| 👉 For the latest version of this article, refer to this post |

Visiting an airport lounge may seem like a pipe dream right now (what I’d give to see the inside of the KrisFlyer Gold lounge again), but there’s no reason we can’t have our annual update on credit card lounge access.

Which credit cards grant lounge access?

Here’s a summary of which credit cards grant airport lounge access, which network they use, and how many free visits you’re entitled to.

| Card | Lounge Network | Free Visits (Per Year) |

|

| Principal | Supp. | ||

| Income Requirement S$30K | |||

Maybank Horizon Platinum Maybank Horizon Platinum |

Selected lounges in SIN, KUL, HKG | Spend S$1K in single trxn within 3 months to travel | |

Diners Club Cards Diners Club Cards |

Diners Network | 1* | N/A |

Citi PremierMiles Citi PremierMiles |

Priority Pass | 2* | N/A |

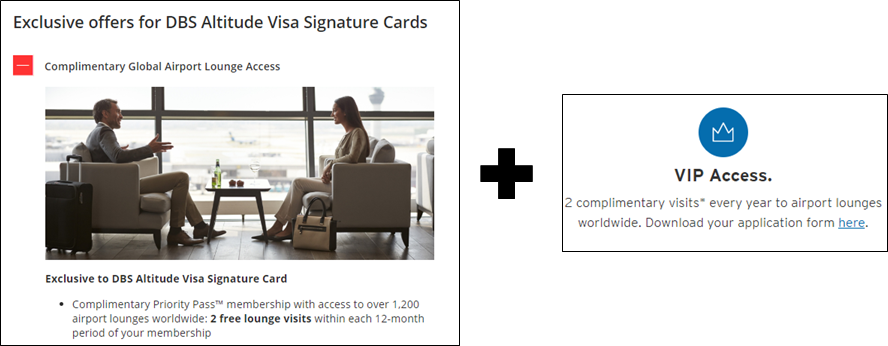

DBS Altitude Visa DBS Altitude Visa |

Priority Pass | 2 | N/A |

ICBC Global Travel Mastercard ICBC Global Travel Mastercard |

Dragon Pass | 6* | N/A |

| Income Requirement S$50-80K | |||

SCB X Card SCB X Card |

Priority Pass | 2 | N/A |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

Plaza Premium | 4 | N/A |

| Income Requirement ≥S$120K |

|||

BOC Visa Infinite BOC Visa Infinite |

Plaza Premium | 2 | N/A |

CIMB Visa Infinite CIMB Visa Infinite |

Dragon Pass | 3 | N/A |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Dragon Pass | 4 | N/A |

SCB Visa Infinite SCB Visa Infinite |

Priority Pass | 6 | N/A |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

LoungeKey | 6* | 6* |

OCBC VOYAGE OCBC VOYAGE |

Plaza Premium | ∞ | ∞ |

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | ∞ | N/A |

Citi Prestige Citi Prestige |

Priority Pass | ∞ + 1 guest | N/A |

AMEX Platinum Charge AMEX Platinum Charge |

Priority Pass, Plaza Premium, AMEX & Centurion Lounges, Delta SkyClubs | ∞ + 1-2 guests | ∞ + 1-2 guests |

| Priority Banking Customers | |||

OCBC PB Visa Infinite OCBC PB Visa Infinite |

Plaza Premium | 2 | 2 |

SCB Priority Banking VI SCB Priority Banking VI |

Priority Pass | 24^ | N/A |

| All caps refer to membership year, with the exception of those marked with *, which follow calendar year ^With min. AUM S$200K. If AUM falls under S$200K, then 4 visits |

|||

Here’s the main changes that happened last year:

- UOB will be discontinuing the JCB Card from 1 April 2021, and has stopped issuing replacement and renewal cards effective November 2020. This means no more access to the JCB lounge program

- The OCBC Premier Banking Visa Infinite has made its debut, with two free visits per year for both principal and supplementary cardholders. Not too shabby, for a card with no annual fee (you get as many free visits as you have supplementary cardholders)

- Diners Club cards now track lounge entitlements by calendar year, instead of their old confusing 1 Apr to 31 March system

- ICBC has extended their impressive DragonPass offer, which gives cardholders six free visits per calendar year. This is now valid till 31 December 2021

Here’s a few things to consider when choosing a credit card for lounge access.

(1) Not all lounge networks are made equal

The main lounge networks used by credit cards in Singapore are Dragon Pass, LoungeKey, Plaza Premium, and Priority Pass.

The main difference between networks is their size.

Priority Pass is by far the most common (and the largest) lounge network. With ~1,300 lounges worldwide, you’re almost certain to find a Priority Pass affiliated facility wherever you’re heading.

Priority Pass has also started to offer more non-lounge experiences, especially in airports where they’ve been unable to negotiate lounge access. These can include F&B credit (usually US$28 in the US and AUD$36 in Australia), or even more exotic things like access to sleep pods in Dubai or nap rooms in selected US airports.

Do note that Priority Pass memberships issued by American Express no longer cover non-lounge experiences, so you’ll be billed separately if you use your Priority Pass for these.

