| An updated review of the UOB Reserve has been published. Please read the latest version here |

I wrote an article about a year ago on the $120K income requirement cards in Singapore. The cards in this segment, such as the Citi Prestige and Standard Chartered Visa Infinite, come with annual fees that are 2-3X those of entry level cards. However, they also throw in additional benefits like large welcome mile offers, unlimited lounge access and airport transfers.

In that article I alluded to a “segment above $120K”, which for lack of a better name I’ll dub the “$500K credit card segment”. That’s a bit of a misnomer, because some of these cards (eg AMEX Centurion) don’t have published income requirements, but $500K gives you the rough idea of the type of clientele they’re targeting. In this grouping you’d find the DBS Insignia, the AMEX Centurion, the Citibank Ultima and the UOB Reserve

The UOB Reserve (confusingly sometimes also referred to as the UOB Privilege Reserve) launched back in 2011, aimed at HNWIs. A little bird recently sent me some information about the card, and I thought it might be interesting to lift the veil from this prestigious card and see whether it’s worth the hefty cost of entry.

There are four ways to qualify for the UOB Reserve

- Have a private banking relationship with UOB or any other private bank OR

- Minimum annual income of S$500,000 OR

- Spend more than S$200,000 on personal credit cards over the last 12 months OR

- Have a high social/business profile

Criteria (4) is wonderfully ambiguous. I wonder if somewhere out there Han Hui Hui is secretly trying to top up her CPF with one of these cards (well, it would have been possible many years ago…). Apart from that, I actually think that qualification via criteria (3) would be possible if you traveled a lot (and I mean a lot) for work in premium cabins and got to put expenses on your personal card, but otherwise it’s safe to say this is one of those “if you have to ask” cards.

The card is made of Alpaca Silver, a metal alloy of copper, nickel and sometimes zinc or iron. The material has a shiny silver color that looks similar to stainless steel. As per this hippie site:

Alpaca Silver is often used in making alpaca silver jewelry and crafts in Mexico, Central America and South America. It is also common in and has been historically used through out most parts of the world and may go by other names such as German Silver or Nickel Silver.

If you lose your card, it’s S$642 for a replacement. Or you could go for a S$20 standard material card. It’s strange, because I’ve always gotten my few lost UOB cards replaced for free. Maybe that’s just the policy, but they’ll end up waiving it in practice (at least for the standard material card) for cardmembers as a gesture of goodwill. I mean, it’s not like UOB to treat its highest tier cardmembers rather shabbily, right?

It costs you S$3,852 a year in annual fees

The UOB Reserve Visa Infinite comes with an annual fee of S$3,852 per year. You get 50,000 UNI$ (100,000 miles) when you pay that fee, and an additional 50,000 UNI$ when you hit S$250,000 spending within your 12 month membership year. The 50,000 UNI$ is a recurring gift each year you pay the annual fee.

100,000 miles are, conservatively valued, worth about S$2,000. This of course isn’t a card that you sign up for just to buy miles, as there would be many cheaper options out there. You sign up because you believe in the benefits, which we’ll cover below.

It has a general spending rate of 1.6/2.0 mpd for local/overseas spend

This one’s a bit interesting to me, because 1.6 mpd is the best rate for local spending you’ll find in Singapore (for comparison, the DBS Insignia earns 1.6 mpd and the UOB PRVI Miles earns 1.4 mpd), but 2.0 mpd for overseas spending is decidedly average.

Almost every mass market miles card, like the DBS Altitude and the Citibank Premiermiles, earns 2.0 mpd for overseas spend. Heck, the UOB PRVI Miles offers 2.4 mpd, albeit with a very high foreign currency transaction fee of 3.25% (the foreign currency transaction fee for the UOB Reserve is a more sedate 2.8%)

You also enjoy 2.0 mpd on local spending on luxury fashion, watch and jewellery brands like Sincere Fine Watches and Flower Diamond Boutique (psst rich people- you can get 4.0 mpd just by signing up for the OCBC Titanium Rewards card and using mobile payments!)

