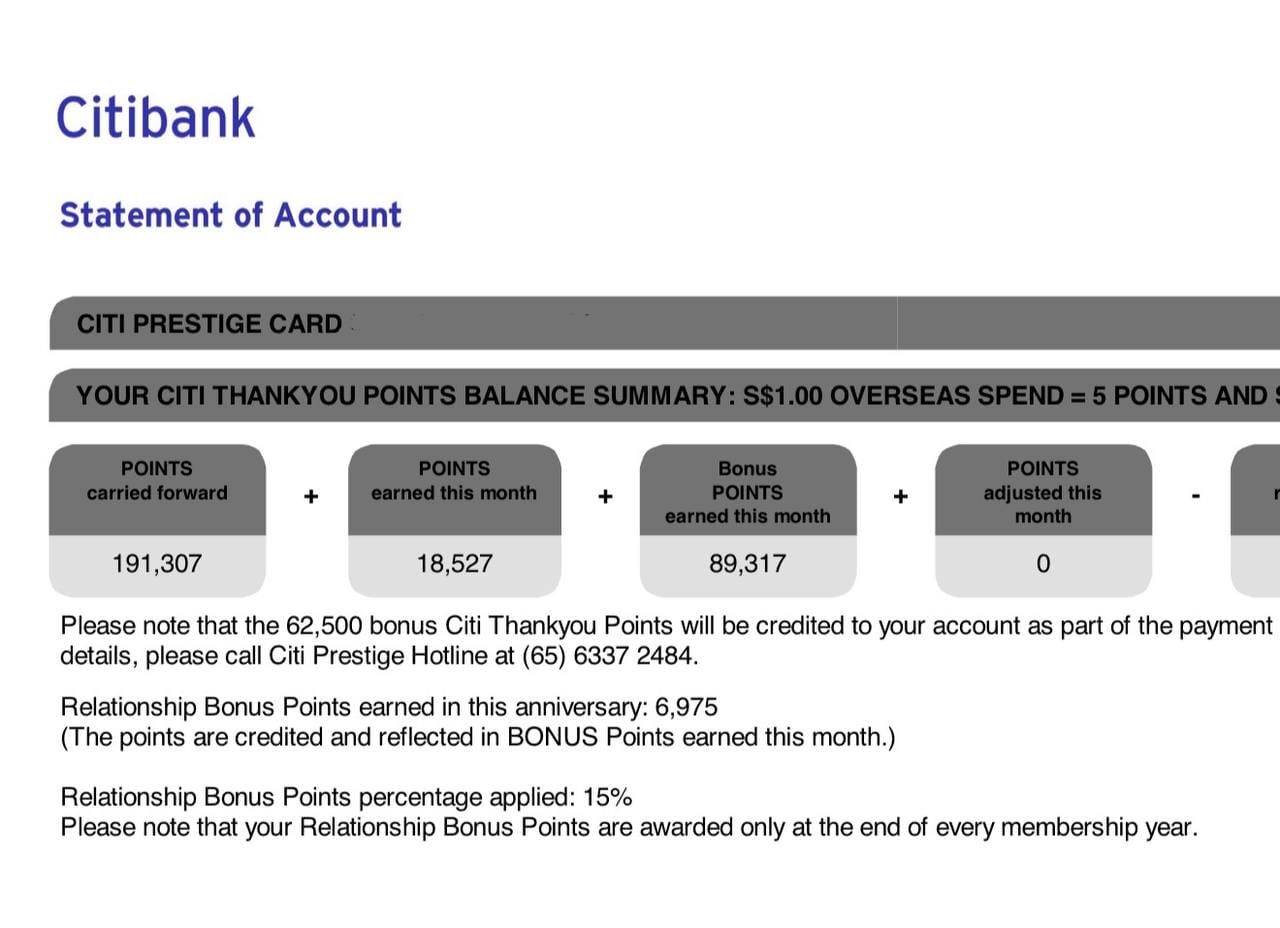

One of the most unique — and misunderstood — features of the Citi Prestige Card is its so-called Relationship Bonus, which awards up to 30% bonus ThankYou points based on the cardholder’s tenure and Citigold status.

It’s intuitive for many people to simply multiply the percentages by the card’s earn rate, so the regular 1.3 mpd on local spending would become 1.69 mpd (1.3 mpd x 130%), and the 2 mpd on overseas spending would become 2.6 mpd (2 mpd x 130%).

Unfortunately, that’s just not how it works. In reality, you’re looking at an extra 0.02 to 0.12 mpd overall— better than nothing, but certainly not as exciting as it appears on first glance!

How does the Relationship Bonus work?

Citi Prestige Card Citi Prestige Card |

||

| Tenure | Citigold | Non-Citigold |

| 0-5 Years | 15% | 5% |

| 6-10 Years | 20% | 10% |

| >10 Years | 30% | 15% |

The Citi Prestige Relationship Bonus awards cardholders with an extra 5-30% ThankYou points, depending on their tenure and status with Citibank.

