Well well.

When HSBC revised its T&Cs to exclude education, insurance, and utilities payments, I remarked that this was the death of the HSBC Revolution. After all, the card’s 2 mpd online bonus rate was only useful for these categories, and with those gone, why keep it?

I’m pleased to see that HSBC has proven me wrong. From 1 August, the HSBC Revolution will receive a major upgrade, allowing cardholders to earn 4 mpd on online spending and contactless payments.

The upgraded HSBC Revolution card

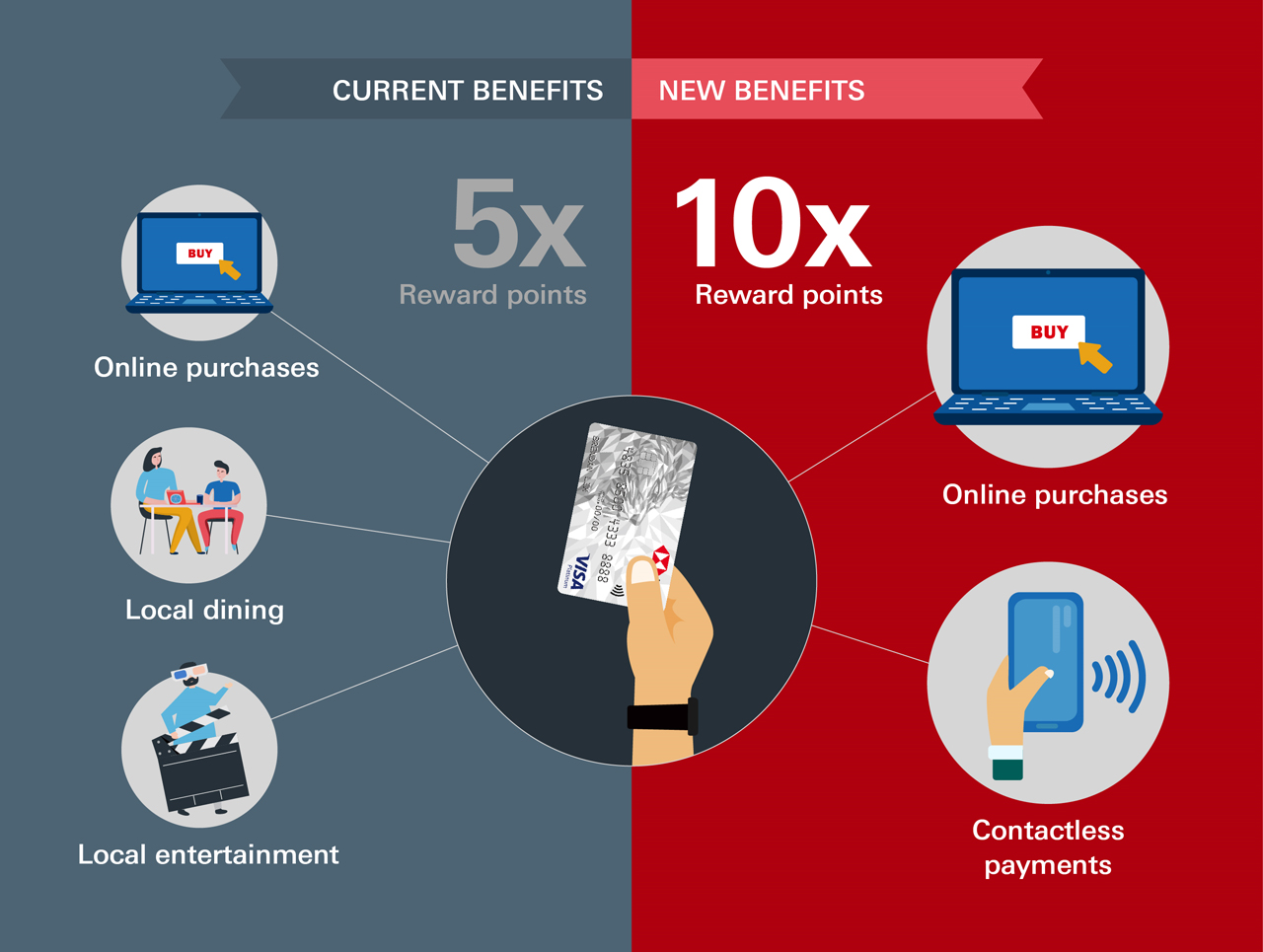

From 1 August 2020, the HSBC Revolution will change as follows:

| Until 31 July | From 1 August | |

| Annual Fee | S$160.50 | None |

| Online Purchases | 2 mpd | 4 mpd |

| Contactless Payments | 0.4 mpd | 4 mpd |

| Local Dining | 2 mpd | 0.4 mpd (physical card) 4 mpd (contactless) |

| Local Entertainment | 2 mpd | 0.4 mpd |

HSBC will scrap the S$160.50 annual fee for the Revolution card, and switch up the bonus categories.

