[The following is a sponsored post by OCBC. The opinions and analysis are those of The Milelion]

The short version: The value proposition of the OCBC VOYAGE card has improved significantly since it first launched in April 2015, thanks to a more competitive earning rate, expanded lounge and limo benefits, as well as last year’s KrisFlyer devaluation.

I recently had the chance to conduct a detailed analysis on VOYAGE Miles, the unique currency issued by the VOYAGE card. These can be converted into KrisFlyer miles at a 1:1 ratio with no admin fee, but more intriguingly, can also be used to pay for revenue tickets on any airline, any cabin and any date.

To summarize: I found that sweet spots exist within the VOYAGE “award chart”, meaning that certain destinations represent better value. These sweet spots, when combined with Business Class fare sales, allow you to redeem flights at rates well below the SQ award chart (assuming you’re airline agnostic). Moreover, VOYAGE allows you to redeem awards for destinations not served by SQ at rates comparable to or cheaper than the KrisFlyer partner award chart, while trying cabin products that would otherwise not have been accessible. And although VOYAGE redemptions tend to be less competitive when SQ Saver space is available for immediate redemption, they still provide a cheaper option than Advantage awards when Saver is on waitlist or just flat out unavailable.

Read on for the full analysis, as well as a special sign up offer for Milelion readers below!

The not-so-short version: I’ve had a bit of an interesting history with the OCBC VOYAGE card, which launched in April 2015, about the same time as The Milelion started.

When I first reviewed the product, I wasn’t all that impressed. It claimed to be a high-end card, but offered only two lounge access passes per year. Its spending requirement of $5,000 in a month to qualify for a complimentary airport transfer was among the highest in the market at the time. It earned only 1 mpd on local spend, putting it at a significant disadvantage to rival cards. And although I found the concept of VOYAGE Miles interesting, their valuation seemed to be roughly fixed, leading me to call the VOYAGE a “cashback card masquerading as a miles card”.

But a few key developments have happened in the 3 years since.

First, additional benefits were added to the VOYAGE to bring it in line with its $120K peers . For example, in September 2015, the card started offering unlimited access to lounges in the Plaza Premium network for both principal and supplementary cardholders (plus one guest). In March 2016, the limo spending requirement was reduced from $5,000 in a month to $3,000, with the number of complimentary trips a month increased from 1 to 2.

Second, KrisFlyer significantly devalued its award chart in March 2017, removing the 15% online redemption discount and hiking award prices across the board. This brought the cost of KrisFlyer redemptions closer to those using VOYAGE Miles and slightly lowered the value of a KrisFlyer mile.

Third, and perhaps most importantly, in January 2018 VOYAGE removed the admin fee to transfer miles to KrisFlyer and tweaked the card’s mpd rates to bring them in line with the market.

- The general spending rate was increased from 1 mpd to 1.2 mpd (on the base version) and as high as 1.6 mpd (on the Premier/Private banking versions).

- Dining mpd was reduced from 2.3 to 1.6, which from my point of view wasn’t that big a loss insofar as I’d be using other 4 mpd cards for that category anyway

- The overseas mpd rate was kept at 2.3, which is still one of the best rates in that category, once forex fees are adjusted for.

Clearly, many of my original issues with the VOYAGE card no longer exist. But VOYAGE Miles as an instrument remain relatively unchanged since inception. That brings me back to the question: just how valuable are VOYAGE Miles?

How valuable are VOYAGE Miles?

VOYAGE Miles have been a constant source of intrigue to me. They can be exchanged for KrisFlyer miles at a 1:1 ratio, but I’ve always been of the opinion that doing so is a waste of their potential. If you’re holding the VOYAGE card with the sole goal of earning KrisFlyer miles, you’d probably be better off with another general spending card (unless, of course, you held the Premier Banking version of the VOYAGE which at 1.6 mpd would be the best general spending card in Singapore).

That’s because the true value of VOYAGE Miles doesn’t come from their call option on KrisFlyer miles. It comes from their flexibility and ability to unlock any seat on any airline on any date, provided you have enough of them.

In some of my earliest analysis of VOYAGE Miles, I concluded that because their value ranged between 2-3 cents each, they represented inferior value over KrisFlyer miles, which could get 4-5 cents when redeemed for Business Class or 5-6 cents when redeemed for First Class.

There are three problems with my initial analysis. First, it was done before the March 2017 KrisFlyer devaluation, which reduced the value of a KrisFlyer mile to 3-4 cents each when used for Business Class Saver awards. This 3-4 cent valuation assumes that a KrisFlyer Saver award is available. We know there are certain routes where Business and First Class open straight to waitlist. The infamous SQ25/26 route is a good example of this. If you have to redeem a Business Advantage award, your valuation per mile drops to 1.5-3 cents.

Second, a 3-4 cent valuation of KrisFlyer miles only holds if you would only ever redeem your miles for Business Saver awards on SQ. Realistically speaking, your weighted average value will be lower than that because sometimes you’ll pay Advantage rates, sometimes you’ll redeem other cabins, sometimes you’ll redeem partner awards. A 2 cent valuation is par the course for what I use now, and any time I get more than that it’s a bonus.

Third, what I’m essentially saying is that a currency with a potential value range of 1-6 cents (KrisFlyer Miles) is superior to a currency with a value range of 2-3 cents (VOYAGE Miles). But this does not account for the fact that VOYAGE Miles can be redeemed for any airfare on any airline, whereas KrisFlyer miles are restricted to SQ, Star Alliance carriers and selected partners like Virgin Atlantic.

