SingSaver is launching a new campaign called Battle of the Cards, where you can get up to $150 bonus cash by picking the winners of three different card showdowns. There’s also three prizes of a trip to Tokyo up for grabs.

How it works

There will be a total of three battles from now till 9 June:

- Battle of the Miles Cards

- Battle of the Cashback Cards (we’re not covering this one)

- Battle of the Rewards Cards

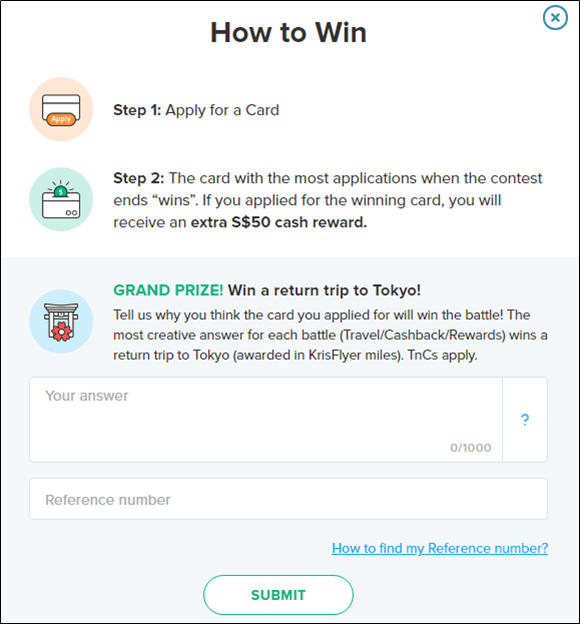

Each battle will feature four different cards, and the card with the most applications wins. Successful applicants for the winning card will get a bonus $50 cash gift (regardless of whether they’re new-to-bank or existing), in addition to the usual SingSaver rewards.

There’s a total of three battles, so you can get up to $150 bonus cash if you pick the right card for all three (of course, there’s nothing stopping you from being kiasu and applying for multiple cards during each battle).

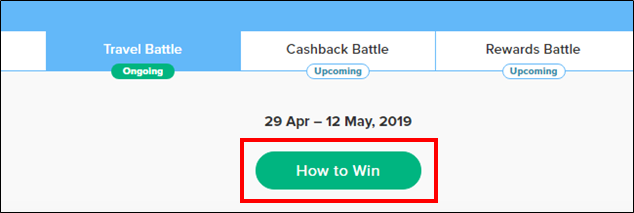

To win the trip to Tokyo, you need to apply for at least one eligible card and answer the question “why do you think the card you applied for will win?” at this page (click on the “how to win” button)

| Battle of the Cards T&C: Link | Battle of the Cards FAQ: Link |

Here’s my assessment of the first battle: Battle of the Miles Cards.

Battle of the Miles Cards

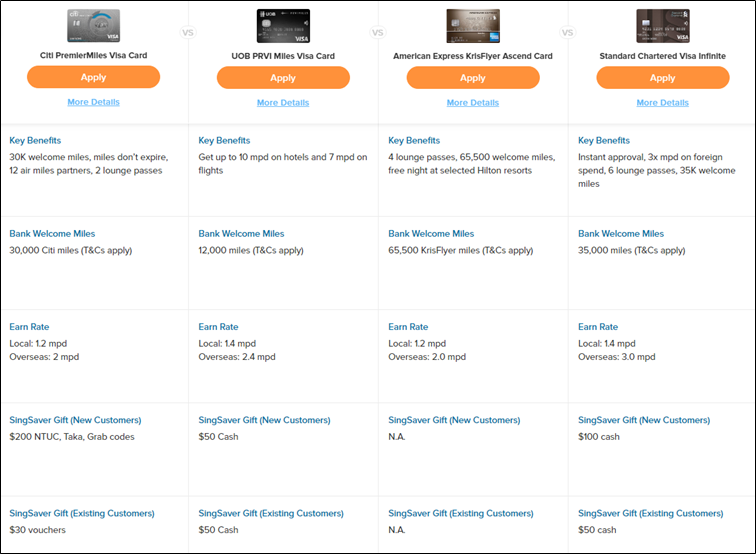

The four cards available for this battle are the Citi PremierMiles Visa, the UOB PRVI Miles Visa, the AMEX KrisFlyer Ascend and the SCB Visa Infinite.

