When I covered UOB’s reduction of the income requirement for their PRVI Miles cards, I noted that it was curious that the income requirements for the AMEX and Mastercard versions were cut to 50K, but the Visa remained at 80K.

At the time I wrote it off as an oversight, figuring that UOB would update the site a few days later. After all, it wasn’t like the PRVI Miles was a special tier of Visa- as per the branding on the card it was just plain vanilla Visa, not Gold, Platinum, Signature or Infinite.

And then I got this comment from Dennis

Aaron – not sure how much truth is in this but running the PRVI Miles Visa BIN through a bunch of online databases seems to suggest that it’s an Infinite :O

Even though the bank doesn’t market it as such (unlike the MC version which is clearly marketed as a WMC), perhaps that’s the reason why the income req hasn’t come down yet. (and also how they’re able to make enough money to sustain 1.4mpd)

Pffft. I thought. Some nutjob on the comments. Just humour him.

And then I got this from Matthew

Hi Aaron,

I can indeed confirm that UOB Privi Miles codes under Visa Infinite.I registered for Visa Infinite Concierge under with the card as well as the Hilton Fast Track to Gold with 2 stays/ 4 Nights.

A bit of a shocker for me as well.

Cheers.

I follow the principle that if one person tells me something it’s unreliable, but if two people tell me something it’s gospel truth. This philosophy has worked out swimmingly for me, which is why I am convinced global warming is a liberal hoax. Stupid polar bears.

Gospel truth or not, I still decided to verify it for myself with my friend’s card (I only have the AMEX and MC versions). But how do you tell if something is a Visa Infinite when it doesn’t say so on the tin?

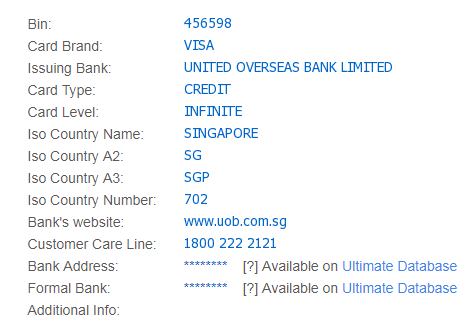

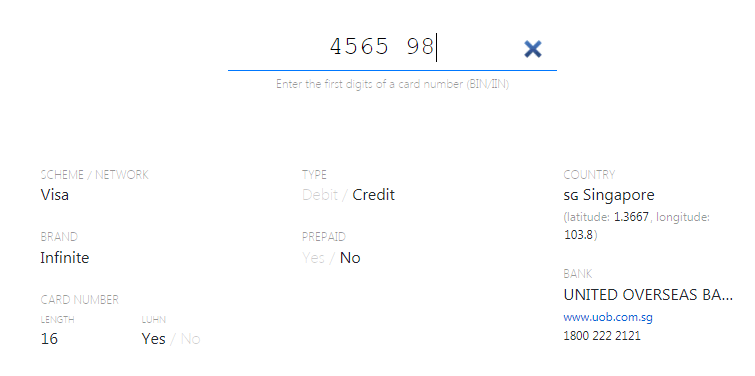

(1) Checking the bin on bindb

For the uninitiated amongst you, a Bin is a Bank Identification Number. I’ll let bindb explain it better.

The Bank Identification Number, also known as the credit card bin can tell you the name of the bank that issued the card, the type of card like Debit or Credit, brand of card Visa, MasterCard and level of card like Electron, Classic and Gold. From the bindatabase you can also check other details about the card and issuer. Credit card bin numbers are the first 6 digits of a card number.

I plugged in the six digits and this is what came out

Holy moley. To make sure it wasn’t just this site saying it, I also looked it up on binlist.net, binchecker.com, bincodes.com, and exactbins.com. All of them concurred.

