It seems like all the rage at UOB these days is to take a unified bonus cap, and split it into two trickier-to-optimise sub-caps. We’ve seen it happen with the UOB Lady’s Solitaire and UOB Visa Signature, and now it’s time for the UOB Preferred Platinum Visa to join the fun!

From 1 October 2025, this popular card will split its S$1,110 monthly bonus cap into:

- S$600 for mobile contactless transactions

- S$600 for selected online transactions (e.g. shopping, supermarkets, food delivery and entertainment)

If you squint hard enough, this is technically a buff. The maximum monthly spend eligible for 4 mpd has increased from S$1,110 to S$1,200, allowing cardholders to earn an extra 360 miles each month.

But let’s be clear: UOB isn’t making these changes because it likes you. It’s doing so to make it harder to fully optimise the UOB Preferred Platinum Visa. Unless you’re meticulous about your spending, you will very likely earn fewer miles from this card going forward.

In other news, the UOB Preferred Platinum Visa will also follow the UOB Visa Signature’s lead in recognising SimplyGo as contactless spend, meaning you’ll now earn 4 mpd on bus and MRT rides.

Details: Changes to the UOB Preferred Platinum Visa

Here’s a rundown of the changes that are happening to the UOB Preferred Platinum Visa.

| Effective Date | Change | Verdict |

| 28 Aug 2025 | SimplyGo earns 4 mpd | 👍 Good |

| 1 Oct 2025 | Monthly bonus cap increased from S$1,110 to S$1,200 | 👍 Good |

| 1 Oct 2025 | Monthly bonus cap split into 2x sub-caps of S$600 | 👎 Bad |

The SimplyGo enhancement takes effect from 28 August 2025, while the changes to the structure of the bonus cap will take effect from 1 October 2025.

You can find the FAQs here, and the revised T&Cs here.

SimplyGo transactions now earn 4 mpd

Previously, the UOB Preferred Platinum Visa excluded SimplyGo from its definition of “contactless spend”, which meant that you would only earn 0.4 mpd on such transactions.

But in July 2025, the UOB Visa Signature revised its definition of contactless spend to include SimplyGo, and now the UOB Preferred Platinum Visa has followed suit.

From 28 August 2025, cardholders will earn 4 mpd on SimplyGo bus and MRT rides, provided they pay through mobile contactless (i.e. tap your phone, not the physical card).

| Payment Method | Eligible? |

| ✅ | |

|

❌ |

| ✅ | |

| ✅ | |

Tapping physical card Tapping physical card |

❌ |

| ❓ What about S$5 earning blocks? |

|

Because of UOB’s points rounding policy, you usually need to spend at least S$5 to earn any miles— spend S$4.99 and you walk away empty-handed. Given that the average SimplyGo transaction will likely be <S$5, the question then becomes how you could possibly earn anything from this. The answer lies in the fine print:

So except in extreme circumstances, you’ll almost certainly earn some miles on your rides. |

Changes to monthly bonus cap

The UOB Preferred Platinum Visa currently earns 10X UNI$ per S$5 (equivalent to 4 mpd) on selected online transactions, and all mobile contactless spend.

The 10X UNI$ per S$5 comprises of:

- Base reward: 1X UNI$ per S$5 (0.4 mpd)

- Bonus reward: 9X UNI$ per S$5 (3.6 mpd)

A combined bonus cap of 2,000 UNI$ per calendar month applies to both categories, which is equivalent to S$1,110 of spending.

| Category 1 (Selected Online Trxns) |

Category 2 (Mobile Contactless) |

|

| Monthly Bonus Cap (UNI$) | 2,000 UNI$ |

|

| Monthly Bonus Cap (S$) | S$1,110 | |

| Caps are based on calendar month | ||

| ✅ Selected Online Transactions | |

| Category | Merchant Category Codes (MCCs) |

| Department and Retail Stores | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631,5641, 5651, 5661, 5691, 5699, 5732-5735, 5912, 5942, 5944-5949, 5964-5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5811,5812,5814, 5333, 5411, 5441, 5462, 5499, 8012, 9751 |

| Entertainment and Ticketing | 7278, 7832, 7841, 7922, 7991, 7996, 7998-7999 |

Given how much I emphasise using the UOB Preferred Platinum Visa for mobile contactless payments, the online spending bonuses often come as a surprise to many. If I had a penny every time someone said “huh, isn’t PPV for offline spending only…”

But in this case, ignorance was bliss, because there was nothing stopping you from spending the full S$1,110 on mobile contactless every month, and never even touching the selected online transactions category.