A facility that lets you buy as many miles as you want at 1.9 cents each

Remember the UOB PRVI Pay facility? That feature, available to holders of the UOB PRVI Miles card, allows you to buy as many miles as you want at 2 cents each. The UOB Reserve card has something similar called the “UOB Reserve Payment Facility” which lets you buy as many miles you want at 1.9 cents each.

1.9 cents per mile isn’t necessarily the cheapest option out there, but keep in mind that unlike other cheaper options (eg annual fees, tax payment facilities) which cap you at a certain amount of miles, this Reserve Payment Facility gives you carte blanche to buy as many miles as you need. Assuming you had the sort of life that allowed you to travel as and when you wanted, you’d almost always be better off buying the miles needed for business or first class tickets through this facility and redeeming awards.

Do note that transactions incurred under this payment facility do not count towards the S$250,000 spending required to get the bonus 50,000 UNI$ in a membership year.

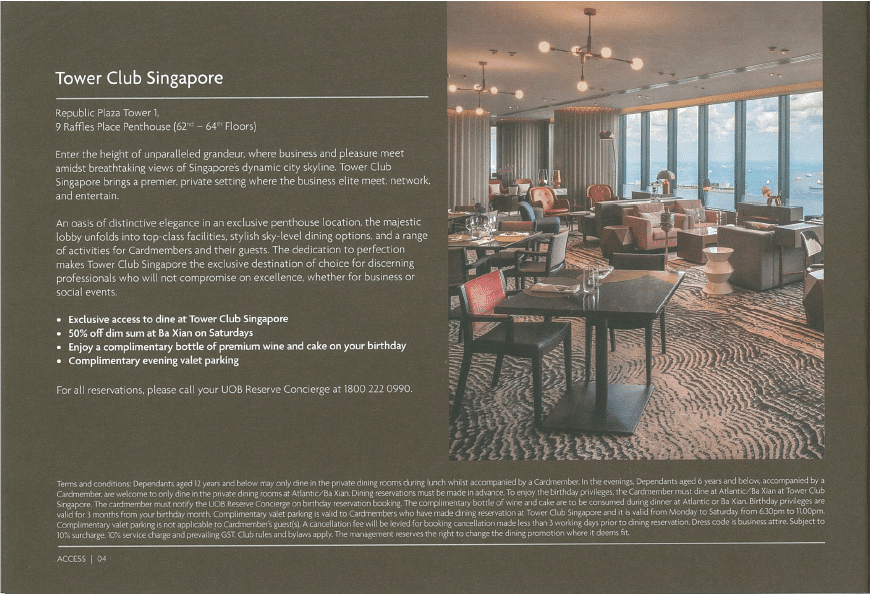

Private club access to the Tower Club, China Club and Sentosa Golf Club in Singapore

The UOB Reserve comes with private club access to several clubs in Singapore and abroad.

Tower Club access is considered fairly “standard” for top of the line cards (the AMEX Centurion, Platinum Charge, Platinum Reserve, UOB Visa Infinite [available for a mere S$350K a year, pffffttt] all get access too), and it’s a pleasant enough place to wine and dine people. I’ve done a couple of visits as a guest and each time was disappointed that they did not tar and feather a commoner for my amusement.

It’s a shame that cardholders still need to pay a 10% surcharge on charges at the Tower Club since they’re considered “reciprocal members”. To be fair, cardholders who access the Tower Club through AMEX Centurion are expected to stump up 10% more too.

