I’ve thrown my share of peanuts at the SC X Card, Standard Chartered’s ill-fated attempt to break into the metal card market.

This product, launched with such fanfare and an unprecedented 100,000 miles sign-up bonus, quickly became the laughing stock of the market due to its fulfilment issues, strictly-no-waivers-but-ok-here’s-a-waiver drama, and the general incredulity that SC expected cardholders to pay S$695.50 for essentially two lounge visits.

All in all, the SC X Card went from headline news to virtual irrelevance in the space of just a year, making me wonder what on earth the strategy was.

But credit where it’s due, because the SC team may have just pulled a 1,000 IQ move that turns the X Card from punchline to something actually useful.

SC X Card now offering first year annual fee waiver

Apply Apply |

|||

| Income Req. | S$80,000 p.a. | Points Validity | No expiry |

| Annual Fee (Inc. GST) |

S$695.50 (waiver option) |

Min. Transfer |

2,500 points (1,000 miles) |

| Welcome Gift | 30,000 miles (with payment of AF) |

Transfer Partners |

|

| FCY Fee | 3.5% | Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

Applicants for the SC X Card can now enjoy a choice of:

- A first year fee waiver, or

- A 30,000 miles sign-up gift, with payment of the S$695.50 annual fee

There’s absolutely no reason to take the miles. Given the annual fee of S$695.50, that’s paying 2.32 cents apiece– way too expensive when you can generate them from around 1 cent apiece through Citi PayAll’s periodic promotions.

The smarter option is to take the first year fee waiver. Now, SC is careful to emphasise the “first year” part. Per the T&Cs (emphasis mine):

You will not be eligible for the X Card Upfront Gift Promotion.

However, you and your supplementary X Cardholder (if any) will enjoy an annual fee waiver for the first year. You will only be charged with an annual fee of S$695.50 (including GST) and the supplementary X Cardholder (if any) will be charged with an annual fee of S$107 (including GST) in the subsequent year(s).

For the avoidance of doubt, this annual fee will only be waived in the first year but is strictly not waivable in the subsequent year(s), for as long as the principal X Card and supplementary X Card is active

But come on, we all know what the deal is. Despite this rhetoric, SC has had no qualms about waiving the X Card’s subsequent years’ fees in 2020, 2021 and 2022. It’s not like they had much of a choice; no one in the right mind would pay S$695.50 for what the X Card has to offer.

So I’m going to call their bluff on this, and look, even if they do change their minds down the road and charge the 2nd year’s annual fee (good luck with the exodus), there’s nothing stopping you from cashing out your points, cancelling the card and getting a refund.

Given that the annual fee is no longer an issue, why should you seriously consider getting an SC X Card?

Why use the SC X Card for general spend?

The SC X Card may not be the highest earning general spend card on the market, but when you consider what it brings to the table, I think there’s a case to be made for it being one of the best general spending options on the market.

Generous rounding policy

The SC X Card earns 1.2 mpd on local spend, and 2.0 mpd on FCY spend. That’s on par with most of its general spending rivals, though not quite top of the class.

| Card | Local MPD | FCY MPD |

UOB PRVI Miles UOB PRVI Miles |

1.4 | 2.4 |

OCBC 90°N Mastercard OCBC 90°N Mastercard |

1.2 | 2.1 |

SC X Card SC X Card |

1.2 | 2.0 |

Citi PremierMiles Citi PremierMiles |

1.2 | 2.0 |

DBS Altitude DBS Altitude |

1.2 | 2.0 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 | 2.0* |

OCBC 90°N Visa OCBC 90°N Visa |

1.0 | 2.0 |

| *June and Dec only, otherwise 1.1 mpd | ||

But here’s the thing: SC has one of the best miles calculation policies on the market.

While some banks round your transaction down to the nearest S$5, and others to the nearest S$1, SC awards 360° Rewards Points even on the cents.

| 💳 SC X Card Calculations | |

| Local Spend | Multiply transaction by 3, then round to nearest whole number |

| FCY Spend |

Multiply transaction by 3, then round to nearest whole number. Multiply transaction by 2, then round to the nearest whole number. Add the two figures. |

Therefore, the minimum spend required to earn points is S$0.17, whether in local or foreign currency.

This means the SC X Card will always outperform the Citi PremierMiles Card, DBS Altitude Card and OCBC 90°N Card, even though they have the same headline earn rates. It also means it can sometimes trump an ostensibly higher-earning card like the UOB PRVI Miles, at least where small transactions are concerned.

Wide range of transfer partners

Moreover, there’s quantity of points, and there’s quality of points.