Not anymore.

From 1 October 2025, the UOB Preferred Platinum Visa will introduce a sub-cap of 1,080 UNI$ per calendar month for each of the two categories, which is equivalent to S$600 of spending.

| Category 1 (Selected Online Trxns) |

Category 2 (Mobile Contactless) |

|

| Monthly Bonus Cap (UNI$) | 1,080 UNI$ | 1,080 UNI$ |

| Monthly Bonus Cap (S$) | S$600 | S$600 |

| Caps are based on calendar month | ||

This is a positive change in the sense that the total miles you can earn from the UOB Preferred Platinum Visa each month (without going into 0.4 mpd territory) will increase from 4,440 (S$1,110 @ 4 mpd) to 4,800 (S$1,200 @ 4 mpd).

However, this is a negative change in the sense that you can no longer earn 4 mpd on S$1,110 of mobile contactless spend. For example, if you were to spend S$1,110 on mobile contactless alone, you would earn just 2,604 miles from October 2025 (S$600 @ 4 mpd + S$510 @ 0.4 mpd), a 40% reduction from the status quo.

That’s to say nothing of the increased cognitive load involved in juggling two separate sub-categories on one single card.

Currently, it’s relatively straightforward to see how much of your monthly bonus cap remains, by simply tallying up the total month’s spend. But once the bonus cap is split into two categories, things will get much more messy.

UOB isn’t going to keep a running tally of how much cap you have left for each bonus category, nor does it categorise your spending. Therefore, the only way to calculate the remaining bonus cap for each category is to tally up items line by line — which transactions belong to Category 1, which transactions belong to Category 2?

It’s almost as if the UOB Preferred Platinum Visa is now two cards in one.

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on selected online transactions | S$600 |

“Card #2” “Card #2” |

4 mpd on mobile contactless | S$600 |

The first card offers 4 mpd on selected online transactions, capped at S$600 per calendar month. The second card offers 4 mpd on mobile contactless, also capped at S$600 per calendar month.

If you really do plan to spend across both categories, it’s going to be a royal pain to track your spending.

What can you do about this?

The only way to avoid this nerf is to play along with UOB, and start using the UOB Preferred Platinum Visa across two bonus categories instead of just one.

