Trust Bank 🏦, a joint venture 🤝 between between Standard Chartered Bank 🏧 and NTUC Enterprise 🛒 launched 🚀 yesterday 📅 as Singapore’s 🇸🇬 first digital bank 🙌🎊🎉🥳.

|

| Use code: EVX76G17 and get cashback of S$5 to S$1,000 |

Did you find that paragraph insufferable to read? If so, Trust Bank might not be right for you, given how employee remuneration seems to be directly correlated to the number of emoji used.

Trust Bank desperately, desperately wants you #fellowkids to know that it’s hip and trendy, so much so its T&Cs are saturated with emoji, as if they were drafted by a team of avuncular boomers who earnestly believe this will help connect with the “cool and radical youth of today yolo”.

And yet it feels like they’re speaking out of both sides of their mouth, since all the talk during the launch event was about bringing banking to the elderly and less tech-savvy, a commendable goal in and of itself.

Can you really be all things to all people? Perhaps- if “all people” doesn’t include miles chasers.

You see, Trust Bank is in a unique position compared to other digital upstarts like GXS in that it offers both a savings account and credit card (versus just saving account for GXS). While I can’t speak to how good the savings account is, (there are other bloggers who will cover that much better), I’m certainly able to weigh in on the Trust Card.

Trust Card Trust Card |

|

| ★★ |

|

| The Trust Card’s ambitions, while noble, are hamstrung by a hopelessly confusing rewards scheme with numerous gotchas. The best thing might be the free rice. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

tl;dr: Outside of FairPrice Group spend, the Trust Card is virtually useless. But in order to trigger the FairPrice Group bonuses, you need to spend outside of FairPrice Group! This Penrose stairs model means that the claim of “up to 21% rebates” is nothing more than a marketing gimmick.

Now, I should probably state upfront that I’m well aware I’m not the right target market for Trust Bank (and if you’re reading this, you probably aren’t too). In fact, I’m likely to be their worst possible customer, seeing as how I’m taking the sign-up gifts and running.

That said, we look at things from a rewards perspective here, and if you’re savvy enough to know your credit card alternatives, then there’s very little attractive about the Trust Card.

Well, except for S$35 of free FairPrice vouchers and a 1kg bag of rice.

No, really.

