On paper, the UOB Visa Signature is an excellent addition to your wallet, offering 4 mpd on up to S$2,400 of local and overseas spend. Even better— since it’s a blacklist card, you don’t actually need to memorise categories. So long as you pay in foreign currency (FCY), or in SGD via contactless, you’ll earn the 4 mpd.

But it’s not as simple as it sounds. To enjoy the 4 mpd rate, you must also spend at least S$1,000 per statement month, either in SGD or FCY.

This is a concept that confuses a lot of people, so I thought it’d be good to have a post explaining it in detail.

How the UOB Visa Signature’s minimum spend requirement works

The UOB Visa Signature offers 10X UNI$ per S$5 (4 mpd) on overseas, petrol and contactless spending, divided into:

- A base reward of 1X UNI$ per S$5 (0.4 mpd)

- A bonus reward of 9X UNI$ per S$5 (3.6 mpd)

The bonus reward is subject to the following conditions:

| Min. Spend (per statement month) |

Cap (per statement month) |

|

| Category 1: Overseas | S$1,000 in FCY | S$1,200 in FCY |

| Category 2: Petrol and Contactless | S$1,000 in SGD | S$1,200 in SGD |

For either bonus category, cardholders must spend at least S$1,000 per statement month (Category 1: FCY, Category 2: SGD). The bonus is capped at 2,160 UNI$ per Category, per statement month, equivalent to S$1,200 of spending.

Category 1 and 2 can be mutually exclusive. In other words, in a given month I can choose to spend S$1,000 in FCY to unlock 4 mpd on Category 1, or S$1,000 in SGD to unlock 4 mpd on Category 2, or both.

How is overseas spend defined?

Overseas spend refers to any online or in-person transaction charged in a currency other than SGD.

However, UOB has one more requirement. The transaction must also be processed through a payment gateway outside of Singapore. For example, Agoda processes Visa payments in Singapore, so if you booked a hotel in FCY and paid with a UOB Visa Signature Card, you would not earn the Category 1 (Overseas) bonus.

Fortunately, there’s a way of checking where a payment is processed before making an actual transaction, which I’ve written about in the article below.

For what it’s worth, the payment gateway issue will only affect online transactions. Using your card overseas in-person will earn 4 mpd, so long as you don’t fall victim to the DCC scam (i.e. always opt to pay in FCY and not in SGD).

| ❓Must my overseas spending be made via contactless? |

| No. Contactless, chip or even magnetic stripe transactions will all be eligible for the overseas spending bonus. |

How is petrol and contactless defined?

Petrol spend refers to any transactions made at petrol stations (MCC 5541/5542).

Shell and SPC are officially excluded in the T&Cs, but in practice, Shell earns UNI$ nonetheless. I can’t say for sure whether this is a feature or a bug, or whether it’ll still be accurate by the time you read this post, so do it at your own risk (I feel better about Shell than SPC).

Contactless spend refers to any transactions made via the following contactless methods:

| Payment Method | Eligible? |

| ✅ | |

|

❌ |

| ✅ | |

| ✅ | |

Tapping Physical Card Tapping Physical Card |

✅ |

Contactless spend does not include online or in-app transactions.

I realise this can be confusing at first, so the general rule to remember is that if you hear a “beep” sound when you pay, it’s a contactless payment. If you don’t hear a beep (e.g. an online or in-app transaction), it’s not a contactless payment.

What counts towards the minimum spend?

Category 1 (Overseas)

The S$1,000 minimum spend must be made in FCY, and excludes any transactions on UOB’s general exclusion list, such as education, hospitals, government services and insurance premiums. The full list of exclusions can be found in the T&Cs at point 1.(iv).

Category 2 (Petrol and Contactless)

The S$1,000 minimum spend must be made in SGD on petrol and contactless spending, and excludes any transactions on UOB’s general exclusion list, such as education, hospitals, government services and insurance premiums. The full list of exclusions can be found in the T&Cs at point 1.(iv).