Gone is the bonus for local dining and entertainment, which is no big loss given that you could do much better with other cards anyway. In its place comes a 4 mpd bonus for online purchases and contactless payments, capped at S$1,000 per calendar month.

The 4 mpd will be awarded in the form of 10X HSBC rewards points, split into:

- 1X base points for every S$1 of eligible transactions

- 9X bonus points for every S$1 of eligible transactions

Bonus points will be credited by the end of the following calendar month from the date of transaction.

The new T&C can be found here.

4 mpd for contactless payments & online spending

HSBC defines contactless payments as those made via Visa contactless through a

contactless terminal mode which includes Visa payWave and Apple Pay.

In case you’re wondering why Google Pay isn’t listed, that’s because HSBC cards are not supported on Google Pay, believe it or not. Ditto for Fitbit Pay and Samsung Pay, sadly, but it just means you’ll have to bring the physical card around.

| Eligible? | |

|

|

✔ |

| ✗ | |

| ✗ | |

| ✗ | |

| ✔ |

Online transactions will cover both internet and app-based transactions.

Do note that HSBC is not awarding a blanket 4 mpd on all contactless and online transactions. Instead, they’re adopting a “whitelist” approach, defining eligible transactions as follows:

| Category | MCCs |

| Travel related such as Airlines, Car Rental, Lodging, Cruise Lines and Travel Agencies |

3000 to 3350, 3351 to 3500, 3501 to 3999, 4411, 4511, 4722 |

| Department Stores and Retail Stores | 4816, 5045, 5262, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5691, 5699, 5732 to 5735, 5912, 5942, 5944 to 5949, 5964 to 5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5411, 5441, 5462, 5499, 5811, 5812, 5813, 5814 |

| Others such as Transportation and Membership Clubs |

4121, 7997 |

This should still cover all the basics, such as:

- airline and hotel bookings

- e-commerce shopping at Amazon, Lazada, Qoo10, Shopee, Taobao

- food delivery with Deliveroo, foodpanda, GrabFood

- ridesharing apps like Grab, gojek

- taxi transactions

GrabPay wallet top ups will not earn bonus points, based on HSBC’s rewards exclusion categories.

How does this compare to the UOB Preferred Platinum Visa?

These new perks make the HSBC Revolution a direct competitor with the UOB Preferred Platinum Visa. However, it has two key advantages:

- The UOB Preferred Platinum Visa awards points in S$5 blocks (anything less than S$5 earns 0 points), while the HSBC Revolution awards points per S$1

- The UOB Preferred Platinum Visa does not earn miles at SMART$ merchants like Cold Storage and Giant. There’s no such restriction for the HSBC Revolution

On the flip side:

- UOB has a bigger cards ecosystem and pools points, so there’s less of a risk of orphan balances. HSBC does not pool points among its cards

- The UOB Preferred Platinum Visa adopts a “blacklist” approach, which means that all contactless transactions earn 4 mpd unless otherwise stated. HSBC only awards 4 mpd on certain MCC ranges

This means the UOB Preferred Platinum Visa still has an important role to play in your wallet- use it at the dentist’s office, or at the hair salon, or anywhere that isn’t on the HSBC Revolution’s whitelist.

What can I do with HSBC rewards points?

HSBC Rewards Points can be transferred to Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles, at a 5:2 ratio.

| Transfer Ratio (Points: Miles) |

|

|

5:2 |

| 5:2 |

HSBC charges a S$42.80 annual fee that covers unlimited points transfers, and points are valid for 37 months from date of accrual.

