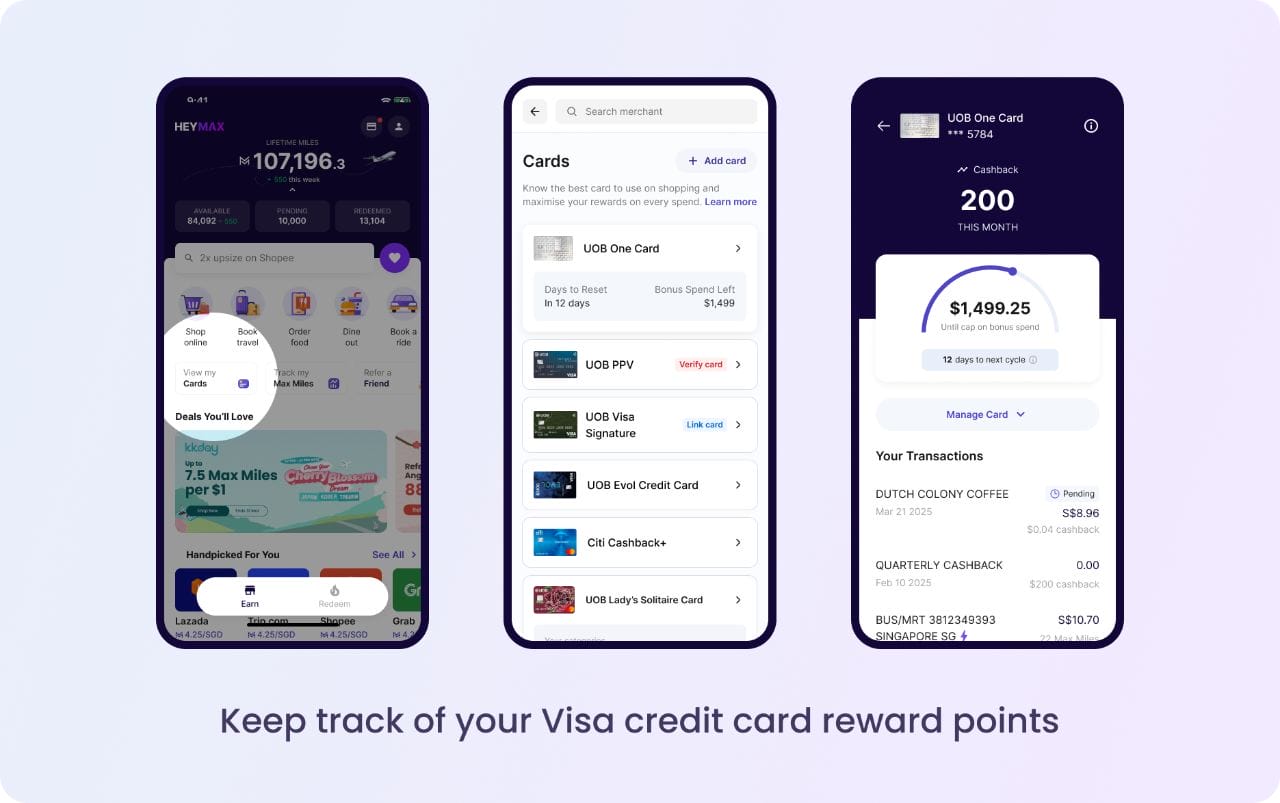

I’ve previously written about the HeyMax Card Maximiser feature, which helps keep track of points earned and the remaining bonus caps on your credit cards.

This is crucial for cards like the HSBC Revolution, which earns 4 mpd on the first S$1,500 spent at bonus merchants each month, and just 0.4 mpd beyond that. If you accidentally go beyond the limit, your average earn rate will drop very quickly!

However, there’s another important thing to keep track of too: minimum spends. For some cards, the bonus rates don’t kick in until a certain minimum spend has been met. Spending below that threshold could be a costly oversight too.

It’s usually a pain to keep tabs on this, because most banking apps track card spending on a statement cycle basis, even if the minimum spend is enforced based on calendar month. But here’s some good news: the HeyMax Card Maximiser has just been enhanced to add support for minimum spend tracking.

