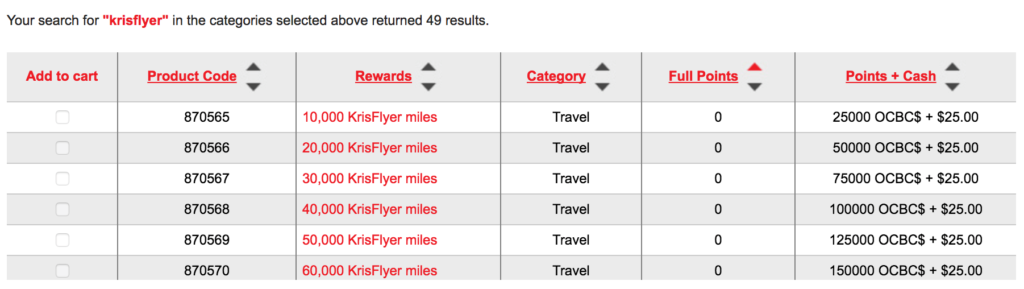

Credit card admin fees for miles transfers are pretty much the industry norm now – for those of you currently chalking up 4mpd on the OCBC Titanium Rewards card, for instance, you’ll probably one day find yourself looking at the redemption screen and groaning at the dreaded ‘+$25.00’.

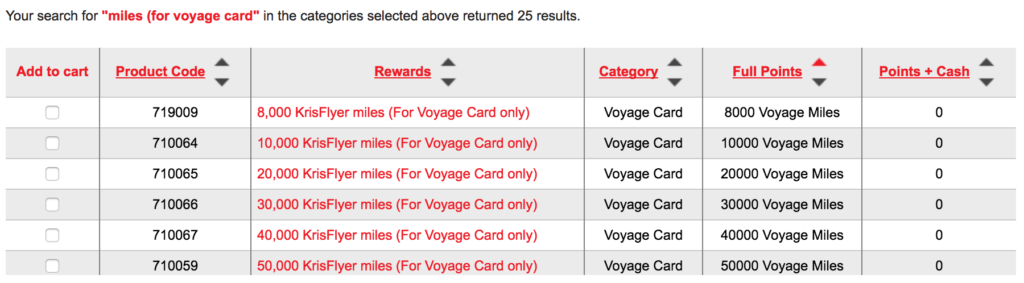

Interestingly enough, corresponding redemptions for the Voyage Card no longer seem to include the $25 admin fee! (addendum: OCBC bills them as ‘waived’, which probably means they’re reserving the right to restore the fee when they one day feel like it.)

With this change, I now see the OCBC Voyage as a pretty flexible source of buffer miles to supplement my 4 mpd earn from other sources. Since there’s no admin charge incurred for transferring Voyage Miles, you’re free to move them in smaller quantities if desired (including that little 8,000 mile block, which can allow you to transfer smaller amounts closer to what you actually need).

For some, this change might even make it worthwhile paying additional annual fees to buy VMs – I imagine it to be pretty useful having a reservoir of miles to tap on as and when required, with no additional charge for transferring them over to KrisFlyer, although I would not advise over-investing in this. (Update: It’s been highlighted in the comments, and confirmed by HWZ CSO, that miles earned by paying additional annual fees would be transferred to KrisFlyer automatically, with no option to retain them as Voyage Miles.)

I’d transferred VMs as recently as Oct 2017 and was charged $25 then, so I’m pretty sure this is a recent development – possibly in tandem with the 2018 rate revision, which put it on par with the other general spend cards.

