| ⚠️Important Note |

|

Standard Chartered has switched to a new points redemption portal, and for the moment it appears as if non-Visa Infinite points cannot be pooled with Visa Infinite points. I’m in the midst of investigating this further, and will update the post when I learn more. In the meantime, the article below refers to how the legacy system worked. Use it as an FYI for now! |

Standard Chartered can be a confusing bank for first-time miles chasers.

In addition to having two different rewards portals (which leads some to mistakenly believe that KrisFlyer transfers are no longer possible), they also have two different conversion rates: one for Visa Infinite cardholders, and one for everyone else. This means that the number of miles that 1 Standard Chartered 360° Rewards Point gets you depends on what Standard Chartered cards you have.

In this post, we’ll look at how this strange system works.

Standard Chartered’s two-tier rewards system

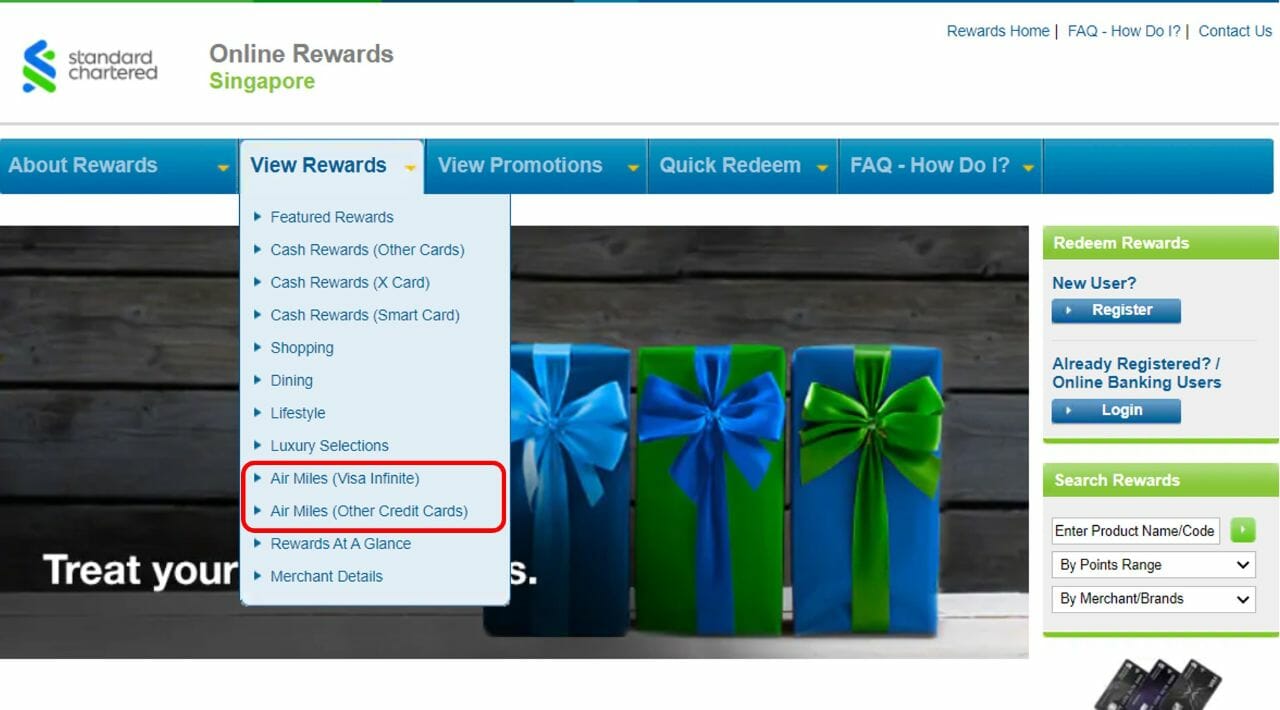

Browse the Standard Chartered online rewards catalogue, and you’ll notice something odd.

