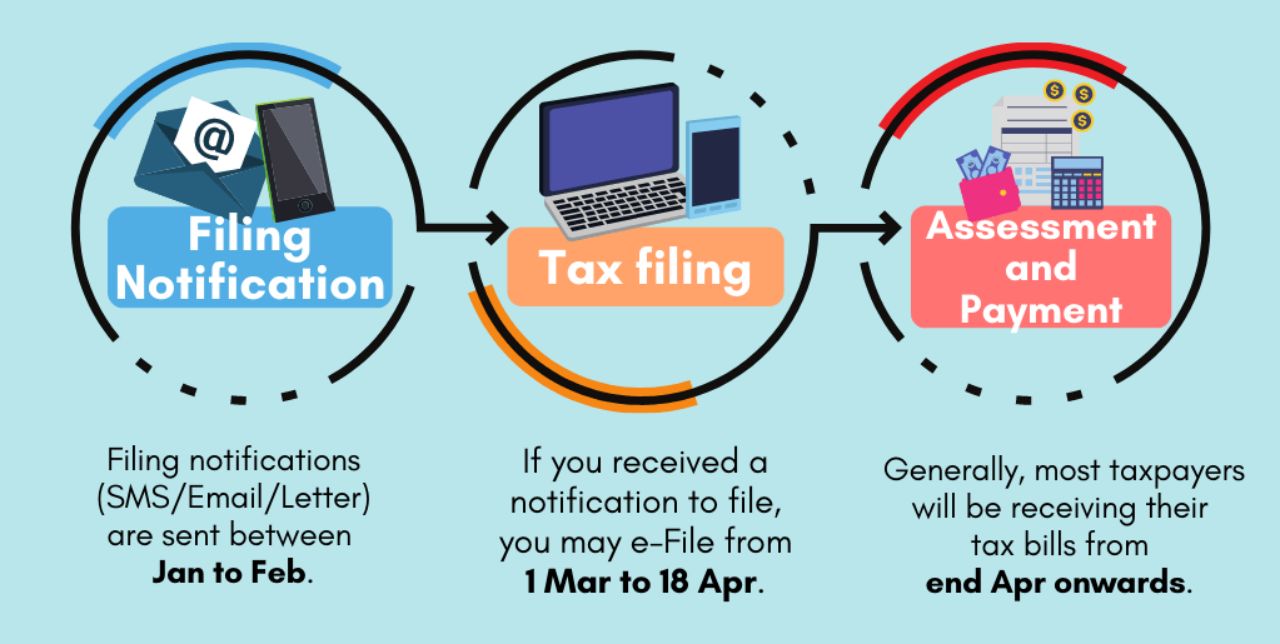

Tax season is here again, and it’s time to look at this year’s options for paying with a credit card to earn miles.

Individuals with income tax obligations will need to file their taxes by 18 April 2022. They’ll subsequently receive their tax bill (NOA) from the end of April onwards.

IRAS sends NOAs in batches, so you may not receive yours at the same time as others in your household or company. Don’t take it personally; I promise they haven’t forgotten about you.

| 💰The MileLion’s Income Tax Guide 2022 |

How do I pay my income tax bill with a credit card?

IRAS doesn’t accept credit card payments. In their own words:

Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

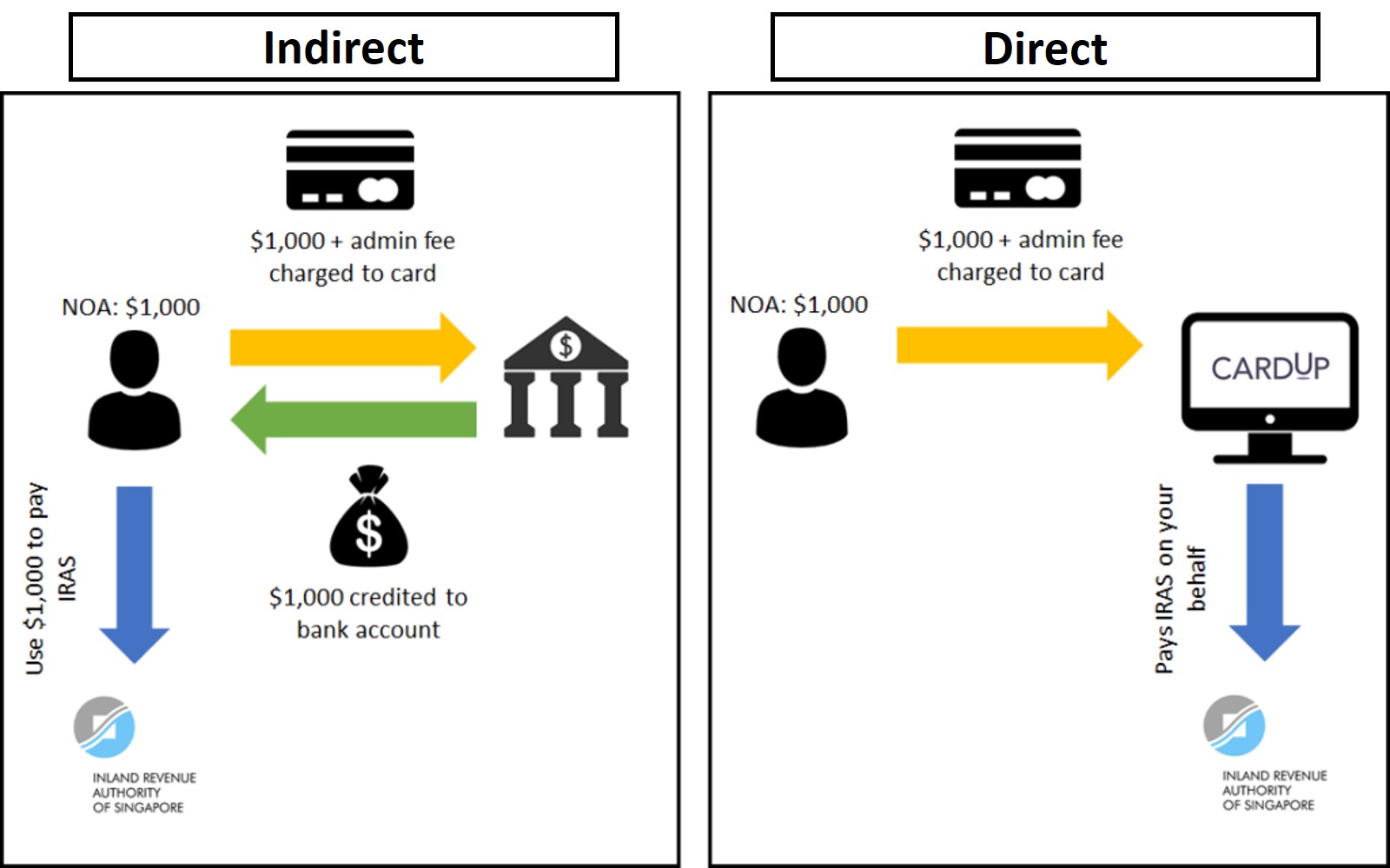

However, this doesn’t mean you can’t use your credit card to pay taxes. There are two types of tax payment facilities, which allow cardholders to earn rewards in exchange for a small fee. I divide them into “indirect” and “direct”.

| Indirect Payment Facilities | Direct Payment Facilities |

|

|

Both direct and indirect facilities work the same in the sense that your credit card is charged for the tax amount due plus an admin fee.

Where they differ is that:

- an indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS

- with a direct payment facility, the facility provider pays IRAS on your behalf.

Whether it’s better to use an indirect or direct facility all comes down to the cost per mile: the admin fee, divided by the miles you receive on your card.

Regardless of which one you pick, some common rules apply:

- You can’t pay someone else’s tax bill, only your own (at most you may be able to pay for a spouse, although YMMV)

- You can’t overpay your tax bill

What are the fees involved?

