| 👍 Update: CardUp has launched a special offer for Milelion readers: Pay income tax with just a 1.75% fee with the code ML175TAX20. Read the full details here |

Income tax season is now underway, and if you’re looking to earn miles from your tax payments, CardUp has a promotion lined up for you.

New CardUp customers: 1.89%

CardUp is offering new customers (and existing users who have yet to make their first payment) a special rate of 1.89% on income tax payments with the promo code MLTAX20.

This code is valid with all Singapore-issued Mastercard and Visa cards, excluding Citi and Standard Chartered Bank cards.

Payments must be scheduled by 23 June 2020, with due date latest by 26 June 2020. The full T&C for this code can be found here.

Existing CardUp customers: 1.99%

Existing CardUp customers will enjoy a special rate of 1.99% on income tax payments with the promo code ML199TAX20.

This code is valid with all Singapore-issued Visa and Mastercard cards, excluding Citi and Standard Chartered Bank cards.

Payments must be scheduled by 23 June 2020, with due date latest by 26 June 2020. The full T&C for this code can be found here.

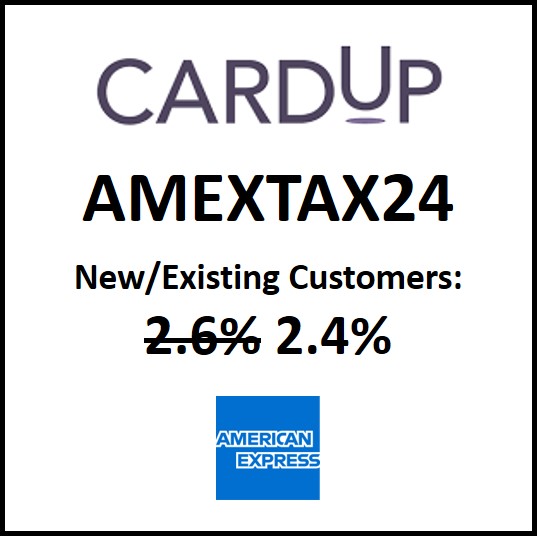

AMEX users: 2.4%

CardUp customers (regardless of new or existing) who wish to use American Express cards can enjoy a discounted fee of 2.4% with the promo code AMEXTAX24.

Payments must be scheduled by 23 July 2020, with due date latest by 28 July 2020. The full T&C for this code can be found here.

What’s the cost per mile?

With the discounted admin fee, here’s how much buying miles will cost with the following credit cards, in terms of cents per mile (CPM).

| Card | MPD | CPM @ 1.89% |

CPM @ 1.99% |

DBS Insignia DBS Insignia |

1.6 | 1.16 |

1.22 |

UOB Reserve UOB Reserve |

1.6 | 1.16 |

1.22 |

OCBC Premier & PB VOYAGE OCBC Premier & PB VOYAGE |

1.6 | 1.16 |

1.22 |

AMEX Centurion AMEX Centurion |

1.951 | 1.20 (@ 2.4% admin fee) |

|

BOC Elite Miles BOC Elite Miles |

1.5 | 1.24 |

1.30 |

| 1.4 | 1.32 |

1.39 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.32 |

1.39 |

AMEX Platinum Charge AMEX Platinum Charge |

1.561 | 1.50 (@ 2.4% admin fee) |

|

HSBC Visa Infinite* HSBC Visa Infinite* |

1.252 |

1.48 |

1.56 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.55 |

1.63 |

OCBC 90N OCBC 90N |

1.2 | 1.55 |

1.63 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.55 |

1.63 |

OCBC VOYAGE OCBC VOYAGE |

1.2 | 1.55 |

1.63 |

| 1. Promotional earn rate until 20 July 2020 2. With minimum S$50K spend in previous membership year, otherwise 1.0 mpd |

|||

| A running list of all the cards which earn points with CardUp can be found here. Broadly speaking, any general spending card will earn points with CardUp. There are no 10X opportunities, however, so don’t use cards like the Citi Rewards or DBS Woman’s World Card. |

Citi and Standard Chartered Bank cardholders can use the code GET225 to enjoy a 2.25% admin fee on tax payments, but they’d be better off sticking to PayAll and EasyBill (or the SCB Visa Infinite tax payment facility) respectively. The same goes for HSBC Visa Infinite cardholders, who can buy miles from 1.2 cents each via their bank’s tax payment facility.