Overview: Trust Card

Trust Card Trust Card |

|||

| Download (Android) | |||

| Download (iOS) | |||

| Use code: EVX76G17 and get cashback of S$5 to S$1,000 | |||

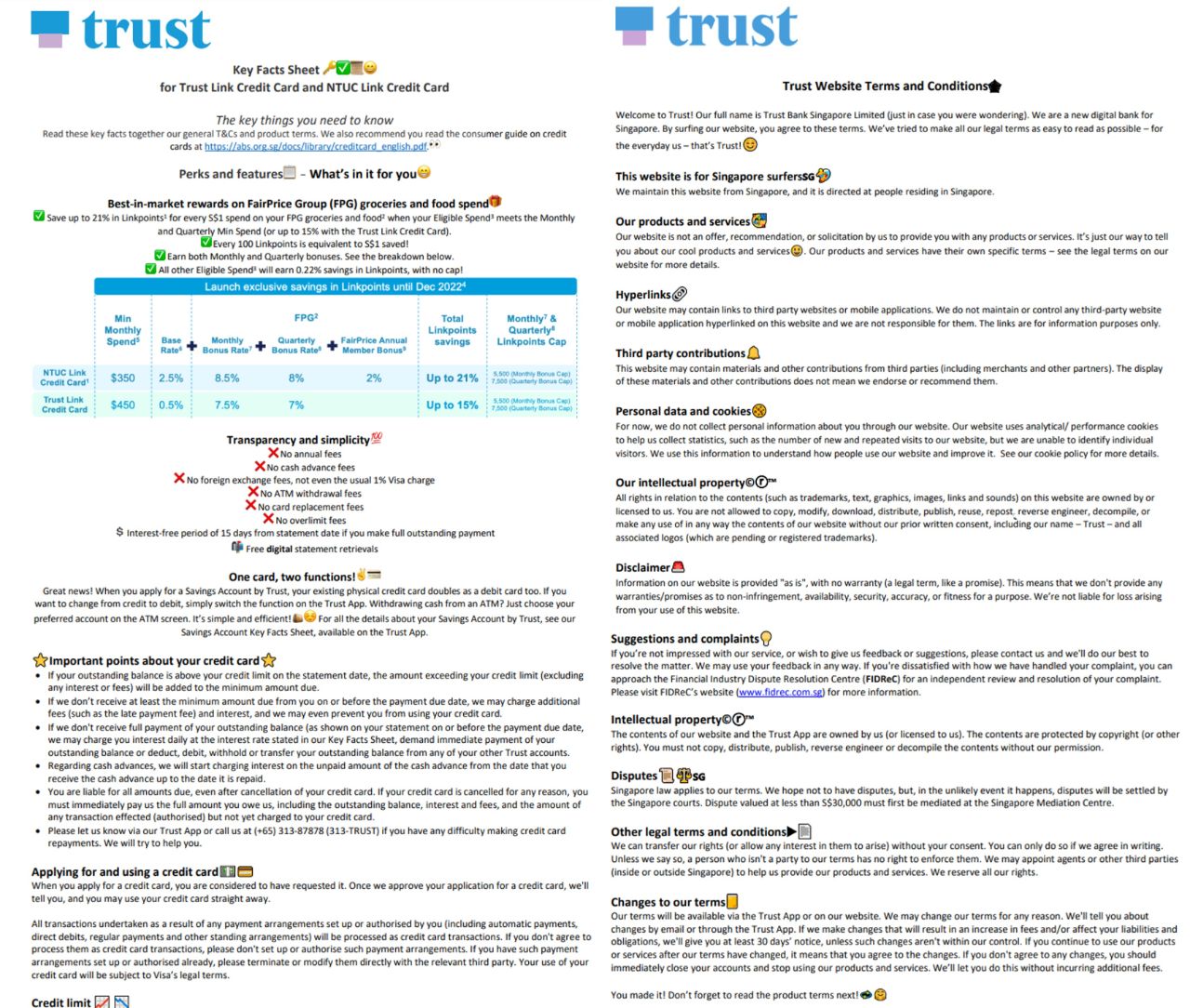

| Annual Fee (Including GST) |

None |

FCY Fee | None |

| Welcome Gift | S$35 FairPrice eVoucher | Transfer Partners |

|

| Local Earn | 0.22 Lpd | Transfer Fee | None |

| FCY Earn | 0.22 Lpd | Special Earn | Up to 21 Lpd at FPG |

| Lpd= Linkpoints per S$1 | FPG= FairPrice Group Merchants Cardholder Terms and Conditions | FAQs |

|||

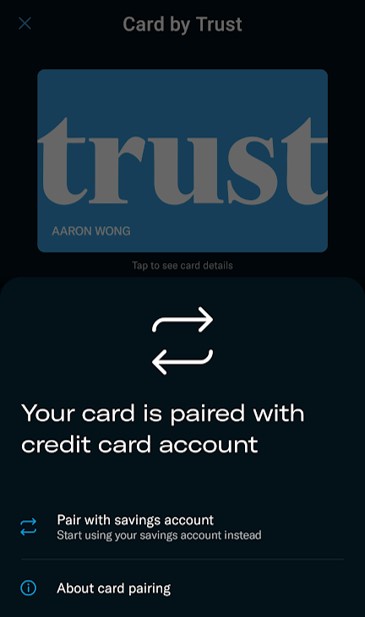

The Trust Card has a minimum income requirement of S$30,000 p.a., and no annual fee. It acts as a 2-in-1 solution. You can use it as a credit card, or a debit card if you have a savings account with Trust. The app allows you to instantly toggle between both modes.

Cardholders will receive both a virtual and physical Trust Card; the latter is numberless for security purposes (if you need to make an online transaction, you can retrieve the card details from the Trust app). The virtual card can be added to both Apple Pay and Google Pay for mobile wallet transactions.

Do note that there are two types of Trust Cards out there:

|

|

| Trust Link Credit Card | NTUC Link Credit Card |

The default card is the Trust Link Credit Card, but if you’re an NTUC Union member, you will receive an NTUC Link Credit Card instead (your union membership will be automatically reflected on the Trust app). This has a higher earn rate for spend at FairPrice Group merchants, but features are otherwise the same.

In this review, I will use the term Trust Card when referring to both cards, and individual product names otherwise.

Sign-up bonus: S$35 FairPrice vouchers (and some rice)

Let’s start with the sign-up bonus, because it’s probably the best thing about the Trust Card:

- All new Trust customers who sign up with the referral code 2GQEAM81 will get a S$10 FairPrice e-voucher (I get the same too)

- A further S$25 FairPrice e-voucher will be awarded upon first transaction of any amount on the Trust Card

The FairPrice e-vouchers have no minimum spend, and are valid for four months. They can be used at any online or offline platforms of FairPrice, FairPrice Finest, FairPrice Xtra, FairPrice Shop, Warehouse Club and Unity (except Changi Airport).

