Kris+ has launched a new promotion offering an 8% bonus on KrisPay miles when you convert Citi Miles or Citi ThankYou points between now and 26 February 2026. These KrisPay miles can then be instantly transferred to your KrisFlyer account, without any fees.

This is basically the same deal we saw around the same time last year, and while it’s generally not a good idea to transfer credit card points via Kris+, there could be some scenarios where it makes sense.

|

|||

| S$5 for new Kris+ Users | |||

| Get S$5 (in the form of 500 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Transfer Citi points to Kris+ with an 8% bonus

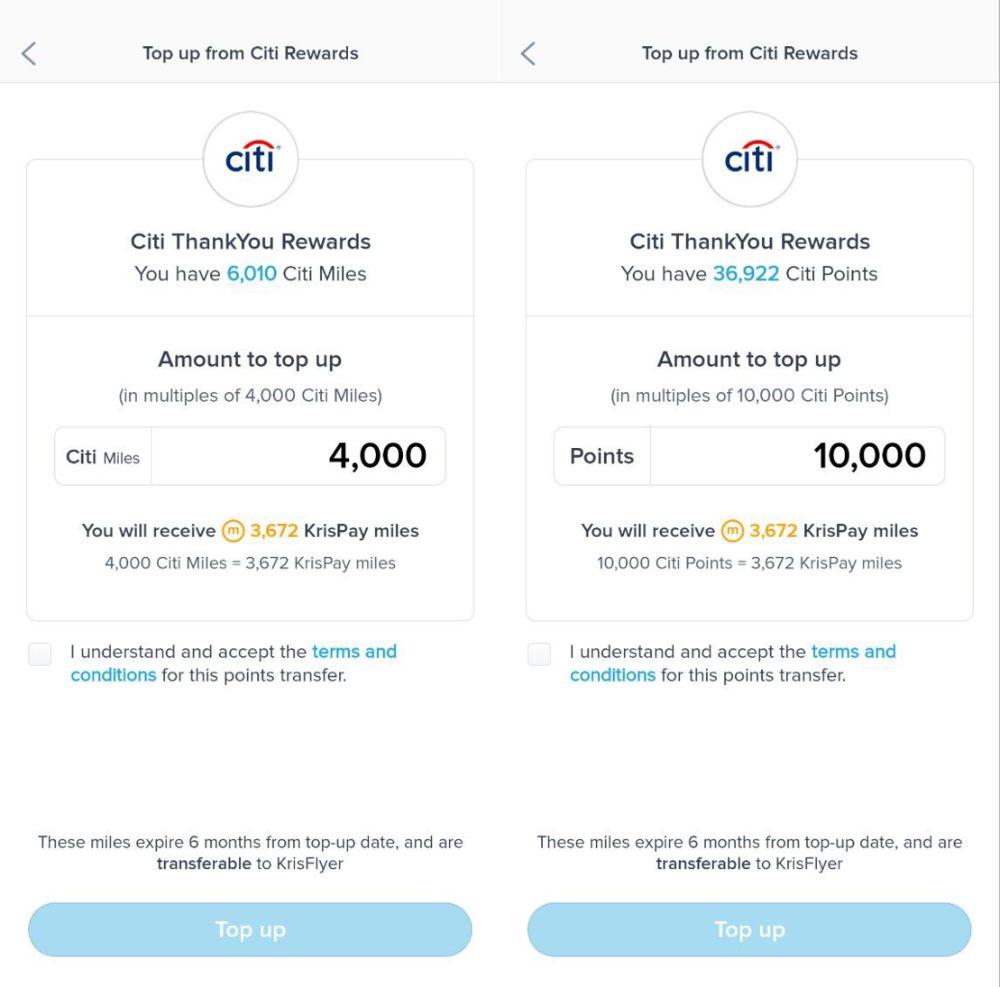

From 12 November 2025 to 26 February 2026, Citi cardholders will receive an 8% bonus for every conversion of at least 4,000 Citi Miles or 10,000 ThankYou points.

|

||

| Citi Miles/ TY Points | KrisPay Miles | |

| 4,000 Citi Miles | ⇒ | 3,672 miles |

| 10,000 TY Points | 3,672 miles |

|

There is no cap on the number of transfers you can make, nor the bonus miles that can be received.

The bonus will be reflected on the Kris+ app at the point of transfer, so you can check the final amounts before confirming.