How do I use the code?

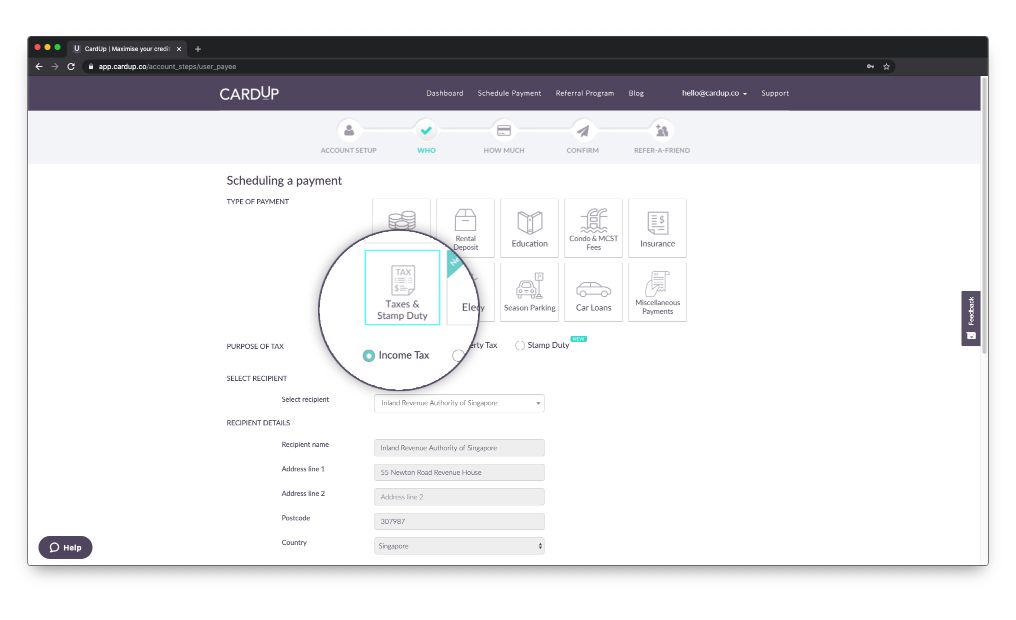

After you’ve logged in to your CardUp account, click the “Schedule Payment” button and select “Taxes & Stamp Duty”). Select “Income Tax”, acknowledge the terms and conditions and click “Next”.

Enter the amount you wish to pay (this should match the amount reflected on your NOA)…

Enter the amount you wish to pay (this should match the amount reflected on your NOA)… …and the date on which you wish to make payment.