I made a small donation to charity and got the vouchers credited instantly, and others have reported success buying small items on Qoo10/Shopee etc, even top-ups to Revolut. I’m assuming there’s no exclusion categories for the sign-up bonus (though there are for earning LinkPoints; see below).

| ⚠️ Important Note |

|

When joining Trust, open the credit card first, then the savings account (only if you’re interested; the savings account is not required for the reward).

If you open the savings account first, you won’t be able to open the credit card due to a system glitch. |

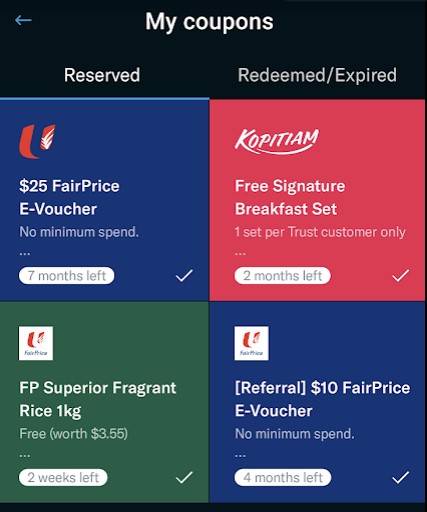

You thought we were done? Not hardly. S$35 of FairPrice e-vouchers is grand and all, but the true gems go unpublished.

Navigate to the coupon section of the Trust app after registration, and you’ll find:

- A 1kg bag of Fairprice Superior Fragrant Rice (worth S$3.55)

- A free Signature Breakfast Set at Kopitiam (worth S$3.10)

Both yours, absolutely free. Who needs a 100,000 miles sign-up bonus?

Trust Card earn rates

The Trust Link Credit Card earns Linkpoints as its rewards currency. As a reminder:

100 Linkpoints = S$1

Linkpoints can also be converted to a handful of loyalty programmes including KrisFlyer, which I’ll talk about later on.

|

|

|

| Trust Link Credit Card | NTUC Link Credit Card | |

| General Spend | 0.22 Lpd | 0.22 Lpd |

| FairPrice Group Spend (until 31 Dec 22) |

Up to 15 Lpd | Up to 21 Lpd |

| FairPrice Group Spend (from 1 Jan 23) |

Up to 8 Lpd | Up to 14 Lpd |

| Lpd= Linkpoints per S$1 |

||

| ⚠️ Important Note |

| When used in debit card mode, the rewards are significantly lower. Be sure to toggle to the correct mode before spending. |

All spending on the Trust Card, whether in local or foreign currency, earns a pathetic 0.22 Lpd which is equivalent to a 0.22% rebate (“with no cap!”, the T&Cs say cheerfully).

That’s far worse than your typical general spending cashback card, which earns 1.5-1.7% cashback. In fact, it’s even worse than what specialised spending cashback cards give if you fail to meet their minimum spend (e.g. the Citi Cash Back Card awards 8% cashback on groceries with a min. total spend of S$800/month; otherwise 0.25%- still better than 0.22%!).

So why even bother with the Trust Card? The hook is meant to be FairPrice Group (FPG) merchants, defined as the following:

| ✔️ Eligible FPG Spend | |

|

|

| *Excludes outlets located within Esso stations | |

Spend at FPG merchants earns Linkpoints according to this table:

| 🛒 Spending at FPG Merchants (till 31 Dec 2022) |

||

|

|

|

| Trust Link Credit Card | NTUC Link Credit Card | |

| Base Rate | 0.5 Lpd | 2.5 Lpd |

| Monthly Bonus Rate |

7.5 Lpd | 8.5 Lpd |

| Quarterly Bonus Rate | 7 Lpd | 8 Lpd |

| FairPrice Annual Member Bonus | N/A | 2 Lpd* |

| Total | Up to 15 Lpd | Up to 21 Lpd |

| *Subject to approval at the FairPrice annual general meeting, excludes Cheers | ||

I don’t blame you for being confused; it took me a long time to figure this out too.

Let’s use the Trust Link Credit Card as an example. There’s three components to consider: base, monthly bonus, and quarterly bonus.

| Component | Min. Spend | Cap |

| Base: 0.5 Lpd on FPG spend ex-Kopitiam |

– | – |

| Monthly Bonus: 7.5 Lpd on FPG spend |

S$450 at non-FPG per calendar month | 5,500 Linkpoints per calendar month |

| Quarterly Bonus: 7 Lpd on FPG spend |

S$450 at non-FPG per calendar month for three consecutive months | 7,500 Linkpoints per quarter |

| ⚠️ First Monthly Bonus on the house |

||

| Trust will automatically waive the minimum spend for the Monthly Bonus in the month of approval. For example, if your card is approved on 5 September 2022, you will not need to meet the minimum spend for September 2022, and will enjoy the Monthly Bonus for September 2022. |

||

I hope you see the catch here: Trust Bank doesn’t want people to simply use the Trust Card at FPG merchants, and sock drawer it otherwise. That’s why they’ve built a hurdle condition of S$450 spend at non-FPG merchants to trigger the monthly and quarterly bonuses.

