the very lovely infographic used in the cover photo was made by Daniel Koh. You should check out the rest of the infographics he made on OCBC Voyage here

To reiterate something I have said many times before- The OCBC Voyage card is a terrible product and there is absolutely no reason you need to own one.

But now that they’ve got a targeted promotion offering 150,000 / 500,000 miles for an annual fee of $3,210/ $10,000 respectively, I’m getting some questions as to whether it’s worth it to sign up anyway.

Let’s do a quick refresher on what the OCBC Voyage card is and whether the sign up bonus makes sense.

What is the OCBC Voyage Card?

The marketing for OCBC Voyage sounds great in principle. Book any seat on any airline. No need to pay conversion fees to change your bank points to miles. No need to waitlist for a limited number of award seats. What could be better?

Well, here’s the main issue-

The OCBC Voyage card is not a miles card. It is a cashback card with a call option for miles.

I believe this will become clearer in the example below.

Using the Voyage Card

When you spend with the OCBC Voyage card, you earn Voyage Miles. Voyage Miles (VM) are OCBC’s internal currency.

You have 2 options for redeeming your VMs.

- You can convert them to Krisflyer Miles at a ratio of 1:1 (hence my comment that they work like a “call option” for Krisflyer Miles)

- You can use them to redeem air travel on any airline through OCBC’s own concierge for a fixed value ~3 cents each.

Suppose I want to travel from Singapore to Sydney in First Class. Here are my choices with VMs-

Option 1- Conversion

You can convert your VMs into Krisflyer Miles at a rate of 1:1 each and redeem a round trip for 127,500 miles plus $515 in taxes on SQ.

Option 2- OCBC Concierge

You can call up the OCBC Concierge and ask them to make a booking with your VMs. The agent will go online and look for revenue seats in First Class from Singapore to Sydney.

Suppose he finds 2 choices -SQ and TG, $8,400 and $6,500 respectively. He will tell you that you can fly with SQ or TG for 280,000 or 216,667 Voyage Miles respectively (this is based on OCBC’s own internal valuation of VMs at ~3 cents each). You pick one and he issues the ticket over the phone, deducting your VMs.

Analysis

You should see the inherent problem here- because VMs have a fixed value, you don’t know ex-ante how much your redemption will cost. It depends on the route, time of year, carrier, even time of departure.

When it comes to premium cabin redemptions, it is almost always a bad idea to use your VMs. This is because they will always only every buy ~3 cents of value. So the number of VMs required scales linearly with the cost of the ticket. You have more options with VMs in the sense that you can use them to buy any ticket, but that flexibility comes at a hefty price.

Your Krisflyer miles, on the other hand, buy 2-3 cents of value for economy class tickets, 4-5 cents of value for business class and 6-7 cents of value for first class. That’s the variable value of your miles, and their most important quality.

This is why I call the Voyage Card a cashback card. OCBC is giving you the equivalent of ~3% cashback every time you earn 1 VM.

The irony of the OCBC Voyage was that it was launched as a card targeting the mass affluent- and at a $120,000 income requirement it certainly is. But the way to get any value out of this card is to use VMs for budget and economy class travel. Hardly what most people have in mind when they think about it

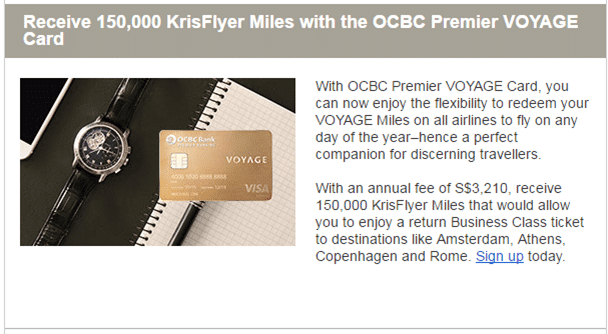

OCBC Voyage sign up bonus

Now, to the second point- OCBC is now offering a targeted sign up promotion for the Voyage card.

| Miles | Annual Fee | Cost Per Mile | |

| Base | 15,000 | $488 | 3.3 cents |

| Targeted Offer 1 | 150,000 | $3,210 | 2.1 cents |

| Targeted Offer 2 | 500,000 | $10,000 | 2.0 cents |

In general, you should not pay anything more than 2 cents per mile when paying annual fees.So the base sign up offer is a terrible deal. You’re paying for the fancy metal card and a whole lot of hot air.

Offers 1 and 2 are much closer to that threshold. Would I jump on it? No, because I have no pressing need for 500,000 Krisflyer miles at the moment, and I’m still quite cheesed off after discovering how much cheaper redemptions on Cathay (no fuel surcharges) are.

But assuming you have a planned redemption in mind (say, return suites tickets to Paris on SQ which would cost 373,500 miles + fuel surcharges), then this might make sense.

More interestingly, remember that OCBC is giving you VMs, not Krisflyer miles per se (as I assumed in the example above). If each VM has a value of ~3 cents, then your 500,000 miles can buy you $15,000 of value should you decide to use those miles to buy a revenue air ticket.

Arbitrage? Maybe. Assuming my calculations are right, and my ~3 cents was based on values given when the Voyage card launched about a year ago. That value at best has stagnated.