That’s pretty much game, set, match, but in case you wanted more proof…

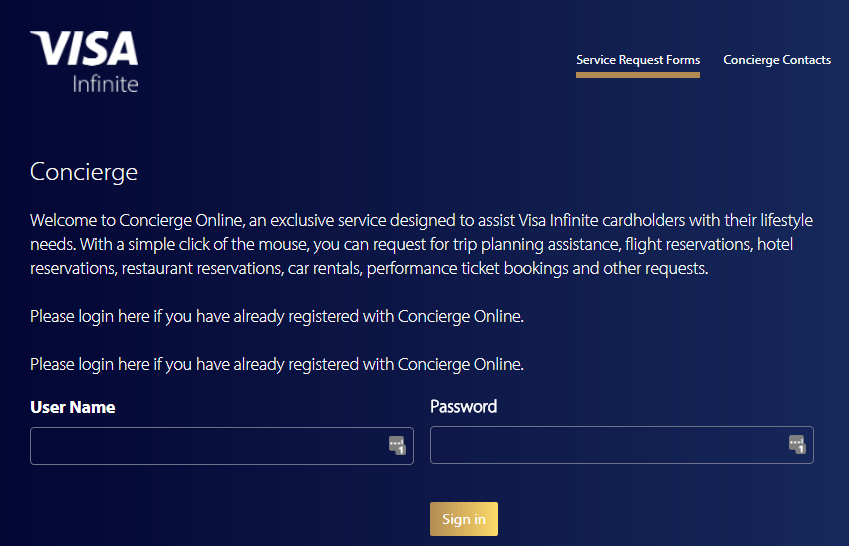

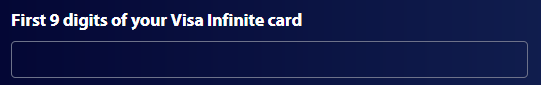

(2) Registering for Visa Infinite Concierge

One of the centrally-provided services that Visa has for its Infinite card tier is a concierge service. I wasn’t too wowed when I used them a few months ago, but that’s not what’s relevant here.

What’s relevant is that before you use the service yo need to register, and the form asks you for the first 9 digits of your Visa Infinite card. Entering the UOB PRVI Visa numbers checked out

So that’s two data points in favor.

(3) Registering for the Hilton Gold fast track offer

I decided to do one more test.

Once upon a time anyone with the first six digits of a Visa Infinite card could get instant Hilton Gold status. But that got abused like you can’t imagine, so they eventually tightened the system up to the point where it’s no longer a straight match but rather a status challenge.

Registration for this worked perfectly with the PRVI Visa.

What’s going on?

Ok, so the PRVI Miles Visa is a Visa Infinite. But why isn’t it branded as one? This is going to involve a lot of speculation from me because I’m not privy to the B2B dealings between Visa and various banks. If you know better, please feel free to chime in.

First, does it cost UOB more to issue a Visa Infinite than a Visa Signature/Platinum/regular card? Intuitively it seems the answer should be yes. After all, Visa Infinite has a concierge and a few other exclusive perks and those all cost money to provide. But if it does, why wouldn’t UOB want to play that up in its branding? It would certainly help raise the card’s profile, because Infinite branding still means something (unlike how Platinum and Signature have become mass market). But instead, UOB has just stuck a regular Visa logo on the cardface. Why would UOB be paying more (assuming it is) and not reaping the branding benefits of that?

Could it be because there’s some minimum income required if you want to market a Visa Infinite card? Based on what I know, all Visa Infinite cards in Singapore have a minimum income requirement of S$120K (I know CIMB will issue a Visa Infinite if you put a fixed deposit collateral of $50K, but let’s ignore that for the moment). So perhaps UOB isn’t allowed to market the card as a Visa Infinite because its income requirement is only $80K. But that brings us back to the previous question- why would UOB want the PRVI Visa to be a Visa Infinite in the first place? What benefit does it give them when they don’t market it that way?