It means your weighted average rebate will be much lower than 21%, since at least S$450 needs to be spent at a measly rebate of 0.22 Lpd (0.22%).

Here’s a worked example. John spends S$450 per month at non-FPG merchants, and S$600 per month at FPG merchants. After three months, he will receive a total of 22,197 Linkpoints, broken down as follows:

| 💳 Trust Link Credit Card Illustration (until 31 Dec 2022) |

||

| Non-FPG | FPG | |

| Total Spend (3 mo.) | S$1,350 (S$450 x 3) |

S$1,800 (S$600 x 3) |

| Base Points | 297 Linkpoints (S$1,350 x 0.22) |

900 Linkpoints (S$1,800 x 0.5) |

| Monthly Bonus | – | 13,500 Linkpoints (S$1,800 x 7.5) |

| Quarterly Bonus | – | 7,500 Linkpoints (S$1,800 x 7, capped at 7,500) |

| Total | 297 Linkpoints | 21,900 Linkpoints |

22,197 Linkpoints (S$221.97) for S$3,150 of spending represents a weighted average 7% rebate. That’s decent, but far from the 21% advertised- the whole equation gets weighted down by the non-FPG spend.

Keep in mind, the above rates are only valid till 31 December 2022, after which they’ll drop as follows:

| 🛒 Spending at FPG Merchants (from 1 Jan 2023) |

||

|

|

|

| Trust Link Credit Card | NTUC Link Credit Card | |

| Base Rate | 0.5 Lpd | 2.5 Lpd |

| Monthly Bonus Rate |

3.5 Lpd | 4.5 Lpd |

| Quarterly Bonus Rate | 4 Lpd | 5 Lpd |

| FairPrice Annual Member Bonus | N/A | 2 Lpd* |

| Total | Up to 8 Lpd | Up to 14 Lpd |

| *Subject to approval at the FairPrice annual general meeting, excludes Cheers | ||

While the minimum spend will remain the same, the monthly and quarterly bonuses will be reduced, together with their caps.

| Component | Min. Spend | Cap |

| Base: 0.5 Lpd on FPG spend ex-Kopitiam |

– | – |

| Monthly Bonus: 3.5 Lpd on FPG spend |

S$450 at non-FPG per calendar month | 4,000 Linkpoints per calendar month |

| Quarterly Bonus: 4 Lpd on FPG spend |

S$450 at non-FPG per calendar month for three consecutive months | 4,000 Linkpoints per quarter |

Going back to our same example with John; under the revised system he’ll receive a total of 11,497 Linkpoints, broken down as follows:

| 💳 Trust Link Credit Card Illustration (from 1 Jan 2023) |

||

| Non-FPG | FPG | |

| Total Spend (3 mo.) | S$1,350 (S$450 x 3 mo.) |

S$1,800 (S$600 x 3 mo.) |

| Base Points | 297 Linkpoints (S$1,350 x 0.22) |

900 Linkpoints (S$1,800 x 0.5) |

| Monthly Bonus | – | 6,300 Linkpoints (S$1,800 x 3.5) |

| Quarterly Bonus | – | 4,000 Linkpoints (S$1,800 x 4, capped at 4,000) |

| Total | 297 Linkpoints | 11,200 Linkpoints |

11,497 Linkpoints for S$3,150 of spending represents a weighted average 3.6% rebate. That may sound better than a 1.5% cashback card, but remember:

- The rebate is given in Linkpoints, which are not as flexible as cold hard cash

- It’s not correct to compare 1.5% and 3.6%, since 1.5% is offered everywhere and 3.6% is a weighted average figure. In fact, the more you spend outside of FPG, the lower your weighted average rebate!

Quite frankly, I think you’d be better off with any of the following:

- CIMB Visa Signature: 10% cashback on groceries with min. S$800 spend, capped at S$20 per month

- Citi Cash Back Card: 8% cashback on groceries with min. S$800 total spend, capped at S$80 per month

- Maybank Family & Friends Card: 8% cashback on groceries with min. S$800 total spend, capped at S$25 per month

- HSBC Revolution: 4 mpd on groceries, no min. spend, capped at S$1,000 per month

It’s also important to highlight that under the revised system, the monthly bonus cap is equal to the quarterly bonus cap. It means that once you hit the monthly bonus cap, there’s nothing further to be earned towards the quarterly bonus!

| ❓ What if I hold the NTUC Link Credit Card? |

|

As if this weren’t complicated enough, it’s even more complex for an NTUC Link Credit Cardholder.

|

To its credit, Trust Bank makes tracking your monthly and quarterly bonuses simple. A widget on the Trust app shows your progress towards monthly and quarter bonus minimum spend, as well as the number of bonus points earned so far.

