Say what you will about the BOC Elite Miles World Mastercard, but I think we’ll all agree that there’s never a dull moment with this card.

Back in March 2019, BOC unveiled a major update to the card’s T&Cs. Most of the ensuing discussion focused on the redefinition of overseas spending, addition of new exclusion categories, and capping of the maximum points convertible in a single transfer.

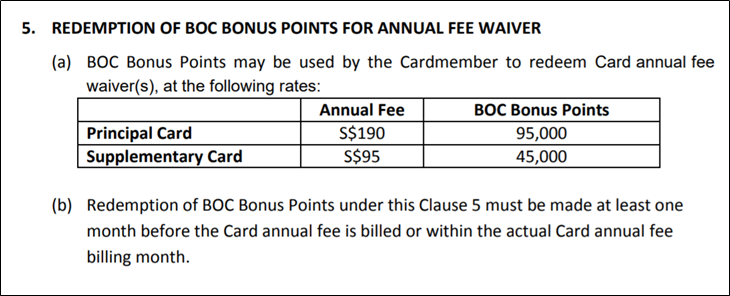

But nestled among the changes was Clause 5, a seemingly innocuous section regarding the redemption of BOC points for annual fee waivers.

I scoffed when I read this, but ultimately considered it to be of little consequence. After all, my philosophy towards annual fees on entry-level cards is simple: if the bank waives it, great; if not, redeem your points and cancel the card. Even if something possessed you to pay, no one in the right mind would choose 95,000 points (31,667 miles) over a S$190 annual fee, so this clause struck me as more of a footnote than anything else.

Well, BOC has a way of surprising you, because Clause 5 has now been thrust into the spotlight.

BOC is granting fee waivers….then charging points instead

From what I understand, BOC doesn’t grant automatic fee waivers on the BOC Elite Miles card. Therefore everyone who has held their card beyond the first year will have been charged an annual fee.

When this happens, you can call up the bank to request a waiver, but here’s where it gets messy.

Some people will get a waiver, see the fee reversed in the next month’s statement and that’s the end of the story.

Others will get an SMS telling them their fee waiver request has been “processed” and will be reflected on their next statement…

…but later find that 95,000 points have been deducted from their balance. Upon calling the bank, they’re told that this is Clause 5 in action- by requesting an annual fee waiver, they’ve consented to a deduction of 95,000 points.

| What happens if you don’t have sufficient points in your balance for a deduction? Your fee waiver should be rejected and you’ll get a call informing you of the fact |

Let’s leave aside the fact that the IVR system through which fee waivers are requested nowhere mentions a 95,000 points deduction. A natural reading of this SMS would lead most people to conclude that their fee waiver request had been successful.

After all, you requested a fee waiver, not to use your points to redeem a fee waiver. And if your points are used, well then, it’s not really a fee waiver is it? These points are as good as money; in fact, 95,000 points (31,667 miles) are worth way more than S$190, so it’s as if your annual fee was increased instead!

BOC are perfectly entitled to charge whatever they want for an annual fee, but 31,667 miles is objectively speaking insane. For comparison, UOB charges 4,800 UNI$ (9,600 miles) for a fee waiver on a S$192.60 card, so that’s a 2 cent valuation, versus BOC’s 0.6 cents (one thing both banks have in common though is that these deductions are done on the down-low).

To put things in perspective, here’s what you could redeem with 31,667 miles:

- Two round-trip Economy Class flights to Bali

- A round-trip Economy Class flight to Hong Kong or Taipei

- A one-way Business Class flight to Hong Kong or Taipei

- A one-way Economy Class flight to Auckland or Christchurch

Even at a conservative valuation of 1.8 cents, those miles are worth about S$570, or 3X the annual fee (fine, the S$190 annual fee is still subject to 7% GST, but let’s not split hairs here).

It’s almost comical how customers are given the impression their fee waiver is successful, only to be hit by an even bigger “fee”. The wording of the SMS is flat out misleading, and people are right to be annoyed. How hard would it have been to state plainly that 95,000 points are being deducted?

What should I do if my points have been deducted?

If you’ve been given a “fee waiver” at the expense of your points, it’s not too late to get them back.

What you need to do is call up customer service and ask them to reinstate your points. You’ll then be given one of three options:

- Pay the S$190 annual fee and get a gym bag plus some discount vouchers for shopping and dining

- Pay a reduced S$95 annual fee plus 45,000 points, and get a gym bag plus some discount vouchers for shopping and dining

- Refuse to pay the S$190 annual fee, transfer your points out and close the card

I’m fuzzy about the exact configurations of options 1 &2, so please chime in if you know better.

It doesn’t help that based on what I’m hearing, BOC CSOs are providing conflicting information. Some are adamant that no one is getting an annual fee waiver (false), others that you have to decide on the phone whether to pay the annual fee or cancel immediately (thereby losing your points, also false)…the whole thing is a big mess, and quite frankly I understand why some people have had enough.

Conclusion

Given that the BOC Elite Miles card no longer offers lounge access, there’s really no compelling reason to pay the annual fee and have nothing to show for it. If you’re unable to get a waiver, your best option may be to throw in the towel, cash out your points and continue your miles journey elsewhere.

