Since 2021, American Express has been running a popular offer with petrol chain SPC that gives registered cardholders up to 21% off petrol.

It’s come slightly late this year, but the offer has now been renewed for 2026 with similar terms as before. You’ll need to re-register your cards to participate, and each registered card can enjoy a maximum statement credit of S$120.

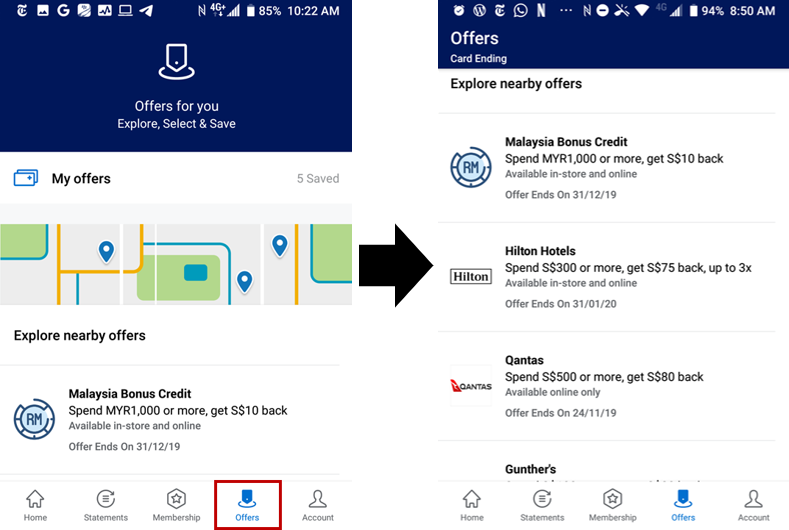

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles, Membership Rewards points, or discounts in the form of statement credits. They can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS, Citi or UOB AMEX cardholders. |

American Express offering up to 21% off petrol at SPC

From 15 January to 31 December 2026, American Express customers can register their cards to save up to 21% off petrol at SPC.

This is broken down into the following components:

- 10% discount for SPC&U Members

- 5% discount for American Express cardholders

- 7.1% rebate for registered American Express Cards

The mathematically-inclined amongst you might notice that 10+5+7.1=22.1%, so why are the savings quoted as 21%? It comes down to discounts versus rebates. Cardholders will receive a 15% discount upfront, with a further 7.1% rebated to them via statement credit.

For example, if you purchase S$100 worth of petrol:

- You’ll pay S$85 at the counter (15% discount)

- You’ll receive a 7.1% rebate from S$85 (S$6.04) credited to your account

- You’ve therefore paid S$78.96 for S$100 of petrol, a discount of ~21%

The maximum statement credit that can be received per registered card is capped at S$120, which means you’d max this out with ~S$1,690 of petrol spending (after the 15% discount).

If you need more petrol than that, you can register multiple cards. However, please only register as many cards as you need, since there’s a registration cap of 60,000 cards per type (e.g. 60,000 AMEX KrisFlyer Ascend, 60,000 AMEX HighFlyer Card etc.; the only outlier is the AMEX True Cashback Card with a cap of 5,000).

The discount excludes transactions made at manual carwash outlets, SpeedyCare automotive centres, and EV charging points.

Statement credits should reflect on your account within five business days from qualifying spend.

Terms & Conditions

The full T&Cs of the AMEX x SPC offer can be found below:

Terms and Conditions for 15% On-site Fuel Savings at SPC at go.amex/spc15percent Terms and Conditions for 7.1% savings via statement credit, on all purchases at SPC

T&Cs

No miles or points for SPC transactions

As a reminder, you won’t earn any rewards with American Express cards at SPC stations, which means using your card is a pure money-saving play.

Rewards for SPC stations were axed for the AMEX KrisFlyer and Platinum cards in March 2020, followed by the HighFlyer card in April 2023. The only exception to the no-rewards rule is the AMEX True Cashback Card, where cardholders will still earn 1.5% cashback as per normal.

Is it worth forgoing miles or points at SPC in favour of a larger discount? It comes down to your personal valuation of a mile, though in this scenario I’d lean towards yes.

But then again, it doesn’t have to be an either/or situation, because you can still enjoy discounts and earn miles if you pump petrol at other chains. Sinopec, for example, runs periodic 23% discounts which you can stack with a 4 mpd card. Esso is also offering a 12% discount plus up to 7 mpd for customers who pay via Kris+.

Pay with Points+ at SPC

| 💳 AMEX Pay with Points+ |

||

1,000 MR points 1,000 MR points |

⇒ | S$6.00 |

In 2021, American Express launched an enhanced Pay with Points programme, aptly called Pay with Points+ (or PWP+ for short). This scheme allows cardholders to redeem Membership Rewards points at an enhanced rate at selected merchants.

SPC is a PWP+ merchant, which means you can redeem 1,000 MR points for S$6, instead of the usual S$4.80. But this still represents poor value, because by choosing PWP+, you’re accepting an implicit value of:

- For Platinum Charge/Centurion members: 1 mile= 0.96 cents

- For all other AMEX card members:1 mile=1.08 cents

I’d pass if I were you.

What other cards can you use for petrol?

The following credit cards offer bonus miles for petrol.

| ⛽ Highest Miles Earning Cards for Petrol |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s Card |

4 mpd | Max. S$1K per c. month, must choose Transport as bonus category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

4 mpd | Max. S$750 per c. month, must choose Transport as bonus category |

UOB Visa Signature UOB Visa Signature |

4 mpd | Min. S$1K spend in SGD per s. month, max. S$1.2K |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

4 mpd | Max. S$600 per c. month, must use mobile payments |

Maybank World Mastercard Maybank World Mastercard |

4 mpd | Offline payments only |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

4 mpd | Max. S$1K per s. month. 1% fee for SGD-denominated transactions |

| C. Month= Calendar Month, S. Month= Statement Month | ||

Where it gets complicated is that the best card from a miles perspective may not necessarily be the best card from a discounts perspective.

I’m in the midst of updating my “best cards to use for petrol” article for 2026, which takes into account both miles and discounts, so stay tuned.

Conclusion

American Express has renewed its partnership with SPC, offering a 21% discount for registered cardholders throughout 2026. A total of 65,000 slots are available per card, so drivers will want to get registered as soon as possible.

Just keep in mind that the discount comes at the expense of earning miles, and if that’s what you primarily care about, then the UOB Preferred Platinum Visa and Sinopec’s simple flat discount scheme could be a better bet.

Is the AMEX overall discount better than paying with the POSB Everyday Card?