![]()

And perhaps it needs to, with T&Cs this obscure.

Trust Card spending exclusions

The Trust Card’s list of rewards exclusions categories are pretty standard for most banks:

- Cash advances

- Cancelled or refunded transactions

- AXS, SAM or ATM transactions

- Any fees (late payment fees, finance fees etc)

- Any amounts rolled over from previous month’s statement

- Insurance premiums

- Any top-ups (except Kopitiam top-ups) or payment of funds to any accounts

- Utilities, Rentals and Cleaning Services (MCC 4900, 6513, 7349)

- Financial Institutions, Securities – Brokers, Quasi Cash, Insurance, Stored Value Card Purchase/Load and Wire Transfer (MCC 4829, 5960, 6010, 6011, 6012, 6051, 6211, 6300, 6540)

- Gambling (MCC 7995)

- Educational Institutions (MCC 8211, 8220, 8241, 8244, 8249, 8299)

- Charitable services, political organisations, religious organisations and government payments (MCC 8398, 8651, 8661)

- Government payments (MCC 9211, 9222, 9223, 9311, 9402, 9405)

These transactions will not earn Linkpoints, nor count towards the S$450 minimum spend required at non-FPG merchants to trigger the FPG bonuses.

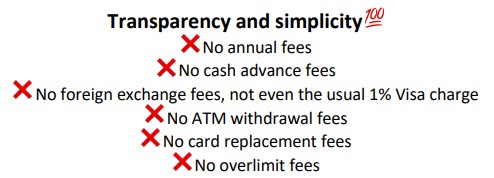

No cash advance fees (but…)

The Trust Card proudly trumpets the fact it has no cash advance fees, but you need to be very, very careful here.

It’s true that you can use your Trust Card to withdraw money from Standard Chartered or Trust ATMs (located at VivoCity FairPrice) in Singapore with no fees. It’s also true that when overseas, you can use your Trust Card to withdraw cash from an ATM at a foreign exchange rate provided by Visa, and no fee from Trust (the overseas ATM operator may levy a fee).

Alas, Trust Bank is being disingenuous here. While there’s no fees, there is interest. Hidden away in the fine print is this clause:

Effective Interest Rate (EIR): 26.9% per annum (minimum). Interest will be calculated daily at 0.074% on the amount withdrawn from the date of the transaction until the date of full payment.

In other words, cash advances aren’t free; you’ll be paying interest from the day you get the money from the ATM.

Now, to some of you this might be obvious- how could Trust Bank be handing out interest-free loans? But remember that Trust is meant to cater to older users and the less tech-savvy. This means transparency is paramount, and plastering “no cash advance fee” over your website and marketing materials isn’t what I’d call a best practice.

If you need to withdraw cash, skip the cash advance feature and switch the Trust Card to debit card mode, which draws from the cash in your account.