As I mentioned earlier, the Relationship Bonus percentage is not applied to the earn rates; rather, it’s applied to the dollar spend amount to derive the bonus points.

In other words, it’s a two-step calculation:

- Step 1: Multiply the bonus percentage by the total eligible spending amount to derive bonus ThankYou points

- Step 2: Multiply the ThankYou points by 0.4 to derive the number of bonus miles

Here’s a simple illustration, for a non-Citigold client with a tenure of two years and a Relationship Bonus of 5%.

- Cardholder spends S$10,000 in a membership year

- The S$10,000 is multiplied by 5% to give a bonus of 500 ThankYou Points

- 500 ThankYou points are worth 200 miles

- The bump in the earn rate is 0.02 mpd (200 miles / S$10,000)

It’s somewhat underwhelming that a 5% bonus translates into a mere 0.02 mpd bump in earnings. Even if you spent a whopping S$100,000 per year, you’d be looking at an extra 2,000 miles, worth perhaps S$30-40!

What are the actual earn rates?

With that in mind, here’s a more accurate version of the Relationship Bonus table:

Citi Prestige Card Citi Prestige Card |

||

| Tenure | Citigold | Non-Citigold |

| 0-5 Years | +0.06 mpd | +0.02 mpd |

| 6-10 Years | +0.08 mpd | +0.04 mpd |

| >10 Years | +0.12 mpd | +0.06 mpd |

Alternatively, to put it in mpd terms:

| Tenure | Citigold | Non-Citigold |

| 0-5 Years | 1.36 mpd 2.06 mpd |

1.32 mpd 2.02 mpd |

| 6-10 Years | 1.38 mpd 2.08 mpd |

1.34 mpd 2.04 mpd |

| >10 Years | 1.42 mpd 2.12 mpd |

1.36 mpd 2.06 mpd |

| Local Spend FCY Spend | ||

Obviously, the math favours Citigold clients, who in their very first year will be enjoying the same bonuses that non-Citigold customers take 10 years to earn!

If anything, this just highlights the overall weakness of the Citi Prestige Card’s earn rates, because competitors like the DBS Vantage (1.5/2.2 mpd) or UOB Visa Infinite Metal Card (1.4/2.4 mpd) offer better returns from day one.

| Income Req. | Annual Fee. | Earn Rates | |

Citi Prestige Card Citi Prestige Card |

S$120K | S$651.82 | 1.42 mpd 2.12 mpd |

DBS Vantage Card DBS Vantage Card |

S$120K | S$599.50 | 1.5 mpd 2.2 mpd |

UOB VI Metal Card UOB VI Metal Card |

S$120K | S$654 | 1.4 mpd 2.4 mpd |

Citi Premier Miles Card Citi Premier Miles Card |

S$30K | S$196.20 | 1.2 mpd 2.2 mpd |

BOC Elite Miles Card BOC Elite Miles Card |

S$30K | S$207.10 (FYF) |

1.4 mpd 2.8 mpd |

Even an entry-level Citi PremierMiles Cardholder would earn 2.2 mpd on overseas spending, more than a Citigold customer with a relationship of more than 10 years!

What counts as tenure?

Your “tenure with Citibank” refers to the length of your relationship with Citibank, not necessarily how many years you’ve held the Citi Prestige Card.

It’s holistic in the sense that it includes both credit card and banking relationships. For example, if you only got a Citi credit card this year, but had a Citi savings account for the past six years, your tenure is taken to be six years.

Holding a supplementary card does not, in and of itself, count towards tenure.

What counts towards Relationship Bonus spending?

When computing the dollar value of spending to which the Relationship Bonus should be applied, Citi will only take into account retail spending, which excludes the following:

| (i) annual fees, interest charges, late payment charges, GST, cash advances, instalment, easy, extended, equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by Citibank); (ii) funds transfers using the card as source of funds; (iii) bill payments (including via Citibank Online or via any other channel or agent); (iv) payments to educational institutions; (v) payments to government institutions and services (including but not limited to court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases); (vi) payments to insurance companies (sales, underwriting, and premiums); (vii) payments to financial institutions (including banks and brokerages); (viii)payments to non-profit organizations; (ix) betting or gambling (including lottery tickets, casino gaming chips, offtrack betting, and wagers at race tracks) through any channel; (x) any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts; (xi) transit-related transactions; and (xii) transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank, as set out in www.citibank.com.sg/rwdexcl (you acknowledge that this list of excluded Merchant Categories or merchants may be updated from time to time at our discretion and you agree to refer to this list for any updates); |

In short, any transaction that is eligible to earn points will count towards the Relationship Bonus calculation.

Any transaction that is not eligible to earn points will not count towards the Relationship Bonus calculation, such as education, government institutions, insurance premiums, charitable donations, GrabPay top-ups, brokerages and utilities, among others.

