While many credit cards advertise free airport lounge access, it’s not really free if you have to pay an annual fee.

However, the good news is that some cards offer annual fee waivers, either in the first year or perpetually subject to certain criteria. In that case, the perk really is costless.

By my calculations, it’s possible to enjoy up to 22 lounge visits per year without paying a single cent, or even unlimited, depending on how strict your definition of “free” is!

What do I mean by “free” credit cards?

There are three ways of thinking about “free”.

- Credit cards which waive the first year’s annual fee

- Credit cards which waive the annual fee for Priority Banking customers

- Credit cards which waive the annual fee upon meeting a minimum spend

(1) will obviously be the most accessible, but the other two categories are worth mentioning nonetheless.

If you really want to get technical, then (2) and (3) still involve some opportunity cost, in terms of the interest that could be earned by depositing those funds elsewhere, or the miles that could be earned by putting that spending on other cards. But let’s not overcomplicate things, shall we?

Credit cards with first-year fee waivers

The following credit cards either offer a waiver of the first year’s annual fee, or have no annual fee to begin with.

| Card | Min. Income | Annual Fee | Lounge Visits |

DCS Cards DCS CardsApply |

S$30K | Varies (FYF) |

1* CY |

Citi PremierMiles Card Citi PremierMiles CardApply |

S$30K | S$196.20 (FYF) |

2 CY Share |

DBS Altitude Visa DBS Altitude VisaApply |

S$30K | S$196.20 (FYF) |

2 MY Share |

StanChart Journey Card StanChart Journey CardApply |

S$30K | S$196.20 (FYF) |

2 MY Share |

CIMB Visa Infinite CIMB Visa InfiniteApply |

S$120K | N/A | 3 MY No Share |

BOC Visa Infinite BOC Visa InfiniteApply |

S$120K | S$381.50 (FYF) |

4 1 Nov to 31 Oct Share |

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$150K | S$654 (FYF) |

4 MY No Share |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

S$30K | S$261.60 (FYF) |

4 CY No Share |

| *Capped at 1x lounge visit per calendar year, regardless of how many DCS cards you hold |

|||

| 🗓️ Note: CY vs MY |

|

In the tables, I’ve also included a tag indicating whether lounge visits are tracked by Calendar Year CY or Membership Year MY. Do note that the Membership Year is based on the date you obtained your lounge membership, not credit card. If you applied for your lounge membership immediately upon receiving your card, they’re likely the same. But if you delayed for whatever reason, they may be out of sync. |

For the Citi PremierMiles Card, DBS Altitude Visa and StanChart Journey Card, cardholders have the option of paying the first year’s annual fee to earn bonus miles. However, this is not mandatory, and you can opt for a first year fee waiver while still enjoying the complimentary lounge visits.

It may also be possible to waive the second and subsequent years’ annual fees, depending on your aggregate spending and relationship with the bank. You will still receive the complimentary lounge visits each year even if the annual fee is waived.

Credit cards with annual fee waivers for Priority Banking customers

The following credit cards offer a perpetual annual fee waiver for Priority Banking customers.

| Card | Min. AUM | Lounge Visits |

Maybank Premier World Mastercard Maybank Premier World MastercardApply |

S$300K | 2 CY Share |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

S$350K | 2 MY No Share |

StanChart Priority Banking Visa Infinite StanChart Priority Banking Visa InfiniteApply |

S$200K | 12^ MY Share* |

HSBC Premier Mastercard HSBC Premier MastercardApply |

S$200K | Unlimited No Guest |

OCBC PPC VOYAGE OCBC PPC VOYAGEApply |

S$1.5M | Unlimited No Guest |

| ^With min. AUM of S$200K, otherwise 2 visits *Maximum one guest per visit |

||

Do note that an annual fee may be charged if your total relationship balance falls below the specified minimums shown in the table above.

