If I were tasked with designing a credit card for millennials, I’m not quite sure what I’d do. Maybe I’d make it earn bonus points on avocado toast and penalize you for spending on housing. Maybe the sign up gift would come in the form of positive reinforcement and a trophy of participation. Maybe all applications could be done via selfies. I don’t know, there are a lot of paths this could go down.

I know what I wouldn’t do, however, and that’s create a card which does pretty much what other cards already do, but worse. That’s unfortunately what we have on our hands with the newly-launched Citi Lazada credit card.

Perhaps I shouldn’t say newly-launched, because the Citi Lazada card has already debuted in Malaysia, Thailand, and Vietnam. Singapore is the fourth country to get it, and the plan is to launch in additional geographies soon. In fact, Citibank and Lazada are targeting a whopping 500,000 sign ups for this card in Southeast Asia over the next few years.

Well pardon me for spitting out my artisanal coffee when I heard that, because if it comes to pass, it suggests that millennials don’t comparison shop as much as everyone says they do. It’s not that the Citi Lazada card is bad per se, it’s just that other cards do what it does so much better.

| tl;dr |

| The Citi Lazada card uses the hashtag #playitup, and that’s kind of unwittingly meta. They’re playing up the benefits, but there’s really nothing it does that other cards don’t do better. You could get it for the free year of LiveUp membership, but otherwise, think of it as a neutered Citi Rewards card. |

Citi Lazada Credit Card Basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Transaction Fee |

| S$30,000 | S$192.60 (first year free) |

None | 3.25% |

| Local & FCY Earn | Special Earn | Points Validity | |

| 0.4 mpd | 4.8 mpd on Lazada (until 29 Feb 20, 4 mpd after) 2 mpd on dining, travel, entertainment, commute (Cap of 10,000 points per month on both categories) |

36 months from card opening date | |

The Citi Lazada credit card has a S$30,000 annual income requirement, and carries an annual fee of S$192.60. This is waived for the first year, just like most of Citi’s other entry-level cards.

Cardholders earn 4.8 mpd on Lazada until 29 Feb 2020 (4 mpd after), and 2 mpd on dining, travel, entertainment, and commute. We’ll talk more about these bonuses and their caps in the next section of this review.

Otherwise, cardholders earn a flat rate of 0.4 mpd on all other local and foreign currency spending. A 3% fee applies to non-SGD transactions, which will increase to 3.25% from 15 December 2019 along with the rest of Citi’s card portfolio.

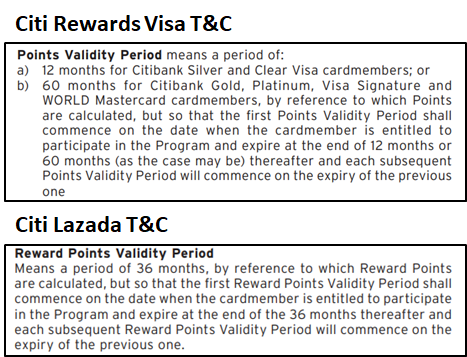

Do note that there’s a difference in the expiry of points on the Citi Lazada card (36 months) versus other Citibank cards (60 months). I can’t explain why, but it’s something to take note of.

Another important thing to point out is that the expiry of points is based on the date of account opening, not points earning. For example, if you opened your Citi Lazada card on 12 Dec 2019, all points earned from 12 Dec 2019 to 11 Dec 2022 would expire on 11 Dec 2022 (even those earned on 10 Dec 2022!). It’s a strange policy to be sure, but not unique to the Citi Lazada card- points expiry on the Citi Rewards card works the same way (albeit with a longer 60 month period)

In any case, as per Citi’s standard practice, points earned on this card will not pool with those earned on other cards like the Citi Prestige or Citi Rewards. This means you’ll pay as many transfer fees as you have cards.

Earn 4.8 mpd on Lazada and 2 mpd on dining, entertainment, travel, and commute

From now till 29 Feb 2020, Citi Lazada cardholders will earn 12X points per S$1 (4.8 mpd) spent at Lazada Singapore. From 1 Mar 2020, the rate will be reduced to 10X points per S$1 (4 mpd).

Do note this excludes purchases made on RedMart, which will earn a paltry 0.4 mpd. I really don’t get this, because in the press release, the Lazada CEO even says “Millennials are now buying more groceries, household supplies and beauty products online than ever before.” Well sure, so why would you exclude your grocery platform from your cobrand card?