For the avoidance of doubt:

- Citi PayAll transactions where the service fee is paid will count towards Relationship Bonus spending

- 4th Night Free stays will count towards the Relationship Bonus in full; the reimbursement is not considered a deduction

- Limo bookings will count towards the Relationship Bonus in full; the reimbursement is not considered a deduction

When is the Relationship Bonus awarded?

You should see your Relationship Bonus credited as a lump sum around the time when your upcoming year’s annual fee is charged.

In theory, there should be no forfeiture of the Relationship Bonus if you decide not to renew your card for the upcoming year, in the sense that the bonus is credited in respect of your spending for the year that’s passed. Obviously, you’ll need to wait for the points to be posted first, cash them out, and then request to cancel the card.

Overview: Citi Prestige Card

|

|||

| Apply | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$651.82 |

Min. Transfer |

25,000 TY points (10,000 miles) |

| Miles with AF | 32,000 | Transfer Partners | 10 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The Citi Prestige Card recently underwent some negative changes, which saw its unlimited airport lounge benefit replaced with 12 visits per year, and the annual fee increased to S$651.82.

This makes it a lot less attractive than before, though it does retain some key benefits like the 4th Night Free on selected hotel stays, complimentary airport limo transfers, dining events and golf privileges. In my “Keep or Cancel” article, I’ve laid out the case for and against cancelling the card, so do have a read of that if you’re on the fence.

If you don’t have a Citi Prestige Card yet, it’s currently offering 57,000 bonus miles with a minimum spend of S$2,000 and the payment of the annual fee, which works out to buying miles at 1.14 cents each — before factoring in the value of any of the other benefits.

Conclusion

Citi Prestige Cardholders can look forward to a Relationship Bonus of up to 30%, depending on their tenure with Citibank and Citigold status.

However, even a fully maxed-out Relationship Bonus of 1.42/2.12 mpd would still be inferior to what you could earn on alternative cards like the UOB PRVI Miles (1.4/2.4 mpd) or DBS Vantage (1.5/2.2 mpd), so those seeking pure miles-earning potential should look elsewhere.

I wouldn’t consider the Relationship Bonus to be a decisive factor in deciding whether to get the card, but if nothing else, it’s a little upside for those who’ve taken the plunge.

Does PayAll count towards the minimum spending of airport transfer?

as per the CSO, yes.

Yes , just got my rebate from last quarter after hitting $20000 with payall

“Therefore, if you’re looking for pure miles earning potential, you should look elsewhere.”

That should read “Krisflyer earning potential”.

For me – given my frequent trips to Europe (hello Turkish, hello Avios) – this is my general spending/rent payment card.

Prestige with CitiGold is a better earn rate that PrivMiles, along with no expiry (not that important) and better partners (important!)

I will say Prestige is better than PrivMiles as a gen spend card unless your overseas gen spend is higher than local (which you should then try to achieve on UOB VS instead if possible)

voyage is 1.6mpd

I’ve used the hotel 4th night credit 3 times this year already for about $1.4k back. Love this card for that benefit!

This is referring to booking the hotel directly right and not thru an agent (eg. Travel app)?

I am just wondering if we can take a class action lawsuit against the bank.

This is clearly a case of misrepresentation.

I must say I agree this seems like clear false advertising.

In what universe would the man on the street consider 0.02 to be 5% of 1.3…….

Take note for last column that says >10, it means 11 years onwards, and not from 10 years & 1 day on.

In other words, it’s really [0-5][6-10][11-XX].

So if you have been with citibank since March 2009 to March 2019, and you were to receive your bonus points today (in August month), you’re considered second column and not third column despite being with citibank for more than 10 years.

This was revealed to me by a CSO and Service Manager

Is citi strict with the annual income? If say 60-90k bracket

Note it is not explicitly mentioned that the relationship bonus applies to Citigold relationship IN SINGAPORE only. While one of the benefits of Citigold is “if you are Citigold in one country, you should be in other countries” they refused to give me the higher tier of relationship bonus on Prestige card, even though I had been Citigold for over 10 years in another country before moving to Singapore. This was despite some ill informed CSO having confirmed to me that I would get the higher tier when I signed up. Citibank – tries to behave like a “global” bank,… Read more »

“The Citi Prestige Card is certainly not as strong a proposition as it was five years ago”

Well, better than 2 years ago with Priorty Pass restaurant benefits popping up left and right incl. guest benefits we can use for our 1744 holding colleagues.

they have added so many restrictions to 4NF and rejecting claims for ridiculous reasons like “ensuite bathroom” <– oh that’s a suite, cannot!

plus no more inflight wifi with boingo, limo transfers got nuked in 2019, haute dining no more

I am trying to cancel my citi prestige card and according to the citibank CSO, I will forfeit the relationship bonus as it is only credited at the same time that the new year’s annual fee is charged. What a letdown. Can anyone else verify this? (If this is correct then there might need to be a minor correction to the article)

When Charged or When Paid?