Here’s some good news if you’re paying rent with CardUp.

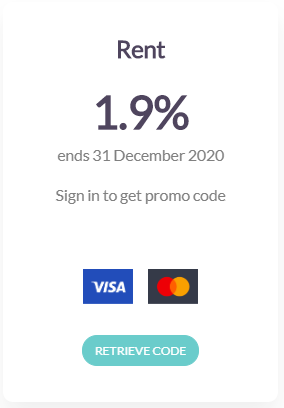

CardUp has extended their 1.9% promotion on rental payments until 31 December 2020. This offer applies to all Singapore-issued Mastercard and Visa cards.

How does CardUp’s discounted rental fee work?

To use the offer, enter the promo code SAVERENT19 during the payment setup process. This is valid for one rental payment a month, set up on or before 31 December 2020 with a due date on or before 5 January 2021.

The full T&C of this promotion can be found here.

If this is your first payment with CardUp, you can get S$20 off the admin fee for your first payment of S$1,000 or more with the promo code MILELION. You can subsequently schedule the rest of your payments with the SAVERENT19 code as well.

| 🏠 Do note that RentHero is offering a 1.75% promotion on rental payments too. However, you can only earn points on RentHero with DBS, Maybank and HSBC (until 1 July) cards |

How much do miles cost with this promotion?

Here’s what a 1.9% fee means for your cost per mile with various credit cards. For more information on whether this is “worth it”, have a read of my guide to valuing miles.

| Card | MPD | CPM @ 1.9% |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.17 |

DBS Insignia DBS Insignia |

1.6 | 1.17 |

UOB Reserve UOB Reserve |

1.6 | 1.17 |

OCBC Premier OCBC Premier & PB VOYAGE |

1.6 | 1.17 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.33 |

| 1.4 | 1.33 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.33 |

Citi Prestige Citi Prestige |

1.3 | 1.43 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.43 |

HSBC Visa Infinite HSBC Visa Infinite |

1.252 |

1.49 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.55 |

SCB X Card SCB X Card |

1.2 | 1.55 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.55 |

OCBC 90N OCBC 90N |

1.2 | 1.55 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.55 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.86 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd 2. With minimum S$50K spend in previous membership year, otherwise 1.0 mpd. CardUp payments will be excluded from 1 July |

||

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

Rental payments continue to be a source of cheap miles in Singapore thanks to these extended promos.

If you’re in the market to buy miles and happen to rent a place, this is an option worth considering.

it’s a shame that so many banks exclude renthero now. hope the same doesnt happen to cardup