Dragon Pass is a China-based lounge network that’s becoming increasingly common among Singapore card issuers. Dragon Pass’ network is slightly smaller than Priority Pass (~970 lounges), but they also offer lounge access at railway stations in China, and dining discounts at certain airport restaurants. In Singapore, you can get a free set meal at The Kitchen by Wolfgang Puck in Terminal 3, for example.

Lounge Key (~1,150 lounges) replaced Priority Pass on the HSBC Visa Infinite a couple of years ago, and also partners with Mastercard to provide lounge access during flight delays. Although it’s not as well known in Singapore as Priority Pass or Dragon Pass, its network is still very extensive.

Plaza Premium is a much smaller network (~70 lounges), although its lounges tend to be higher quality than your average contract lounge. For what it’s worth, almost every Plaza Premium lounge can be accessed by Priority Pass, Dragon Pass or Lounge Key

Plaza Premium has also started a special chain of Plaza Premium First lounges, which offer an experience that could rival that of some airline lounges. Even if you hold a card with free Plaza Premium lounge access, however, you’ll still have to pay an upcharge to access these lounges.

(2) Lounge entitlements stack among cards

Depending on the cards you hold, it’s perfectly possible you might end up with multiple Priority Pass memberships. If so, remember that your allowances are tied to each card, so they stack.

In other words, if I get 2 free visits from the DBS Altitude Visa and 2 free visits from the Citi PremierMiles Card, I have 4 free visits in total.

(3) If you want unlimited visits, be prepared to pay an annual fee

Cards which offer annual fee waivers (e.g DBS Altitude Visa) also offer limited lounge visits. If you want a card with unlimited lounge access, you need to look at those in the $120K segment, where annual fees are mandatory.

The exception is the Maybank Visa Infinite, which comes with an unlimited visit Priority Pass and waives the first year’s S$600 annual fee. Subsequently, you can enjoy a fee waiver when you spend at least S$60,000 in a membership year.

(4) Most visit entitlements are per membership year, however some are by calendar year

Free visit entitlements may refresh based on the membership year (i.e. the date when you got your lounge membership), or calendar year (1 Jan-31 Dec). Be sure to check the wording, because the last thing you want to do is get charged unwittingly.

Most entitlements follow the membership year, but the Citi PremierMiles, UOB Lady’s Solitaire Metal Card, ICBC Global Travel Mastercard, and Diners Club cards follow the calendar year.

(5) Guests (usually) cost you, and supplementary cardholders (usually) don’t get free visits

Some high-end cards like the Citi Prestige or AMEX Platinum Charge allow you to bring a guest at no extra charge. On most other cards, you’ll either have to pay out of pocket (~US$32) or use one of your free visit entitlements. For example bringing three guests with you on your UOB Visa Infinite Metal’s Dragon Pass would exhaust your four-visit allowance.

The policy on children is more nebulous and varies by lounge. Some will turn a blind eye, others will insist on charging you. In general, infants under the age of 2 will be admitted for free.

Supplementary cardholders are generally not entitled to any free lounge visits. The exceptions:

- AMEX Platinum Charge: All supplementary cardholders enjoy the same visit and guest entitlements as the principal cardholder (only the first supplementary cardholder gets an unlimited visit Priority Pass however)

- HSBC Visa Infinite: Up to five supplementary cardholder also gets an unlimited visit LoungeKey

- OCBC Premier Banking Visa Infinite: Supplementary cardholders enjoy same lounge entitlements as principal cardholder

- OCBC VOYAGE: Supplementary cardholders enjoy same lounge entitlements as principal cardholder

- UOB Lady’s Solitaire Metal Card: Supplementary cardholders enjoy same lounge entitlements as principal cardholder

Conclusion

The quality of airport lounges can be extremely variable, and within each lounge network you’ll find some amazing ones, some mediocre ones and some abject ones. The best precaution against wasting your limited lounge visits on a crappy lounge is to simply ask at the front desk whether you can have a quick look inside before you decide. I’ve never had anyone say no to this before.

Some lounges impose time limits on visits, but I’ve never seen this actively enforced because it’s difficult to track who came in when. If they want to enforce this, they’re more likely to impose a limit on how early you can enter (e.g. if your flight departs at 9 p.m and the restriction is 3 hours per visit, they won’t let you in before 6 p.m).

Did I miss out any credit cards with lounge access? Let me know.

There’s also the cryptocurrency Visa Platinum card from crypto.com. Their “royal indigo” tier comes with unlimited lounge access via Lounge Key.

https://milelion.com/2019/10/22/why-i-wouldnt-touch-the-mco-visa-and-neither-should-most-people/

That’s technically a debit card. Which makes it one of the only two debit cards in Singapore that has free lounge access:

Crypto.com Visa Platinum – LoungeKey – Unlimited with 50K CRO stake (~S$2.2k)

HSBC Jade Visa Infinite Debit Card – DragonPass with 2x free access/year (S$1.2m AUM with HSBC)

Once upon a time Revolut Metal comes with 1x free lounge access per year too, but they since replaced it with “free lounge access with delay >1 hour” like GrabPay MC.

Are there any repurcussions for the $30K cards if you just apply for them, don’t charge anything but just use the Priority Pass, and cancel?

nah, nothing will happen

Question here: On SCB website, it shows the Infinite X card as having 4 or 24 priority visits? See https://www.sc.com/sg/priority/priority-pass-faq/