Name something that manages to get worse all the time.

If you said “Justin Bieber’s discography” or “your hairline” you’d be right, but what I actually had in mind was GrabRewards.

The GrabRewards programme has a knack for constantly plumbing new depths, whether it’s cutting earn rates, increasing redemption costs, devaluing partner transfers (often without notice), or nerfing points for credit & debit card payments.

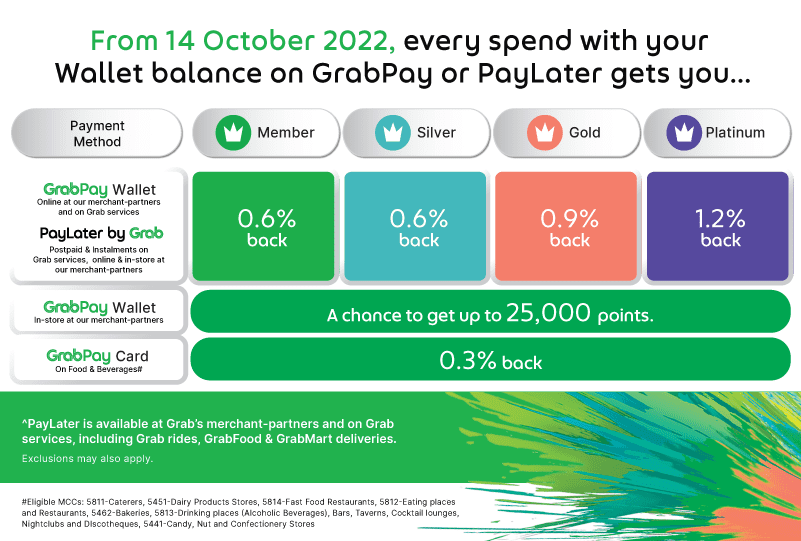

And yet it somehow manages to get even worse from 14 October 2022, where:

- Virtually all rewards for GrabPay Card transactions will be removed

- GrabPay in-store payments will receive a randomised number of points, instead of the regular 3-6 points/S$1

By this point, GrabRewards can basically be summarised as follows:

GrabReward’s latest nerf

Here’s the current GrabRewards earning structure, valid until 13 October 2022.

| GrabRewards Earning Structure (Until 13 Oct 2022) |

||

| Tier | GrabPay Card | GrabPay Wallet & Pay Later |

| Member | 3 | 3 |

| Silver | 3 | 3 |

| Gold | 4.5 | 4.5 |

| Platinum | 6 | 6 |

GrabRewards members earn between 3-6 points per S$1 when they pay with their GrabPay Card, GrabPay Wallet or PayLater. 1 GrabRewards point is worth 0.2 cents, so that’s an effective rebate of 0.6-1.2%.

As a reminder, GrabRewards points are no longer awarded for credit or debit card payments made in the Grab app, effective 1 August 2022. You’ll still earn your regular credit card rewards as per normal, however.

Now here’s the revised GrabRewards earning structure, which takes effect from 14 October 2022.

| GrabRewards Earning Structure (From 14 Oct 2022) |

|||

| Tier | GrabPay Card | GrabPay Wallet (In-store) |

GrabPay Wallet (Online)* & PayLater |

| Member | 1 (F&B) 0 (all other trxns.) |

Random | 3 |

| Silver | 3 | ||

| Gold | 4.5 | ||

| Platinum | 6 | ||

| *Includes rides & deliveries |

|||

Make no mistake. This is the final nail in the GrabRewards coffin, if there ever was one.

No more points for GrabPay Card

Are you a habitual GrabPay Card user? You might want to stop.

Grab is removing GrabRewards points for all GrabPay Card transactions except F&B, which earns a miserly 1 point per S$1. No, that’s not a typo. You earn just 1 point, regardless of tier.

| ❓ F&B Definition | |

| Grab defines F&B as any transaction with the following MCCs: | |

|

|

GrabPay in-store points replaced with lucky draw

If you thought that was bad, how’s this for derisory.

GrabPay users will no longer earn 3-6 points for in-store transactions (the ones where you scan the QR code). Instead, they will receive a randomised number of GrabRewards points, ranging from 0 to 25,000. Who wants to bet how that algorithm is weighted?