Perhaps it’s because UOB doesn’t want to cannibalize demand for its UOB Visa Infinite. But that still doesn’t add up to me, because the UOB Visa Infinite @ $350K annual income is appealing to a very different market from the PRVI. And besides, the UOB Visa Infinite comes with a host of different privileges (eg special invitations to frou frou events) that the PRVI can’t hope to compete with. And it still doesn’t answer why UOB wants the PRVI Visa to be a Visa Infinite when it doesn’t even market it as such.

So that’s what I can’t figure out now. Help me out guys. What is the purpose of having a stealth Visa Infinite?

Do you need a Visa Infinite?

I’m not completely sold on the benefits of having a Visa Infinite, but just so you know what you’re getting yourself into, here are some of the exclusive benefits (I’ve only listed those which are truly unique to Visa Infinite- a lot of the benefits that banks list for their Visa Infinite cards are really things you could get with Signature/Platinum/any other type of Visa, eg the Visa Luxury hotel collection)

- Hilton Gold fast track offer with 2 stays or 4 nights

- Concierge service

- Discounts, upgrades, breakfast and early/late check in/out at Ritz Carlton, Starwood and Mandarin Oriental Hotels

- National Car Executive status

- Complimentary green fees at Serapong Course, Sentosa Golf Club

Of the benefits listed above, I’d say National Car and Hilton status are the most useful, It’s good to have National Car Executive status because it gives you access to the Executive Aisle, which normally has nicer car options stocked in it than the usual Emerald Aisle. If you have no idea what I’m talking about read this and this. Likewise, Hilton Gold is arguably one of the best mid-tier statuses to have.

From time to time there are special offers that pop up on the internet for Visa Infinite cardholders only. So it could be useful to have a VI on hand to take advantage of such deals.

Click here to apply for a UOB PRVI Miles Visa card

[HT: Dennis and Matthew]

Most important to me. Ha. Does this card works with the new UOB PRVI PAY ? 🙂

I’m sure it does.

Tried the card on the visa infinite luxury hotel collection website which required the FULL 16 digits of the card and it didn’t work… :/

https://www.visainfinitehotels.com/authenticate/card

Maybe is just 37.5% of a visa infinite card?

*it’s

my SCB VI also failed the visa infinite luxury hotel collection authentication test. bummer.

Neither the Visa Infinite Concierge nor the Luxury Hotel Collection sign-ups worked for me. Made a quick call to the contact centre and they told me its a Visa Platinum…hmmm…

What does bin checker say?

It says Infinite….

The concierge worked for me. Only the luxury hotel didn’t.

Hi Aaron, I applied the visa card on Sat and used the bin checker. It showed that my card is only at the classic level. Looks like it wouldn’t work for the latest batch issued.

hmmmmm. thanks for letting me know. based on what i’m reading it seems that some people’s PRVI cards have full infinite benefits (concierge, luxury collection etc), some have partial (only concierge) and some have none.

hypothesis: early batches were VI tagged, later batches platinum tagged, current batches base visa. question is why…

the plot thickens.

my prvi miles visa issued May 2017 – infinite

Perhaps UOB is planning on re-branding the PRVI Miles Visa card as a bona fide Visa Infinite card, but you caught them out during the transition phase? It would explain why the minimum income requirement has not been lowered (vs the AMEX and MC versions).

the problem with that theory is that it seems that PRVI Visas issued earlier on had VI status, but those who have just applied for them are not getting PRVI Visa with VI status.

If there is any indication that the earlier batches were VI cards, it would be the silver Visa logo. Back in those days when the Visa logos were still blue and yellow, the silver logo can only be found on the VI cards (and the Prvi had it as well, albeit without the tiny infinite word).

That is until the OCBC 365 VS card came along with a silver logo as well (probably the first one) and it probably doesn’t mean anything since.

My card was issued in 2016 – VI concierge registration works, but not the luxury hotel collection. Binchecker shows it as VI.

thanks for the datapoint. there seems to be something funny about the luxury hotel collection specifically.

Another data point here. Applied on the same day after I read your post. Approved yesterday. Have not received the card but saw it listed on my internet banking account already.

