The American Express KrisFlyer cobrand credit cards may not have the highest miles earning rates on the market, but they do have some of the best sign-up bonuses.

The last round of bonuses lapsed on 30 April, and AMEX has announced a new set valid for approvals between 1 May and 30 June 2020.

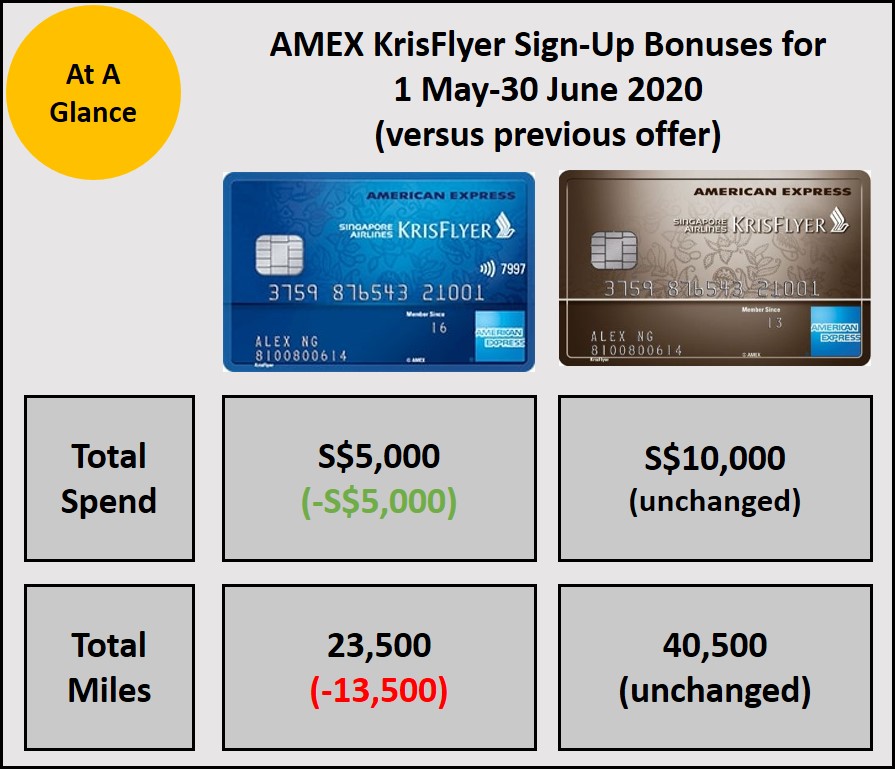

tl;dr: The sign up bonus on the AMEX KrisFlyer Ascend remains the same, but the AMEX KrisFlyer Credit Card has removed the 8,000 bonus miles for spending S$5,000 in months 4-6. AMEX has also removed the 1,500 bonus miles it was previously offering for each of the first two approved supplementary cards.

Read on for the full details.

AMEX KrisFlyer Credit Card

| Old Offer | New Offer | |||

| Spend | Miles | Spend | Miles | |

| First Spend | Any | 5K | Any | 5K |

| MGM^ | S$1K | 5K | S$1K | 5K |

| Months 1-3 | S$5K | 8K | S$5K | 8K |

| Months 4-6 | S$5K | 8K | – | – |

| Base Miles | 11 K (S$10K @ 1.1 mpd) |

5.5K (S$5K @ 1.1 mpd) |

||

| Total Spend | S$10K | S$5K | ||

| Total Miles | 37K | 23.5K | ||

| 💡 ^MGM refers to the AMEX member-get-member program. You’ll be eligible for this bonus if you apply through any of the links in this post. |

Apply for the KrisFlyer Credit Card and get 5K bonus miles

Under the old sign-up offer, AMEX KrisFlyer Credit Card holders who spent S$10,000 in the first 6 months received a total of 37,000 miles.

With the new offer, cardholders who spend S$5,000 in the first 3 months get 23,500 miles. The difference of 13,500 miles arises because the 8,000 bonus miles (and 5,500 base miles) for spending a further S$5,000 in months 4-6 has been removed.