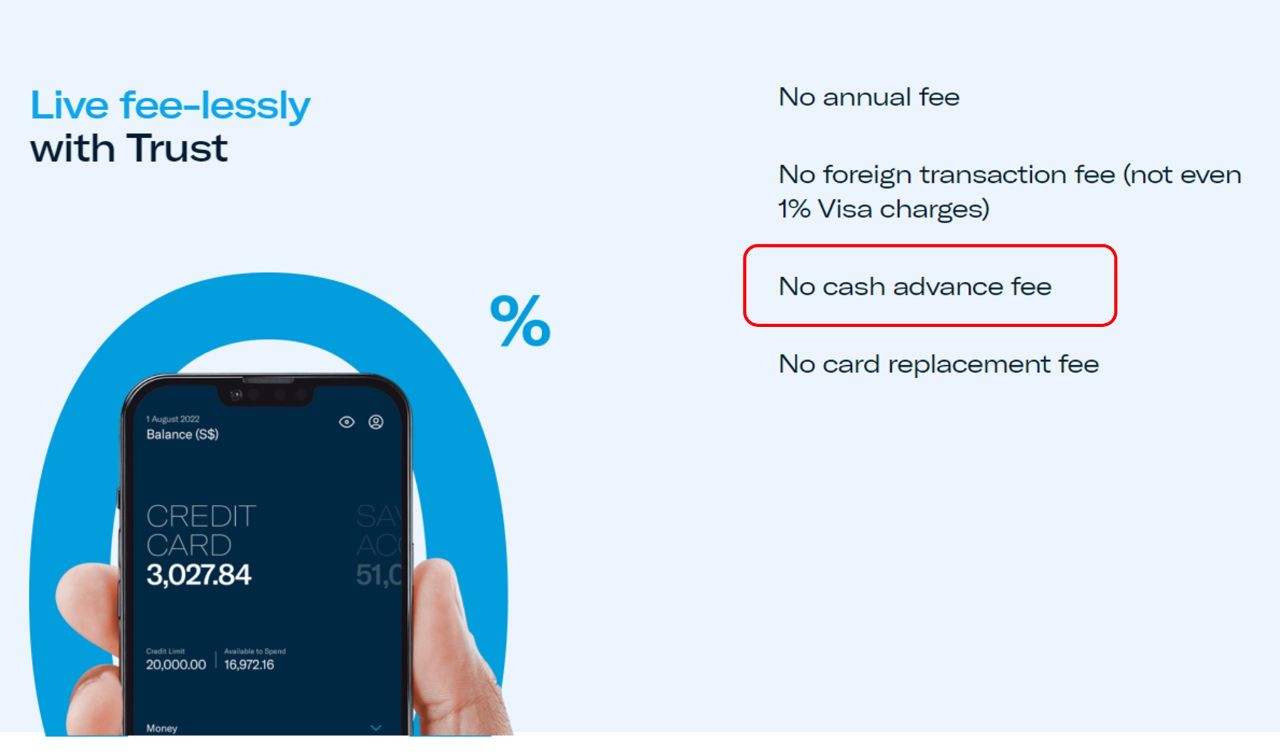

No FCY fees

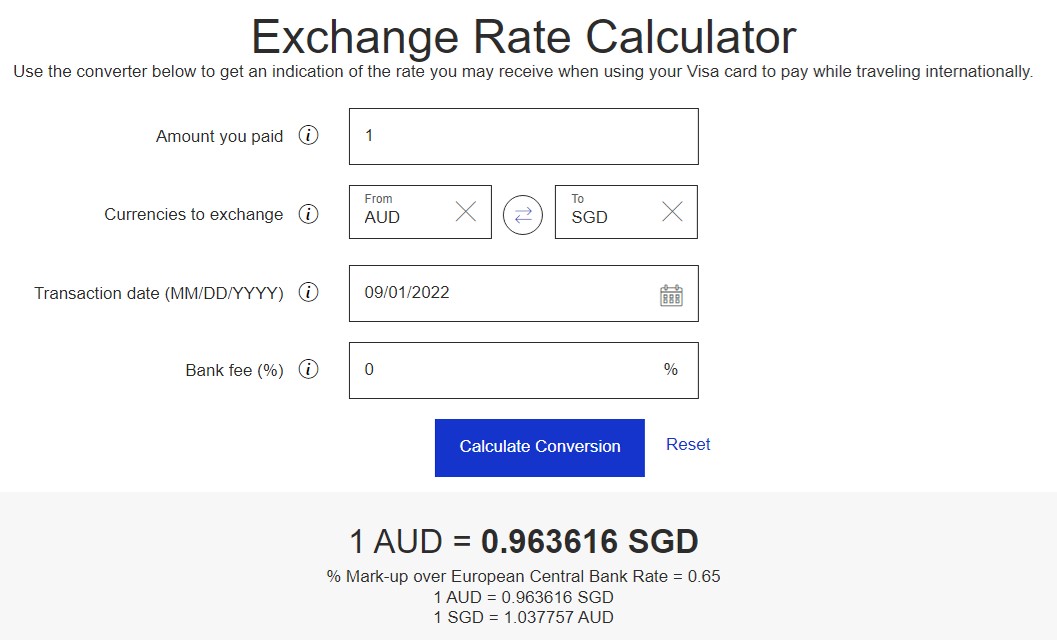

One unique feature about the Trust Card is that it’s the first in Singapore not to levy a foreign currency transaction fee of any sort- neither from the bank side, nor the card network (i.e. Visa).

To test this out, I paid a A$1 transaction, which came up to S$0.96; exactly what the Visa Currency Converter says it should be for a card with zero FCY fees.

Here’s the thing though: given the miserable general spend earn rate of the Trust Card (and the fact there’s no FPG spend to be done in foreign currency), I wager you’d be better off using the Amaze + Citi Rewards Mastercard for 4 mpd and no FCY fees (apart from the spread that Amaze charges).

And even if you were simply looking to minimise the cost of your transaction, or spend on something that doesn’t earn rewards (e.g. overseas school fees), you’d do better with the Revolut or YouTrip, which let you lock in a favourable exchange rate in advance. With Trust, you’re subject to whatever the prevailing rate is at the time of the transaction.