Credit cards with annual fee waivers for minimum spend

The following credit cards offer an annual fee waiver to cardholders who meet the minimum annual spending amounts listed in the table below.

| Card | Annual Fee (Waiver Criteria) |

Lounge Visits |

HSBC TravelOne Card HSBC TravelOne CardApply |

S$196.20 (S$25,000) |

4 CY Share |

DBS Vantage DBS VantageApply |

S$599.50 (S$60,000)* |

10 MY Share |

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$654^ (S$60,000) |

4 MY No Share |

OCBC VOYAGE Card OCBC VOYAGE CardApply |

S$488 (S$60,000) |

Unlimited No Guest |

DBS Insignia Card DBS Insignia CardApply |

S$3,210 (S$300,000)* |

Unlimited No Guest |

| *Fee waiver option will be removed from 1 August 2026 ^First year free with no minimum spend necessary |

||

The minimum spend ranges from S$25,000 to S$300,000 and are strictly enforced with the possible exception of the HSBC TravelOne Card, where data points are more mixed.

Do note that spend-based fee waivers will no longer be possible for the DBS Vantage and DBS Insignia from 1 August 2026 onwards. However, if your card is renewed before this date, you will still be able to receive an annual fee waiver based on your spending in the previous membership year.

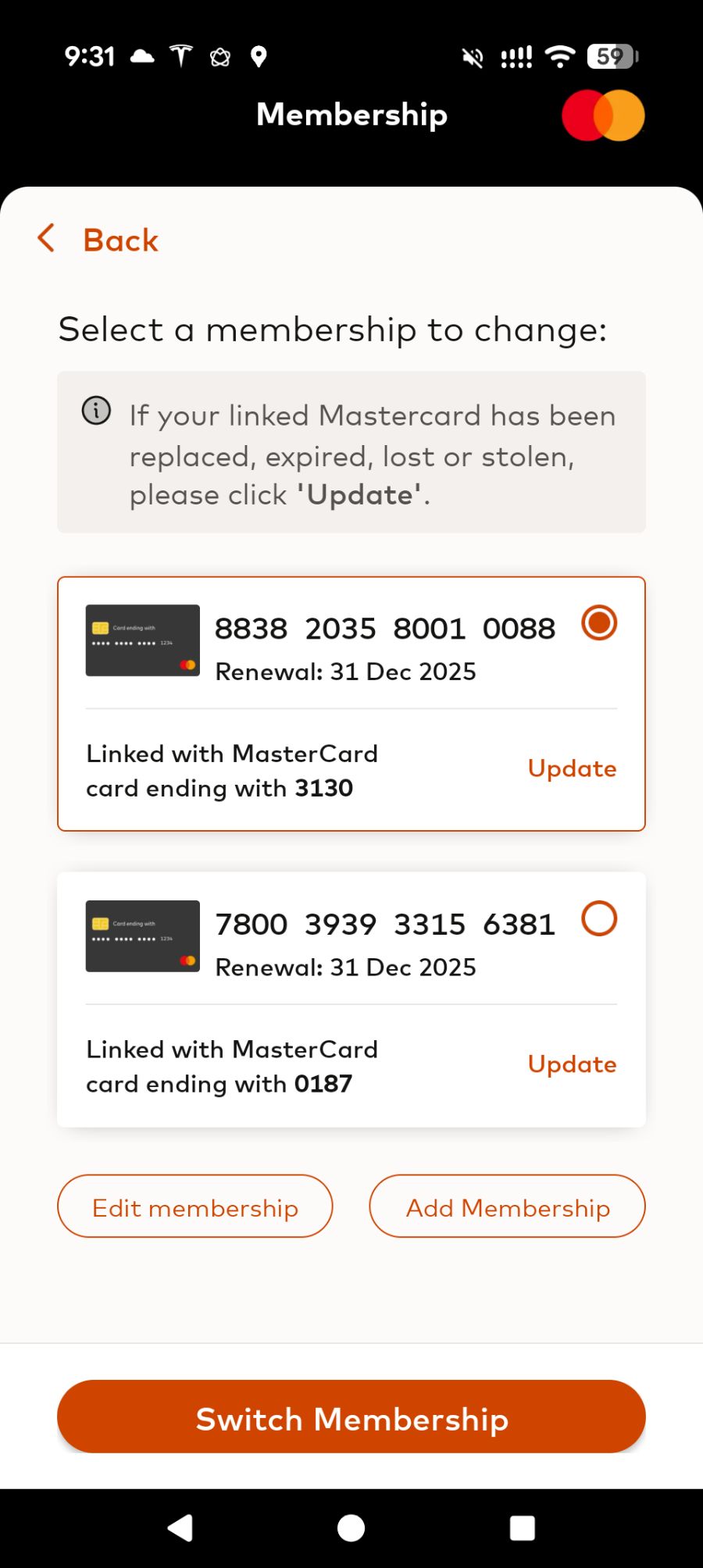

Managing multiple Priority Pass/DragonPass memberships

If you sign up for multiple cards to get more free lounge visits, you’re going to have to manage multiple Priority Pass or DragonPass memberships.

This is relatively straightforward with DragonPass, though the one confusing thing here is figuring out which app to use. You only use the official DragonPass app if:

- You purchased a membership directly from DragonPass

- You’re using the OCBC VOYAGE or OCBC Premier Visa Infinite Card

Otherwise, you’ll be using either the Mastercard Travel Pass (for Mastercard) or Airport Companion (for Visa).

| If your credit card is a… | …download this app |

OCBC VOYAGE Card OCBC VOYAGE Card OCBC Premier Visa Infinite OCBC Premier Visa InfiniteOr if you purchased a membership directly from DragonPass |

DragonPass DragonPass(Android | iOS) |

Mastercard Mastercard |

Mastercard Travel Pass Mastercard Travel Pass |

Visa Visa |

Airport Companion Airport Companion |

That aside, the DragonPass setup is arguably better than Priority Pass because you can have multiple accounts under a single app.