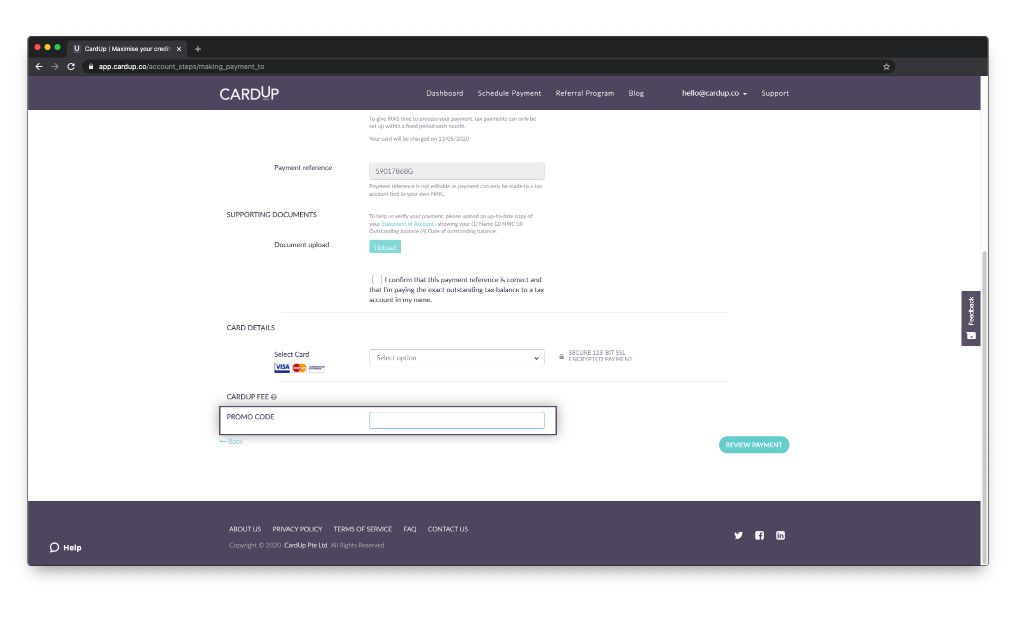

…and the date on which you wish to make payment.  Here’s also where you upload your NOA and enter the relevant promo code.

Here’s also where you upload your NOA and enter the relevant promo code. Ensure the 1.89/1.99% fee reflects on the final screen, then submit your payment for approval.

Ensure the 1.89/1.99% fee reflects on the final screen, then submit your payment for approval.

Other things to note

This promo code can be used a maximum of once per user. In any case, you can only use CardUp to pay off your entire tax due amount, as IRAS doesn’t allow for installment payments via CardUp.

Also note that unlike the tax payment facilities offered by banks where funds are transferred to your account and you make the payment, CardUp makes payment directly to IRAS on your behalf.

CardUp transactions generally count towards sign-up bonus spending for most credit cards, but you’ll want to double check your T&Cs for specific exclusions. For example, the SCB X Card’s 100,000 miles sign-up bonus (since expired) excluded CardUp transactions.

| ❓ If you have doubts about whether CardUp spending will count towards any specific promotion, drop the team a line at hello@cardup.co, and they’ll reach out to check with the bank directly |

Conclusion

A 1.89/1.99% fee represents a great opportunity to pick up miles while paying your income taxes, so be sure to schedule your payments before 23 June 2020.

For more information on earning miles on income tax, be sure to have a read of The Milelion’s full guide here.

Aaron – I am interested to hear your thoughts about collecting air miles when the whole air travel environment in the next year is so uncertain. Business Class may not be what it used to be with a reduced in-flight service and compulsory mask-wearing for passengers. Airlines may significantly increase miles for awards to compensate for carrying fewer passengers due to need for safe distancing. Is now the time to (ahem) switch to cashback?

i wouldn’t switch to cashback, but i’d rethink the price at which i’m willing to buy miles. in the past i’d be happy to settle around 1.8 cents, at the moment i’m closer to 1.5 cent mark. of course that’s highly personal, but i’m waiting to see what the landscape looks like when the dust settles first.

Bit disappointing tbh – how is this different from the CardUp promo sent out by email this evening? Identical rates right?

yup- for existing customers it’s the same offer as last year of 1.99%, for new customers they’ve gone 0.1% lower to 1.89%

Hi, I would like to clarify the difference between cardup vs bank credit card payment.

For cardup, the total income tax would be charged to a credit card and this would mean upfront payment for the entire income tax.

For bank payment, the entire income tax is credited to your bank account and you can choose to pay iras in 12 month giro installment?

This is a like having a low interest loan from the bank? And can be repeated with multiple banks?? Sorry I have to spell it out so clearly… But did I get it right?

Yes, that’s more or less correct.

But remember, you have to pay the bank back the next month when your credit card statement is due