However, do remember that the new bonus categories will only take effect from the following quarter.

Do I need to re-select my bonus categories every quarter?

No. If you do not manually re-select your bonus categories, the choices from the previous quarter will be automatically carried over.

Can I select two additional bonus categories for my supplementary cardholder?

No. The supplementary cardholder’s bonus categories are the same as those of the principal cardholder.

Is the bonus cap based on posting date or transaction date?

The bonus cap is based on the posting date of transactions.

For example, if you make a S$500 transaction on 31 March 2025, but it posts on 3 April 2025, that S$500 spend will count towards April 2025’s cap.

I’ve forgotten what my bonus categories are. How do I check?

You won’t be able to view your bonus categories online, so the only option is to contact UOB customer service.

UOB shenanigans

I heard UOB has S$5 earning blocks. Is that going to be a problem?

The extent of the S$5 earning blocks problem depends on what UOB card you’re using. For the UOB PRVI Miles Card or UOB Preferred Platinum Visa Card, those S$5 earning blocks can lead to a lot of lost miles.

However, the effect is much more benign on the UOB Lady’s Cards, because bonus points are awarded as a consolidated lump sum the following month. In calculating this lump sum, all eligible transactions (unrounded, including cents) are summed up and then rounded down once to the nearest S$5.

If you want the full details, refer to the post below. But long story short, I wouldn’t worry about it with the UOB Lady’s Card specifically.

I heard I should avoid using UOB cards at UOB$ merchants. Is that true?

This used to be an issue, but ever since 1 November 2024, UOB cardholders can double dip on UNI$ and UOB$ at UOB$ merchants.

In other words, go right ahead. You’ll earn 4 mpd plus additional UOB$ cashback.

UOB One Account

Is the UOB Lady’s Card eligible to earn bonus interest on the UOB One Account?

Yes. Spending on the UOB Lady’s Card, UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card will count towards the S$500 minimum spend per calendar month required to trigger bonus interest on the UOB One Account.

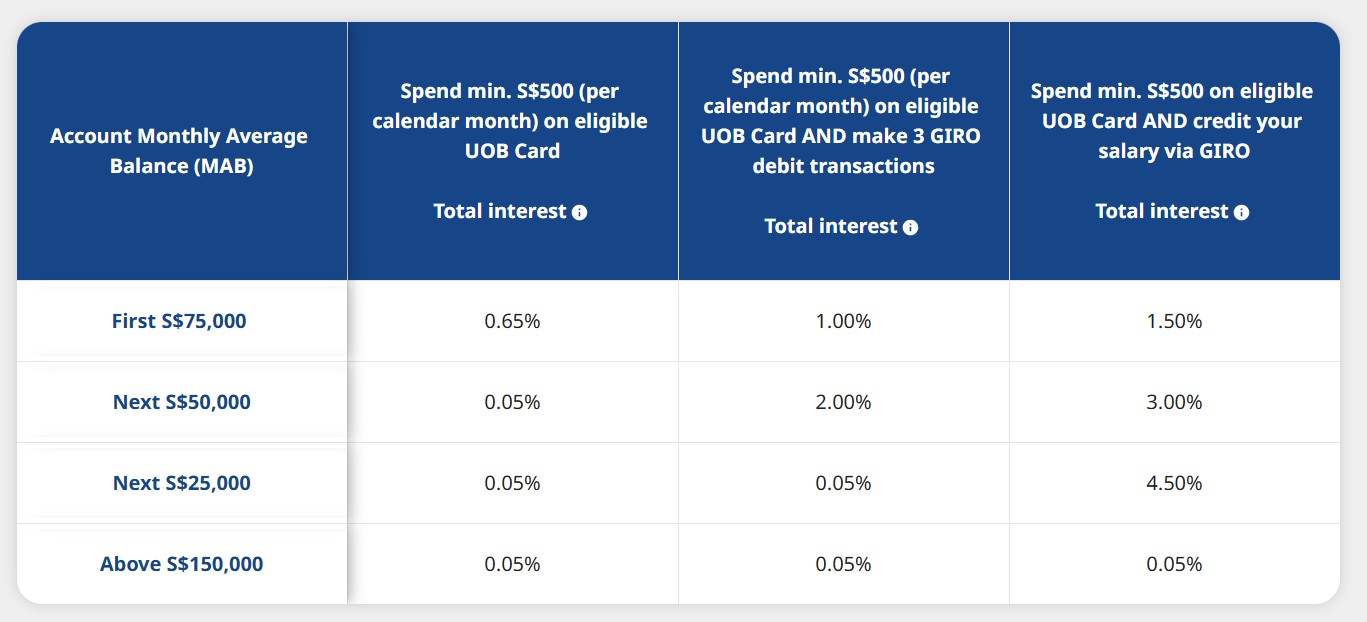

By crediting your monthly salary of at least S$1,600 via GIRO or PayNow (with the code SALA/PAYNOW SALA) and spending at least S$500 per month on the UOB Lady’s Cards, you could earn up to 2.5% p.a. on the first S$150,000 in your UOB One Account.

