Citi PayAll usually runs two big promotions a year in April and October, and while we’ve had to wait a little longer for the second promotion this year, I guess it’s better late than never.

Instead of boosting the earn rates, Citi is offering a 0.5% rebate that reduces the effective admin fee from 2.6% to 2.1%. Depending on which of the four participating cards you hold, you’ll be paying between 1.31 to 5.25 cents per mile.

Unless you’re a Citi ULTIMA Cardholder, you’ll find that this promotion is significantly less generous than the last, where the cost per mile ranged from 1.44 to 1.63 cents. Moreover, the rebate won’t be credited to your card until mid-May 2026, which effectively locks you into your card in the interim period.

Citi PayAll 0.5% fee rebate promo

|

| Note: Citi advertises up to a 0.6% rebate, but that won’t be realistic for the vast majority of customers, for reasons we’ll cover later. |

| Citi PayAll |

From 18 November 2025 to 28 February 2026, Citi is offering eligible cardholders the opportunity to earn a 0.5% fee rebate on Citi PayAll spending.

Eligible cardholders refer to principal cardmembers of the following cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

Where applicable, both the Visa and Mastercard variants of each card are eligible (though keep in mind the Visa versions don’t have long left!).

Here are the key details of the promotion.

- No registration is required

- Payments must be set up between 18 November 2025 and 28 February 2026

- Payment must be charged by 5 March 2026

- Customers must make at least S$6,000 worth of Citi PayAll payments on a single eligible card (though it can be in one or more transactions)

- The fee rebate is capped at S$750 per customer, equivalent to S$150,000 of spending

If you set up any payments before the commencement of the promotion period, you might want to cancel them and set them up again so that the amount will count towards the minimum spend, and qualify for the 0.5% fee rebate.

If you spend on multiple cards, only the card with the highest accumulated spend will enjoy the fee rebate. In other words: stick to a single card!

For the avoidance of doubt, the fee rebate is capped on a customer level. It doesn’t matter how many eligible cards you hold; you cannot earn more than S$750 from this promotion.

| ⚠️ Citi app shows regular rates! |

| The Citi Mobile App (where Citi PayAll payments are set up) will display the regular 2.6% fee. This is to be expected, as the 0.5% rebate will only be credited later, if the eligibility criteria is met. |

What’s the cost per mile?

With a 0.5% fee rebate, Citi PayAll’s regular 2.6% admin fee is reduced to 2.1%.

Here’s what that means for the cost per mile on the four eligible Citi cards.

| Card | Earn Rate | Admin Fee | Cost Per Mile |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 2.1% | 1.31¢ |

Citi Prestige Citi PrestigeApply |

1.3 mpd | 2.1% | 1.62¢ |

Citi Premier Miles Citi Premier Miles Apply |

1.2 mpd | 2.1% | 1.75¢ |

Citi Rewards Citi RewardsApply |

0.4 mpd | 2.1% | 5.25¢ |

Is it worth it?

Unlike the previous Citi PayAll promotion we saw in April, which upsized the earn rate while keeping the admin fee the same, this promotion keeps the earn rates the same while cutting the admin fee.

This mechanic means that some cards will be better than others. For example, it’d be absolute insanity to use the Citi Rewards this time round (5.25 cpm). Heck, even the Citi PremierMiles Card (1.75 cpm) and Citi Prestige (1.62 cpm) are marginal in my opinion. The only people who are likely to be pleased are those with the Citi ULTIMA (1.31 cpm), who will enjoy a lower cost per mile than the April promotion (which bottomed out at 1.44 cpm).

It’s important to note that this may not beat the rates offered by other services like CardUp or SC EasyBill.

For example, an OCBC VOYAGE Cardholder could make recurring payments via CardUp with a 1.8% admin fee and earn 1.3 mpd, buying miles at 1.36 cents. Likewise, a StanChart Beyond Cardholder with Priority Banking or Priority Private status could pay income tax, insurance premiums, rent or education expenses via SC EasyBill with a 1.9% admin fee and earn 2 mpd, buying miles at 0.95 cents.

This might not even be the cheapest way for a Citi cardholder to pay the bills. If you had a Citi Prestige, you could pay rent via CardUp with a 1.79% admin fee and earn 1.3 mpd, buying miles at 1.35 cents.

Refer to the article below for the full list of CardUp promo codes for 2025.