Cardholders also used to receive 1,500 bonus miles for each of the first 2 approved supplementary cards. This has been discontinued.

The complete T&C for this offer can be found here. Bonus miles will be credited approximately 8-10 weeks from the date you reach the spending threshold.

| ⚠️ AMEX has updated the landing page, but not the T&Cs file. T&Cs still reference the old offer. I’ll remove this notice when the file is updated |

AMEX KrisFlyer Ascend

| Old Offer | New Offer | |||

| Spend | Miles | Spend | Miles | |

| First Spend | Any | 5K | Any | 5K |

| MGM^ | S$1K | 7.5K | S$1K | 7.5K |

| Months 1-3 | S$10K | 16K | S$10K | 16K |

| Base Miles | 12K (S$10K @ 1.2 mpd) |

12K (S$10K @ 1.2 mpd) |

||

| Total Spend | S$10K | S$10K | ||

| Total Miles | 40.5K | 40.5K | ||

| 💡 ^MGM refers to the AMEX member-get-member program. You’ll be eligible for this bonus if you apply through any of the links in this post. |

Apply for the KrisFlyer Ascend Card and get a bonus 7.5K miles

There’s absolutely no change to the KrisFlyer Ascend’s sign-up offer. Cardholders who spend S$10,000 in the first 3 months of membership continue to receive a total of 40,500 miles.

However, just like the KrisFlyer Credit Card, AMEX has removed the 1,500 bonus miles for getting two supplementary cards.

The complete T&C for this offer can be found here. Bonus miles will be credited approximately 8-10 weeks from the date you reach the spending threshold.

| ⚠️ AMEX has updated the landing page, but not the T&Cs file. T&Cs still reference the old offer. I’ll remove this notice when the file is updated |

Which transactions are eligible?

As per AMEX’s master list of exclusions, the following transactions will not count towards your sign-up bonus spending.

| a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date; b) Cash Advance and other cash services; c) Express Cash; d) American Express Travellers Cheque purchases; e) Charges for dishonoured cheques; f) Finance charges – including Line of Credit charges and Credit Card interest charges; g) Late Payment and collection charges; h) Tax refunds from overseas purchases; i) Balance Transfers; j) Instalment plans; k) Annual Card fees; l) Amount billed for purchase of KrisFlyer miles to top-up your miles balance; m) Purchase and top-up charges for EZ-Link Cards using American Express Cards; n) Bill payments and all transactions via SingPost SAM kiosks and mobile app (with effect from 1 March 2020); o) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channels) (with effect from 1 March 2020); p) Payments to Singapore Petroleum Company Limited (SPC) service stations (with effect from 1 March 2020); q) Payments for the purpose of GrabPay top-ups (with effect from 1 March 2020); r) Charges at merchants or establishments that are excluded by American Express at its sole discretion and notified by American Express to you from time to time. |

Do note in particular the exclusions for insurance, SPC and GrabPay transactions, which took effect from 1 March 2020. However, charity, hospital, education and utilities payments continue to earn miles, assuming AMEX cards are accepted.

How does this compare to other sign-up bonuses?

As I mentioned at the start of this post, the sign-up bonuses on AMEX cards are some of the best in Singapore. In the table above, I’ve plotted the spending and total miles payoffs for each card, and sorted it by payoff ratio (total miles divided by total spending).

The AMEX KrisFlyer Credit Card’s payoff ratio is the second highest, delivering 4.7 miles for every S$1 spent. The AMEX KrisFlyer Ascend delivers 4.5 miles for every S$1 spent, although you also need to factor in the non-waivable annual fee.