I’ve been thinking a lot about mileage currency diversification recently, and I wanted to look for situations where VOYAGE Miles could provide good value. So I put together a list of destinations and sent them over to the VOYAGE team to get priced in Business Class, round trip. I also added the number of KrisFlyer miles each destination would cost in Business Saver, Business Advantage and through the KrisFlyer partner award chart.

The result is an epic 95 row excel with a whole lot of data to dig into. Here’s the overall file if you want to dive into the numbers, and here are the highlights of the analysis:

VOYAGE Mile valuation is destination-dependent

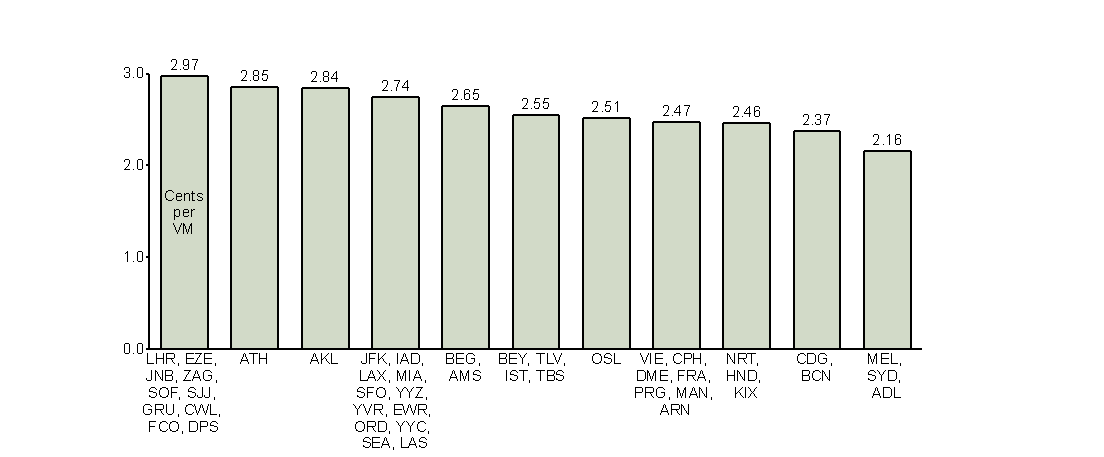

We already know that VOYAGE Mile requirements are related to fares- the higher the fare, the more VMs you need. We also know that they generally fall in the 2-3 cent valuation. That’s broadly correct, but what I was surprised to learn was that the exact value of a VOYAGE Mile depends on where you’re flying to.

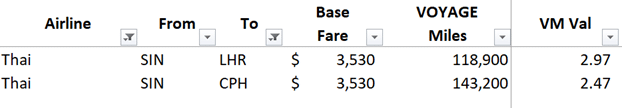

For example, look at these two quotes, both with base fare S$3,530.

A VOYAGE Mile is worth 2.97 cents when used to fly to LHR, but 2.47 cents when used to fly to CPH. 2.97 cents vs 2.47 cents may sound like a small difference, but it really adds up in aggregate. Indeed, I can see in the sample that the valuation of a VOYAGE Mile is constant for the same destination.

That leads me to my next observation…

The VOYAGE system has sweet spots

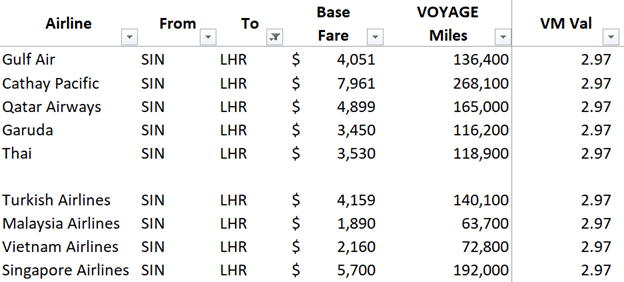

The fact that VOYAGE Mile valuation is destination-dependent implies that there exist sweet spots within the VOYAGE Miles “award chart”. Based on my sample, it appears that VOYAGE Miles command the highest value when used for London, South America or North America flights. Value was relatively lower for Australian destinations. This should give you an idea of which destinations are “most worth it” when spending your VOYAGE Miles.

VOYAGE redemptions may not make sense when SQ Saver awards are immediately available…