Cardholders will also earn 5X points per S$1 (2 mpd) spent on dining, entertainment, travel, and commute transactions, defined as the following:

| Category | Applicable MCCs |

| Dining |

|

| Entertainment |

|

| Travel |

|

| Commute |

|

Unfortunately, there’s a shared cap of 10,000 points per statement month for both 12X and 5X categories. This means you’d max out your bonus by spending:

- S$833 on Lazada (until 29 Feb 20, S$1,000 after) OR

- S$2,000 on Dining, Entertainment, Travel, and Commute

Whether most people would actually spend that much is up for debate, but maybe a better question is: Why would you even use the Citi Lazada credit card for these transactions when you could do much better with other cards on the market?

You don’t even need to look outside Citibank. Take the Citi Rewards Visa, for example, which earns 10X points on all online spend except travel. See how it measures up to the Citi Lazada card on the latter’s supposed “strong points”.

Citi Lazada Card Citi Lazada Card |

Citi Rewards Visa Citi Rewards Visa |

|

| Lazada | 4.8 mpd until 29 Feb 20, 4 mpd after (excludes RedMart) |

4 mpd (includes RedMart) |

| Netflix/Spotify | 2 mpd | 4 mpd |

| Grab/gojek | 2 mpd | 4 mpd |

| Online movie tickets | 2 mpd | 4 mpd |

| Travel | 2 mpd | 0.4 mpd |

| Dining | 2 mpd | 4 mpd (if online, 0.4 mpd otherwise) |

| Cap | S$833 on Lazada OR S$2,000 on dining/ entertainment/ travel/ commute | S$1,000 online spending per statement month |

Alternatively, you could use the DBS Woman’s World Card (it doesn’t require you to be a woman nor earn S$80K a year), which would give you a higher bonus cap than the Citi Rewards plus bonuses on online travel spending.

Or maybe the HSBC Revolution, which doesn’t do as well on Lazada, but matches the Citi Lazada card everywhere else (with no bonus cap to boot).

Citi Lazada Credit Card Citi Lazada Credit Card |

HSBC Revolution HSBC Revolution |

|

| Lazada | 4.8 mpd until 29 Feb 20, 4 mpd after (excludes RedMart) |

2 mpd (includes RedMart) |

| Netflix/Spotify | 2 mpd | 2 mpd |

| Grab/gojek | 2 mpd | 2 mpd |

| Online movie tickets | 2 mpd | 2 mpd |

| Travel | 2 mpd | 2 mpd (for online airfare and hotel payments) |

| Dining | 2 mpd | 2 mpd |

| Cap | S$833 on Lazada OR S$2,000 on dining/ entertainment/ travel/ commute | No cap |

Simply put, in almost every scenario I can think of, there are better cards to use than the Citi Lazada credit card. Offline travel spending? Use the OCBC 90N, if it’s in foreign currency. Public transport? Use the DBS Altitude. Local hotel spending? Use the UOB Lady’s Card. The only thing the Citi Lazada card excels in is Lazada spending, but even that’s just temporary- after 29 Feb 2020, it’s the same as other online spending cards.

The fact that Citi don’t pool points further weakens the case for the Citi Lazada card. If they did, you might just get it for the incremental 0.8 mpd on Lazada spend. But since points don’t pool, getting the Citi Lazada card means not just committing to paying an additional transfer fee, but earning at least 25,000 points (the minimum block for conversion). That’s a tall order, given the inferior earn rates on other categories.

I see the Citi Lazada card as a stripped-down Citi Rewards card. Sure, they’ve added bonuses for travel and offline dining, but the 5X rate and cap means the use cases are extremely limited.

Sign up gift of S$150 Lazada vouchers with S$1.2K spending

The Citi Lazada credit card offers a sign up bonus in the form of Lazada vouchers.

If you’re a new-to-bank Citi cardholder, you’ll receive 3 x S$50 Lazada vouchers when you spend S$1,200 in the first 3 months of approval. Citi defines new-to-bank as a someone who does not hold any principal Citi credit cards currently or in the past 12 months prior to application.

| Technically, the qualifying spend period includes the rest of the month of approval plus three additional months, so if you’re approved on 12 Dec 2019 you’ll have until 31 Mar 2020 to hit the spending |

For comparison’s sake, here’s how this compares to the rest of Citi’s ongoing sign up offers:

| Spend | Reward* | Rebate | |

Citi Lazada Credit Card Citi Lazada Credit Card |

S$1.2K | 3 x S$50 Lazada vouchers | 12.5% |

Citi Cash Back Card Citi Cash Back Card |

S$1.2K | S$120 cash | 10% |

Citi Rewards Visa Citi Rewards Visa |

S$3K | 27,000 points (~S$200) | 6.7% |

Citi PremierMiles Visa Citi PremierMiles Visa($192.60 annual fee must be paid) |

S$9K | 16,500 miles (~S$300) | 3.3% |

*Valuation of miles based on ~1.8 cents each

The rebate percentage column needs to be taken with a pinch of salt, as we’re mixing all sorts of rewards here. Only the Citi Cash Back card’s rebate is a “true” rebate, as it’s given in cash. The rest all depends on how much you value that particular reward- if you hardly shop on Lazada, you may not value S$150 of vouchers at S$150, just like if you hardly fly, you may not value miles at the 1.8 cents valuation I’ve used here.