Do note that under the previous set of T&Cs, any spending in SGD would count towards the minimum spend for Category 2, but going forward, it must be on petrol and contactless specifically.

| ❌ Old T&Cs |

| To earn UNI$10 per S$5 spend on Petrol Spend and/or Contactless Transactions, you are subject to a combined minimum spend of S$1,000 in Singapore dollars, per statement period, but excluding the Excluded Transactions |

| 🆕 New T&Cs |

| To earn UNI$10 per S$5 spend on Petrol Spend and/or Contactless Transactions, you are subject to a combined minimum spend of S$1,000 in Singapore dollars on Petrol Spend and/or Contactless Transactions per statement period, but excluding the Excluded Transactions |

For example, if you had previously used your UOB Visa Signature Card to spend S$100 on Shopee (for whatever reason), that S$100 would not earn 4 mpd, but would count towards the minimum spend for Category 2. Now, it will neither earn bonuses nor count towards the minimum spend.

What if I spend across categories?

Where people tend to get confused is when they make both local and overseas petrol and contactless transactions. The question is how that affects the calculation of minimum spend.

It’s actually not that complicated, so long as you think about it this way:

- If your petrol and contactless spend is in FCY, it counts towards the Category 1 (Overseas) minimum spend

- If your petrol and contactless spend is in SGD, it counts towards the Category 2 (Petrol and Contactless) minimum spend

The table below summarises how different kinds of transactions will be categorised.

| Transaction (Currency) |

Category 1 Overseas |

Category 2 Petrol & Contactless |

| Online 🇸🇬 SGD |

❌ | ❌ |

| Online 🌎 FCY |

✅ | ❌ |

| In-app 🇸🇬 SGD |

❌ | ❌ |

| In-app 🌎 FCY |

✅ | ❌ |

| Contactless 🇸🇬 SGD |

❌ | ✅ |

| Contactless 🌎 FCY |

✅ | ❌ |

| Petrol 🇸🇬 SGD |

❌ | ✅ |

| Petrol 🌎 FCY |

✅ | ❌ |

I’ve also created a few scenarios to illustrate how the miles are awarded.

| Category 1 Overseas (FCY) |

Category 2 Petrol & Contactless (SGD) |

Outcome |

| S$600 | S$500 |

Total: 440 miles (S$600 @ 0.4 mpd + S$500 @ 0.4 mpd) 4 mpd rate is not triggered because the S$1,000 minimum spend has not been met on either Category 1 or 2. |

| S$1,000 | S$1,000 |

Total: 8,000 miles (S$1,000 @ 4 mpd + S$1,000 @ 4 mpd) 4 mpd rate is triggered for both Category 1 and 2. |

| S$2,000 | S$1,000 |

Total: 9,120 miles (S$1,200 @ 4 mpd + S$800 @ 0.4 mpd + S$1,000 @ 4 mpd) 4 mpd rate is triggered for both Category 1 and 2. However, the cap for Category 1 is also breached. |

| S$900 (all contactless) |

S$100 (all contactless) |

Total: 400 miles (S$900 @ 0.4 mpd + S$100 @ 0.4 mpd) 4 mpd rate is not triggered because the S$1,000 minimum spend has not been met on either Category 1 or 2. |

| S$1,200 (all contactless) |

S$100 (all contactless) |

Total: 4,840 miles (S$1,200 @ 4 mpd + S$100 @ 0.4 mpd) 4 mpd rate is triggered for Category 1 4 mpd rate is not triggered for Category 2 as S$1,000 minimum SGD spend has not been met |

Note in particular the last two scenarios, which show how overseas and local contactless spend do not mix. Overseas is overseas, local is local. Even if you unlock the overseas 4 mpd earn rate through FCY contactless spending alone, it has no bearing on whether you earn 4 mpd on local contactless spend. That requires a minimum spend of S$1,000 in SGD, period.

Say it with me: “Contactless overseas transactions do not double count towards ‘overseas’ and ‘petrol and contactless’; it will only count towards ‘overseas’.”

