Citibank has added GrabRewards as a points transfer partner, allowing for one-way transfers from Citi credit card points to GrabRewards.

To mark the launch, Grab is offering a limited-time 10% bonus on transfers of Citi credit card points, although it’s still not a phenomenal deal by any means.

Transfer Citibank points to GrabRewards

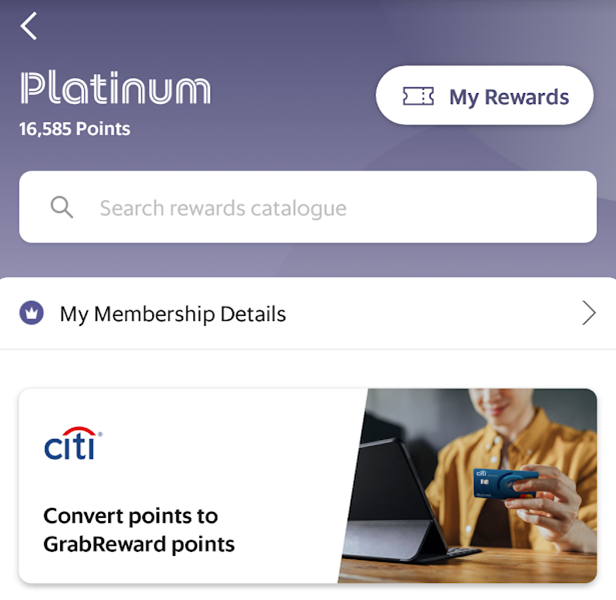

The option to link your Citi and Grab accounts can now be found in the Grab app, under the GrabRewards section. You’ll be prompted for the last four digits of your Citi card, as well as your Citi-registered mobile number. Enter the OTP to complete the linkage.

Once linked, Citi cardholders can transfer points to GrabRewards at the following ratio.

|

|

|

| 825 Citi Miles |

⇒ |

|

| 2,200 ThankYou points | ||

| *Limited-time rate till 17 Nov 21 | ||

From 16 October to 17 November 2021, customers who transfer Citi Miles or ThankYou points to GrabRewards will receive a 10% bonus, with no cap (T&C). This bonus has already been reflected in the table above

Transfers are instant and do not have any admin fee. The minimum transfer amount is 825 Citi Miles or 2,200 ThankYou points, with incremental blocks of 165 Citi Miles or 440 ThankYou points.

Is it worth converting?

Not particularly.

GrabRewards points are typically worth 0.2 cents each, so by transferring Citi Miles or ThankYou points, you’re implicitly accepting a value of:

| During bonus period (till 17 Nov 21) |

After bonus period (from 18 Nov 21) |

|

| Citi Miles | 0.67 cents ea. | 0.61 cents ea. |

| ThankYou points | 0.25 cents ea. | 0.23 cents ea. |

To put it another way, Citi Miles and ThankYou points can be converted to airline miles at a ratio of 1:1 and 5:2 respectively. By converting them to GrabRewards points, you’re implicitly accepting a value of:

| During bonus period (till 17 Nov 21) |

After bonus period (from 18 Nov 21) |

|

| Citi Miles | 0.67 cents/mile | 0.61 cents/mile |

| ThankYou points | 0.63 cents/mile | 0.57 cents/mile |

That’s abysmal, to say the least.

The only situation I could see this making sense is if you had orphan points, since transfers to airline miles require a minimum of 10,000 Citi Miles/25,000 ThankYou points.

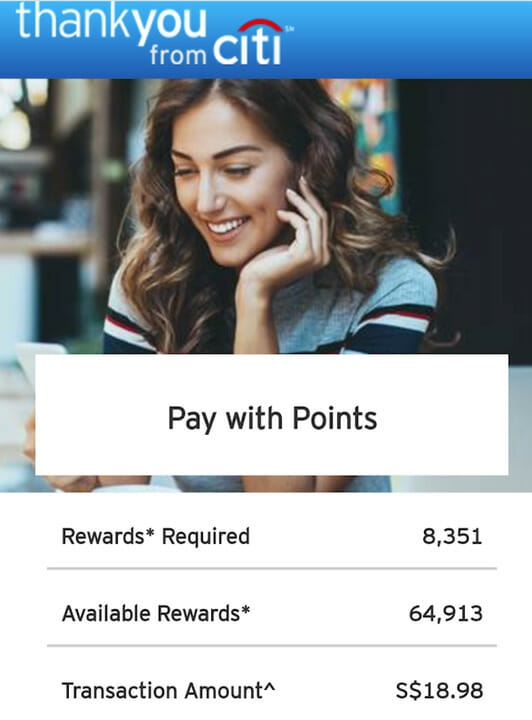

But even so, outside of the launch promo period, using Citibank’s Pay with Points option would yield a value of 0.23 cents per ThankYou point- exactly the same value as if you chose the GrabRewards route!