That’s right, Grab is replacing guaranteed points with what’s effectively a gacha mechanic, and passing it off as an enhancement. Oh sure, some people will get lucky and win the 25,000 points, and Grab will plaster their faces all over its marketing, but remember: the house always wins.

It almost sounds like satire, until you realise they’re dead serious.

GrabPay online and PayLater unchanged

The only things to emerge unscathed are:

- Online GrabPay Wallet transactions

- PayLater transactions

- Grab rides & deliveries

These will continue to earn 3-6 points per S$1, depending on your tier, and depending on your payment mode (you won’t earn points on rides and deliveries if you pay via credit card).

Well, for now anyway.

Does GrabPay still have any uses?

With the latest nerfs, there’s just simply no more reason to use GrabPay for retail spend.

I’ve said it before and I’ll say it again. The only remaining use case for GrabPay is as a conduit to earn rewards on transactions that are normally ineligible.

This involves funding your GrabPay wallet with a card that still earns rewards for top-ups, then using the balance to pay for things like income tax, MCST fees, town council fees, insurance premiums, hospital bills via AXS.

There are currently only three credit cards which still earn rewards for GrabPay top-ups. Enjoy them while they last.

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX SIA Business Card AMEX SIA Business CardApply |

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback | No cap |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback | No cap |

In addition to this, I suppose GrabPay in-store payments might still be useful for merchants that don’t accept credit cards. I’m thinking about hawker centres and HDB shops where the ability to earn 1.8 mpd or 1.7% cashback, plus a lucky draw chance, is still better than walking away empty-handed.

And since GrabPay online payments are still unscathed, those who pay their utilities bill online (e.g. Geneco) can continue to earn up to a 1.2% rebate in points.

Conclusion

The latest edition of GrabReward’s death by a thousand cuts starts from 14 October 2022, with points all but removed from the GrabPay Card, and GrabPay in-store transactions rewarded with a glorified lucky draw.

Tucked away on the GrabRewards landing page is this little nugget.

We’ll continue to update the GrabRewards programme to make it relevant to you so check back here occasionally to see how we’re making your everyday transactions, rewarding.

That’s ominous, to say the least. But at this point, how much worse can they really make it?

If you’re reading this Grab, that’s not a challenge.

October 14th….reminder to cut up the card.

can still use it as public transport card to get 1.8mpd/1.7%…

SCB Smart Card for 6% cashback

Are you sure this works? It’s probably excluded in the t&c…

It’s advertised clear as day on their website. Daily commute : Bus and MRT

When they finally stop awarding points/rebates for topping up the damn wallet, only the most uninformed of boomers will be left using their payment services.

Nope. The main use is still as Amex proxy. The extra points are just good to have. Card is only dead when they start charging processing fees to top up. Right now there’s still a lot of benefit using some form of Amex card for rewards on PayNow QRs.

The next change will be:

1% top up fees

No reward point unless use grab service with grab wallet.

S$10 per month membership fee to use grab service

More than happy to see that happens, then Grab dead, we welcome Uber back

First one might happen soon, possibly before end of the year. Make hay.

Second one already implemented, right? Grab can’t influence banks to nerf the banks’ own cards reward points, but they already stopped awarding GrabRewards points for credit/debit card payment.

Third one…surely you jest. I would immediately switch to taking cabs again.

Can use capitacard amex to top up grabpay account to pay for restructured hospital bills. $1200 will get a month worth of free carpark. 🙂

There is still value for GPMC in its place, much to the disappointment of this article, especially in the realm of cashback if we do dive into the intricacies.

But alas, this seems like the wrong forum for it, so it’d be best to keep things relevant here.

They nerf it right before the next power up challenge. Good shit.

Hi Aaron, there’s a typo in your article:

“Does GrabPay still have any uses?” should read “Does GrabPay still have any users?”

No need to thank me…

Ha! Well at this rate…

Does anyone know if this new change affects online payments using GPMC? Example, Geneco allows both GP Wallet and GPMC online payment methods.

GPMC online – ???

GPMC paywave – changed to 0.3% for F&B only

GP Wallet online – no change

GP Wallet QR in store – changed to lucky draw

Actually, I don’t really care about the points. As long as the cashback from Amex remains, I’ll still use it until the $30,000 annual limit.