HeyMax Card Maximiser now tracks minimum spends

HeyMax users can now track minimum spend progression for the following credit cards.

| Card | Min. Spend | Unlocks |

StanChart Smart Card StanChart Smart CardApply |

S$800 per s. month | 7.42 mpd or 8% rebates on bonus categories (no cap) |

| S$1.5K per s. month | 9.28 mpd or 10% rebates on bonus categories (no cap) | |

DBS yuu Visa DBS yuu VisaApply |

S$800 per c. month | 10 mpd on yuu merchants (capped at S$823 per c. month)* |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

S$800 per c. month | 2.8 mpd on FCY spending (no cap) and air tickets (capped at S$10K per c. month) |

| *Also requires spending at 4x yuu merchants per calendar month |

||

Users will be able to track their progress on the linked card page, and receive a notification from the app when they hit the target.

![]()

HeyMax tells me the tracker is sophisticated enough to filter out ineligible minimum spend. For example, if you were to spend on utilities with the Maybank Horizon Visa Signature, that amount will not count towards the S$800 minimum, and will not affect the tracker.

I don’t see much incremental value here for the DBS yuu Visa, since the yuu app already tracks (yuu app > Brands > DBS) your minimum spend and progress towards the 4x merchant requirement each month.

![]()

However, it’s a useful feature for the StanChart Smart Card and Maybank Horizon Visa Signature, especially the latter since the Maybank app has this annoying bug (feature?) where it does not show pending transactions.