On the dropdown menu, there’s two options for miles:

- Air Miles (Visa Infinite)

- Air Miles (Other Credit Cards)

Click the Air Miles (Visa Infinite) option, and you’ll see a redemption with a rate of 2,500 points = 1,000 KrisFlyer miles.

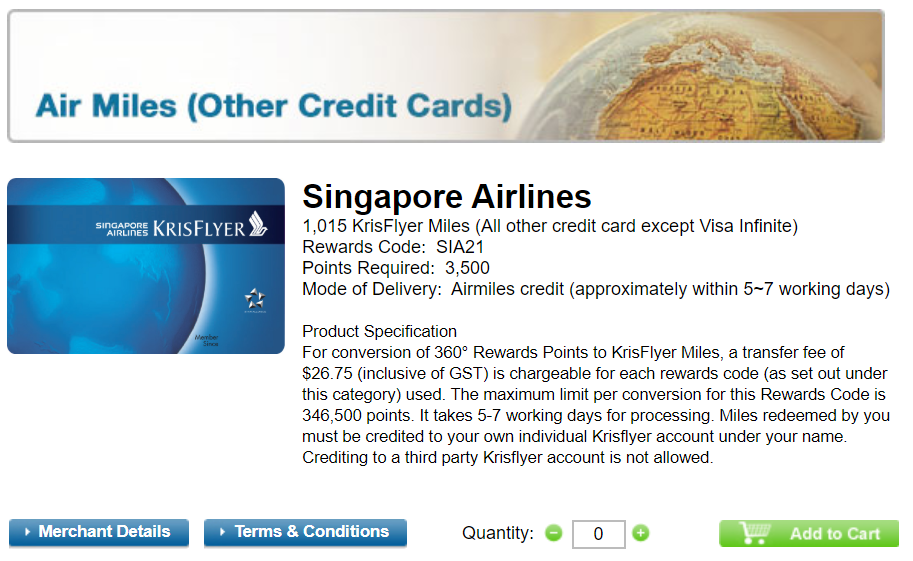

Click the Air Miles (Other Credit Cards) option and you’ll see a redemption with a rate of 3,500 points = 1,015 KrisFlyer miles.

In other words, there’s one rate for Visa Infinite cards, and another for non-Visa Infinite cards.

- Visa Infinite: 1 point = 0.4 KrisFlyer miles

- Non-Visa Infinite: 1 point = 0.29 KrisFlyer miles

Standard Chartered currently has three different Visa Infinite cards (this is often confusing because there’s literally a card called the Standard Chartered Visa Infinite).

Do note that this quirk does not affect Standard Chartered’s other transfer partners, where the conversion rate is the same regardless of whether you hold a Visa Infinite or non-Visa Infinite card.

| Frequent Flyer Programme | Conversion Ratio (SC Points: Partner) |

| 2,500: 1,000 |

|

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 3,000: 1,000 | |

| 3,500: 1,000 | |

| 3,500: 1,000 | |

|

3,500: 1,000 |

| 5,000: 1,000 |

How to take advantage of the better rate

What if you’ve been earning points on a non-Visa Infinite card all this while? Are you just out of luck?