At this point in time, I’m not sure what else I can say about the BOC Elite Miles card, other than it’s not for the faint of heart. It may earn a market leading 1.5/3.0 mpd on local/overseas spending, but you’ll have to ask yourself whether it’s really worth all the aggravation, with its slow processing times, mysterious interest charges and now this.

tl;dr: even if your BOC Elite Miles fee waiver appears to be successful, watch your points like a hawk. If you see a 95,000 sized hole in your balance, call the bank immediately and get it sorted out. Get waived, or get out.

Thanks for sharing, Aaron. It’s really time-wasting and misleading from BOC as can see from your post. Probably the best option would be cancelling the card……..

Well… i have transferred all points out and left almost none inside. So i guess if I refuse to pay, i can only cancel the card? lol

This reminds me I’ve got to check on my late fee waiver which is 2-months old and has incurred another round of late fees. All I forgot was that the card was charged the miles conversion fee. What a bloody nightmare.

Update: I just got my statement 7 days after it was dated. Both late fees and interest charges were reversed but they snuck the AF in there. I had just gone down to the main branch to cancel the card and had to sign a hard copy form. It’s perhaps the first time I’ve had to do this.

I am so happy that they declined my application twice, when the card was first launched. This bank is just bad news… but keeps the milelion busy 🙂

Thanks for the post!

I have over 200k miles. Better transfer by end of the month before I am hit with the fees.

Strangely enough my annual fee should have been due in October but it hasn’t popped up yet. Have people been getting theirs in the month following the 1yr anniversary or in the month itself? Definitely would not keep the card if I have to pay SGD190 or cough up a ridiculous amount of miles for it.

I contemplated for months over getting this card, the points expiration was one thing but the IT and CSOs’ lack of professionalism really made me drop the idea each time I was tempted; not to mention it takes months for the application + approval and actual receiving the card. I hope this is the last straw to make me drop the idea once and for all. In your last related post u mentioned u stuck on because of their smart saver account, what’s your personal take on this given now that the annual fee is now practically mandatory? Simply speaking… Read more »

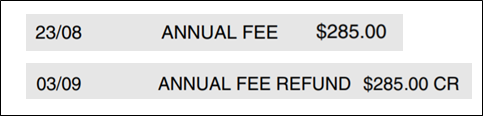

i was actually one of the fortunate people who got a fee waiver without any drama. but yes, if i didn’t get one, i’d close for sure. keep in mind i was on the hook for 285 thanks to supp card. i’m already plotting an exit strategy though, need to get my miles out first

Hi Aaron,

do you think the waiver is due to spending beyond a certain threshold or the lack of spending with the card? based on saerogenta’s comment, i have the impression that waiver is granted if you don’t use the card frequently and hence has little to lose by cancelling the card.

BOC CSO told me over the phone that this has never happened…it was either miles or annual fee payment.

I requested for a refund back in September and it was reflected in October’s statement. Don’t see them deducting 95k points from my pot though. Either because I don’t have enough (only 23k points after I took some out) or it’ll only be reflected next month.. Will keep a look out.

BOC is bloody disingenuous. This will be the straw that breaks my camel’s back if indeed points are deducted in conjunction with fee waiver.

Am in exactly the same situation – fee posted in Sep statement, waiver reflected in Oct statement but no points deduction “hole”.

Aaron… for those who see a “hole”, how many months after the fee was originally posted to the statement was the “hole” reflected in the subsequent statement?

the deduction should happen once your “fee waiver” is approved, so after you get that SMS i’d recommend checking.

BOC=MIC=Made in China=what do you expect?

I made a request for fee waiver over the phone via and the automated message said they will review the request and respond within 2 weeks time. Is that normal? 2 weeks is incredulously long.

2 weeks is incredulously short in the boc context, as cardholders have discovered.

Thanks Aaron for the headsup. Do we still get miles for Ipaymy cardup payments? I always had the impression that we do but the recent top 40 spenders programme excluded ipaymy and cardup. Am also considering cancelling since I only use them to pay rents.

As per BOC, yes. but who really knows at this point in time.

Interestingly enough, I received this SMS on Friday:

BOCCards: Enjoy Annual Fee waiver as billed in your BOC credit card statement when you make 1 retail transaction by 15 Nov. The waiver will be reflected in your following month statement. Do continue to use your card for all your lifestyle needs. Call 18003385335 for queries. SMS UN to 79777 to unsub

Not sure how true this is!

I had the same today….let’s see

DBS Altitude card did the same thing, waive the annual fee then deduct 5000 points. They return the points after I complain.

Doesn’t DBS award you 5k pts at the point they charge you the annual fee?

I believe you mean uob

This BOC card is a massive time waster. Never ever going to bank with them. I will stay away from any of their product from a 10 foot pole. Even cashing out the point is a nightmare. They have a manual system of redemption and can’t redeem the points immediately. One has to wait for the redemption to be completed before cancelling the card and by then 2x late fee already charged. Please the possibility of this showing up in your credit report

All in all it wasn’t worth the time and effort.

I applied for a waiver. Got a call after two weeks saying no waivers are being given. On renewal you get a gym bag. I called back and cancelled the card. The operator did not ask why I was cancelling or try to get me to renew, just assumed it was due to annual fee. I got the impression they actually don’t want people to renew.

Do you know Aaron, they updated their TnC, it’s now a rubbish card.

http://bit.ly/EMTnC20