HSBC has announced an update to their credit cards rewards T&Cs which takes effect from 1 July 2020.

To summarise, there’s a whole swathe of new exclusion categories, such as insurance, education, utilities, plus CardUp & ipaymy (and probably RentHero, as per the team). It also means the impending irrelevance of the HSBC Revolution, as I’ll explain below.

HSBC’s new rewards exclusion categories

As it stands, HSBC’s current rewards exclusions list is surprisingly short:

| 4. “Excluded Transactions” shall mean fund transfers, balance transfers, cash advances, finance charges, late charges, any other fees and charges pursuant to HSBC’s credit card cardholder’s agreement, charges to a Card under HSBC’s Cash Instalment Plan, any expenditure incurred as part of a Points plus cash redemption under the Programme, any expenditure relating to a corporate or business transaction (as determined by HSBC in its sole discretion), transactions relating to the trading of securities of any kind including but not limited to any top up of any cash amount required by a financial institution, transactions relating to any stored value card including but not limited to EZLink and Transitlink facilities, transactions (whether or not performed online) relating to any payment or money transfer facilities, any unposted, cancelled, disputed and refunded transactions and such other categories of transactions which HSBC may exclude from time to time without notice or giving reasons. |

From 1 July 2020, HSBC’s updated rewards exclusion list will read as follows:

|

The main additions to take note of are CardUp/ipaymy payments, insurance, educational institutions, and utilities. I’m quite surprised that charities and government agencies were’t explicitly excluded before, but in any case I don’t know anyone who’s tried it.

Here are the alternative cards that you can use.

CardUp/ipaymy

The vast majority of general spending cards will continue to award points for these transactions, so it’s business as usual for now.

I am worried, however, that there’s a slow but steady trend to exclude these transactions, which would more or less spell the death of these companies. In recent memory, the SCB X Card and UOB PRVI Miles have excluded such spending from counting towards sign up bonuses (although they still award regular points), and Bank of China will exclude them altogether from 15 June.

It’s a good bet that if CardUp/ipaymy are excluded, RentHero can’t be far behind. I’m in the process of checking with the RentHero team whether they’re affected, and will update this post in due course.

| Update: The RentHero team has informed me that they will also be excluded from earning points under the new T&Cs |

Insurance

This was already a very marginal category, with very few options to begin with. Your best bet is to use the GrabPay Mastercard, topped up with the Citi Rewards Visa (not Mastercard) for 4 mpd.

Education

Hopefully your institution accepts AMEX, because the ground here is disappearing very fast. UOB stopped awarding points in September last year, SCB stopped on 2 May, while Bank of China will stop on 15 June.

I don’t see anything in the Maybank T&Cs excluding education payments, but in the absence of data points I can’t confirm whether the Maybank Visa Infinite, World Mastercard or Horizon Visa Signature would work.

Utilities

I’m not to worried about this one yet, because you still have a healthy selection of cards to choose from. In particular, the UOB PRVI Miles Mastercard and UOB PRVI Miles Visa are awarding up to 3 mpd on these payments, subject to registration and achieving a minimum spend.

This basically nerfs the HSBC Revolution

The HSBC Revolution earns 2 mpd on online purchases, local dining and entertainment. That’s a relatively low rate, as you could easily earn 4 mpd online and on dining with the right credit cards.

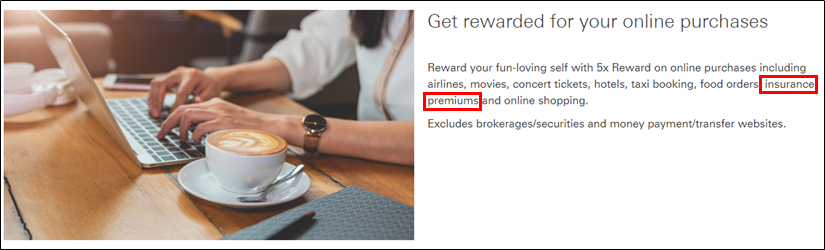

However, many miles chasers still kept it around because it offered the most miles on education, utilities and insurance payments. While other banks go out of their way to exclude these, HSBC even explicitly stated “insurance premiums” as a bonus category on their website.

With the new exclusions, there’s very little reason to keep the HSBC Revolution. You’d be better off getting a DBS Woman’s World Card or Citi Rewards for online spending, and a UOB Lady’s Card or Preferred Platinum Visa (where contactless payments are accepted) for dining.

Conclusion

This is bad news for anyone hoping to pay insurance or education bills without incurring an additional fee, but with the discounted MDRs these merchants pay, banks have found it no longer profitable to dish out the points.

I’ve updated The Milelion’s credit card guide to reflect these latest changes.

I have a feeling that Singapore credit card market is killing themselves, it becomes more and more tasteless

Does this means no points even for the first $200 top up for ez-link?

I sent a secured message to HSBC via online banking, and received the confirmation that Ez Reload won’t earn 5x as well.

RIP HSBC Revolution. Even for uncapped miles on dining and online spending, UOB Krisflyer Card has cornered that market too, assuming you are OK with the delayed miles.

Orphan points!

Time to cancel my HSBC revo..goddamnit!!!

A bit off topic, but does anyone know if there’s a card that credits miles for government related payments? Ie. online payment to ministry of health or manpower?

Now HSBC revolution excludes the insurance premiums with the 10X Reward Points Programme