Key Features: AMEX KrisFlyer cards

KrisFlyer Credit Card KrisFlyer Credit Card |

KrisFlyer Ascend KrisFlyer Ascend |

|

| Income Req. | S$30K | S$50K |

| Annual Fee | S$176.55 (first year free) |

S$337.05 |

| Local Spend | 1.1 mpd | 1.2 mpd |

| Overseas Spend | 2.0 mpd (Jun & Dec) |

2.0 mpd (Jun & Dec) |

| Specialized Spend | -2.0 mpd on SIA/Silkair -3.1 mpd on Grab (S$200/ month) |

-2.0 mpd on SIA/Silkair -3.2 mpd on Grab (S$200/ month) |

| Transfer Fees | None | None |

The AMEX KrisFlyer Credit Card is AMEX’s entry level offering, and doesn’t have any frills to speak of apart from its first year fee waiver.

The AMEX KrisFlyer Ascend, on the other hand, comes with four complimentary lounge passes, Hilton Silver status (great if you’re planning to buy points as you get the 5th night free on redemptions), a complimentary night at selected Hilton properties, and a fast track to KrisFlyer Elite Gold. To enjoy these benefits, you’ll need to pay the S$337.05 annual fee.

Conclusion

The new sign-up bonus on the KrisFlyer Credit Card represents a devaluation from the previous one, insofar as you no longer have the option of earning a further 8,000 bonus miles from spending S$5,000 more.

However, the value proposition for the KrisFlyer Ascend remains unchanged.

For a full list of all the sign up bonuses currently on the market, refer to our guide here.

Unless someone can refer you to a much better deal, like this one

(Aaron… if you feel it’s inappropriate to share referral link on your site, please remove this post.)

it’s basically the same offer. the difference being the one you linked to hasn’t been updated to reflect the removal of month 4-6 bonus.

Not really. The link I got was from someone who got the card in recent months. Think the bonus applies even if Amex chooses to amend their signup bonus starting this month.

Essentially it offers 5,000 miles on first spend + 5,000 miles for spending only $1,000 within 3 months. Add the 3,000 miles for supplementary cards and 1,100 BAU miles for the $1,000 spend, this works out to be 14,100 miles for spending only $1,000. Effectively, 14.1 MPD right? Or am I looking at it all wrong?

Same as the offer in this post, but no more 3k for supp cards regardless of how you apply. 5k miles for 1k spending applies to the offer in this post too- so you’ll end up with 11.1k miles for spending 1k

I used to hold the KrisFlyer Amex credit card. How much time should elapse before it is considered a new sign up?

Six months

Thanks!

you will not be eligible to the welcome as long as you had a SIA cobrand card before with Amex. T&C page 5 “The Welcome Bonus of 5,000 KrisFlyer miles offer (“Welcome Bonus”) is applicable only to first time applicants of any co-branded American Express Singapore Airlines Credit Card. Card Members who have existing or cancelled co-branded American Express Singapore Airlines Credit Cards (including but not limited to the American Express Singapore Airlines Solitaire PPS Credit Card, American Express Singapore Airlines PPS Club Credit Card or American Express Singapore Airlines KrisFlyer Ascend Credit Card) are not eligible for the Welcome… Read more »

Hi Aaron,

I am already a AMEX KF card holder; can I get the MGM bonus if I apply to the AMEX Ascend card through your link ?

Thanks !

yup, your existing KFCC will also be cancelled.

but you will not be eligible for the welcome bonus right? I was looking at T&C page 5

“The Welcome Bonus of 5,000 KrisFlyer miles offer (“Welcome Bonus”) is applicable only to first time

applicants of any co-branded American Express Singapore Airlines Credit Card.

Card Members who have existing or cancelled co-branded American Express Singapore Airlines Credit

Cards (including but not limited to the American Express Singapore Airlines Solitaire PPS Credit Card,

American Express Singapore Airlines PPS Club Credit Card or American Express Singapore Airlines

KrisFlyer Ascend Credit Card) are not eligible for the Welcome Bonus.”

Hi Aaron. Am currently holding KFB which anni is coming soon. If I cancel my KFB and get Ascend via your MGM link, would I qualify for the mgm bonus this way? Thanks

Yes, that’s right.