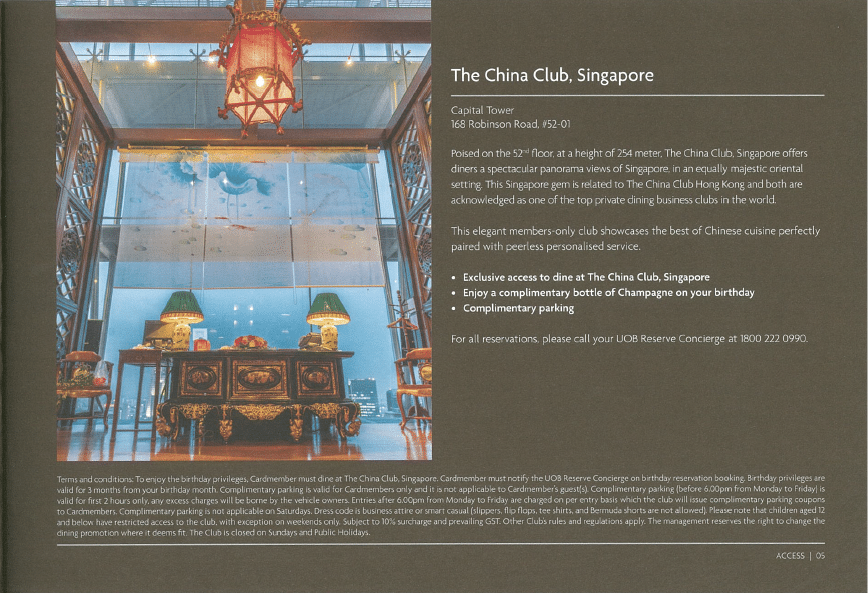

The China Club, located on the 52nd floor of Capital Tower, always struck me as more of a restaurant than a club per se. But it’s got great ambiance and you get a free bottle of champagne on your birthday, plus complimentary parking.

The really interesting thing to me is that you also get a complimentary International Associate Club (IAC) membership. The IAC is a grouping of high quality city, golf and country clubs with about 220 members across the world.

The list of clubs is pretty impressive, and although you pay for all the services and F&B you consume at the club, it’s a lot better than paying membership fees that’s for sure. This benefit can be especially useful if you need a nice meeting place when you’re overseas, or want to access facilities like a pool or tennis court that not all hotels may have.

You’re only allowed to visit clubs 200km away form your residence, which rules out those in Singapore.

Two other interesting things I noted about IAC membership. You get:

- Platinum status in the GHA (the second highest tier in the program. if only there were a way to get Black status for free…)

- Sixt rental car Gold status (again, not the top tier but having status can be really useful when renting a car)

Travel privileges: travel concierge, air ticket upgrades, lounge access

Cardholders get a dedicated travel concierge from UOB Travel to manage your travel needs (and presumably sell you packages). I imagine they’ll have occasional promotions with selected airlines and hotels, the details of which you’ll only find out after you join (kind of like this promotion with OCBC Voyage).

What’s disappointing is that the UOB Reserve card only gives you complimentary airport transfer when you spend a minimum of S$5K on packages with UOB Travel.

Most of the cards in the $120K income range will offer you airport transfers at a much lower threshold (eg Citi Prestige with S$1.5K overseas spend in a quarter, or the HSBC Visa Infinite with S$2K spending in a month) with fewer restrictions. Given that DBS offers unlimited airport transfers for its Asia Treasures members, you’d imagine that UOB could do something similar for its top tier clients.

If you hold a UOB Reserve card, you get a one-way upgrade to First Class when you travel in Business Class with British Airways for trips to or from Singapore. Ben often jokes that British Airways First Class is the world’s best Business Class, and it’s kind of easy to see why. The BA First Class product looks sleek and modern, but it’d be much more at home in a Business Class cabin for sure.

British Airways Business Class? It’s an abysmal product, light years behind many other airlines with its 2-4-2 configuration. I mean, just look at it. 0 privacy in the middle seats, 0 privacy in the aisles, and the high density configuration is not going away any time soon.