Don’t forget that transferring Citi credit card points into KrisFlyer miles via Kris+ is a two-step process. Once you’ve done the first conversion, you will need to tap the “transfer now” button to convert the KrisPay miles into KrisFlyer miles at a 1:1 ratio.

If you wait longer than 21 days, or spend any portion of the converted KrisPay miles, the remaining balance will be “stuck” inside Kris+. KrisPay miles can only be spent at a relatively poor rate of 1 cent per mile, and expire after six months regardless of activity.

Is it worth it?

The main drawback of converting Citi (or DBS/UOB) credit card points to KrisFlyer miles through Kris+ is the loss in value.

If you were to convert points through the Citi app instead, the rates would be:

- 10,000 Citi Miles = 10,000 KrisFlyer miles

- 25,000 ThankYou points = 10,000 KrisFlyer miles

Why convert Citi points via Kris+?

So why would you want to convert Citi credit card points into miles via Kris+?

- Transfers via Kris+ are free, while transfers via the Citi app have a S$27.25 fee

- Transfers via Kris+ are instant, while transfers via the Citi app usually require 24-48 hours

- Transfers via Kris+ have a minimum block of 4,000 Citi Miles/10,000 TY points, while transfers via the Citi app require a minimum block of 10,000 Citi Miles/25,000 TY points

For example, if you had 10,000 Citi Miles on your Citi PremierMiles Card, your choices are:

- Convert them via the Citi app into 10,000 miles with a S$27.25 fee, and a 24-48 hour wait

- Convert them via Kris+ into 9,180 miles with no fee, instantly

Unless you value a mile at more than 3.3 cents each, then it’s a better idea to save on the conversion fee (and enjoy instant conversions) by going through Kris+.

Alternatively, you might have already decided to cancel your Citi PremierMiles Card, but still have a balance of 6,000 Citi Miles. That’s too small for a transfer through the Citi app, and the points would be “stranded” if not for the Kris+ option (which requires a minimum of just 4,000 Citi Miles). Taking a haircut on the transfer is better than letting those points go to waste!

| ❓ Haircut vs Transfer Fees |

| The more points you transfer, the more significant the haircut (in absolute terms). There will come a point where the loss in miles more than offsets the S$27.25 savings in conversion fees, but that depends on how much you value a mile. |

All the same, I wouldn’t transfer more points than necessary, as Citi credit card points are very valuable. Cardholders can choose from 11 different transfer partners, so there’s no point putting all your eggs in one basket.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

What about expiry?

With regards to Citi credit card points:

- Citi Miles never expire

- Citi ThankYou points earned on the Citi Rewards Card are valid for up to five years

- Citi ThankYou points earned on the Citi Prestige and Citi ULTIMA Cards never expire

On the other hand, KrisFlyer miles will expire three years after accrual, so converting points to miles might be putting time pressure on yourself to spend them.

Since KrisFlyer miles expire at the end of the month, you could stretch the validity period by delaying the conversion from KrisPay to KrisFlyer. For example, you might transfer your Citi credit card points to Kris+ on 17 February 2026 to enjoy the bonus, but wait until 1 March 2026 to convert them to KrisFlyer (thereby getting validity all the way till 31 March 2029 instead of 28 February 2029 had you transferred in February).

However, this runs the risk of forgetting, so I’d highly recommend setting a calendar reminder!

Conclusion

Kris+ is offering an 8% conversion bonus on Citi Miles & ThankYou points from now till 26 February 2026.

While it’s normally not a good idea to convert credit card points via Kris+, due to the haircut involved, it might still make sense for those with an orphan points balance, or who have an immediate need for miles.

There’s several months to take advantage of this offer, so there’s no need to rush. And if there’s no rush, then you might want to make transfers via the Citi app instead and save yourself the haircut!

That’s great info and new. Thanks for sharing! I always look forward to your posts.

I do have a question. How can a person determine which is better value, a haircut or S$27.25 conversion fee? At what level does paying S$27.25 conversion makes optimal sense than using the 8% haircut? Assuming there is no immediate need for points conversion and wait of 24-48 hours is acceptance?

depends on how much you value a mile. your breakeven point is conversion fee/value of a mile. so if it’s 1.5 cents, then your breakeven point is 1,817 miles. 8% haircut means 22,708 miles transferred. if you’re transferring more than this, then it’s worth paying the conversion fee.