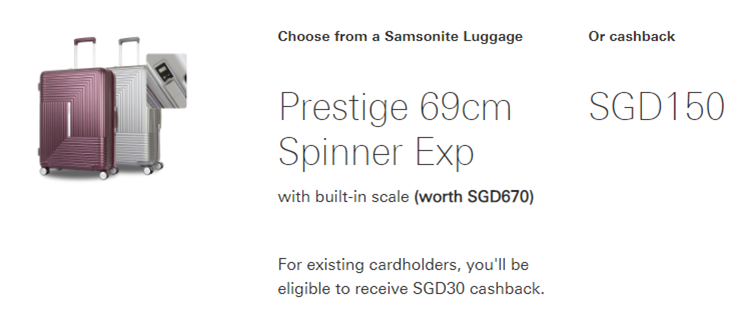

Welcome gift of luggage or cashback

From now till 31 August, new-to-bank customers can choose between a Samsonite Prestige 69cm luggage bag (worth S$670) or S$150 of cashback when they spend a minimum of S$800 during the qualifying period. Applicants will be prompted for their choice at the time of application.

The qualifying spending period depends on when your card was approved:

| Card Opening Date | Qualifying Spend Period |

| 1-30 June 2020 | 1 June- 31 July 2020 |

| 1- 31 July 2020 | 1 July- 31 August 2020 |

| 1-31 August 2020 | 1 August-30 September 2020 |

| 1-15 September | 1 September- 31 October 2020 |

Customers who apply via MyInfo will receive an additional S$30 of Grab codes.

This offer is available for customers who do not currently hold a principal HSBC credit card, and have not done so in the past 12 months. The full T&C can be viewed here.

Conclusion

I’m very pleased about this development, as it’s breathed new life into the HSBC Revolution. The free copy of The Entertainer and the removal of the annual fee only sweetens the deal.

I’ll be adding this card to my wallet and looking forward to 1 August.

🥳

So eating out still use UOB PPV right? anyway this is nice to have as it is zero annual fee now. regretted cancelling it the last time.

aaron you can also mention the sign up bonuses offered with the bank maybe?

added the details on the sign up gift

MCC for dining (generally) is in HSBC whitelist so no harm to use this for paywave at restaurants / food places

Aaron : in the initial table, you mentioned “Local Dining 2 mpd 0.4 mpd”.

However the MCC for restaurants is 5812, which is whitelisted (as u mentioned later in the article).

Hence, it would be a good idea to clarify the 0.4 in your first table does not apply where the payment is contactless at a restaurant – in such case, u would get 4mpd….

yup, will edit that.

Taping of physical card consider as contactless payment?

Yes, unlike PPV.

You mentioned UOB PPV still has an important role to play – “use it at the dentist’s office, or at the hair salon”, does these transactions also get 4mpd on PPV?

Separately, any idea if Favpay transactions linked to credit cards are counted as contactless – be it for Revolution, PPV or any other cards that awards additional points/rewards for contactless transactions?

They do but you must pay using mobile payment.

I will usually link grabpay card (topped up with CRV) to Fave pay to double dip.

This is such welcome news!! This development would lead to so much marital bliss!! Let me explain: I applied for UOB cards twice in the past 3 years, and was deemed not eligible for either the PRIVI Miles or the Preferred Platinum. This, despite being eligible for, and currently holding the Amex Platinum Charge and Citi Prestige. I also previously held the SC Visa Infinite and HSBC Visa Infinite cards. We have a Fairprice next door, and I would curse UOB everytime I shopped there and earned a meagre 1.2 mpd from Citi 😀 For 4mpd, I would try to… Read more »

Hi RTK

Just for a reference point, do you know why you were rejected by UOB? Do they have some sort of Rule like Chase 5/24 in US? Or perhaps it is related to type of income, maybe they prefer salary statements rather than NOA or business statements?

Thanks for the info in advance. Hope it’s not too intrusive to ask

Thanks data! I’m employed, decent income levels, good credit rating..

Oh well..

just to share: i find UOB very conservative (or unwillingness to deviate) with their risk assessment algorithm. my application to review credit limit was rejected few times. i checked the CBS report and realised i got a HX grade so i queried CBS about the record sent to UOB. while other banks also see that HX grade on the CBS report, it has no bearing on credit worthiness (i know this since DBS/Citi/OCBC already increased my limit/successful application). the CBS record basically states that it was a litigation that was concluded and anyone can tell it is not due to… Read more »

Hi RTK I hold cards from many banks include the Platinum Charge Card and SCB X-Card but when I applied for OCBC Titanium, and I got a letter saying I do not meet the criteria. I went to the Credit Bureau to get my free credit report and I was graded the highest level. I think there is something red flagged in OCBC Bank system against my name or NRIC. Anyway, I could not be bothered to visit and get it changed since there are plenty of alternatives in Singapore. For you, UOB probably has something marked against you recorded… Read more »