As mentioned, it’s not free to use your credit card to pay income tax. There’s an admin fee involved, which varies depending on facility.

| 👍 A free way to earn miles on income tax |

|

| Apply Here |

|

There is only one truly free way to earn miles on income tax payments: the AMEX HighFlyer Card. Cardholders earn 1.8 mpd on all local spend, including GrabPay top-ups. By topping up your GrabPay account and then using it to pay IRAS (via AXS), you can essentially earn 1.8 mpd on your income tax bill.

Do remember that your GrabPay wallet can hold a maximum of S$5,000 at any time, and there’s a S$5,000 daily transaction limit and a S$10,000 monthly transaction limit. Those paying significant income tax bills will need to split their payments into smaller transactions or over several days. The AMEX HighFlyer Card is exclusively for SME owners. While you will need an ACRA business registration number to apply, there is no minimum turnover or headcount required (you personally must earn at least S$30,000- this need not come from the business itself, it can be from other sources). If you’re running a home business, giving tuition or engaged in some other side hustle, setting up a sole proprietorship or LLC would qualify you to apply. Read about the latest AMEX HighFlyer Card sign-up offer here. |

Here’s a list of the various payment facilities and the applicable fees.

| 🧾 List of Payment Facilities |

||

| Bank | Applicable Cards | Admin Fee |

| HSBC Premier, Visa Platinum, Revolution, Advance, Visa Infinite | 0.5-1.5% | |

| SCB Visa Infinite | 1.6% | |

| All cards except HSBC | 1.7-2.6% | |

| OCBC VOYAGE | 1.9% |

|

| UOB PRVI Miles, Visa Infinite Metal, Reserve | 1.7-1.9% | |

Link Link |

All SCB cards | 1.9%^ |

Link Link |

All Citi cards | 2% |

| All DBS cards | 2.5% | |

| Key | Indirect | Direct |

| ^Public rate; SC is known to target different people with different rates |

||

| There is an additional option called ipaymy, but for reasons outlined in this post, I have made a decision not to endorse or comment on their services. Their tax payment promotion last year was on par with CardUp. | ||

It may be tempting to compare the options on the basis of admin fees, but that’s only half the story. You need to also consider the earn rate.

For example, the HSBC Premier Mastercard has an admin fee of 0.5% and an earn rate of 0.4 mpd, so your cost per mile is 1.25 cents. On the other hand, the SCB Visa Infinite has a higher admin fee of 1.6%, but also a much higher earn rate of up to 1.4 mpd, resulting in a lower cost per mile of 1.14 cents.

You also need to keep in mind that banks may apply different earn rates for income tax payments. For example:

- the UOB PRVI Miles Card normally earns 1.4 mpd, but awards 1 mpd for UOB payment facility transactions (you’ll earn 1.4 mpd via CardUp, though)

- all DBS cards earn a flat 1.5 mpd for income tax payment plans, instead of their usual rates.

If this is too complicated for you, the next section should make it very simple.

What are my options for paying tax with a credit card?

| 👉 CardUp offer for MileLion Readers |

|

If this is your first-ever CardUp payment, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). You can subsequently use the MLTAX22 for the rest of your income tax payments. |

Here’s a sample of the rates you can expect to pay with each card, pending additional promotions and targeted offers.