Exactly the same 1st six digits as your friend’s card. Infinite on binchecker. Works on concierge but not on luxury hotel collection.

Applied on 17 July and it showed up in my iBanking this morning. The card number is showing as a valid Infinite status using the BIN checker.

No issue with the VI Concierge and VI Luxury Hotel Collection.

Thanks for the data points guys. Xcode- seems like you’re the first guy who hasn’t had trouble with the vi luxury collection…

AH MY BAD. The VI Luxury Hotel Collection doesn’t work. I got it confused with the Hilton Gold fast track.

Got it in Feb 2017.

BIn checker says VI. No problems with concierge or hilton. But can’t access vi luxury collection.

Xcode, just to double confirm, you were at visainfinitecollection.com site?

Correction. Visainfinitehotels.com

My bad. Got confused with the Hilton Gold fast track. VI Luxury Hotel failed.

I’ve actually tried the luxury hotel site with an actually VI card and that didn’t work as well..

*actual

Mine has been indicated as Infinite status…. and I have been having this card for a few years already.

I recently got myself the HSBC VI just so I could get the Hilton Honors fast-track and the unlimited Priority Pass for myself and my supp card holders.

Am wondering…. since my Privi Miles Visa is currently at Infinite status, can they downgrade that? Unfortunately the Privi Miles Visa does not come with Priority Pass at all.

Just received my prvi visa yesterday. bindb says it’s infinite (same bin number as your example)

luxury hotel site: failed

VI concierge: registered, no problem

Got my Prvi Miles Visa card approval on the 16th August. Checked based on Bin, is a Infinite. Both Hilton fast track and concierge no problem. Luxury hotel site failed too. It says that the card is not among the list of participating cards. Maybe it is only open to certain infinite cards that have enrolled into the program? Strangely my friend received a text invitation for the Prvi Miles Visa card by text yesterday. But her income is well below the 80k mark. Could there be different versions of the card for different income levels? Also I checked with… Read more »

I can think of a few,yes. But the luxury hotels site doesn’t even need an infinite, a visa signature is good enough. Uob cso probably doesn’t know what he’s talking about, the bin doesn’t lie

Right, Aaron. Thanks for your reply!

I got offered the Prvimiles Visa 2 plus years back when they first launch the program.. Nv realise its a VI up till today. Have been successful registering for concierge service & Hilton fast track but luck out on the visa infinite luxury hotel collection. Im guessing Visa offers some benefits as “standard” as they probably have a global arrangement with those merchants while other benefits such as lounge access and luxury hotels collection comes as “add-on” benefits that the issuing bank would have to pay for should they wish to extend those benefits to their clients? By not “signing… Read more »

that’s an interesting theory. I will run it past my friend who works there.

Would be interesting to find out what’s going on

Just to follow up on this discussion. I found out Mastercard has a “LoungeKey” benefit for its World mastercard and Elite World Mastercard members and i found this in their T&C –> Depending on the terms of benefit enrolled by your issuing bank, a charge will automatically be made to your nominated World Mastercard card for lounge visit made by cardholder, as well as accompanying guest. Please check with your issuer for more information.

link to the webpage http://www.worldcard.mastercard.com/content/mc/offer-exchange/world/ap/en/travel/Mastercard-Airport-Experiences-provided-by-LoungeKey-Global.html

I believe that backs up my theory about why some cards seems to have more benefit than others.

This is a Visa Platinum card that probably happens to share a BIN (but different sub-range) with their Visa Infinite offering. The early batches might have had card numbers mixed in with the Visa Infinite ranges by accident. The online BIN checkers only tell you what is the base product behind the BIN. An issuer can issue different products under the sub-BIN ranges.

interesting- but if the check that hilton/national car etc use to verify whether a card is a VI for the purposes of granting additional benefits is based on the BIN lookup, then isn’t the card as good as a VI even if technically it isn’t?

luck of the draw i think, depending on when you got your PAN issued. anyways it seems this card is being upgraded to VS in April.