View the Battle of the Cards lineup here

Citi PremierMiles Visa

| SingSaver Gifts | New-to-Bank | Existing Customer |

| Citi PremierMiles Visa | $300 NTUC, Grab or Taka vouchers | $30 NTUC vouchers |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $192.60 (First Year Free Option) | 10,000 | 3.0% |

| Local Earn | FCY Earn | Special Earn | Lounge Access |

| 1.2 mpd | 2.0 mpd | 3.0 mpd- Expedia 7.0 mpd- Agoda 10.0 mpd- Kaligo |

2 Priority Pass lounge visits |

The Citi PremierMiles Visa card earns 1.2 and 2.0 mpd on local/overseas spending, with bonus rates of 3/7/10 mpd on Expedia, Agoda, and Kaligo respectively.

New-to-bank customers who apply for the Citi PremierMiles Visa can earn 30,000 miles when they spend $7.5K within 3 months of approval and pay the $192.60 annual fee. This consists of 9,000 base miles, 10,000 miles for paying the annual fee and 11,000 bonus miles.

Apply for the 30K sign up offer here ($192.60 annual fee must be paid, new customers only)

Alternatively, they can opt to have the first year’s annual fee waived, and get 10,000 miles when they spend $3K within 3 months of card approval. This consists of 3,600 base miles and 6,400 bonus miles.

Apply for the first year free offer here (new & existing)

Existing customers can opt to pay the first year’s fee to get 10,000 miles.

Apply for the first year paid offer here (existing)

[Do note that Citi has another offer for existing customers which involves paying the first year’s fee, spending $7.5K in 3 months and getting 23,000 miles plus a $100 Kaligo e-voucher. This is not available through SingSaver]

Citi PremierMiles Visa cardholders get two complimentary Priority Pass lounge visits each calendar year, and have access to the 12 different FFPs, the widest selection of partner airlines in Singapore.

| Citi is supposed to change their lounge provider to Dragon Pass in the near future, but this has yet to materialize |

New-to-bank customers can get $300 of NTUC/Grab/Taka vouchers upon approval, while existing customers can get $30 of NTUC/Grab/Taka vouchers.

UOB PRVI Miles Visa

| SingSaver Gifts | New-to-Bank | Existing Customer |

| UOB PRVI Miles Visa | $50 cash | $50 cash |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $256.80 (First Year Free) | None | 3.25% |

| Local Earn | FCY Earn | Special Earn | Lounge Access |

| 1.4 mpd | 2.4 mpd | 3.0 mpd- Grab, first $200 per month till 31 Jul 19 7.0 mpd- Agoda, Expedia, UOB Travel 10.0 mpd- Kaligo |

None |

The UOB PRVI Miles Visa is a general spending workhorse, earning 1.4/2.4 mpd for local/overseas spending without any cap or minimum spend requirement. Cardholders can also earn 7 mpd on Agoda, Expedia and UOB Travel, plus a further 10 mpd on Kaligo.

Both new-to-bank and existing customers can get $50 cash upon approval. Do note that only the UOB PRVI Miles Visa is eligible for the Battle of the Cards. If you’d like to apply for other UOB PRVI Miles cards, please scroll down to the bottom.