UOB Lady’s Savings Account

UOB Lady’s Cardholders can earn an extra 2-6 mpd with the UOB Lady’s Savings Account. I’ve written a separate set of FAQs, so refer to the article below for more information.

Conclusion

The UOB Lady’s Cards are among the most flexible rewards cards in Singapore, thanks to the ability to change bonus categories every quarter.

You can even earn an extra 2-6 mpd by pairing them with the UOB Lady’s Savings Account, though most people will find that the 2 mpd band is the sweet spot— anything beyond this has too high an opportunity cost (in terms of foregone interest on the funds in the account).

If you have other questions about the UOB Lady’s Card that aren’t answered here, feel free to post them below.

Have you guys met a situation in which you only get 9x bonus and not 5x bonus? I have Travel and Family selected. And for the past 2 months, Travel nets me 9x and 5x as described correctly. But Family nets me only 9x and missing the 5x. My assumption is that if there is 9x given I should be getting those extra 5x; else it’d be none at all.

Tried calling the hotline, as usual they are useless in answering questions on their own products.

my 9x and 5x post at the same time like clockwork. not to insult your intelligence, but don’t forget to tap “view all” under UNI$ history.

Hi Aaron, thanks for the reply. Yes exactly, the 9x and 5x for my Travel category has come in like clockwork in the past 2 months. Only for Family, I got 9x and no 5x. Of course I did check all transactions, no 5x just for that Family category.

At first I thought it could be an MCC issue. But if it were MCC issues, then I won’t be getting 9x in the first place.

Aaron, are the spendings and the award of the bonus Uni captured based on transaction date or posting date ? Had some spending which was transacted before month end but only posted the next month.

Hi Aaron, thank you for the detailed FAQ. For the quarters, I just checked with the UOB chat agent and they told me that the quarters is based on when I signed up for the card. So in my case where I signed up on Sept, my current quarter is Sep – Nov. Any changes to the bonus cateogory I made in Sep will only take effect from Dec – Feb.

But the T&C for the Lady’s card put calendar quarter. Has anyone else asked about this?

CSO is wrong, simple as that.

Shopee, Lazada and Qoo10 etc are under which category? or they dont qualify as a bonus category?

Hi, do you know if overseas dining spending still counts towards the bonus miles category?

anyone tried canceling the card and reapplying it in hopes of changing their category?

Hi Aaron, with the 6 mpd becoming 4 mpd after 29 Feb 2024, do you think there is any point getting the UOB Lady’s cards now (Jan 2024)? Or just use other cards that give 4mpd such as HSBC Revolution, UOB PPV, DBS WWMC?

I forgot the categories selected initially at point of card sign up and literally went in 2ce to the portal to reselect options.

is there a better way to check which options have been selected?

Hello, can I confirm that the contactless payment also get miles? Apple wallet can store this card.

Curious to know what category does furniture/home appliances/renovation or interior design costs fall under. Might be spending soon on such costs.. curious if they fall under UOB Ladies Card Categories (solitaire).

Should the maxed out bonus be 1,800 for $1000 spend? Since it’s 9 UNi$ per $5 block

yes that’s right. have edited that part.

If using Money Lock in the Lady’s account, does that still qualify for the unstoppable pairing promo?

i dont have experience using money lock, but my assumption is that locked amounts still qualify for regular interest/benefits

Yes it does. I have locked up $10k to ensure the AMB stays above $10k.

Hi Aaron, i tried to waive the annual fee for UOB Lady’s card via the App, however it states Unsuccessful. Do i need to pay the card bill first before proceeding to click on waive fees on the app?

Hi Mick! Did you manage to get it waived in the end? If so, how did you appeal? I’m experiencing the same thing. Their CSO claims request can only be submitted through the app or automated call system; they can’t submit

Hello! does it apply for in-app usage of mobile wallet as well (for instance, paying for bubble tea using apple pay through the chagee app, having selected dining as a category)

thank you!

Hello! I just applied for UOB Solitaire Lady’s Card and used for Agoda and Trip.com. Despite I chose Travel as my bonus category, UOB customer service told me they are ineligible due to MCC4722. Anyone encountered the same issue?