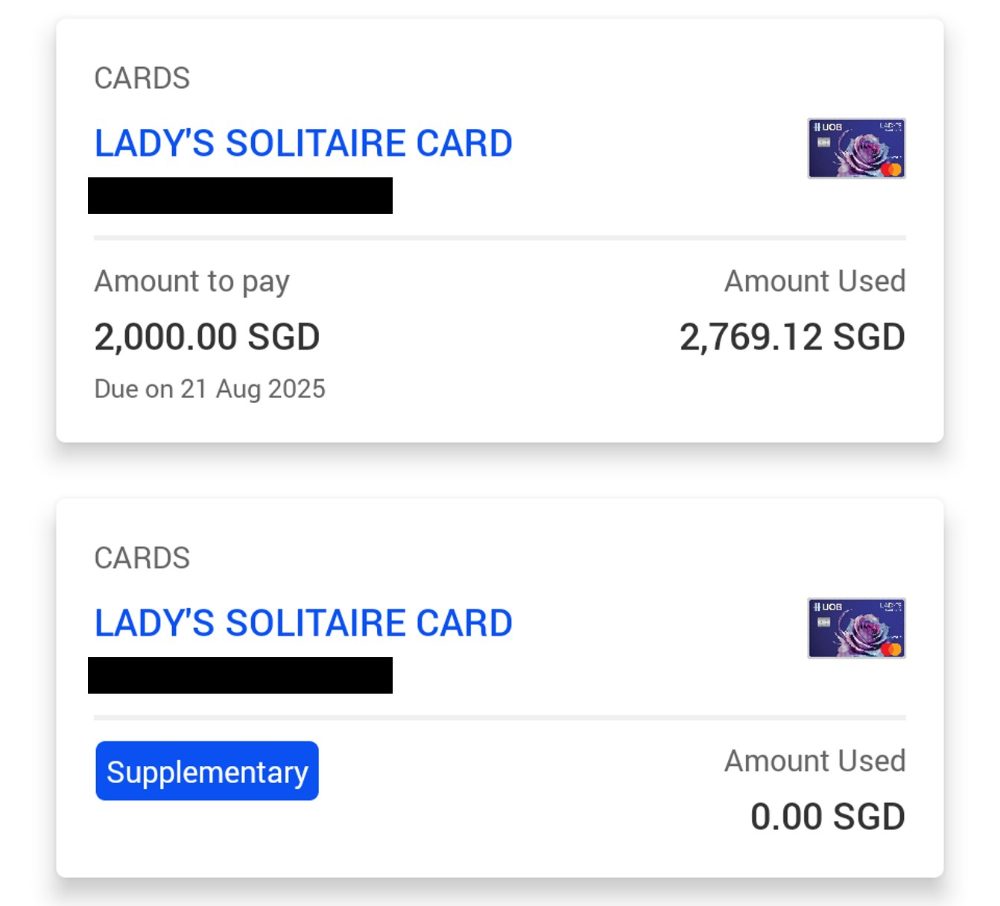

As I mentioned above, this won’t be easy. So I’m going to repeat the same advice suggested by a MileLion community member, when UOB started getting trigger happy with the sub-caps: Get a supplementary card.

To be clear, this does not increase your bonus cap. What it does is make it much easier to track your spending. For example, you could put all the spending for Category 1 on the principal card, and all the spending for Category 2 on the supplementary card.

Since these cards are shown as separate accounts on internet banking, you can just look at the total spend on a card level. This is what I’ve done for my UOB Lady’s Solitaire Card, to better manage its now separated bonus caps.

You know, I wouldn’t be surprised if this whole series of nerfs turns out to be the best-ever supplementary card campaign for UOB!

Alternatively, you could commit to buying S$600 worth of vouchers at the start of every month to fully utilise the “selected online transactions” category. After that, any additional spend counts towards the “mobile contactless” category (i.e. total spend minus S$600).

The simplest way to do this is HeyMax, where all transactions code as MCC 5311 and qualify for the UOB Preferred Platinum Visa’s bonus on selected online transactions.

|

|

| Sign up here |

|

|

|

Don’t make last-minute transactions!

One last point to note: the UOB Preferred Platinum Visa tracks bonus caps based on posting date, not transaction date.

If you make a transaction towards the end of September 2025, and it posts from 1 October 2025 onwards, it will be subject to the revised bonus caps instead (i.e. S$600 for selected online transactions, S$600 for mobile contactless payments).

Which cards track spending by transaction date vs posting date?

To be safe, I’d recommend avoiding spending on the last few days of the calendar month.

Conclusion

The UOB Preferred Platinum Visa now treats SimplyGo bus and MRT rides as contactless spending, making them eligible for 4 mpd.

However, the bigger news here is that from October 2025, the monthly bonus cap will be increased from S$1,110 to S$1,200, but also split into strict sub-caps of S$600 for selected online transactions, and S$600 for mobile contactless payments.

Theoretically, if you were able to min-max each category on the dot, you’ll come out ahead since the card’s monthly earning potential increases by 360 miles. In practice, however, many people will struggle to be so precise, and therefore earn fewer miles than before.

Year-end bonus looking good for whoever at UOB came up with the sub-caps idea, then…

What do you make of the changes to the UOB Preferred Platinum Visa?

Hi, is payment through FairPrice app either via scan and go or just check out via the QR code considered online spend?

For fairprice spend, will be 2 types of txns. If you pay by tapping, it will be mobile contactless. if you pay by scan through app, it will be online.

The SimplyGo buff doesn’t take plane “immediately”. The announcement was announced today, as was published by this article, today 27 Aug. The buff starts tomorrow, 28 Aug. But as you pointed out, since the card tracks by posting date instead of transaction date, effectively the UNI$ earned will be from Sep as SimplyGo takes a few days to accumulate spendings by day before posting.

thanks, have fixed that!

Is spend via FairPrice at using QR code at checkout or scan and go, considered online spend?

Use app, of course online spending la

flights get more expensive to redeem and miles becoming harder to earn 🙁

This may be a silly question, but are you allowed to get a supplementary card in the same name as the primary cardholder? Or do you have to get your spouse or someone else to nominally hold the supplementary card?

you can’t get a supp card for yourself. believe me, i’ve tried!

Just ditch all UOB cards. HSBC got the message when they annihilated the Revo and closed the Visa Infinite to new applications. Six months later they’re back to enticing customers with sign-up bonuses, 4mpd being restored, and fee waivers.

Yes please

All that matters on wall street and the equivalents are the figures for TOMORROW.

xxx losses last month? FORGOTTEN!

yyy new customers this month?

U GET A BONUS, U GET A BONUS, U ALL GET BONUSES!

