While mandatory travel insurance requirements are starting to be scaled back around the world, some countries still require it for foreigners.

| ⚕️ ASEAN Countries & Travel Insurance | |

| Not Required | Required |

|

|

| *Not stated as a requirement on IATA Timatic or SIA’s travel advisory page, but mentioned on Vietnam’s official tourism page | |

I firmly believe that no one should travel without insurance anyway, regardless of the rules, but what if your coverage comes from a credit card? Travel insurance from credit cards is just as valid as a stand-alone policy, but you won’t have that all-important one-page certificate with your name and details on it.

I’m not sure how it works for other cards, but thanks to Head for Points, I’ve learned it’s possible for AMEX Platinum Charge cardholders to generate personalised insurance certificates online.

AMEX Platinum Charge insurance

|

| Policy Wording |

AMEX Platinum Charge cardholders enjoy complimentary travel insurance when they pay for their outbound and inbound travel with their card. For the record, coverage will apply if you redeem airline miles and use the AMEX Platinum Charge to pay for taxes and surcharges.

Coverage includes, among other things:

- S$1 million for death or total permanent disability

- S$1 million of medical expense coverage

- S$4,000 of emergency dental treatment

- S$150 hospital cash allowance

- S$10,000 trip cancellation and postponement

- S$400 for flight or baggage delays

COVID-19 medical expenses are covered as well.