If you were inclined to spend ThankYou points in this way, you’d be better off using Pay with Points (that’s not an endorsement of Pay with Points, mind!) since you can spend it on anything, while GrabRewards points must be spent within the GrabRewards ecosystem.

To be fair, GrabRewards periodically offers pointsback promotions which boost the value per point to the 0.3 cents range, so if you converted Citi points and held them until a pointsback sale, you might get as much as 0.38 cents per ThankYou point.

| 💳 Better than the GrabPay Card… |

|

Here’s another amusing thought experiment. The Citi PremierMiles Card earns 1.2 Citi Miles per S$1, which would be 4 GrabRewards points/S$1 during the promotion period and 3.6 GrabRewards points/S$1 afterwards. That’s actually better than 3 GrabRewards points/S$1 a base or Silver GrabRewards member would earn with the GrabPay Card. If anything, this just highlights what a dismal return you earn with the GrabPay Card, and why there’s absolutely no reason for it to be your general spending card (and believe me, I’ve seen people using it as such) |

But I don’t know why we’re talking about this anyway. Save your Citi rewards points for miles! End of story.

Conclusion

Citibank cardholders can now transfer Citi Miles and ThankYou points to GrabRewards, but that doesn’t mean they should.

Unless you’re dealing with a small orphan points balance, you’d get much more value converting them to airline miles (especially now with the various VTL options at your disposal)- and remember, Citi points are incredibly valuable with the widest range of transfer partners in Singapore.

The 10% transfer bonus doesn’t really change the equation at all.

Your comment on Grab MC as a general spend card misses the point as those grab rewards points are on top of the 1.7% cashback you get from topping up your Grab balance with UOB Amex. Or the 1.8mpd you could get with the Amex SIA business card.

the grab point, 1.7% cashback, and occasional 25% redeem discount makes Grab MC good. Really good

But if you are looking for miles alone, the value of miles cc is easily 2 times the reward.

This is why I use grab point to redeem every other thing except miles. It is supposedly to be used to redeem for things outside of miles

So both of you are correct.

This is the Milelion not Cashbacklion so the 1.7% cashback + dismal grab points is moot to both the author and his target audience.

The SIA business card is only applicable to business customers and is not a general consumer card, hence its limited exposure. Not forgetting that there is an annual cap on the conversion of highflyer points to krisflyer points, complicating its use as a general spend as people tend to want unlimited spend no fuss experience on their general spend.

Matthew i dont think its correct to say that milelion only talks about miles and not cashback, and extrapolating this to the target audience is wrong. The author can certainly clarify as well.

You’ve missed the point. In the article, there was a bit of a cheap shot taken at people who use Grab MC as a general spend card because the points or cashback earned on topup was not taken into consideration by Aaron, when actually it is a perfectly reasonable choice (for both mile earners and cashback earners, if you fit the profile). I know what point Aaron is trying to make, but it has come out really clumsy and ham-fisted which is not what Aaron is usually known for.

Firstly this is his blog and he gets to have his opinion on whether miles or cashback are better on his own media. On to the general spend issue, he demonstrated in his view how ironically using the Citi Premiermiles and converting to Grab Rewards through this program yields you more Grab Rewards than using the GPMC as a Silver member. How you take the information is up to you. If I were someone using GPMC, I would appreciate this information being published honestly and use it to my advantage, perhaps adjust my strategy, instead of taking offence that someone… Read more »

Matthew, If as what you say ‘This is the Milelion not Cashbacklion so the 1.7% cashback + dismal grab points is moot to both the author and his target audience’ then shouldnt there not be any posts about cashback, not to mention referrals to singlife, ads on dbs multiplier account, credit card sign ups with crypto currency rewards (i am not saying there shouldnt be)? Your analogy is flawed.

The posts you have mentioned do not have a better miles option. Where there is a superior miles option, that has always been the recommendation.

Not recommending cash back over miles is different from not covering free cash offers.