(ht: oprah)

Given UOB’s recent circus acts, it’s becoming painfully clear they think their customers will just sit quietly and take it. I’m sure plenty of alternatives exist that don’t come with this level of arrogance – is there any plan for an article that helps customers like me figure out the most efficient way to deprioritize or ditch UOB altogether?

I cannot agree more….there’s just so much more to be aware of to get max value out of UOB cards now.

You can grumble but unfortunately it’s still the best suite of 4mpd cards in the market. With the PPV, VS, and Lady’s Solitaire, the overall combined cap is $5,100 – and most importantly, UNI$ are pooled.

Does this mean that September SimplyGo transactions are summed and posted on the 7th of October? So in September I can spend $1100 as contactless mobile spend (not SimplyGo) and get 4mpd and also use the PPV for SimplyGo in September and still get 4mpd because they will post in October even though I charged more than $1100 in September?

If indeed UOB Visa SimplyGo transactions are summed and post on the 7th of the following month or isn’t that how it works?

Ignore my previous post.Seems like the SimplyGo transactions eat into the uni$ bonus for the month they occur without actually being reflected in the uni$ balance until the 7th of the following month. Makes it even harder to track what is happening – time to update my speadsheet as UOB has a nasty habit of not awarding uni$ for valid transactions so it’s prudent to audit them – although they seem to be doing it less frequently than they used to.

“UNI$ are calculated based on the accumulated spend on SimplyGo Transactions per calendar month”.

SimplyGO transactions will be reflected daily and posted every 4-6 days.

You will have some of the transactions falling into the following month.

I noticed that SimplyGo transactions are posted Daily to my DBS Altitude Visa.

If the same applies to the UOB PPV, then it will not be easy to hit the minimum of $5 assuming one makes only 2 trips a day and these trips are not exceedingly long in terms of distance.

“For AMEX and Visa cards, fare charges are accumulated daily, but UNI$ are calculated based on the accumulated spend on SimplyGo Transactions per calendar month, and awarded to Cardmembers on the 7th calendar day of the following month”

Actually…… UOB has made it relatively easy to earn 4mpd for many years now. PPV and VS has been around for ages (still miss u though PPA)! While most banks have one 4mpd card, UOB has three?!? And for this early(?) Gen Yer who still finds it hard to shop online, whitelist paywave has gotta be the most stressfree SOP of the lot! Much has been said about their antics and believe me, i’ve been there but credit to them (and pretty smartly in my view) for at least preserving a still respectable system of 4mpd without an outright nerf… Read more »

Omg look at this… I hope you continue to enjoy uob aircon until they stop that in their branches…

A prominent company switching off air con? Lol which world do you live in?

All these self entitled kids, believing everything is owed to them..

How many uob cards are in your Apple Pay???

Any idea if Heymax will continue to be able to track spend limit of the sub categories accurately? I imagine it won’t be too crazy for them to adapt to it

Came here as soon as I got the SMS alert from UOB lol.

With the incoming nerf to the UOB PPV, I assume the $600 for online spend will extend to using Atome too? If that’s the case, I might just cancel my DBS WWMC since that’s all I really use it for. Might get a no-frills cashback card for smaller purchases in the region of < $5. Is Evol still any good?

Hi Aaron, based on the latest UOB nerfs on Preferred Platinum Visa and Visa Signature Card, and if I have all these 2 cards, does it make sense that I should choose to pay via Visa Signature first over Preferred Platinum if I can regularly reach my minimum $1000 spend?

How are Kris+ payment tracked under this revision?

Tried for many food outlets, payment through Kris, using applepay and GPay, it will be online. MCC code will follow the store MCC code

How is Kris+ wprkflow implemented with this change?

Hi. For the online transaction, is it similar to the list for OCBC titanium rewards?

This is literally a qn answerable in 3mins by googling

Hi,

If my card statement is generated on 2nd Oct, would all my Sept spend in PPV be earning based on old Sep rules or capped at the new rules for Oct? Appreciate your advice! 🙂

If I buy stuff on Lazada or Shopee, are those considered online transactions?

Anyone knows?

Hi Aaron and ML followers. I got email from UOB saying they will keep the 1080 max level but split on 2 cat. Mail reads

Plus, starting from 1 October 2025, you can enjoy an increased bonus UNI$ up to UNI$2,160 per calendar month, capped at UNI$1,080 per category below: •Category 1: Selected Online Transactions •Category 2: Mobile Contactless Transactions

maybe a targetted stunt ? Not complaining;-)

UNI$1,080 is equivalent to SGD600 if you did not know