| 💰 Summary of Tax Payment Options (Please read all footnotes) |

|||

| Card | Via | Fee (MPD) |

CPM |

Citi ULTIMA Citi ULTIMA |

PayAll1 | 2% (2.5 mpd) |

0.8 |

Citi Prestige Citi Prestige |

PayAll1 | 2% (2.5 mpd) |

0.8 |

Citi Premier Miles Citi Premier Miles |

PayAll1 | 2% (2.5 mpd) |

0.8 |

Citi Rewards Citi Rewards |

PayAll1 | 2% (2.5 mpd) |

0.8 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

CardUp2 | 1.7% (1.6 mpd) |

1.04 |

DBS Insignia DBS Insignia |

CardUp3 |

1.75% (1.6mpd) |

1.07 |

UOB Reserve UOB Reserve |

CardUp3 | 1.75% (1.6 mpd) |

1.07 |

SCB VI SCB VI |

SCB | 1.6% (1.0/1.4 mpd)5 |

1.14/ 1.6 |

HSBC VI HSBC VI |

HSBC | 1.5% (1.0/1.25 mpd)6 |

1.2/ 1.5 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

CardUp3 | 1.75% (1.4 mpd) |

1.23 |

UOB VI Metal UOB VI Metal |

CardUp3 | 1.75% (1.4 mpd) |

1.23 |

HSBC Premier Mastercard HSBC Premier Mastercard |

HSBC | 0.5% (0.4 mpd) |

1.25 |

OCBC VOYAGE OCBC VOYAGE |

CardUp2 | 1.7% (1.3 mpd) |

1.29 |

OCBC Premier VI OCBC Premier VI |

CardUp2 | 1.7% (1.28 mpd) |

1.31 |

SCB X Card SCB X Card |

CardUp3 | 1.75% (1.2 mpd) |

1.43 |

DBS Altitude Visa DBS Altitude Visa |

CardUp3 | 1.75% (1.2 mpd) |

1.43 |

UOB PRVI Miles MC UOB PRVI Miles MC |

CardUp4 | 2.25% (1.4 mpd) |

1.57 |

AMEX PPS Card AMEX PPS Card |

CardUp7 | 2.2% (1.3 mpd) |

1.66 |

AMEX Solitaire PPS Card AMEX Solitaire PPS Card |

CardUp7 | 2.2% (1.3 mpd) |

1.66 |

DBS Altitude AMEX DBS Altitude AMEX |

DBS | 2.5% (1.5 mpd) |

1.67 |

HSBC Revolution HSBC Revolution |

HSBC | 0.7% (0.4 mpd) |

1.75 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

CardUp7 |

2.2% (1.2 mpd) |

1.79 |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

CardUp | 2.6% (1.4 mpd) |

1.81 |

KrisFlyer UOB KrisFlyer UOB |

CardUp4 | 2.25% (1.2 mpd) |

1.83 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

CardUp7 | 2.2% (1.1 mpd) |

1.96 |

AMEX Centurion AMEX Centurion |

CardUp7 | 2.2% (0.98 mpd) |

2.20 |

AMEX Platinum Charge AMEX Platinum Charge |

CardUp7 | 2.2% (0.78 mpd) |

2.76 |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

CardUp7 | 2.2% (0.69 mpd) |

3.12 |

AMEX Platinum Reserve AMEX Platinum Reserve |

CardUp7 | 2.2% (0.69 mpd) |

3.12 |

| 1. Earn rate of 2.5 mpd during promo period from 6 Apr to 31 Jul 2022 2. Use code OCBCAFF17, valid only for new users. Valid till 31 Aug 2022. Existing users use MLTAX22 3. Use code MLTAX22, valid till 31 Aug 2022 4. Use code GET225, valid till 31 Dec 2022 5. Spend min. S$2K per statement month (including tax payments) to earn 1.4 mpd; otherwise 1 mpd 6. Spend min. S$50K in previous membership year to earn 1.25 mpd; otherwise 1 mpd 7. Use code AMEXNEWTAX22, valid only for new users. Existing users use AMEXTAX22 for 2.4% fee. Valid till 31 Jul 2022 |

|||

| 🧮How is this calculated? |

|

For CardUp, both the admin fee and the tax payment earn miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles (ignoring rounding). This works out to 1.43 cents per mile. For bank facilities, only the tax payment earns miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,200 miles. This works out to 1.46 cents per mile. |

Which offer is the best?

If we’re just talking lowest cost per mile, it’s hard to compete with Citi PayAll’s offer. 2.5 mpd with a 2% admin fee yields a cost of 0.8 cents per mile- one of the cheapest prices you’ll ever see.