Enhanced 0.55% and 0.6% rebate for Citi insurance

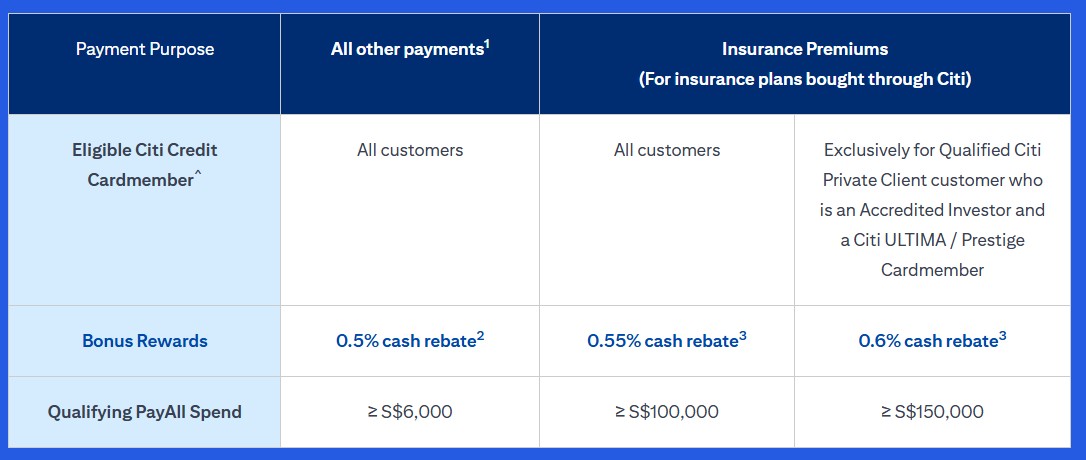

Citi is also offering a higher rebate tier of 0.55% or 0.6% to customers who pay for insurance plans bought through Citi, but this won’t be realistic for the vast majority of cardholders.

For example, to earn a 0.55% cash rebate, cardholders must spend at least S$100,000 in Citi PayAll payments for Citi insurance premiums. If they are Citi Private Clients customers with Accredited Investor status and also Citi ULTIMA/Prestige Cardholders, they can earn a 0.6% cash rebate- provided they spend at least S$150,000 in Citi PayAll payments for Citi insurance premiums!

The fee rebate is offered on up to S$400,000 of qualifying spend, but the minimum spend is just so staggeringly high that it’s practically irrelevant.

When is the rebate credited?

Cardholders will need to pay the regular 2.6% fee for Citi PayAll payments made during the promotion period. The 0.5% fee rebate will be credited within 12 weeks from the end of the promotion period, i.e. 23 May 2026.

That means a wait of up to six months for the rebate, during which you can’t cancel your Citi card!

Terms & Conditions

The T&Cs for this promotion can be found here.

What can you do with Citi points?

Citi Miles and ThankYou points are amongst the most versatile in Singapore, and can be converted to 11 frequent flyer programmes and one hotel programme.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

All conversions have a flat fee of S$27.25.

Citi Miles, and Citi ThankYou points earned on the Citi ULTIMA and Prestige Cards do not expire. Citi ThankYou points earned on the Citi Rewards Card are valid for up to five years.

Citi PayAll transactions count as qualifying spend

Citi PayAll transactions will count towards the qualifying spend required for welcome offers and card-related benefits, provided the service fee is paid.

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige Card

- The minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige Card

Citi PayAll transactions also count towards the aggregate sum to which the Citi Prestige’s Relationship Bonus is applied.

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Conclusion

Citi PayAll has launched its second major promo for the year, but frankly speaking it’s kind of meh.

Unless you’re a Citi ULTIMA Cardholder, you’re looking at a cost of 1.62-1.75 cents per mile (I’m hoping that Citi Rewards Cardholders will have the good sense not to participate!), which is higher than the 1.44-1.63 cents per mile figure we saw during April’s income tax promotion.

Don’t forget that a minimum spend of S$6,000 on Citi PayAll is required, and an overall spending cap of S$150,000 applies. Also, you won’t see the rebate until May next year, and it will be forfeited if you cancel your credit card before it arrives.

It’s worth checking whether a competing service like CardUp or SC EasyBill might offer a lower cost per mile, based on the ongoing promotions they have.

With a “deal” like that, why bother?

Citi is nudging me to give up the Citi Rewards card. *sniff* *sniff*

that said, payall is the only option for income insurance.

I’m thinking to use citi payall to renew my upcoming car insurance with budget direct. But can’t seem to find it in any of the category choices.

Any suggestion how I should be doing it?