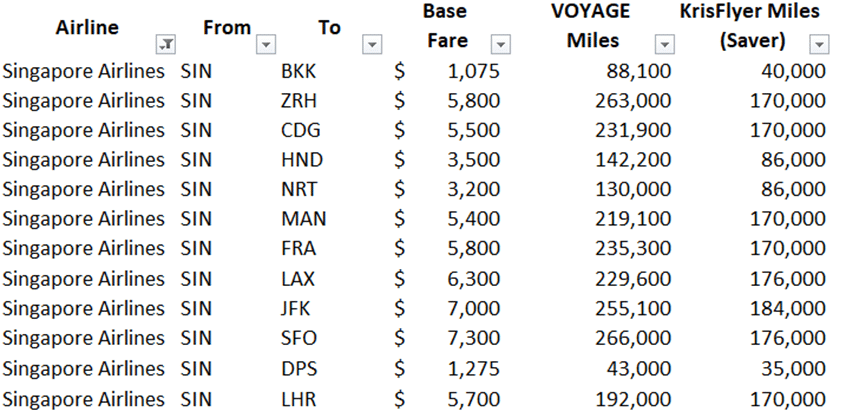

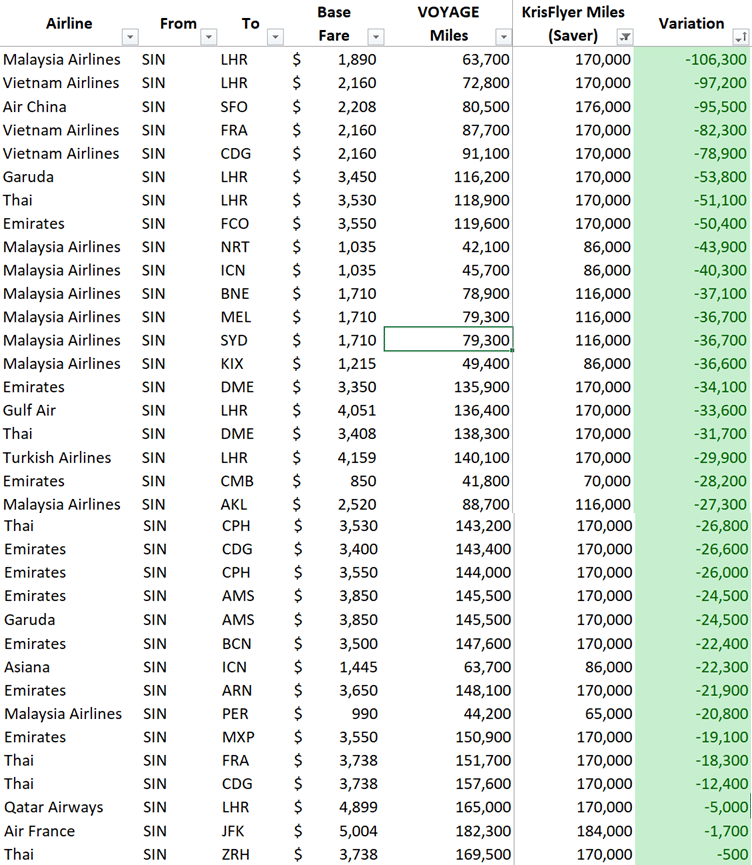

Singapore Airlines revenue tickets ex-SIN are inherently expensive because Singapore is a captive market, and this high price means VOYAGE Mile quotes increase accordingly. On the other hand, saver awards are (relatively) low priced. Here’s how VOYAGE Mile quotes compare with KrisFlyer Business Saver awards out of Singapore:

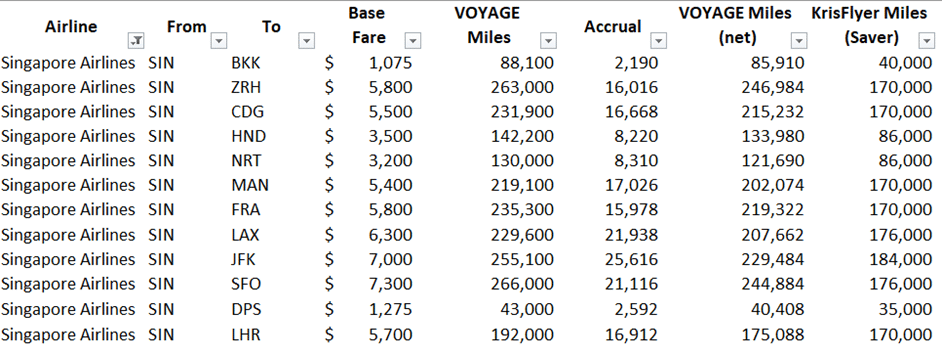

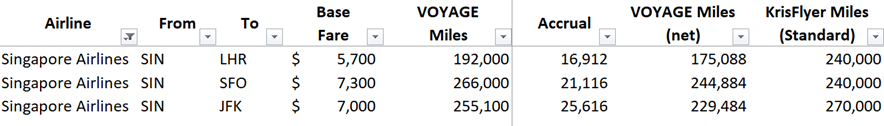

We can see a significant gap in the mileage requirements for VOYAGE Miles versus KrisFlyer Saver awards. However, it’s important to remember that tickets booked with VOYAGE Miles are eligible for mileage accrual, so the actual cost should be adjusted downwards for a fair comparison.

This closes the gap somewhat, but it’s still quite clear that if saver awards are available for immediate confirmation, it’s quite hard to make the case for using VOYAGE Miles.Of course, any experienced frequent flyer knows that this is rarely the case on certain routes. In fact, there are some flights on which Business Saver awards are virtually impossible to redeem, and in those cases, VOYAGE Miles can be extremely useful.

…but VOYAGE redemptions offer better value than Advantage Awards

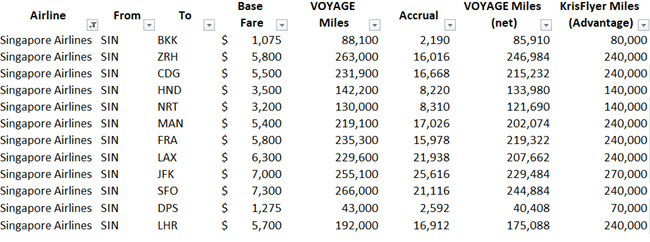

When Business Saver awards are not available, we can see that VOYAGE Mile redemptions are almost always more competitive than paying Business Advantage award prices:

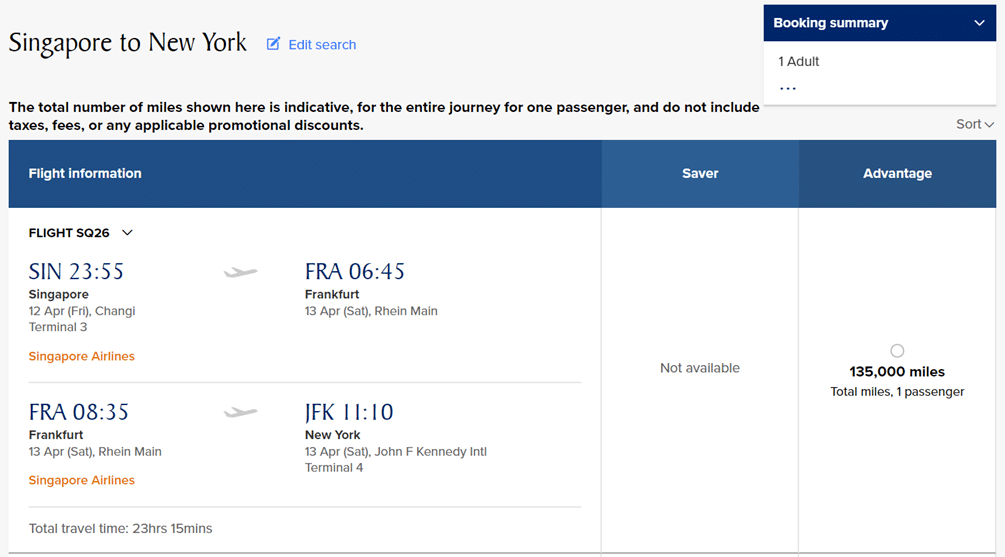

It’s unlikely you’ll ever need to redeem a Business Advantage award to a place like DPS or BKK, but practically speaking there are particular long haul SQ flights where Business Saver seats are nigh impossible to find, even on the waitlist. For example, SQ25/26 from SIN-FRA-JFK is notoriously difficult to redeem. At best you’ll snag maybe 1 Saver award after a long period of waitlisting, but if you’re looking for two seats you may well have to settle for 1 Saver and 1 Advantage. There are even numerous dates where the waitlist is not open at all, as the screenshot below shows.

Other flights that are almost impossible to redeem Business Saver seats include the non-stop SQ31/32 to SFO and SQ321/322 to London. For these 3 tricky-to-redeem flights, VOYAGE Mile redemptions are much more competitive.

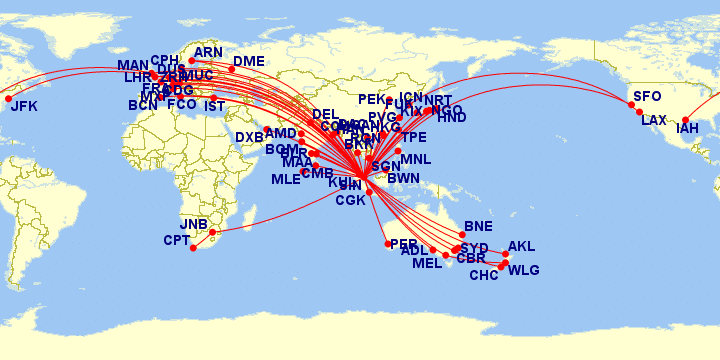

VOYAGE redemptions are useful for reaching places not served by SQ

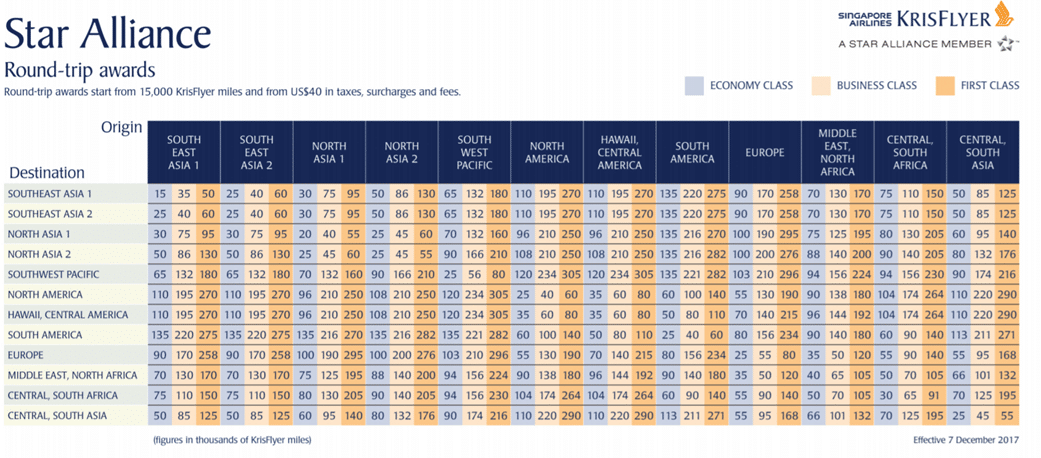

SQ serves more than 60 destinations worldwide, but doesn’t cover South America, Canada or much of Eastern Europe, Africa or the Middle East. If you want to redeem miles to a destination that is not served directly by SQ, you’re going to have to refer to the KrisFlyer partner award chart, which was devalued late last year.

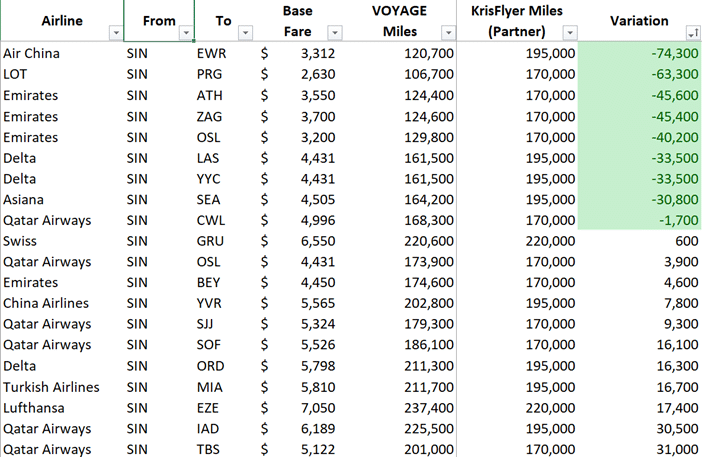

Redemptions through the partner award chart are generally higher than Saver awards (but not as expensive as Advantage). Therefore we can find several destinations where VOYAGE Miles offer good value (highlighted in green below):

The table above shows that VOYAGE Miles offer excellent value to Prague, Newark, Athens, Zagreb, Oslo, Las Vegas, Seattle and Calgary. You could even argue that in marginal cases like Sao Paulo, Beirut or Vancouver, the mileage you’d accrue on a revenue ticket would make up for the difference. Flying with other airlines does not pose a time disadvantage in this situation, in the sense that even if you wanted to include SQ in your travel plans you’d still be looking at a one stop minimum.