There are a few caveats to note, however:

- You must clock at least S$5,000 of PayAll payments during the promotional period to qualify for 2.5 mpd (you can combine different types of payments e.g. rent, insurance- it need not all be tax)

- This offer is only available till 31 July 2022, so fully utilising it would entail paying off your entire tax balance by then. This has cashflow implications, since you could have paid over 12 months with IRAS’s interest-free installment plan

If you can’t meet the S$5,000 minimum spend or want to preserve your cashflow, then CardUp’s offer of 1.75% (MLTAX22) would be a good alternative (albeit only for Visa cards). Remember that you can always earn free miles on S$1,154 of payments with the code MILELION, assuming you’ve never used CardUp before.

For those with significant tax bills (>S$30,000), CardUp may be able to offer a concessionary rate. Email hello@cardup.co if this applies to you.

Other important points to note

Apply for as many facilities as you want

If you hold more than one of the cards above, there’s nothing stopping you from applying for multiple tax payment facilities in order to buy more miles (otherwise known as churning).

For example, someone with a S$10,000 tax bill who holds both the SCB Visa Infinite and HSBC Visa Infinite could send the same NOA to both SCB and HSBC. Upon approval, he/she could buy up to 26,500 miles (14,000 from SCB, 12,500 from HSBC) for S$310 (S$160 from SCB, S$150 from HSBC).

Take particular care if you’re applying for two direct payment facilities, however, because overpaying your tax bill will trigger a refund from IRAS, and a possible clawing back of the miles by the bank.

|

“Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount.” |

There’s no chance of this happening with indirect payment facilities, because the onus is on you to pay IRAS. What you do with the cash after it’s deposited into your account is your own business.

You can still use GIRO

IRAS allows taxpayers to split their payment into 12 interest-free installments via GIRO. This is great for maximizing your cashflow, and something I opt for each year.

Setting up GIRO for income tax can be done via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

There are no issues using GIRO if you opt for an indirect payment facility, as the bank simply credits the cash to your account, and how you go about paying IRAS after that is up to you.

It’s also possible to use GIRO when you’re paying via a direct payment facilities, though you’ll want to make manual payments well in advance of each month’s scheduled deduction (on the 6th of each month) to avoid double payment.

To illustrate, suppose your tax bill is S$12,000 and you opt for GIRO. IRAS will split your tax bill such that S$1,000 becomes due each month.

| Month | Manual Payment | GIRO | Total Paid |

| May 2022 | – | S$1,000 | S$1,000 |

| Jun 2022 | – | S$1,000 | S$2,000 |

| Jul 2022 | S$400 | S$600 | S$3,000 |

| Aug 2022 | – | S$1,000 | S$4,000 |

| Sep 2022 | S$1,500 | – | S$5,500 |

| Oct 2022 | – | S$500 | S$6,000 |

| Nov 2022 | – | S$1,000 | S$7,000 |

| Dec 2022 | – | S$1,000 | S$8,000 |

| Jan 2023 | – | S$1,000 | S$9,000 |

| Feb 2023 | – | S$1,000 | S$10,000 |

| Mar 2023 | – | S$1,000 | S$11,000 |

| Apr 2023 | – | S$1,000 | S$12,000 |

Suppose you make a manual payment of S$400 in July 2022. According to your payment schedule, you were supposed to pay S$1,000 in July, so GIRO will automatically adjust to deduct S$600 instead of S$1,000 for that month.

Then suppose you make a manual payment of S$1,500 in September 2022. According to your payment schedule, you only needed to pay S$1,000 in September, so GIRO won’t take any deduction for this month.

When October 2022 comes round, assuming you make no further manual payment, GIRO will deduct S$500 to put you “back on schedule” with S$6,000 paid off by the end of October 2022.

Now, it’s important to keep in mind that IRAS GIRO deductions take place on the 6th of the month the tax is due (or the next working day if that happens to be a weekend or public holiday). If your manual payment is made close to this date, it’s possible the regular GIRO deduction will still take place.

My advice would be to make manual payments at least one week before the 6th, and in any case, the CardUp system won’t let you schedule payments during the last few and first few days of each month.

