Maybank has become the latest bank to launch a Pay with Points feature, called (with no small amount of irony) “Points Optimiser”– I suppose optimisation is a point of view, after all.

TREATS points can now be used to offset local or foreign currency purchases charged to your Maybank credit card.

How Maybank’s Points Optimiser feature works

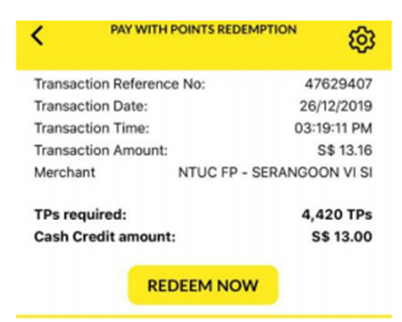

Maybank principal cardholders can use the Maybank TREATS SG app to redeem their TREATS points as cash rebates against outstanding amounts.

Cardholders must have a minimum of 1,700 TREATS points to use this feature, and the rate offered is 1,700 TREATS points= S$5.

For what it’s worth, Maybank’s TREATS catalogue has the option to redeem a S$50 cash credit for 17,000 TREATS points, so you’re no better or worse off by opting for Pay with Points over redeeming through the catalogue.

| TREATS Points: Miles | |

| 5,000: 2,000 | |

| 12,500: 5,000 | |

| 2,500: 1,000 |

1,700 points is worth 680 miles with Asia Miles, KrisFlyer or Enrich, so that’s like accepting a valuation of 0.74 cents per mile. Needless to say, it’s terrible value, and something that should only be a last resort.

To put it another way: suppose you’re using the Maybank Visa Infinite card, and earning 3 TREATS points per S$1 (1.2 mpd) on local spend and 5 TREATS points per S$1 (2 mpd) on foreign currency spending. If you choose to Pay with Points, you’re getting an effective rebate of 0.88% and 1.47% respectively. You might as well have used the Maybank FC Barcelona cashback card for a flat 1.6% rebate instead!

Maybank Pay with Points launch promotion

Maybank is currently offering up to 3,000 TREATS points (800 miles) to the first 4,000 customers who make a Pay with Points redemption:

- The first 1,000 cardmembers who received a targeted SMS/eDM will be eligible for 3,000 TREATS points when they make at least one Pay with Points redemption by 30 September 2020

- The first 3,000 cardmembers who did not receive an SMS/eDM will be eligible for 2,000 TREATS points when they make at least one Pay with Points redemption by 30 September 2020

Gifts will be issued within 30 days after the end of the promotion period. The T&C of this promotion can be found here.

How does this compare to other banks’ Pay with Points schemes?

As poor value as Maybank’s Pay with Points scheme is, it’s not the worst. BOC, Citibank, HSBC, OCBC, UOB all offer lower rates. I’ve done an extensive analysis of the various Pay with Points schemes in Singapore, so have a read of this post if you’re thinking of heading down that route.

| Value Per Mile | |

OCBC 90N/ OCBC 90N/OCBC VOYAGE |

1.0 cents |

SCB X Card SCB X Card |

1.0 cents |

AMEX Platinum Reserve/ AMEX Platinum Reserve/AMEX Platinum Credit Card |

0.86 cents |

SCB Visa Infinite SCB Visa Infinite |

0.78 cents |

AMEX Platinum Charge AMEX Platinum Charge |

0.77 cents |

DBS (all cards) DBS (all cards) |

0.42- 0.75 cents |

Maybank (all cards) Maybank (all cards) |

0.74 cents |

OCBC Titanium Rewards OCBC Titanium Rewards |

0.69 cents |

HSBC (all cards) HSBC (all cards) |

0.63 cents |

Citi PremierMiles Citi PremierMiles |

0.61 cents |

Citi Rewards Citi Rewards |

0.57 cents |

UOB PRVI Miles UOB PRVI Miles |

0.5- 0.57 cents |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

0.5 cents |

BOC Elite Miles BOC Elite Miles |

0.2-0.25 cents |

Conclusion

My feelings on Pay with Points programs are well documented, so I won’t go over them again, suffice to say that those who pay with points might as well have used a cashback card in the first place.

On a separate note, Maybank has teased a “bid with points” feature, which could be potentially interesting depending on what’s available. I’d very much like to see a bank launch a KrisFlyer Experiences or Marriott Bonvoy Moments equivalent, so I’ll be keeping tabs on this.