VOYAGE redemptions can help you take advantage of business class fare sales

First Class rarely goes on sale, and Economy Class isn’t what we earn miles for. But Business Class sales are fairly common, and the question is how VOYAGE Miles can be used in conjunction with these to achieve redemptions below the cost of even KrisFlyer Saver awards. After all, if VOYAGE Mile costs are tied to the revenue price of a ticket, it stands to reason that there could be situations where fare sales could result in certain destinations pricing below KrisFlyer savers.

Here are some of my picks:

What this suggests is that to the extent that you’re airline agnostic (i.e. Business Class is Business Class), there is some serious value to be found by using VOYAGE Miles as opposed to traditional KrisFlyer miles. True, the itineraries here may involve adding a stop to your journey, but I can imagine a lot of people who would be happy to do that in exchange for lower cost redemptions. 63,700 VOYAGE Miles for a round trip business class flight to London, for example, is incredible value.

It’s not like you have to slum it, either. All the flights above offer full flat business class seats, at least on the long haul segment. For example, if you flew Malaysia Airlines to any of the destinations above, your SIN-KUL leg would be on a narrow body aircraft but your subsequent flight would be on an A330 or A350 with full flat seats.

Similarly, you’d be able to fly on Garuda’s 77W business class product to London which seems to have garnered very good reviews as well.

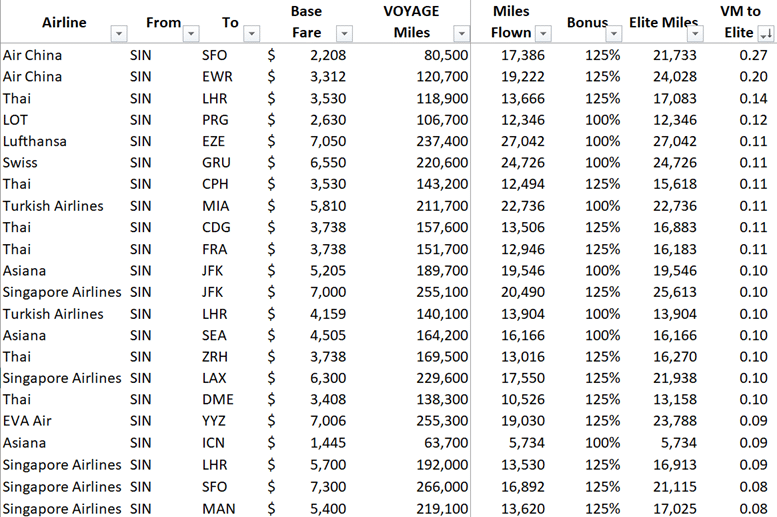

VOYAGE redemptions can help you renew your elite status

Tickets booked by the VOYAGE concierge are revenue fares, so they’re eligible to earn elite status credit on your preferred program. I was curious to see which fares offered the “best” VOYAGE Mile to elite status earning ratio so I looked at a sample of Star Alliance carriers. In the table below, I’ve assumed that you credit your miles to KrisFlyer. Remember that you need to accumulate 50,000 Elite Miles within a 12 month period in order to qualify for KrisFlyer Elite Gold.

You can see that in general, it’s possible to earn upwards of 0.1 Elite Miles for every VOYAGE Mile spent. On some itineraries to VOYAGE Mile sweet spot destinations like North America, that can go as high as 0.2-0.27. A hypothetical round trip to SFO and EWR on Air China, plus an additional SIN-ICN round trip on Asiana would earn you Elite Gold status for just under S$7,000 of base fare.

If you’re just short of miles to requalify for elite status, it’s well worth seeing if you can find a VOYAGE Mile redemption that maxes out the elite miles you earn.

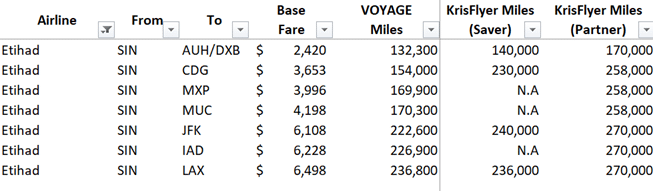

VOYAGE redemptions can help you try new cabin products

There are some cabin products that are almost impossible to redeem if you’re a Singapore-based flyer. This is either because the miles are hard to come by, or the product just doesn’t have good award space available. For example, Etihad has an amazing First Class product on their A380 aircraft. The Apartments, as they’re called, feature completely enclosed suites in a 1-1 layout with a separate bed and seat. There’s a shower and personal chef on board. The ground experience, despite recent cutbacks, remains one of the most luxurious in the game.

The problem is, Etihad’s First Class would be very difficult for someone based in Singapore to redeem. Citibank is the only bank that supports transfers to Etihad Guest, and the mileage requirement for Etihad First Class awards is prohibitively expensive (373,000 miles for First Class between Singapore and London).

Earlier this year, VOYAGE ran a promotion with Etihad where members who purchased an Etihad Business Class ticket got a free upgrade to First Class. You’d be eligible for this promotion even if you redeemed your VOYAGE Miles for the Business Class ticket. Here’s how many VOYAGE Miles you’d have paid, compared to the requirements for a First Class award ticket through KrisFlyer.