For more instructions on how to setup a recurring income tax payment series with CardUp, refer to this link.

Don’t forget about transfer partner variety

When evaluating two cards with similar cost per mile figures, it’s helpful to think of qualitative factors as well.

For example, Citi Miles would be superior to DBS Points or UOB UNI$, thanks to the sheer number of transfer partners available. If you need a refresher on who partners with who, check out this article.

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Another consideration is points expiry- non-expiring Citi Miles and Travel$ would be more useful than expiring UNI$ or HSBC Rewards Points. For a guide on points expiry policies by bank, refer to this post.

Conclusion

Income tax bills are a great opportunity to buy miles on the cheap, though everyone will need to crunch the numbers and decide what price they’re willing to purchase at.

I will be updating this article as new tax payment promotions are announced, so bookmark it for future reference.

MileLion readers can use the code MLTAX22 to pay income tax with a fee of 1.75%. Payments must be set up by 31 August 2022 with a due date by 25 August 2023. This code can be used once, for either a one-time payment or a recurring monthly series.

MileLion readers can use the code MLTAX22 to pay income tax with a fee of 1.75%. Payments must be set up by 31 August 2022 with a due date by 25 August 2023. This code can be used once, for either a one-time payment or a recurring monthly series.

Too confusing – how do admin fee, mpd, and CPM work? What is the net earn?

And for Citi PayAll, based on their fine print, cards like Cashback Plus are included.

TL;DR. City PayAll promotion is the best, cheapest and most flexible option.

Hi, i always use the AMEX plat card unless the merchant don’t take AMEX. Will you recommend using AMEX plat card when paying tax thru Card Up? thanks

If I’m already on IRAS GIRO, can I still apply for Citibank Payall, pay one lump sum to hit the $5k min spend without cancelling the GIRO? if the GIRO detects a huge amount manual payment, then it will use the amount to cover the outstanding balance in my IRAS account right? so there will be no more monthly auto deduction. Am I right?

Yup, pretty much. $5k will cover x number of instalments, after which giro continues

Can anyone that has paid multiple months giro with a payall payment confirm this? I saw a comment from someone else saying they paid two months giro and got sent a refund by IRAS for the extra month (and Citi can then claw back the miles by their T&C)

Is there a typo here? It should be admin fee instead of annual fee right? “Both direct and indirect facilities work the same in the sense that your credit card is charged for the tax amount due plus an annual fee.”

thank you, have fixed that.

Did not see the option of using Amex cards. Any suggestions?

Nothing good for now. Cost will be way too high

Can you send the tax amount first to your Citi and then use PayAll in case your tax bill is larger than your credit limit?

Any idea if there will be a promo for Amex?

Appreciate the tip on churning

if i am looking at purely using card to top up cashcard at Transit link machine (with no minimum spent to hit), could i ask for advice which credit card provides the best mpd rate?

Dear Milelion, I know history does not always predict the future, but does Citi Payall have a tendency to renew the 2.5mpd bonus rate? Just wondering how the cpm for Citi Payall would compare to other alternatives if we assume that income tax will be paid over GIRO for 12months, with a 2.5mpd earn rate till july and then 1.2mpd for the remaining months.

Payall can pay tax for friends/family?

Hi Aaron please take a look at this, this brings the charges down to 1.9% for UOB PRVIMILES (one-time payment) but why does the earn rate show 1mile per dollar? shouldnt it be 1.4mile per dollar for UOB local spent? or are we supposed to add them together 1 + 1.4 = 2.4 Appreciate if you could chime in on this. Thanks!

https://www.uob.com.sg/personal/cards/payment-services/payment-facility.page

Uob only awards 1 mpd for payments made via payment facility

refer to latest post.

Thank you for writing an article on it!!

Can you pay SG tax with US credit cards? Citi, Amex, Chase

For Citi PayAll, do i need to cancel my GIRO and pay lump sum?

i tried the HSBC and i still need to print and mail over lol

Now that 2023 tax season is here, will you be updating this article?

there will be a 2023 edition, but not so soon