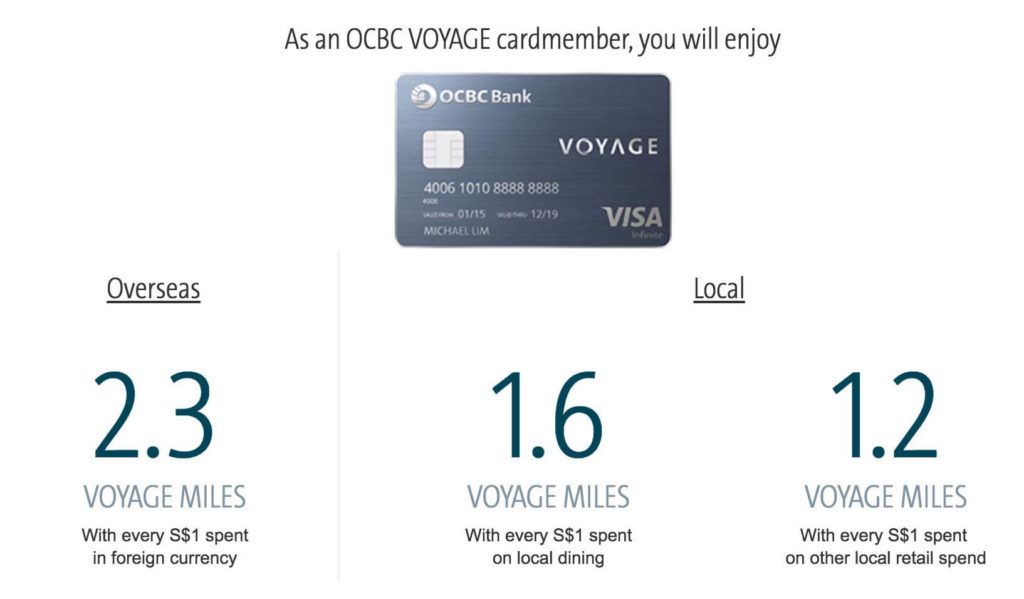

In related news – as it turns out, the elite versions of the card (carried by OCBC Premier, OCBC Premier Private Client or Bank of Singapore customers) now receive 1.6mpd for local general spend. On the card’s official website, you can actually click on a dropdown arrow to reveal the enhanced earning rates.

The 1.6mpd earn rate beats a previous top contender, the UOB PRVI (1.4mpd), although it loses narrowly for overseas spend (2.4mpd – addendum: though as Tiger9119 has commented, the lower FCY fees for OCBC Voyage almost certainly more than makes up for it). Plus, none of that rounding-down-to-$5 nonsense, which makes it useful even for small transactions (although it might still be affected by exclusions for transactions to government institutions). Overall, that makes it a really viable card for general spend.

While I can’t recommend that you lock up funds just for a good miles card (OCBC Premier status, already the lowest of the lot, requires $200,000 worth of assets under management), it is worthwhile looking into getting the card if you already possess elite OCBC status.

[HT: The Shutterwhale]

Addendum

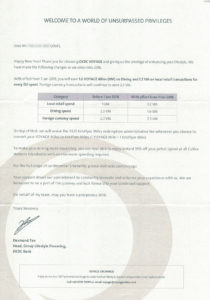

Since first typing this post, I’ve received the following letter from OCBC formally announcing:

- 2018 rate revision

- Waiver of $25 KrisFlyer transfer fee

- 19% discount at Caltex (also highlighted in comments by gariontjk)

The third point’s the only new point of data here, but if you pump at Caltex that’s probably going to make this card even more attractive (although I personally think the OCBC Titanium Rewards via mobile payment with 4mpd, coupled with 14-16% discount for OCBC cards, is the superior choice).

Received the mailer about this revision and somewhat disappointed with the drastic reduction from 2.3 to 1. 6 for local dining. Darn. 🙁

Me too. Got the card to use for dining, which is my main expense. But with this change… 🙁

But a 1.6 miles general spend with visa level of acceptance……Mmmm…… (cue insert Homer Simpson drooling face)

Only if you’re a ‘premier’ customer. Which I presume many of us general consumers won’t be. Oh well.

I’ve gotta say I was tempted – but unless OCBC closes two eyes about minimum AUM to retain Premier (and also drop below fee) I don’t think it’s all that feasible for many of us (even if doable, opportunity cost too high). =(

My personal experience is that they have been quite lax. My main transaction with them is the 70k in the 360 account to max out the interest earned.

OCBC Voyage overseas spend earn rate of 2.3 miles per $ is still better than UOB PRVI 2.4 miles due to its lower foreign transaction fee (2.8% vs 3.25%)

true. and also need to consider that 1 VM is worth slightly more than 1 Krisflyer mile (call option to convert)

Good point. Have added to the main post. Thanks for highlighting!

And recently there was a promo of 3mpd for overseas transactions.

Does anyone know if CardUp payments would qualify as “other local retail spend”?