Is there any redeeming value?

The Voyage card gives 2.3 VM per S$1 on dining. There are better options, of course (a certain preferred platinum AMEX card is still alive…), but assuming you want a Visa for flexibility then this card might work. It’s still a lot of money to pay for a dining card though, given that they don’t waive the annual fee of $488.

You get 2.3VMs per S$1 spent overseas too, just below UOB PRVI’s 2.4 miles per S$1. So again, that might be a valid use of it.

I suppose what gets me is the mischaracterization of this card. OCBC has a long history of not having a good miles offering, and this card was the one they hyped up as changing all that. I’m not buying.

But hey, it’s made of metal!

in your s/s table , you have the miles and annual fee column mixed up 🙂

good spot. have fixed it, thanks! chalk it down as an in office too late error

Under option 2, there is a typo: “..SQ for TG..” It should be “…SQ or TG…”

Did you receive my question a few days ago? I asked in your Question section.. Just wondering whether u received it.

ah yes, sorry i must have missed that one. there’s an article on the changes to the krisflyer card portfolio here– the krisflyer blue card is basically the amex gold card in a new shade.

also, typo fixed. thank you!

if it is the case, paying $10,000 to have 500,000 miles, from my opinion, it is not a bad deal… we can transfer to ANA to redeem the awarded air ticket.

from SG to USA, it will take 95,000 miles for a biz class ticket without surcharges.

or we can use Asiamiles, as the award chart is according to the distance.

not sure if i’m understanding you correctly, but VMs can only be transferred to krisflyer. you cannot transfer them to ANA or Asiamiles. you can redeem them for ANA/cathay tickets at revenue rate/ approx 3 cents each

If the internal value of a VM is still at 3c, what I’m thinking is buying them at 2c each will give a 30% discount off your future economy bookings.

Of course, OCBC’s internal valuation of the VM is subject to change at any moment and probably without any annoucement too, so there’s alot of risk in that.

Has anyone here actually used VM to redeem a ticket thru the OCBC voyage service? maybe that can give us abit more resolution.

I’m very puzzled why you aren’t as enthusiastic about the 500,000 KF miles for S$10,000 deal, as you are for what you get with Lifemiles. 160,000 Krisflyer miles gets an SQ Business ticket to Europe, which means S$3,200 + taxes, etc. Seems OK, no? Under this deal, a KF mile is worth S$0.02, as you say. During a Lifemiles sale, a Lifemile is worth US$0.01375 (= S$0.0195). 156,000 Lifemiles are required to go to Europe, making it S$3,042 at today’s exchange rate. For $158, I avoid the hassles and complications of transacting Lifemiles with Avianca. Not *that* bad a deal,… Read more »

I suppose it depends how much you want to spend on flights.

I certainly don’t need to buy that many miles every year, though I’m sure I could use them over their 3 year lifetime.

three thoughts- (1) the 500,000 kf miles for $10K deal is targeted, so not everyone will be able to take advantage of that (2) the value of lifemiles for me is not to redeem with SQ (because you won’t find SQ long haul premium cabin space anyway and you can earn KF miles very easily in SG). It’s to try flying other star alliance first/business class products (think NH, BR) that would cost you more to redeem via krisflyer (3) lifemiles has some sweet spots that the sq award chart does not have. think flying from singapore to hawaii (via… Read more »

Hi Aaron

From what I understand, the 500K miles for $10K is not a targeted offer. Anyone who can apply for a Voyage card (even the basic card) can opt for this offer.

It is even stated in their application form which you can get from any branch.

its definitely not a targeted offer. I was given the option on the printed application form.

my bad. then reasons (2) and (3) would weigh higher for me than (1)

read up a bit more on this. it started life as a targeted promo, then was eventually rolled out to everyone. guess they could use some cashflow

Hi Aaron, Really detailed post but kinda confused because, e.g. for round trip business class flight Singapore – San Francisco costs $6,681.10 (saver class) or 176,000 KFmiles (saver class) + fees (~ $150). Using the option to pay ann. fee of $3,210 for 150,000 miles and then converting a further spending in future for $25 to make 200,000 to qualify for this ticket translates to a total cost of about $3,400 (rounding up) using this card! – Thats almost half the price compared to traditional round trip business class ticket. Not to mention unlimited lounge visits for yourself and your… Read more »

hi shan. you’re right in saying that if you are paying the annual fee just for the miles, and are certain you can get saver award space (which is not always the case), then it would be cheaper to buy miles via the annual fee than paying the revenue price. but you can’t compare revenue and award space directly in the sense that they have different availability buckets. besides, even after you buy the 150k miles via the annual fee you need to get 26k more for your redemption- and the voyage card will penalize you there with 1 mpd… Read more »

I was hoping to use the bonus 150 000 to top up my existing miles in my KF account to redeem a roundtrip biz. It seems like u are saying that the 150k will b in an exclusive VM version that can only be redeemed thru the concierge, and cannot be combined with my actual KF miles in my acct?

Can transfer to KF. Search the blog post for “option 1 – conversion” and you’ll see it.

Since that’s the ‘normal’ route that most miles/points cards have as well, I’m guessing that’s why this post examined the value of VM if redeemed directly.