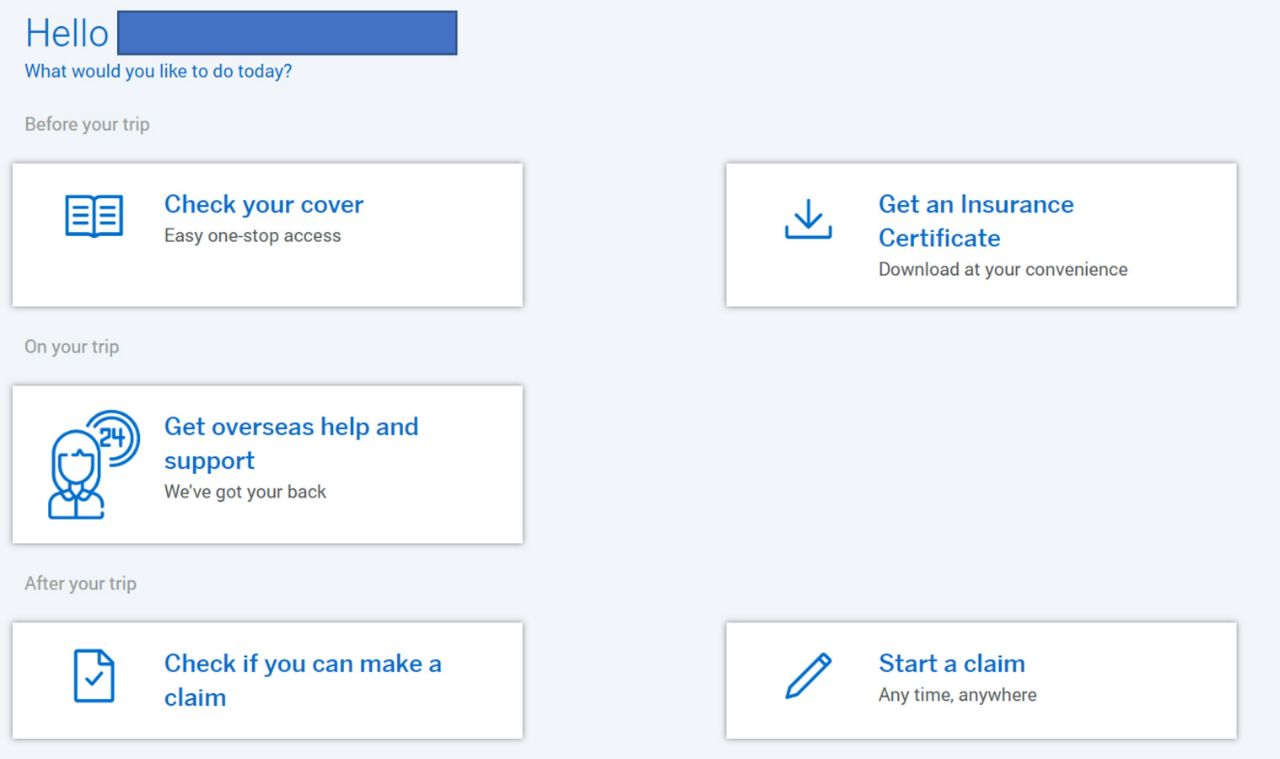

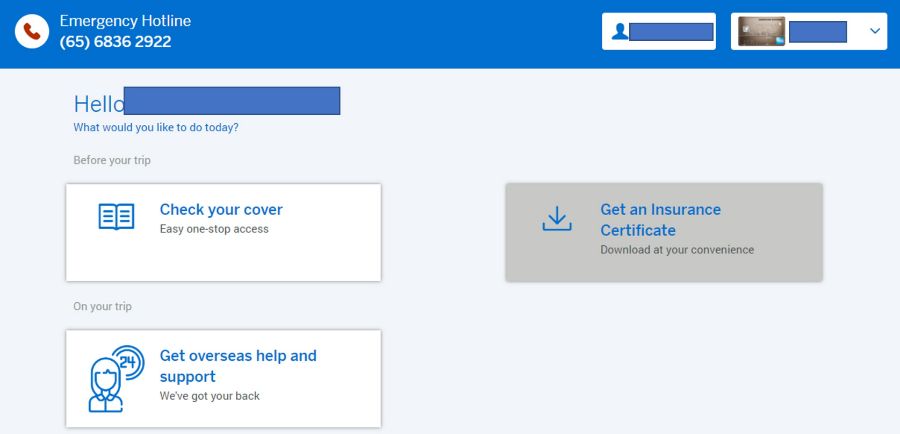

To generate an insurance certificate, head to this link and login with your American Express credentials.

Click “Get an Insurance Certificate”, then “English certificate”.

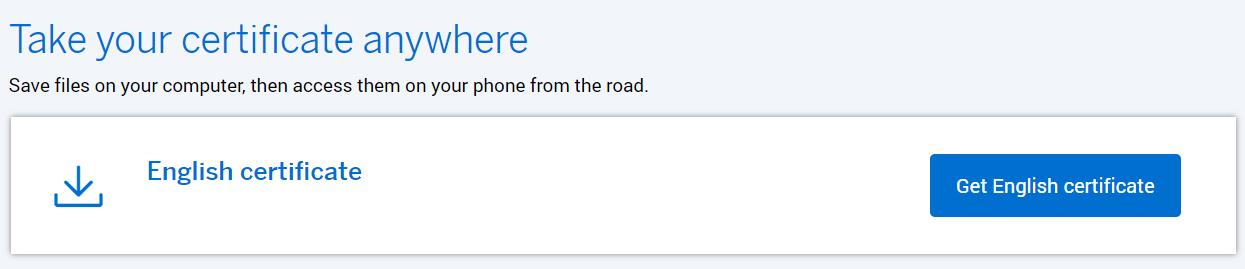

You’ll be prompted to fill in your first and last name, email address, trip dates and passport number.

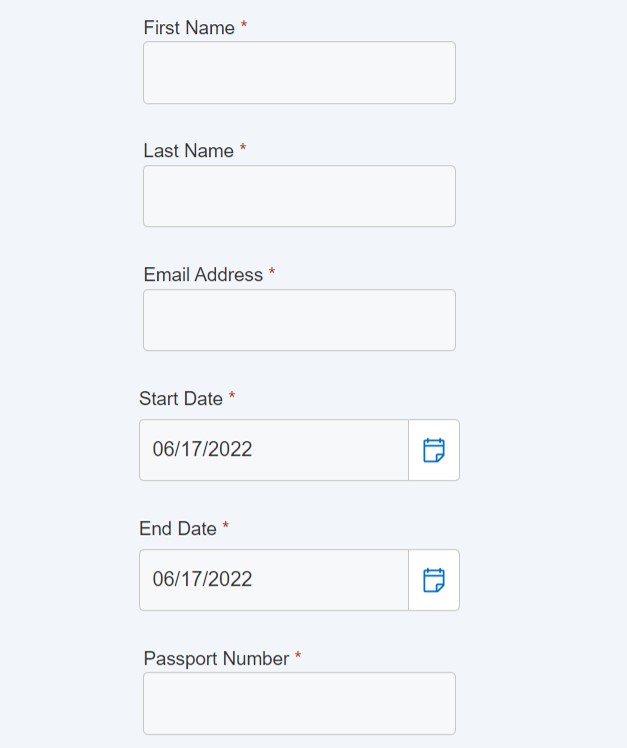

A PDF certificate from Chubb will be automatically generated and sent to your email.