Keep in mind that a maximum of one voucher can be used per check out, so you can’t spend all S$150 at once- in fact, it’s more likely than not that you’ll need to top up a little out of pocket. These vouchers have a six month validity, and will be awarded two months after you hit the qualifying spend. Any difference in value must be paid with the Citi Lazada card. Oh, and you can’t use it for digital goods, gold/jewelry and toddler formula.

The Citi Lazada credit card is not yet available on SingSaver, but I expect it to be added shortly with the usual gift of S$200 cash for new-to-bank customers that stacks with whatever Citi is giving.

One year complimentary LiveUp membership and shipping rebates on Lazada

Remember July’s great LiveUp nerf, where Lazada absolutely torpedoed the program? Membership prices were raised by 20%, rebates were cut, and free shipping was removed from everything except RedMart. Since then, I’ve not seen the benefits of LiveUp as worth the cost of entry.

| Until 1 July 2019 | From 1 July 2019 | |

| Subscription Cost | S$49.90 for 12 months 60-day free trial |

S$59.90 for 12 months S$5.99 for 30 days No more free trial |

| Grab | 3 x S$3 off every 3 non-promo Grab rides per month | 3 x S$3 off every 3 non-promo Grab rides per month |

| Netflix | 2 month free subscription | 2 month free subscription |

| Lazada/ Redmart/ Taobao | 5% rebate for Lazada and RedMart, capped at S$30 per month | 4% rebate for LazMall and RedMart, capped at S$50/month |

| Free delivery for Lazada, RedMart and Taobao Collection | No more free delivery except for RedMart (>$40) | |

| Foodpanda | 8 x free delivery for orders >S$20 per month | 8 x free delivery for orders >S$20 per month |

| Chope | 15 x 200 bonus Chope$ per reservation, per year | 15 x 100 bonus Chope$ per reservation, per year |

Well if you’re like me and cancelled your subscription in an angry millennial temper tantrum, the good news is that all Citi Lazada cardholders (new-to-bank and existing) will receive a free LiveUp membership for one year. Subsequently, they’ll have to pay the regular S$59.90 annual subscription fee.

You’ll receive a promo code to activate your LiveUp membership within 2 months of approval. This benefit applies even if you’re an existing LiveUp member; what’ll happen in that case is your existing membership will be extended by a year. Since the first year’s fee on this card is waived, it really is a hack to get a free LiveUp membership. I mean, I don’t like what Lazada did to LiveUp, but if it’s free, I’ll take it.

Citi Lazada cardholders will enjoy a shipping rebate with a minimum spend of S$50 per transaction at Lazada, capped at four rebates per month. The shipping rebate is in the form of a S$1.99 cashback, and is credited within 2 months after the transaction has been posted. I don’t shop enough on Lazada to know whether S$1.99 is adequate for shipping, but I can’t imagine it’s enough to cover registered post or overseas delivery.

Conclusion

In general, I get very annoyed when companies try to position a product as “millennial-friendly”, or make sweeping statements about millennials that treat us all as one amorphous blob.

Oh, our data says that millennials love to shop online! Let’s create a card with underwhelming benefits but brand the heck out of it with flashy marketing. They’ll sign up for it because #hashtags!

Speaking of hashtags, it’s kind of amusingly meta that the Citi Lazada credit card uses #playitup. Because that’s exactly what’s happening here- they’re playing up the card, but it’s really no better than the other offerings on the market. In fact, when it comes to pure points earning, it actually performs worse.

So get a Citi Lazada card if you want a free year of LiveUp membership, but otherwise stick to your other cards for the optimal miles earning strategy. And when the first year’s over, don’t feel bad about switching out to something else.

After all, we millennials are a fickle bunch.

Do we even have good non-airline co-branded credit cards in Singapore? I can think of maybe 1 or 2 good cash back ones, but no good miles cards off the top of my head.

saved me – i thought the 12x applied to redmart and was going to apply today. thanks!

But even if it did offer it on redmart, remember you’d have to earn at least 25k points on just that one card because Citi points don’t pool. Then, since it doesn’t make sense to cash out just one block, you’d be committed to putting even more spending on it in the only category it makes sense: lazada. It’s a bit of a trap, in my opinion