The UOB Reserve comes with an unlimited Priority Pass for lounge access worldwide, but surprisingly it’s only for the principal cardholder. Guests are charged at US$27 each. When you consider the Citi Prestige card’s Priority Pass gives unlimited access for the principal cardholder and one guest, plus costs a whole lot less…

I don’t consider the rest of the hotel benefits to be anything special, given that they can be accessed with other mass market credit cards. For example, the brochure makes much of the Visa Luxury Hotel Collection, the Starwood Luxury Privileges Program, Ritz Carlton Stars, Mandarin Oriental Fan Club etc but all these are things that can be booked by any travel advisor (the Visa Luxury Hotel Collection is available to anyone with a Visa Platinum or higher, which is basically everyone).

Dining privileges are…lackluster

One thing that surprised me was the dining benefits of the UOB Reserve (or lack thereof). I guess I’m mentally benchmarking it to what the AMEX Centurion (or even the Platinum Charge for that matter) has, with its numerous 1 for 1 offers and the Love Dining program.

Every elite card worth its salt will have some sort of tie up with prestigious restaurants. The AMEX Centurion, for example, even buys tables at certain popular restaurants to ensure it can always offer its members access on demand. In that sense, the UOB Reserve meets the bare minimum here, although the publicity materials don’t exactly make it clear the type of access they have to celebrity chef restaurants. There’s some vague mention here of access priority booking, private kitchen tours and free wine (woo hoo), but I guess only cardholders will know for sure.

Cardholders get 20% off ala carte lunch and dinner menus at 9 restaurants in RWS, but you need to spend at least S$200.

The rest of the dining benefits aren’t anything to get excited about. 30% off at the Pan Pacific and PARKROYAL hotels is good to have, but the rest of the benefits are limited in scope (selected restaurants at Ritz Carlton Millenia and Mandarin Oriental) and quantum (10-15%).

For the sake of comparison, the DBS Insignia has a complimentary Club Hyatt membership that offers up to 50% off dining at the Hyatt (something that the UOB Reserve had when it first launched, but was phased out later on).

Conclusion

The AMEX Centurion has an annual fee that is several times that of the UOB Reserve, so it doesn’t seem like a fair comparison to put them head to head. That said, the DBS Insignia’s annual fee at S$3,210 is slightly lower than the UOB Reserve, and that comes with 100,000 miles and two free nights at selected premium hotel properties such as Anantara Hotels & Resorts, Six Senses Resorts, COMO Hotels & Resorts, YTL Hotels, Small Luxury Hotels of the World, Taj Hotels, Resorts & Palaces, Alila Hotels & Resorts, and Banyan Tree Hotels & Resorts. It also has an unlimited Priority Pass.

So the way I see it, it’s much easier to recover value from the DBS Insignia than the UOB Reserve. This of course depends on your individual usage patterns, and I’m sure both banks have exclusive non-published events and promotions that I’m not able to take into account here. On the face of it however, the UOB Reserve needs to step up its benefits to justify the high annual fee.

Hi Aaron,

Back in 2016, my RM contacted me regarding this card and I was informed that the spending accumulated from the payment facility counts towards the $250,000 minimum spending.

I’m not sure if they’ve changed their tune to that but if they really have, that would be such a bummer.

Yes, it counted until 31 Dec 2017. From 1 jan this year they stopped

I don’t think there is a single UHNW credit or charge card our there that is “good”, let alone “vey good” and let’s forget about “fantastic”… UHNW cards are exactly that.. it’ll show that you are UHNW.. and that you can’t be fussed about how to max the miles earned or used… God forbid that you’re worth $50m and you’re seen by your neighbour or subordinate using your OCBC Titanium PINK at Guardian Pharmacy for 4mpd, because you maxed out at $12k on your BLUE on yesterday, right? Maybe some day, when I grow up, I’d want to use an… Read more »

“There are many business class products worth flying with. British Airways is not one of them.” So true.

I think another perk they give is a complimentary health screening package at Parkway Shenton that’s worth over $400 if you had to pay

they may have done that in the past, but all I see now is 10% off health screenings.