Linkpoint partner conversions

Here’s where things could potentially get interesting for miles collectors.

Back in April 2022, KrisFlyer added Link Rewards as a two-way conversion partner, allowing members to transfer miles and points between the two programmes. 1 Linkpoint is worth anywhere from 0.5 to 0.536 miles, depending on how many you transfer at one go.

|

|

| Linkpoints | KrisFlyer Miles |

| 100 | 50 |

| 200 | 100 |

| 1,000 | 500 |

| 2,000 | 1,070 |

| 5,000 | 2,680 |

What this effectively means is that the Trust Card could be viewed as a miles card with earn rates of:

- 0.118 mpd for general spending

- Up to 8.0 mpd for FPG spending (but note all the minimum spend shenanigans and caps, which means your effective rate will be much lower) during the promotion period, and 4.3 mpd afterwards

However, given that 100 Linkpoints are worth a S$1 rebate, you’re effectively buying KrisFlyer miles at:

- 2 cents per mile, for transfers of 100-1,000 Linkpoints

- 1.87 cents per mile, for transfers of 2,000 Linkpoints and above

That’s on the high side, and I’d prefer to use Linkpoints for rebates instead.

Linkpoints can also be transferred to airasia rewards (formerly known as BIG) and Park Rewards at the following rates:

- 1,000 Linkpoints = 420 airasia points / 2,000 Linkpoints= 880 airasia points

- 1,000 Linkpoints= 300 Park$ / 2,000 Linkpoints= 650 Park$

Neither ratio is particularly appealing.

Linkpoints could previously be transferred to Asia Miles and GrabRewards points as well, but these partnerships have been indefinitely suspended, with “no plans to continue them in the near future” (as quoted to me by a customer service officer).

Conclusion

Trust Card Trust Card |

|||

| Download (Android) | |||

| Download (iOS) | |||

| Use code: EVX76G17 and get cashback of S$5 to S$1,000 |

Does the Trust Card have its use cases?

It most certainly does. I kind of think of it as an auntie card, suitable for retirees who do the bulk of their spending within the FairPrice ecosystem (and are hopefully aware of the need to spend at least S$450 outside of it). The fact that they’re planning to set up a “customer experience centre” at VivoCity FairPrice to help the less technically-inclined setup an account suggests the type of clientele they’re looking at.

Moreover, they’ve built an app that delivers an idiot-proof sign-up process. My approval came instantly, and other banks could learn from how smooth and seamless the experience feels.

As a tool for rewards optimisers, however, the Trust Card is virtually irrelevant. I’m struggling to think of a role for it, because even from a groceries perspective, you could do much better with other cards on the market (not to mention spare yourself the cognitive load of navigating all the gotchas).

Again, this suggests it’s a me problem more than anything else. I’m sure the Trust Card will find its niche; I mean, the erstwhile Plus! card did very well for OCBC even though it never came across my radar at all.

And if it wants to do so while utilising every emoji in the world, who am I to say 💩?

The sack of rice is definitely the heaviest sign up bonus out there lol… Very generous!

Not just approval, but rejection came instantly too. Not sure why I was rejected when I meet the minimum requirement with a AA rating (maybe because I am currently unemployed, who knows). And I was told by CS that I can reapply immediately: just need to “uninstall the app and reinstall the app again in order to onboard and apply for credit card again” lol.

For the vouchers, any idea if we can stack it and use it in the store, or is it online only, 1 voucher per order?

wut. if nothing’s changed since you first applied, i wonder why they think applying again will help. what’s that definition of insanity again?

how come i didnt see the $25 voucher

me too! Saw nothing at all.

How do you convince asians to sign up for a product? Free rice ofcourse!

Mine was not instant approval and got stuck at the screen with your application is being reviewed and get back within 3 business days. I have like 8 credit cards and never have any problem with instant approval.

So YMMV.

Wife’s not instant either, probably because she’s self employed

Just tried applying and met with the application being reviewed and get back within 3 business days screen too. I am not self employed though but salaried employee and also have other credit cards.

I was not instant approved either. I am salaried employee.

Could be that i just got a AMEX card 2+ months ago.

I find the lack of emoji here disturbing 👿

Guess this is useful for people with the ocbc ntuc card to have the replacement card since ocbc discontinuing that next year

This is the first article in milelion history where I didn’t finish the whole article, and was reading only every other 5 lines. Still have no idea how this card works 😂

having spent 8 hours writing it, i don’t think i’m any clearer either.

On the FPG spend, only 0.5% is uncapped but it goes up to 2.5% for the base rate without the rest of the monthly/quarterly requirements. Which i guess isn’t terrible?