Apply for the UOB PRVI Miles Visa card here

| If you opt for the UOB PRVI Miles AMEX, spending $50K in a membership year will get you 20,000 bonus miles, and you can redeem up to eight complimentary airport transfers per year. |

SCB Visa Infinite

| SingSaver Gifts | New-to-Bank | Existing Customer |

| SCB Visa Infinite | $100 cash | $50 cash |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $150,000 | $588.50 | 35,000 (first year) | 3.5% |

| Local Earn | FCY Earn | Special Earn | Lounge Access |

| 1.0 mpd (1.4 mpd if >$2K spend per month) | 1.0 mpd (3.0 mpd if >$2K spend per month) | N/A | 6 Priority Pass lounge visits |

The SCB Visa Infinite is part of the so-called $120K credit card segment (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and overseas spending respectively if you spend more than S$2K in a statement period, otherwise you earn 1.0 mpd for everything.

The card offers six Priority Pass visits, but does not have airport limo service. The SCB Visa Infinite has a non-waivable annual fee of $588.50, for which you’ll get 35,000 miles. Remember that the $100 new-to-bank SingSaver gift reduces the first year annual fee to $488.50, which represents buying miles at 1.396 cents each, a very good price.

Also remember that the SCB Visa Infinite offers one of the lowest cost tax payment facilities in the market. For a processing fee of 1.6%, you can earn 1.4 mpd on your taxes assuming you spend at least S$2K during a given statement period- this works out to 1.14 cents per mile, perfect for people who want to buy miles on the cheap.

Apply for the SCB Visa Infinite here

AMEX KrisFlyer Ascend

| SingSaver Gifts | New-to-Bank | Existing Customer |

| AMEX KrisFlyer Ascend | 6,500 miles with $10K spend in first 3 months | 6,500 miles with $10K spend in first 3 months |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $50,000 | $337.05 | None | 2.5% |

| Local Earn | FCY Earn | Special Earn | Lounge Access |

| 1.2 mpd | 2.0 mpd (June & Dec), 1.2 mpd otherwise | 2.0 mpd- Singaporeair.com 3.2 mpd- Grab, first $200 per month 3.2 mpd- “Daily Essentials” |

Four Plaza Premium lounge passes |

The AMEX KrisFlyer Ascend earns 1.2 mpd on local spending, and 2.0 mpd for overseas spending in June and Dec (otherwise 1.2 mpd). Cardholders earn 2.0 mpd on Singaporeair.com, 3.2 mpd on Grab (first $200 each month) and 3.2 mpd on “Daily Essentials” (first $200 each month). You can see all the ongoing bonus mile promotions here.

Cardholders receive four lounge passes plus a free night’s stay at selected Hilton properties in Asia Pacific. They also enjoy complimentary Hilton Silver status, and a fast track to KrisFlyer Elite Gold.

SingSaver applicants receive a bonus 6,500 miles when they spend $10K within 3 months after approval, on top of the usual AMEX KrisFlyer Ascend sign up bonus.

Apply for the AMEX KrisFlyer Ascend here

Alternatively, you may want to consider applying for the AMEX KrisFlyer Ascend through the ongoing AMEX x Milelion Million Mile Giveaway, where we’re giving away ten prizes of 100,000 KrisFlyer miles each to successful applicants. Plus, you can get 7,500 miles when you spend $50 within the first 3 months after approval, and up to 66,500 miles when you spend $20K in the first 6 months after approval, broken down as follows:

Read more details and take part in the competition here.

Conclusion

The following cards are not eligible for the Battle of the Cards contest, but you can still get the usual SingSaver rewards when you apply

- UOB PRVI Miles AMEX ($50 cash for new + existing cardholders)

- UOB PRVI Miles Mastercard ($50 cash for new + existing cardholders)

- Citi Prestige ($300 vouchers for new cardholders, $30 for existing)

If you’re looking for rewards cards, check out the Battle of the Rewards Cards, which features:

- UOB Lady’s Card

- HSBC Revolution

- SCB Rewards+

- Citi Rewards Visa

Has anyone received the Singsaver bonus from the March round?

still too early for march bonuses. T&C says they should be delivered end may/early june i believe

Uob privi miles has a 12k bonus miles for new to bank for spending 4k. Is it applicable here?

yes, it is.

Half of the population cannot apply for the UOB lady’s card during the Rewards contest segment, so….