Maybe you should call them to check.

from OCBC:

1.3.20 Payment of funds to prepaid accounts and merchants who are categorised as “payment

service providers”. OCBC Bank has the absolute discretion to determine which provider is

considered a “payment service provider”.

I believe the miles from paying the annual fees are credited to Krisflyer immediately, not stored on the card

Nope, can confirm that they’re credited as VM on the card.

I just filled up the application form yesterday. David might be right. If you opt for the 150k miles or 500k miles offer, the wording seems to suggest it will be credited immediately. Otherwise would have opted paying $3210 for 150k VM if it can redeem a return business to Europe.

Oh hmm. I stand corrected – for me, it was deposited as VM back in Jun 2017. I find it weird that they’d choose to deposit as KF instead of VM though (the latter gives them flexibility to devalue and would thus be more beneficial to the bank).

Did you have to provide your KF number during application? Previously, you had to register your KF number separately (I only did it a few months down the road) so if you now provide it upon sign up that supports the theory.

Checked with the CSOs on HWZ and they’ve confirmed that T&C dictates that bonus paid VM need to be transferred to KF immediately, which is a really weird requirement (to me).

In practice, for me my first year bonus miles were credited as VM. Maybe it’s simply because they did not have my KF number at time of registration and so couldn’t transfer immediately – if anyone else has personal experience with this, do share!

When I signed up for the card last October, VM was credited to my account, and I just received a call from OCBC telling me that they will transfer my VM to Krisflyer!

Mine’s from last June… man I hope they’re not going down a hit list!

From OCBC Voyage website:

Annual Service Fees & Charges

Principal card with the following Annual Service Fee options:

S$488 (with GST) with 15,000 complimentary VOYAGE Miles.

S$3,210 (with GST) with 150,000 Miles.

S$10,000 (with GST) with 500,000 Miles.

It mentioned Miles not VOYAGE Miles for option 2 and 3.

What happens if the transaction done locally is neither retail nor dining? eg. Payment at local hospital or hotel.

Will it still earn 1.6MPD?

This line in the T&Cs is also weird…

1.1.4 Overseas Retail and Dining Spend :

… For the avoidance of doubt, any overseas retail and dining spend

charged to the Card in Singapore dollars will earn VOYAGE Miles at a rate of S$1: 1 VOYAGE Mile;

Shouldn’t it fall back to 1.6MPD if the overseas retail spend is charged in SGD?

Retail spend in card T&C generally refers to any real spend (as opposed to card fees etc.) so yes, should still earning 1.2/1.6mpd, depending on tier.

As for the T&C I’m positive that the 1mpd rate given is based on last year’s earn rate. Clearly their card team is not as eagle-eyed as you are. ? (but maybe OCBC is really that evil. I’ll try checking with HWZ CSOs.)

Checked with the CSOs on HWZ and they’ve confirmed that SGD charges overseas will indeed earn at 1:1 ratio, lower than the local general rate of 1.2/1.6.

IMO this is a really scumbag move for them to make – now you’ve got to be doubly careful not to use activate DCC on it, and also when a website’s/app’s payment processor is based overseas…

Maybe there are some changes: OCBC VOYAGE Credit Card only 1.1.1 Overseas Retail and Dining Spend: earn 2.3 VOYAGE Miles for every S$1 equivalent charged in foreign currency to the Card. For the avoidance of doubt, any overseas dining spend charged to the Card in Singapore dollars will earn VOYAGE Miles at a rate of S$1: 1.6 VOYAGE Miles. Any overseas retail spend charged to the Card in Singapore dollars will earn VOYAGE Miles at a rate of S$1: 1.2 VOYAGE Miles; OCBC Premier VOYAGE Credit Card, OCBC Premier Private Client VOYAGE Credit Card and Bank of Singapore VOYAGE Card… Read more »

Great news! Looks like they’ve updated it.

I’d left the CSO some feedback regarding how stingy I thought the 1:1 rate was; not sure that’s what caused the change, but I’m okay taking some credit for this update anyway. 😉

(or maybe it was a typo after all.)

A typo that we (the people) pointed out to them.

Not forgetting there is an 19% instant discount on petrol at caltex, with no minimum spend.

Thanks for highlighting! Have added to the main post.