It is no surprise the rewards are crap – i mean SCB? Just think of their X card and say no further. NTUC could have done no worse.

What’s the maximum amount you can withdraw overseas via debit card without a fee?

Revolut is great but there’s a ~300sgd limit which might make this card a great back up for when you exceed the limit

A plain reading of the T&Cs suggest no cap. Which is exactly why I’m planning on getting the debit card.

I tried opening an account and THERE IS NO WEB ACCESS!! That’s right, there’s no UNIVERSL WAY TO ACCESS YOUR MONEY from any computer or phone. You need to download an app! You lose your phone, you’re toast. Your phone updates and the app isn’t compatible (not the first time) and you’re toast. You change from a Xiaomi MIO phone and you’re toast (there’s no app for that). You want to print a transaction receipt from your laptop and you’re toast. Download transactions? Nope. Even copy and paste cannot. How did MAS approve a bank that lacks even the basics… Read more »

Thank you for the lowdown on Trust Bank and Cards. 😉

In Milelion We Trust 🙂

Would applying for this card affect new to bank status with SCB? Just cancelled X card in June 2022 so waiting for NTB status to reset.

My wife who has an existing SCB credit card says her Trust card limit was very low due to her holding a SCB card.

Hey, really interesting and helpful article.

Apologies if my math is wrong. I’m looking at the union member card because even if you don’t use the UTAP funding, there is 4% rebate on NTUC up to 6k annual spend. $2925 yearly or $244 monthly at NTUC would cover that. Not sure where you got the 2023 rates, but let’s assume the Linkpoints caps are the same for the NTUC version. The $350 minimum monthly spend of non-FPG together with the $267 maximum monthly spend to hit the quarterly bonus cap gives a rebate of 6.18 Lpd a month. The next FPG spend of $233 to hit… Read more »

The trick for the Citi Cash Back card is to frontload your supermarket spending by buying vouchers. NTUC Fairprice goes one step further by using gift cards that you can deduct down to the cent. Then you can slowly exhaust the gift card balance and top up again when the times comes.

If the first month’s min spend is waived, does that mean I can just spend $734.00 for the first month to enjoy 8 link points her dollar? This gets me 5872 link points or $58.72 (12.5% rebate) ?

I don’t know about others but I’ve been spammed so many damn times by their emails. Hitting the unsubscribe link multiple times over days yielded NOTHING and I didn’t get whatever freebie they said they were gonna give me. I got most annoyed by their constant spamming that they have upgraded this and that that I deleted the app in disgust

And I’m a staff of this bank

Thanks for the comprehensive review. Also note that there are several service and product issues with trust bank which I hope they resolve. I am unable to get link points with the card and the cashier at fair price was unable to help either so I am out of luck unless trust bank fixes it.

For an “all digital” bank without a brick and mortar premises their customer service seems to have gone missing. Try contacting a human or getting answers to your problems. Again … I hope these are just teething problems that they fix.

But remember that Trust is meant to cater to older users and the less tech-savvy…..

If you happens to retire recently, you will be not be eligible for this Trust Credit Card as a “replacement” even if you want to.

Nice review, honest and intelligent

Can we apply for a sub card with the Trust Card?

Hopeless customer service. I’m being scammed on overseas transactions which merchant is not responding to my requests to cease current & future payments & these useless credit card customer service representatives keep saying it can’t do anything about it but just keep on apologising even after letting them know that I’ll be cancelling my credit card with them, they just ignore what I mentioned & reply with automated pre-scripted messages asking if there’s anything else they can help me with, will be ending the chat, glad they could help me (which was no help at all) thanking me for using… Read more »

Although they said “Up to 21% saving”, but but…. is 21% saving possible? I calculated with several combinations, it looks like not possible due to “cap/limit” and “minimum eligible spend” as stated in the Term and Condition. I might be wrong, but hopefully someone from Trust Bank can explain the truth. Thank you.

I dont’ recommend Trust credit card. It has rejected late fee waiver request. That shows they dont’ value customer relations given I’ve used their card frequently. Compared with established banks, Trust bank makes money from people’s occasional late fee payment mishaps, other banks that I’ve used– OCBC, UOB, HSBC, Stanchart, etc. — all have approved waiver requests.

[…] Select either the Credit Card or Savings Account. I chose the Savings Account because we have enough credit cards. It’s at 1% p.a. for the first $50,000 and as a bank, the deposit is insured by SDIC for S$75,000 per customer account. If you are interested in the credit card, Milelion.com did a detailed review on it: milelion.com/2022/09/02/trust-link-credit-card-review-too-many-emoji-not-enough-free-rice. […]