As stated, the health screening package comes complimentary, and some additional privileges are 10% off

Generally speaking the portfolio of cards UOB has now is generally below par compared to the others. It’s those that they do not issue anymore that was good, however that’s history. I’ve moved on from such banks that hesitate to give customers value.

I used to have this card and I agree you can get a better ROI from the DBS Insignia (which is why I switched to it). Back in the day this UOB card came with Hilton Diamond membership and the annual fee was lower at $3300 + GST. Over the years the fee went up and the benefits reduced. Kind of typical of UOB though.

I used to have this card and I agree you can get a better ROI from the DBS Insignia (which is why I switched to it). Back in the day this UOB card came with Hilton Diamond membership and the annual fee was lower at $3300 + GST. Over the years the fee went up and the benefits reduced. Kind of typical of UOB though.

I reckon most of not all banks in SG play the same game.. not just UOB.. HSBC Visa Infinite lowered both the local and overseas mpd rate after a couple of years, OCBC Voyage lowered their local dining mpd from 2.3 to 1.6, UOB, we’ll those who know, know.. but they all do it.. They attract new applications by offering something sweet (of course) and then progressively remove or reduce perks one by one.. To be fair, UOB can still be up at the top for mpd, with Visa Signature and PPV, if you study the perks properly and spend… Read more »

I feel the cheaper Amex Plat Charge works better for me. Concierge seldom fails, good dining promotion, unlimited priority pass for main + supp holder and even brings 1 guest each for free, hotel status with SPG/Mariott, Radisson, Shangrila, Hilton, car rental status with Avis & Hertz, matched status with SQ. nothing else i would need from a credit/charge card.

except, maybe, a better miles earning rate 🙁

I was a member of “IAC- International Associate Club” some years back. The terms and conditions still stand from the website ( http://www.iacworldwide.com/introduction.php) that: “There are IAC clubs in more than 40 countries with a wide range of amenities, including some 60 golf courses, over 100 clubs with athletic and/or sports facilities and, for that business trip, prestigious venues suitable for conferences or entertainment in key cities worldwide. When travelling, simply log on to our website for details of available facilities at your destination. Present your IAC membership card and enjoy the welcome reserved for valued members. As a member,… Read more »

Good spot, will update this. Thanks!

[…] status with Marriott, Radisson Rewards, Shangri-La and Hilton. Once upon a time, holders of the UOB Reserve Visa Infinite card received complimentary Hilton […]

Hi Aaron, My wife told me about this UOB card some time back and finally I went online today to check it out and found your article most interesting however there is a section in your article that suggests that it is not the least expensive card to purchase miles with at 1.9 cents per mile so I clicked on your link and saw HSBC Premier MC that I have enables you to purchase miles at 1.25 cents per mile and so I called them up since I have that card and they absolutely denied that you could purchase miles… Read more »

Hsbc premier mc is for buying miles via the tax payment facility. You are buying miles implicitly through the processing fee.

Can anyone confirm if Criteria (3) is valid? $200k is not hard to hit if one uses his personal UOB cards for all business expenses. I’m reluctant to think UOB will give this card based on this criteria alone.

It is valid. You will need to furnish them with 12 months past statements from your credit card. I just did that.

Guys the main benefit that I see for this card is the unlimited purchase of miles at 1.9 cents per mile. Eg a SQ suites return ticket to Tokyo on the A380 is 140k miles. Using this card it will cost me ~737SGD to purchase (online SQ retails abt S$8000 plus). Talk about ultimate ROI! Pls correct me if I’m wrong!

Sorry what I meant it cost S$2660 for 140k miles (at 1.9 cents per mile). But SQ retails for S$8000 plus…

plus taxes +++

I just got a UOB Reserve Invitation with it having 1.6 mpd local and 2.4 mpd for overseas (I got this by “high social/business profile”, as I don’t have 2mil lying around). Does anyone have more information about this card? The benefits got increased I believe

yup. this article is due for an update- the card recently got refreshed and the 2.0 mpd on fcy spend is now 2.4 mpd