Now, here’s what I find interesting.

As mentioned earlier, insurance coverage is only applicable if you use the AMEX Platinum Charge to pay for the outbound and inbound legs of the trip. However, you can generate an insurance certificate regardless of whether you’ve done this.

I think the legal team was careful to cover their bases here, as the letter only states that the individual is “entitled” to coverage, and adds the following clause:

“This insurance program provides coverage to the Insured when the travel costs for the originating and return journey of the trip are being charged to the Cardmember’s Platinum Charge Card”

Add the fact you can put anyone’s name on the certificate (understandable, given that the policy is meant to cover your spouse and dependent children as well) and it almost feels like a “generate your own insurance certificate” tool, something that could be easily abused. I mean, I can’t imagine the average check-in agent or immigration official could be bothered enough to cross reference your credit card statement and see if the coverage is actually active…

While other American Express cards like the AMEX KrisFlyer Ascend and AMEX Platinum Credit Card also come with complimentary travel insurance, the portal unfortunately does not allow you to generate certificates. In those cases, you’ll need to contact Chubb and see if they can assist you.

Conclusion

AMEX Platinum Charge cardholders can generate a personalised travel insurance certificate that provides documentary proof of coverage (though I wonder how the person reading the certificate will know if the coverage is active!). It only takes a few minutes to do, and delivery is instant.

For more information on travel insurance policies that cover COVID-19, refer to the link below.

But why will you want to do that? The objective of buying insurance is to make sure you are covered, not really for the purpose of bypass the immigration.

Because… amex platinum charge insurance is just as good as purchased insurance

sometimes better

Hi, does the insurance also cover travelling partner who is not card holder?

Isn’t the covid-19 coverage mentioned right there in the certificate? Last paragraph…

Oh yes you’re right. I must be going blind. Thanks, will update

Do you know how I can do this fir HSBC Visa infinite

i think AMEX is the only one with this functionality. all others: call up the CSO

Does it work with Amex HighFlyer corporate card? even for this scenario if we redeem using our own Krisflyer miles “For the record, coverage will apply if you redeem airline miles and use the AMEX HF to pay for taxes and surcharges.”

Question: Did anyone actually get checked?

What was that email contact that could help in processing AMEX Plat Charge if your fixed incoming falls below 150K? Thanks Guys

Ddi you actually receive the pdf in email? How long does it take? I tried twice about a week back and have not received the cert via email so far.

got it almost instantly.

Is Amex Platinum charge card travel insurance comparable to the Chubb regular Travel Insurance policy for family? Are there anything that is not covered or should add on? Chubb travel agent does not have knowledge and couldn’t answers

Now getting this when I check the link above: Application is not availableThe application is currently not serving requests at this endpoint. It may not have been started or is still starting.

So I think no longer working.

Hello Aaron, do you know if the link has changed? No longer seem to be working for me.

yeah the link no longer works. haven’t found a replacement

I just discovered you can generate the insurance certificate from the Amex portal:

1) Login to https://www.americanexpress.com/en-sg/account/login/

2) Click the top left menu > Insurance > Insurance Benefit Centre

3) Rest of the steps are then the same as what’s in this article

Can’t find the “insurance benefit centre” option. Seems to be missing

Spoke to the CSO, the below link worked for me.

https://www.americanexpress.com/sg/insuranceportal

https://www.americanexpress.com/en-sg/insurance/benefit-centre/login?inav=sg_menu_insurance_benefit_centre

For anyone that requires the COI this was the link given to me by amex today to generate it.

Awesome! this works. Thank you very much.