Other products that VOYAGE could help you unlock include the Delta One Suites (if/when it finally starts serving Singapore), or SWISS First Class (which can’t be redeemed by anyone other than Miles and More elite members).

Annual Fee and Reader Offer

The OCBC VOYAGE has a regular annual fee of S$488, which comes with 15,000 VOYAGE Miles. In a best case scenario where you maxed out the value of your VOYAGE Miles through sweet spot redemptions, these could be worth up to S$445 (2.97 cents each).

Other key points of value include access to VOYAGE Exchange, a concierge service which provides additional lifestyle and trip-related assistance like event bookings, personal shopping, itinerary planning and even emergency medical services if required. It’s also worth factoring in the unlimited access more than 80 Plaza Premium Lounges around the world, and complimentary limo transport with a spend of at least S$3,000 in a month.

If you’ve decided you want to explore the VOYAGE card, OCBC is extending a special offer to readers of The Milelion: a discounted first year annual fee of S$260 that includes all the standard benefits of the VOYAGE card except for the 15,000 VOYAGE Miles. From year 2 onwards, your fee will revert to S$488 with the 15,000 renewal VOYAGE miles.

This offer only applies to those who sign up using the link below before 8 September 2018. You will initially be charged S$488, which will be waived and corrected to S$260 within 3 working days.

Sign up for the OCBC VOYAGE here

Conclusion

The OCBC VOYAGE can definitely offer you something different from a traditional miles card. I think the VOYAGE card would be the most useful for a traveler who wants maximum flexibility and isn’t hell bent on flying SQ every single time. In fact, it’s arguably the best option available to those of us in Singapore who want to try different airlines and different cabin products that the would normally be impossible to redeem given the mileage programs available to us here.

Excellent analysis! Do you have official confirmation of the “VM Award Chart”? Otherwise it could just be a one-off quote, subject to changes. And every time we need to book a ticket, we need to go through another 95 row excel sheet to assess the value!?

Gosh, Aaron! Where do I begin..?? First, a round of applause, followed by three bows, and then I’ll finish off by blowing kisses!! Not sarcasm… what an epic piece! A mountain of USEFUL information that’s going to warrant at least 3-4 re-reads (a bit like watching Good Morning Vietnam the first time)! Of course different people will takeaway different “good bits” depending on the individuals: 1) Local and Foreign dollar spend amount, 2) How often one travels using revenue tickets and redemptions, and 3) Whether one prefers to stick to one carrier (for various reasons) or okay with any (or… Read more »

There are other 1.6mpd general spend cards. Reserve and insignia. How do those compare?

I think it’s the sweet spot for ppl like myself who aren’t high SES for reserve.

In so far that the number of Voyage miles required are tied to the commercial value of a ticket (unlike KF miles), one should simply treat them as a currency. Do I want to pay $X for the ticket? And if so, perhaps I would want to pay cash with another card like the DBS Altitude which gives 3x mpd. And I don’t agree that Business Class is Business Class. SQ/ CX versus TG/ CA? Yes, you need less Voyage miles for the latter but you get what you pay for. For me, the whole point of being in the… Read more »

In one sense you are right- number of vm’s depend on the commercial value of the ticket. In another you aren’t- in that vm’s can attract higher value for particular destinations. they’re sort of a hybrid miles currency in that point.

Clearly no one would think that tg j is on par with SQ J, so if both products were priced the same i’d go with SQ. If tg j were 50% the miles of SQ J, however…

Question – the miles u get come with ur purchase. U are purchasing and that is ur intention. So the miles u can are technically free. So when u redeem ur Voyage miles, wouldn’t the ticket be “free”? Correct me If i am wrong but if u use altitude u r paying for the ticket – no utility to it though? Another reminder altitude offers 3 mpds but it’s capped at 5k and only for online air/hotel. Other cards offer higher everyday earn rate which offers better spread over the long term. Abit too taxing if u have to keep… Read more »

Hi Aaron,

Excellent analysis! I like how the article explains the various situations that VM will provide better value (or lower redemption rate) over the typical Krisflyer option.

The only complain I have is that the earning rate for this card is similar to general spending card so by using this card, I will be ‘stuck’ with a general spending card and will require a large amount of spending in order to accumulate sufficient VM.

Of course I could still use other specialized cards (WWMC, etc) but I would be spreading out my miles too much.

Agree with your comment. Not a good strategy to spread miles around too much, unless of course you have a high spend in which case you will value the intangible benefits of some cards over the like-for-like mile earning ratio for individual spend categories across different cards.

Absolutely. So the qn you have to ask yourself is- do I value the flexibility of holding vm’s as a currency vs traditional kf miles? Like I said, if kf miles are the be all and end all goal, then you’re better off with a 4/8mpd card strategy.

