CardUp is service that lets you pay rental, income tax, condo fees, insurance, car loans and more with your credit card, earning rewards points in the process. The usual admin fee is 2.6%, but CardUp is offering Milelion readers a 1.99% discounted rate for tax payments made in the month of June.

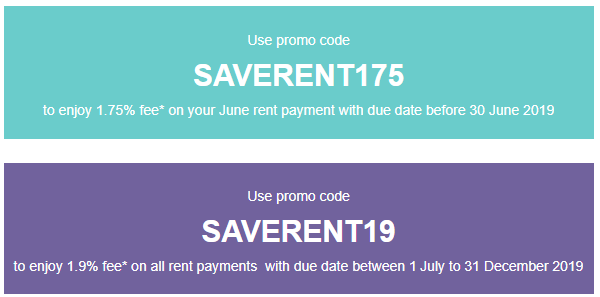

If you’ve got rental payments to make, then CardUp’s got quite the deal for you. CardUp customers can pay rent with a 1.75% admin fee in June, and subsequently at 1.9% for the rest of 2019.

The full T&C of this promotion can be found here. This promo applies to both Visa and Mastercard cards, but not to AMEX or credit cards issued outside of Singapore.

You’ll need to schedule a one-time rental payment by 25 June with a due date on or before 30 June 2019 to enjoy the 1.75% fee. Subsequently, you can set up a recurring rental payment from July to December to enjoy the 1.9% fee.

Remember, however, that if this is your first payment with CardUp, you can get $20 off your admin fee with the promo code MILELION. Here’s which code saves you more, depending on your rental amount:

| June 2019 | July-December 2019 | |

| Which code to use? |

|

|

The following table illustrates the cost per mile with various cards.

| MPD | CPM @ 1.75% | CPM @ 1.9% | |

DBS Altitude Visa  OCBC VOYAGE  Citi PremierMiles Visa |

1.2 | 1.43 | 1.55 |

|

|

1.25 | 1.38 | 1.49 |

| 1.3 | 1.32 | 1.43 | |

UOB PRVI Miles Visa/ UOB PRVI Miles Mastercard  SCB Visa Infinite (Spend >$2K per month)  UOB Visa Infinite Metal Card |

1.4 | 1.23 | 1.33 |

BOC Elite Miles World Mastercard |

1.5 | 1.15 | 1.24 |

UOB Reserve  DBS Insignia  OCBC VOYAGE (BOS/Premier Banking) |

1.6 | 1.07 | 1.17 |

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they do) and whether there are any 10X opportunities (there aren’t).

| CardUp FAQ

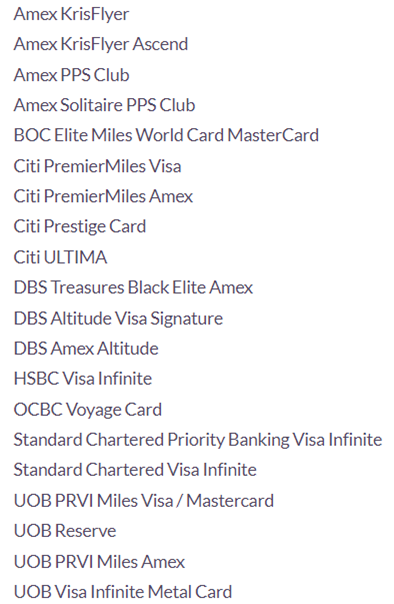

Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

A 1.75% admin fee is the lowest in the market right now for rental payments, and if you’re paying rent and looking to buy miles, you can’t do much better than this.

Questions about any of the CardUp promotions should be sent to hello@cardup.co