Wow… dunno how to react cos I just called to HSBC yesterday afternoon to cancel the card! I have not been using it for the past 1 year. I guess no love loss…

same. just lose out on the sign up gift i guess

does this mean we can top up grab pay with this card?

no

mentioned in the article: “GrabPay wallet top ups will not earn bonus points, based on HSBC’s rewards exclusion categories. “

So can i use this to top up my grab pay mastercard, and would HSBC give me 4mpd for that? Technically i can then use that to pay almost everything…

no

mentioned in the article: “GrabPay wallet top ups will not earn bonus points, based on HSBC’s rewards exclusion categories. “

whoops. simplygo is 4111, not 4121. have removed the line from the article

i see, ok means no 10x rewards for usage on public transport.

how about top-ups to ez-link cards via ez-reload or using their app? last time they got specify in their T&Cs, the new one don’t have.

Downside of UOB PPV vs HSBC is that UOB PPV now awards the bonus UNI$ only for mobile txns i.e. cannot tap the physical card. Some people find it easier to tap the physical card (which HSBC allows) esp in view of covid where people have to have the mask on all the time. Hard to get faceID to work and trobulesome to key in passcode. But the annual fee for transfer seems steep. How long are their points valid for?

Found my answer:

All Points awarded shall expire at the end of a 37 month period which shall commence from the month subsequent to the month in which such Points were awarded.

37 months validity is more generous than UOB UNI $ expiry of 2 years, so perhaps worth it to get this card since there is no AF + they award points for every $1 iso $5 blocks that UOB does. Hard to say how long this new T&C of 10x reward points will last for though.

in the grand scheme of things, transfer fees should be a rounding error. most people will do at most 1 transfer a year, maybe 2 if you spread your points across multiple cards.

Unfortuantely for DBS, I have do it yearly due to expiry of their DBS WW points on an annual basis. Most other banks have min 24mth expiry I believe.

Holding on to this card turns out to be a good thing lol

can i get 10X points by using paywave or applepay to pay fairprice grocery purchase or dining?

U didn’t read the article?

Sry….I am not native Singaporean. My english is not that good.

Just want to confirm with you guys.

Do you mean the “whitelist” in the article?

Please read the article before asking, else you are wasting the efforts of producing this article.

Yes, Supermarkets, Dining and Food Delivery are eligible categories

ic. thanks a lot

This is just like the Citi Rewards like a $1k cap. 4mpd is good but feels kinda nerfed still.

i guess if u breach your cap with UOB PPV or Citi Rewards, this is now a new avenue for you to clock 4mpd for that month, but yea also means more points lying around with different banks.

Does monthly GIRO payment to gym facilities like Fitness First considered online transaction? Previously it is considered online transaction, now it is not mentioned.

Hi Aaron,

Will you be updating your “What card do I use…?” page with this new addition of HSBC Revolution. Seems like it’s really going to be a very good card to have that covers so much of basic necessities (dining, gym etc)

the what card article is periodically updated as new cards come into the picture- will do the next update end of month

Hi Aaron, thanks for your insightful sharing as usual! Can I know if there is a cap on HSBC spending to qualify 4miles?

The revised T&Cs are a welcome change, but after combing through the whitelist MCCs, I noticed that there are some notable MCCs not included. E.g. in the travel category, the MCCs listed for lodging are for hotels/resorts/motels with their own MCC (i.e. major lodging merchants), which means other lodging using generic MCC 7011 does not earn 4mpd! 🙁 Not sure if this is a deliberate exclusion by HSBC but it didn’t make sense to me that 7011 is not included. I’d have to make sure that I book such lodging using a travel agency such as Booking.com in order to… Read more »

yes, good spot. i will drop hsbc an email about this and see what they say.

oh thanks! Pls update if hsbc replies. really would like to know their reasoning as it is curious that the generic airline MCC is included, but not the generic lodging MCC and generic car rental agency MCC.

they have added it already! see latest T&Cs

oh my! 🥳🥳 such a boon to ppl like me who don’t really stay at major hotel chains. there are times when I’d book directly with the lodging merchant on their website instead of using third-party sites like Booking.com.

The $1000 cap per month is per billing cycle or calendar month, i.e. 1st to 30/31st of the month?

calendar month

Thanks! Shall wait for September then!

Hi, Existing card holders got the chance for the Samsonite luggage?