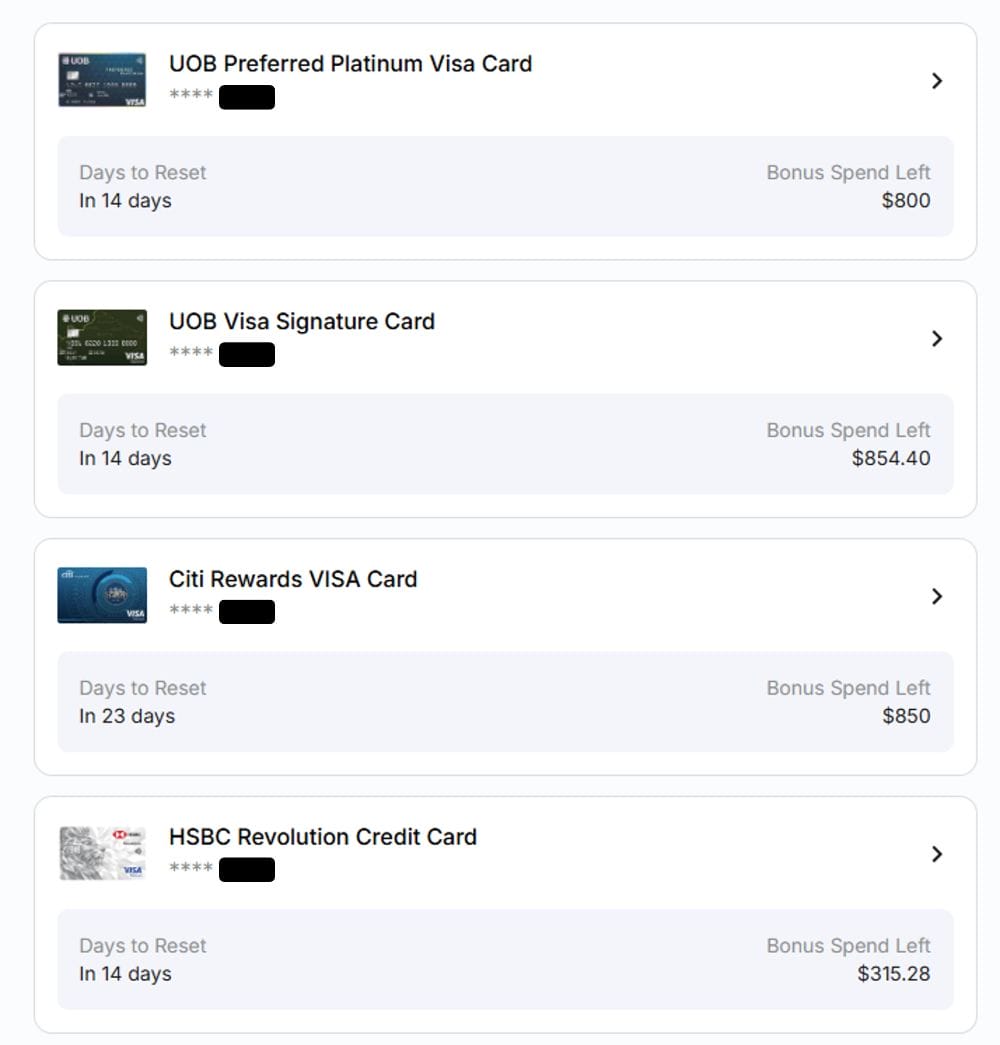

Of course, the real challenge will be getting the Card Maximiser to support cards like the UOB Preferred Platinum Visa and UOB Visa Signature, with their tricky bonus sub-caps and (in the case of the latter) minimum spend. HeyMax says that support for these two cards should be added in the near future.

Other (miles-earning) cards which have minimum spend requirements include:

- Maybank XL Rewards Card: Min. S$500 per c. month for 4 mpd on bonus categories

- Maybank Visa Infinite: Min. S$4K per c. month for 3.2 mpd on FCY spend

- Maybank World Mastercard: Min. S$800 per c. month for 2.8 mpd on FCY spend, min. S$4K per c. month for 3.2 mpd on FCY spend

- KrisFlyer UOB Credit Card: Min. S$1K spend on SIA Group in a m. year for Accelerated Miles

That said, we’re unlikely to see support for anything but the Maybank Visa Infinite, as the rest of these cards are Mastercard, and the Card Maximiser relies on a transaction feed that Visa provides.

Recap: HeyMax Card Maximiser

|

| Get a HeyMax account |

The HeyMax Card Maximiser allows you to automatically track your expenditure, points earned and remaining bonus cap for selected Visa cards.

To use the Card Maximiser, you need to first pair your card with your HeyMax account.

- Login to your HeyMax account

- Navigate to Your Cards

- Click on Add Card, then follow the instructions

A test transaction of S$0.01 (or S$1, depending on the card) will be charged and later refunded. This is very similar to ShopBack GO or Qatar’s Card Linked Offers, both of which rely on the transaction feed that Visa provides to track and reward card spending.

Once the linking is completed, HeyMax will start tracking how much you’ve spent on each card, and deduct it from the bonus cap accordingly.

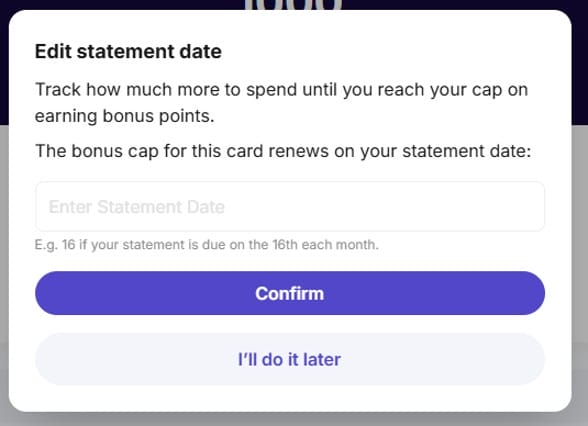

In the case of the Citi Rewards Visa, StanChart Journey Card and UOB Visa Signature, where bonus caps are tracked by statement month, you’ll be prompted to enter the last day of your statement date so the system knows when to reset your cap.