For example, I currently have a DragonPass membership from the CIMB Founders Card, and another from the HSBC TravelOne Card. Both use the Mastercard Travel Pass app, and I can simply toggle between both.

With Priority Pass, the situation is more complicated because it’s not possible to store multiple memberships under a single account.

Instead, you will need one account per membership, and each account requires its own username. For example, if you have three Priority Pass memberships, you need three usernames.

I’ve included some tips on how to handle this in the article below.

What other cards offer airport lounge access?

If you can’t get enough lounge visits from free cards alone, then paying an annual fee isn’t the end of the world, provided the entire package of benefits offers good value.

For the complete list of cards offering lounge access in Singapore — both fee-paying and free — refer to the article below.

Conclusion

If you’re looking for truly free airport lounge access, there are numerous credit cards which offer this without the need to pay an annual fee. And don’t forget: if your Player 2 (wife, girlfriend, wife and girlfriend) qualifies for cards, you can effectively double the allowance at no extra cost!

Any other fee-free cards with lounge visits?

If we have a few of these cards presumably we do need multiple priority pass sign ins and accounts?

yup. 1 priority pass account per card.

Most of the time on my visit in changi with amex priority pass, they keep saying it’s full. So pretty much I couldn’t use it for my last 4 trips in changi.

Wife and girlfriend = triple, no? Just sayin’.

i think the dilemma here is who you want to pool your lounge visits with.

would be more informative if adding in “reset per calendar year (like Citi PM)” and “reset per membership year (like DBS Altitude)”

refer here: https://milelion.com/2025/01/11/best-credit-cards-for-airport-lounge-access/

Do all cards issued by DCS Cards Centre have 1 free complimentary lounge pass/year? (i.e. visa, mastercard and diners international brands under DCS Cards Centre)

It looks like Flex does not have it? But I have the Vicom card and 1 visit is included

Only Diners card. Their Visa/Mastercard don’t have. The pic in this article is misleading.

have updated it, thanks!