How is minimum spend tracked?

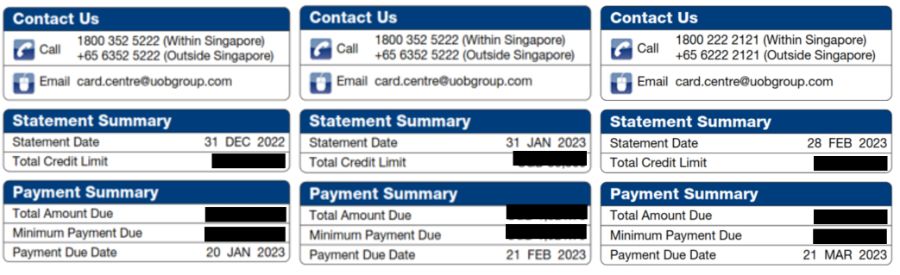

Minimum spend is based on statement month, not calendar month. To find out what your statement month is, log in to internet banking and download your e-statement. The statement date is the last day of your statement month.

To keep things simple, what I did was call up customer service and request a change of statement period to match the calendar month. Now, all of my statements are generated at the end of each calendar month.

This may or may not still be possible (like many banks, UOB caps the number of customers whose statement cycle can end on a particular date), but it doesn’t hurt to ask.

Conclusion

The UOB Visa Signature’s minimum spend requirement takes some explaining, but it’s much, much simpler if you just follow this heuristic:

- Anything in FCY counts towards the minimum spend for Category 1 (Overseas)

- Anything in SGD on petrol and contactless counts towards the minimum spend for Category 2 (Petrol and Contactless)

There is no double counting across categories; a transaction will either count towards the minimum spend for the overseas bonus, or the minimum spend for the petrol and contactless bonus.

Some people may try to avoid the hassle by simply using the UOB Visa Signature as a single-category card, and while that’s a perfectly valid strategy, do note you’ll be leaving half the card’s bonus cap on the table. If you’re disciplined enough to track your statement month and minimum spends — and have the ability to spend at least S$1,000 in FCY each month — the card can comfortably pull double duty for both local and overseas transactions.

Is it just me or do you not even have a referral link for the card?

nope. it’s so good they dont even give out referrals!

How about if $1100 local contactless with $0 FCY, will it still trigger 4mpd?

if u read

(a) and (b) are mutually exclusive. That’s to say, you can choose to satisfy just (a), just (b) or (a) + (b).

So $500 eligible petrol spend + $500 in eligible fcy spend works?

I suggest you read the t&cs yourself. Answer to Johan is yes. Answer to Kel is no.

Shouldn’t it be (a) and (b) are NOT mutually exclusive, if (a) + (b) is allowed?

ah yes. i should be saying “can be” mutually exclusive.

Hi, since i not drive. So in sg i use it only for paywave to earn 10x, not add it in applepay to use and only use the physical card to tap the merchant terminal, right?

As long as you paywave more than $1000 per month for petrol

Don’t confuse people lah, they already said they don’t drive. No need to paywave for petrol. As per article, as long as you spend minimum of S$1000/mth for this category ‘petrol and contactless transactions’, you will earn 4mpd. Subject to usual exclusions. Apple Pay or tapping paywave is fine.

Contactless spend does not include online, in-app Apple or Google Pay transactions, nor SimplyGo transactions.

Does this mean if I pay using krispay and select Apple Pay on my phone and uob signature card won’t earn x10 points?

Hi.

If i use the credit card purely for overseas expense amounting to sgd2,000 and no transaction at all on local.

Will i get 8,000 miles?

I have and overseas Insurance premium to pay every month. it will be > 1000 and <2000 SGD equivalent. Will I still abe to get the 4mpd?

Insurance is excluded from earning rewards by UOB. (Depends on MCC)

Hi, Paying petrol online with UOB Visa Signature eg. via Kris+, is it 4mpd or 0.4mpd?