The past year has seen industry-wide hikes in the foreign currency (FCY) transaction fees that banks charge on credit cards.

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3.0%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, thereby increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3.0%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

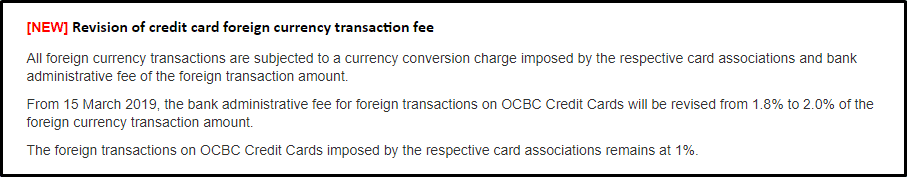

There are precious few banks that still have a sub 3% FCY fee, and now there’s one less as OCBC announced today that it’s increasing its FCY fee from 2.8% to 3% effective 15 March 2019.

With the latest update, here’s how the different banks stack up on FCY fees.

[table id=3 /]

The lowest FCY fee is currently offered by AMEX at 2.5%. That’s kind of surprising, given AMEX’s reputation as the “high fee bank”, and one wonders how long that will continue given the overall market trend.

Should you use your OCBC cards overseas?

OCBC currently has two miles and points earning cards- the OCBC Titanium Rewards, and the OCBC VOYAGE.

The OCBC Titanium Rewards earns 4 mpd on the first S$12K spent each membership year on clothes, shoes, bags, department stores, electronics, and babies’ and children’s wear, be it in SGD or FCY.

The OCBC VOYAGE earns 2.3 mpd on FCY spending throughout the year, without cap. OCBC has informed me that this will be increased to 2.4 mpd from 15 March to 31 December, so be on the lookout for an alert next week.

With the revised 3% fee, here’s how these two cards stack up with the competition:

[table id=23 /]

I would certainly continue to use the OCBC Titanium Rewards for eligible 10X categories overseas, and the higher-than-average FCY earn rate for the VOYAGE means that cardholders shouldn’t feel too bad about continuing to use it overseas as well (especially since you’re earning VOYAGE Miles, which are more valuable than regular miles).

Conclusion

These changes take effect from 15 March so if the incremental fees change your overseas usage equation, you’re going to want to remember to switch cards accordingly.

My overall sense is that despite the recent increases in FCY fees, it can still make sense to use your credit cards overseas to earn miles (so long as you don’t fall prey to the DCC scam). Now, if only we had another crazy 5 mpd without cap promotion again…

Use Youtrip Prepaid Mastercard for foreign currency transactions and use a credit card that gives you miles/rebates for topping up Youtrip card. You get miles/rebates for almost free.

Think most banks don’t offer rewards for top ups OR do they?

You will be surprised that some credit cards still give rewards!

ooo secretive tiger!

but the card itself is useless…no rewards, frequent errors and double charges, and did i mention no rewards? if i want a fuss free card i’ll just use icbc global which is the same exchange rate but 0.50% better. and its a credit card.

You save foreign currency transaction fee (2.5-3.5%) when using Youtrip. The rewards come from the credit card that you use to top up if you can find one. I value 1 mile at 3cts and for ICBC global, you get back 0.5cts for every dollar.

So far, the only “problem” I had when using Youtrip is when I forgot to unlock the card thru the app.

there’s no savings, in fact there is a loss. the icbc global card gives the exact same exchange rate with a net 0.50% benefit. so each time you’re using youtrip you lose 0.50% compared to icbc. plus you have to fund your account where in icbc case you get to delay payment.

if you can find a card that still give rewards for top ups then its worth it, but so far most have excluded it I think, or will eventually exclude. anyway if you value your mile at 3 cts shouldn’t you be using boc world!!

I am not using ICBC or BOC card, I am using other cards that give me 1 mile or more for topping up Youtrip, I get miles for free. Top up the amount only when you want to use it. The card that you use to top up Youtrip also give you up to 51 days till payment due date. It take just a few seconds to unlock Youtrip card thru the app and do the top up.