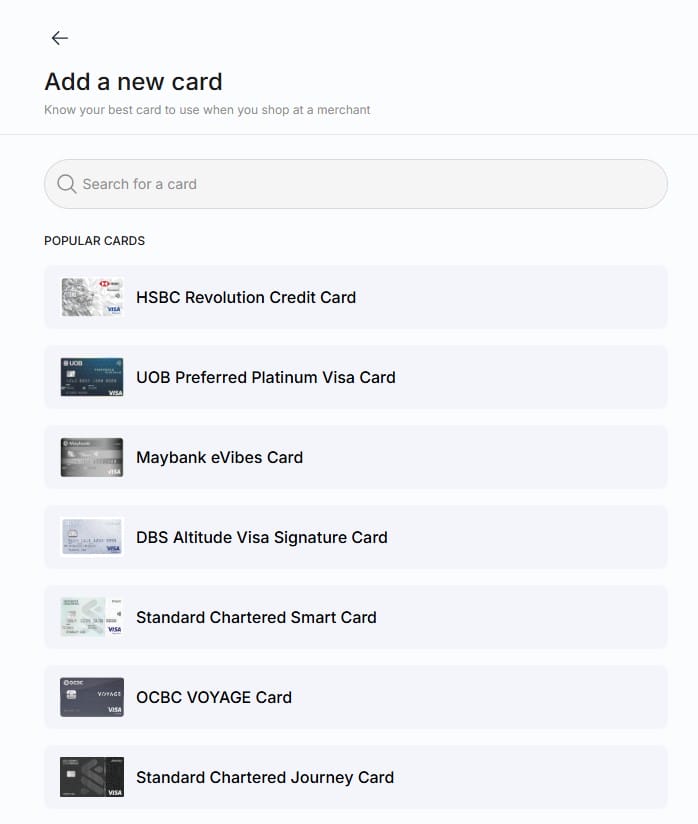

While the Card Maximiser supports transaction tracking for (almost) every Visa card, the calculation of points earned and remaining bonus caps is only supported for the following Visa cards.

| 💳 HeyMax Card Maximiser Supported cards for points and bonus cap tracking |

||

| Card | Earn Rate | Bonus Cap |

Chocolate Visa Debit Card Chocolate Visa Debit CardApply |

1 mpd | S$1K per c. month |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 mpd (SGD) 2.2 mpd (FCY) |

N/A |

Citi Rewards Visa Citi Rewards Visa |

4 mpd | S$1K per s. month |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd (SGD) 2.2 mpd (FCY) |

N/A |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd (SGD) 2.2 mpd (FCY) |

N/A |

DBS yuu Visa DBS yuu VisaApply |

10 mpd | S$823 per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | S$1.5K per c. month |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | S$10K per c. month (for air tickets; no cap for FCY) |

StanChart Journey Card StanChart Journey CardApply |

3 mpd | S$1K per s. month |

StanChart Smart Card StanChart Smart CardApply |

9.28 mpd | N/A |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | S$1.2K per c. month (2x sub-cap of S$600) |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | S$2.4K per s. month (2x sub-cap of S$1.2K) |

Conclusion

HeyMax’s Card Maximiser feature now supports minimum spend tracking for the DBS yuu Card, Maybank Horizon Visa Signature and StanChart Smart Card. This saves cardholders from having to manually tally their spending, and alerts will be sent once the minimum spend for the month has been reached.

Separately, HeyMax plans to add support for the UOB Preferred Platinum Visa and UOB Visa Signature, which will be a huge quality-of-life improvement if it can get the bonus sub-cap tracking right.

Still waiting for them to first add Maybank XL card to their database.

Hey! Long Yin from the HeyMax team here. We’re working on adding this card in the next 1-2 weeks. It took a while but thanks for the feedback and appreciate your patience.

Hey! We’ve just added support for the Maybank XL card. You can now add the card to your profile and get it recommended for merchants where it earns you the best rewards. Do note that spend/rewards tracking for non-Visa cards are not supported yet. Feel free to drop me feedback if you have any! longyin@heymax.ai

Can someone briefly explain how does HeyMax actually tracks the spending, for transactions not through HeyMax app.

Hey Noile, Long Yin from the HeyMax team here. We partner with Visa to help you track your Visa card transactions. When you link your cards on HeyMax, we essentially ask for your authorisation and redirect you to a Visa-hosted webview to input your card info. With your authorisation, Visa sends us a stream of your transactions that happen on your linked card thereafter.

Happy to help answer any other questions you might have!

one thing really annoying about heymax is that when you pay the credit card bill, it treats the amount paid as though you paid something using the card, until the credit card payment finish processing.

Thanks for the feedback – if you can share an example with me to joe@ heymax.ai – would be amazing. We will fix this.