Also I am getting VM for my singtel bill (pay manually every month) and annual fee for second year onwards is waived if you spend >60k

I paid my singtel bill on 28 Dec 17 and I got the VM.

Hard to spend that much for me… Haha! Unless one day all childcare and tuition centres accept CC.

Getting miles for telco payment is quite the norm for general spend cards, right? If you really want to optimise, aren’t there 4mpd options (e.g. Citi Rewards, DBS WWMC)?

Think majority of ppl would have trouble hitting 60k on general spend… especially if they have other cards they’re earning 4mpd on. Hope they’re able to give manual waivers too (though I’m not too hopeful).

Assuming your overseas spending is in USD at an exchange rate of 1.35 UOB PRVI: USD100 x 1.35 + 3.25% = SGD139.38 (324 miles) OCBC Voyage: USD100 x 1.35 + 2.8% = SGD138.78 (317 miles) 324-317 = 7. 0.60$/7 miles = 8.5cts per mile UOB PRVI: USD101 x 1.35 + 3.25% = SGD140.78 (336 miles) OCBC Voyage: USD101 x 1.35 + 2.8% = SGD140.26 (322 miles) 336-322 = 14. 0.62$/14 miles = 4.4cts per mile UOB PRVI: USD500 x 1.35 + 3.25% = SGD696.93 (1668 miles) OCBC Voyage: USD500 x 1.35 + 2.8% = SGD693.90 (1593 miles) 1668-1593 = 75.… Read more »

Thanks for elaborating. In case it wasn’t clear previously, I totally agreed with your earlier comment. =)

Based on the above spending of USD100/101/500 and exchange rate of 1.35 and if we are buying miles through overseas spending, OCBC Voyage will be cheaper by at least or about 12%.

We will be buying miles at:

UOB PRIV: USD100 (SGD139.38-135.00=SGD4.38). SGD4.38/324miles= 1.3518cts per mile.

OCBC Voyage: USD (SGD138.78-135=SGD3.78). SGD3.78/317miles= 1.1924cts per mile.

UOB PRVI: USD101 (SGD140.78-136.35=SGD4.43). SGD4.43/336miles= 1.3184cts per mile.

OCBC Voyage: USD101 (SGD140.16-136.35=SGD). SGD3.81/322miles= 1.1832cts per mile.

UOB PRVI: USD500 (SGD696.93-675.00=SGD21.93). SGD21.93/1668miles= 1.3147cts per mile.

OCBC Voyage: USD500 (SGD693.90-675.00=SGD18.90). SGD18.90/1593miles= 1.1864cts per mile.

Sorry for being so lengthy.

Not at all. This is great! I wouldn’t have the head to work out these sums.

I’m lost (math noob here lol), but curious. May I know how is it that the difference for USD 100 spend is so much higher at 8.5cts per mile, while in a scenario of USD 101 spend it could be brought down to just 4.4 cts per mile? Am i conceptually missing something? Thanks.

I’m guessing it’s because USD101 x 1.35 + 3.25% = SGD140.78 earns 12 more miles than USD100 (since UOB rounds down to nearest $5).

The actual differences quoted are actually rather small, but you can see how it can add up over time!

because of UOB rounding down policy. For spending of SGD139.38 , you only get miles for SGD135.

I have a feeling that OCBC voyage miles will be devalued soon . I think it is cheaper for OCBC to transfer VM to krisflyer miles.

On the contrary, because VM aren’t going to be devalued, the bank wants you to transfer to KF? VM technically allows one to redeem a revenue ticket with any airline. I would have considered the 150k miles offer if that would allow me to redeem a business class ticket to Europe. HWZ seems to have conflicting reports of how much 1 VM is worth. Oddly enough like Aaron’s previous article, it’s worth more redeeming econ class tickets haha!

take note, for the premier private voyage card, it is 2.3 V.M per $1 SGD spent on all food (local)

Thanks. Is this confirmed? I’d seen screenshots of an email advertising this, but the website still lists the 1.6mpd figure as captured in the post.

Had heard that the email was in error, but I don’t have personal experience in this respect. Are you able to confirm that it’s 2.3mpd earned?

is this a recent change? as per the website premier voyage card is 1.6 vm for dining (and all local transactions)