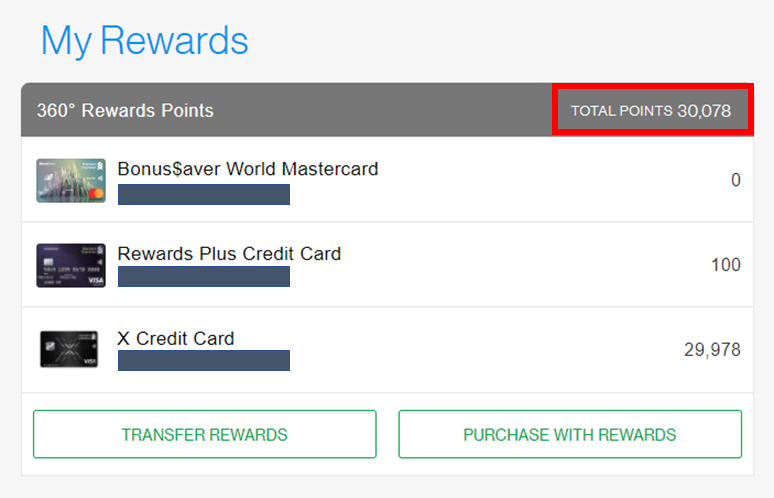

Not quite. Standard Chartered pools points, and if you have a Visa Infinite card, all your points can be redeemed at the more favourable rate, regardless of where they were earned. In the example below, notice how the 100 points on the Rewards+ Card are pooled with the 29,978 points from the X Card during redemption.

This might have been a tall order a few months ago, since Standard Chartered Visa Infinite cards all had high income requirements or hefty annual fees/AUM. But the X Card now offers a first year fee waiver, and its S$80,000 income requirement has been revealed to be more of a serving suggestion than a hard and fast rule. This would be my pick, if you wanted to enhance the value of your existing 360° Rewards Points.

Did the SC X Card just become Singapore’s best general spending card?

Here’s the bump to your earn rates for the SC Rewards+ Card and SC Smart Card, simply by adding a free X Card to the mix.

| Without Visa Infinite | With Visa Infinite | |

SC Rewards+ Card* SC Rewards+ Card* |

2.9 mpd on FCY spend | 4 mpd on FCY spend |

SC Smart Card^ SC Smart Card^ |

5.6 mpd on fast food, streaming, SimplyGo | 7.7 mpd on fast food, streaming, SimplyGo |

| *Capped at S$2,222 per membership year ^Valid till 31 Dec 2023 |

||

Frankly I wouldn’t bother with the SC Rewards+ Card, but the SC Smart Card (perpetual fee waiver) could be a good option now that the 7.7 mpd earn rate on fast food, streaming entertainment and SimplyGo has been extended till 31 December 2023.

Conclusion

Standard Chartered’s rewards system is confusing to say the least. Instead of having two different redemption rates, I don’t see why they couldn’t have one rate, and adjusted the earn rates of the Visa Infinite and non-Visa Infinite cards accordingly.

Given the ease with which you can now get a Standard Chartered X Card, however, there’s no reason why you should accept the lower rate!

SC Visa Infinite

SC Visa Infinite

SC Priority Banking Visa Infinite

SC Priority Banking Visa Infinite

Hey Aaron! For the SC Smart Card, do you earn 7.7mpd even with the SC X Card?

under the old system, yes. but with SC’s new rewards portal, it’s not clear if pooling is still a thing anymore. i will need to investigate further

I just did a transfer for my SCVI last week at 2500:1000

I notice that my SCSmart rewards is a seperate entry and if I select that for transfer, it shows 3500:1000

It may well be that if I ever flatten my SCVI balance, it will start to pool/pull from SCSmart and still exchange at 2500:1000

But I don’t see how that is a viable option for people with high balance in their SCVI, which they don’t intend to flatten just for the sake of the SCSmart card. Resign myself to 3500:1000 for my SCSmart for now

Tried SCB’s new portal today (the date of this article). So far the Convert Points to Air Miles function is not working (for me at least). There’s supposed to be a slider function for points to convert but it’s not appearing. 🙁 Hopefully it’s just momentary as I need some KF miles to book some flights ASAP.

Only KrisFlyer for redemption partner now seemingly.

I’m unable to redeem my points at the more favourable rate now. 🙁

1015 KF miles for 3500 points for non-visa infinite

1000 KF miles for 2500 points for visa infinte

A transfer fee of $27 (inclusive of GST) is chargeable for each order. :'(

I can only convert to Krisflyer program now. What happened to all their other programs? They are still on their website, but no functionality to convert? Called them and agents don’t know anything either.

I found the same as well (ie can only see option for Krisflyer conversion).

The reward for each card seems to be individually tracked as well. Looks like SCB is forcing us to convert by card. DAMN.