I cancelled my VOYAGE card in May after 3 years. The allure of a metal card lost its lustre after I found how hard it is to utilise the benefit, especially when it matters. I couldn’t use the Plaza Premier Lounge in Brisbane because they didn’t have a contract with VOYAGE. It’s hard to rack up all the miles for all the “sweet spots” or long-haul flights unless you have a high spend. The 15,000 VOYAGE miles for SGD$488 annual fee represents the poorest sign-up value of any mass-market miles card in the market which you have illustrated before. Let’s… Read more »

One important thing to keep in mind is that when you pay an annual fee you aren’t just paying for miles. You need to look at the entire package. The qn is whether you believe the lounge access, limo and concierge service is worth the differential (assuming you value a mile at 2 cents, which in the case of Voyage may be slightly too low). Like I said, there is no point comparing this card to a card that earns 4 mpd when flying krisflyer saver Awards is your goal. But if not? If saver isn’t available, or you want… Read more »

No offence with my comment, just highlighting the other side of the coin. Yours is the only mile/point hack blog that I read in Singapore. Besides the fact that this “special” sign-up offer comes with 0 VM, the annual fee CANNOT be waived from 2nd year onwards. You have to fork out SGD$488 for 15,000 VM every year. There is no fee waiver for supp card holders from 2nd year. (SGD188 annual fee.) So to your point, Aaron, it MAY have its uses but only for high spenders. Like what Ken says, to each its own, but my 2 cents… Read more »

Thanks, considering this card. With the miles I might be able to cover the cost of the Fee for my yr end travels with biz class tickets. But prestige might be a good alternative too coz of the 4th night. Perhaps Voyage shld do something similar too then it will definitely seal the deal. Hopefully someone from ocbc picks this up and does something about it. There’s 1.5 mil travel ins coverage for Voyage too, any difference between the one from prestige? Another point to share though, I called the ocbc hotline, it seems that with a min. Spend a… Read more »

Apparently OCBC VOYAGE will waive if you spend more than 60K/yr. High bar for low SES like me scrounging for miles.

That might work for me. How about prestige?

Only downside to prestige is the local rate of 1.3 though…higher than Voyage but V has higher dining at 1.6 and foreign spend earn rate of 2.3.

Suits my spend pattern. Entertain and travel for biz.

Michael – since u had the Voyage does online shopping but paid in foreign currency gets 2.3?

Based on what you’ve just said, then combination of Maybank, with 3.2 mpd on dining, petrol and taxi fares.. and SCB VI, with 3 mpd for foreign spend, would be best for you…?

Maybank? Let me check it out.

SCB – FORGET IT. Worst card services ever. Assured me that they will waive fees but didn’t. Ended up rolling and rolling till I “owed” them $$$. Had the gull to insist I pay first den they will waive. Thereafter took 1 month to return my money via cheque. Not putting myself thru that. No amount of miles is worth it.

Haha.. I’m sure lots of us have individually had our own run ins with diff banks.. I dislike HSBC quite a bit, but still make use of them, and the keyword here is to “make use of them”.. no emotions.. I personally use banks/credit cards as tools and nothing more.. if this particular bank is able to give me what I want, and I can have as little interaction with them, that would be best for me.. I’ve even over the years, applied for, used, cancelled when they stop being relevant, and then when they come up with something new… Read more »

Based on my experience, foreign currency transactions, both online and offline get 2.3 miles per S$

Hi @Dan.. I reckon in SG, if one had to choose just ONE Credit Card and cant have any other, even then, it would prolly be a toss up between SCB VI and C PMC.. But really there is no ONE card out there that does it all. if there was, 1) The rest of the banks would have zero sign ups, 2) The likes of Aaron won’t have half as much to do, 3) We won’t have the current “fun” we’re having playing cat and mouse with the various banks.. I mean, even the likes of TPG just updated… Read more »

Thanks! True that but then there is the allure of a metal card. But we’ll will check out the cards and weigh out the benefits.

Cheers to cat and mouse games!!!

Haha.. I personally couldn’t care less if the card was made of PVC.. so long as it works for me.. ?

I reckon my comments covered both @David and @Michaels comments/gripes.. To each his own.. @Michael, You commented that you “cancelled your card after 3 years because it lost its luster”, to me, lucky you, that you managed to enjoy the benefits for over 2 years before they changed their 2.3 to 1.6 mpd for local dining (and other perks), cos in my case, they changed it (I think) about 6 months after getting my card.. ha! My point is, regardless whether it’s OCBC, HSBC, UOB, Citi, etc.. Banks will continue to come up with “incentives” to get everyone to sign… Read more »

These things need to be looked at carefully. In a place where annual fee waivers are common, having to cough up annual fee means needing to make sure the justification exists. I have 2 premium cards where I justify the fee – Amex Platinum (Aus version) and Citi Prestige (SG version). Amex Platinum I can justify because I pay a net A$250 per year after minusing the included travel credits, and with 2 unlimited priority passes plus guest on each and 4 free supp cards, each of whom are eligible for all the hotel statuses and lounge access (based on… Read more »

The analysis would be heavy for an ordinary mile chaser, but I like it! Made me actually consider getting a Voyage card. The flexibility is definitely a plus point

Quick qns. Does the 15k VM that comes with paying the annual fee sit in as VM in your account?

When paying S$3k+ for 150k VM, they force you to convert it to KF – not allowed to sit at VM in your account..

150K is KF miles transferred immediately to your KF account, not VM in the firsr place, although there was a edge case reported where it was accrued in VOYAGE as VM. The 15K VM accrues in your VOYAGE account with no expiry. (Unless you decide to cancel the card.)

I guess that would’ve truly been too good to be true…!! S$10,000 buys 500,000 VOYAGE Miles (it doesn’t), which translates to 2x R SIN>JFK Return (with 20,000 Miles balance) which is almost S$40,000 on a Revenue Ticket, and I come home with PPS after 2nd trip.. I’d buy that in a heartbeat!

The calculator I used in the above was ‘bought at sungei road’ and was wrong… sorry..

Hi Aaron,

Thanks for the article!

Quick question: Where can I find the VM award chart from OCBC website?

Thanks!

it does not exist. what i have done is to impute it by working backwards.

From your chart, it appears that we can use VM to pay for the base fare only. The website suggests the taxes can be paid with VM too. Is that correct? What would the rate be, if you happen to know? Not significant in the overall scheme of things, but if at 2-3c rate, it’s still cheaper.

you can use VM to pay base fare and taxes. for this article i only showed VMs for base fare so that we could do a fair comparison to award tickets (the taxes and surcharges will be the same). I don’t know the rate that VMs get when applied to taxes and surcharges, but i do know it is less than when VMs are applied to base fare. that’s why I’d recommend using VMs for base fare instead of surcharges.

Never ever use VM for taxes/surcharges! Was quoted14,100 VM for taxes of S$70.13, 1 VM is worth less than half a cent if used for taxes or surcharges.

yes, i think maximizing your VMs means not using them for taxes/surcharges. anyway the taxes/surcharges on VM tickets will be the same as those on award tickets.

There are restrictions on whether you can choose to use the VM for flight or tax. For tax it is less than half cent per mile.

I don’t know how you get the chart above based on destination. I get a consistent $0.011 cents per mile in my queries w the concierge for tickets.

For partial redemption I am being forced to pay for taxes first before using the miles valuation. So the mile value is less than one cent.

I am starting to regret getting this card.

yes, for taxes VMs attract a much lower valuation. that’s why in the charts above i’ve only shown what it’s like to pay the fare component with VMs. in any case that will make it a more fair comparison with the krisflyer redemption rates, where you have to pay the taxes in cash anyway.

if you are getting a consistent value then you are probably looking at cities in the same zone. as mentioned in the article, cities in the same zone will have constant valuation. are you looking at australia, by any chance?

Looking at an Asian destination in the other direction from Aussie.

But I must say this changes the article’s conclusion, that the value of a Voyage Mile starts at 1.1 c/mile. Which is actually, quite low. Question is how much I value the access and choice of airline, knowing that VM in Asia generally is worth 1.1c/mile.

This is unncessarily complicated. OCBC should up their game and make this more intuitive without the need for us to refer to spread sheets and/or go through loops like this. I will be canceling my card when it’s time to pay the annual fee, pity cuz (superficial me here) the champaign metal card is quite chio

I think OCBC has done an excellent job in blurring the lines between a cashback card and a miles card by offering both feature in the same card. This card can earn up to approx 7% cashback, but instead of giving you the cash, they keep it in Voyage miles and let you use these “cash” to pay for a revenue ticket. However, I don’t like the idea of paying retail price to fly premium. And if you really have to pay because there are no saver awards available, you can buy a ticket and earn whatever credit card perks… Read more »

Hi Aaron, Thank you for the insightful analysis! In your previous Voyage analyses, you had mentioned that Economy redemptions could make sense (for “value”, not “access”) given the “fixed” value of VMs of about 3cts/VM across First, Business and Economy. In your latest analysis, were you able to see the same “fixed value” (2.97cts/WM for LHR, 2.74cts/WM for LAX etc) for Economy as well? If you don’t have the Economy data, would you mind helping us to check the Economy VM valuation for your set of flights? (Or at least for SQ?) I apologize that it’s a lot to ask… Read more »

hey justin. so the short answer to your qn is that if a VM is worth 2.97 cents towards trips to LHR, it’s worth 2.97 regardless of whether it’s F, J, PY or Y. i don’t have economy data because i wanted to look at premium cabin redemptions. however, if you’re a voyage cardholder you can always get the latest quotes direct from the concierge.

Many thanks Aaron!

out of curiosity- i went to look at SQ tickets to london. if you snag an economy lite deal, it’s S$930 base fare RT. at 2.97 cents that’s about 30k VM round trip…versus 76K KF miles on economy saver. hmmm…..

Justin’s comment brings up the main point of the Voyage. For people with incomes that need to be spread across a family for travel, so value over access.

This was a really good analysis and opened my eyes on how to use this card.

Lamenting my stupidity at missing the Ethiad “hack” above…

What do you think the chances are of a repeat promo?

Signed up this card using the link here with finsense but am still charged $488 for the annual fee.

Have emailed the person from finsense who gave me the original sign up document in the first place, but this is not a good start tbh.

Drop me a mail? Will follow up on it personally

checked. you’ll see a $488 charge at first, which will be waived and corrected to $260 within 3 working days. something to do with how their back end is set up. this is supposed to be mentioned during the sales call.

Unfortunately that did not happen.

Am being billed for the full $488 in my latest month statement. Have dropped Finsense another email.

Don’t worry about it I’ll work with Finsense. I guess I’m the only one who took up this offer lol?

[…] recently wrote about the OCBC VOYAGE card, recapping some of the main changes to the product since it first launched and laying out some of the best use cases for VOYAGE […]

Hey thanks for the comprehensive write up on the card! Am holding the Premier banking version thus am getting 1.6mpd on this card. What i feel is great is the Metal card that is gold in colour, 19% off petrol and the free transfer of miles to KF! I have emailed them before regarding VM required to travel to certain destinations and I must agree with the others below that it is very sophisticated at best! But i will try my best to look up on how to maximise the card as i can see on my redemption chart that… Read more »

Hi, how do we use voyage miles to make redemptions directly? Don’t we need to convert to krisflyer miles first? Thanks!

I had the card, didn’t see the value of it (or rather, couldn’t make it valuable to me), so I dropped it after less than a year…

Now.. my new goal.. tho I reckon it won’t be easy to reach.. but here my goals..

Minor Goal: To first attain SQ PPS status on points.. using VOYAGE Miles.. which shouldn’t be too difficult… and then,

Ultimate Goal: To attain SQ PPSS status on points.. 🤪

I have been using Voyage card and accumulating voyage miles recently, and I reached out to Voyage exchange for a quotation recently for a flight to Japan, but they got back to me with valuation of 1.26 cents per voyage miles. Do you happen to know if they have recently had devaluation of voyage miles? Compared to your 2.45 cents per voyage miles valuation, they have really cut the valuation into half.