SC has one of the widest range of transfer partners on the market. Cardholders can transfer points to 10 different transfer partners, with a transfer fee of S$26.75:

| Frequent Flyer Programme | Conversion Ratio (SC Points: Partner) |

| 2,500: 1,000 | |

| 2,500: 1,000 |

|

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 3,000: 1,000 | |

| 3,500: 1,000 | |

| 3,500: 1,000 | |

|

3,500: 1,000 |

| 5,000: 1,000 |

Compare that with the number of transfer partners competing cards have:

| Card | Transfer Partners |

Citi PremierMiles Citi PremierMiles |

12 |

SC X Card SC X Card |

10 |

DBS Altitude DBS Altitude |

4 |

UOB PRVI Miles UOB PRVI Miles |

2 |

OCBC 90°N Mastercard OCBC 90°N Mastercard |

1 |

OCBC 90°N Visa OCBC 90°N Visa |

1 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1 |

This makes 360° Rewards Points more valuable than DBS Points, UNI$ or Travel$ (although OCBC is supposedly adding seven new transfer partners soon, so we’ll need to keep tabs on that).

2 free Priority Pass visits

SC X Cardmembers enjoy two complimentary Priority Pass visits per membership year.

That’s on par with other general spending cards like the Citi PremierMiles Card and the DBS Altitude Visa, and better than the OCBC 90°N Card and UOB PRVI Miles.

| Card | Free Lounge Visits |

Citi PremierMiles Citi PremierMiles |

2x |

SC X Card SC X Card |

2x |

DBS Altitude DBS Altitude |

2x (Visa only) |

UOB PRVI Miles UOB PRVI Miles |

0 |

OCBC 90°N Mastercard OCBC 90°N Mastercard |

0 |

OCBC 90°N Visa OCBC 90°N Visa |

0 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

0 |

Non-expiring points which pool

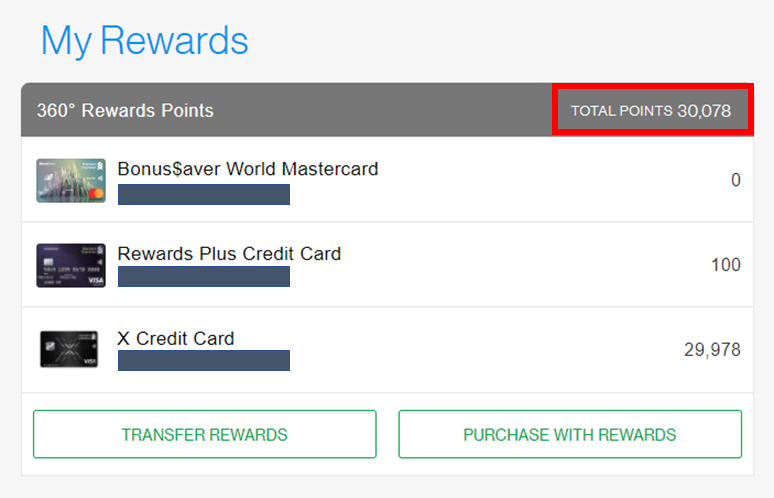

360° Rewards Points earned on the SC X Card never expire, and pool across cards.

Unlock extra miles with Rewards+ and Smart Cards

| ⚠️ Important Update |

| Standard Chartered has launched a new rewards portal, which unfortunately removes the ability to pool points when redeeming KrisFlyer miles. Therefore, this benefit no longer applies. |

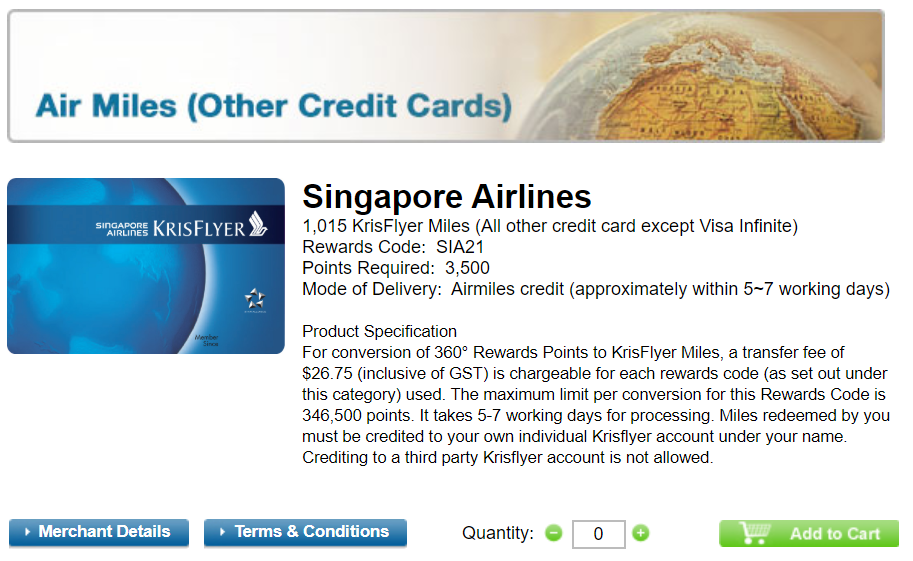

For the uninitiated, SC has a two-tier rewards system:

- Visa Infinite cardholders redeem KrisFlyer miles at a rate of 2,500 points= 1,000 miles

- Non-Visa Infinite cardholders redeem KrisFlyer miles at a rate of 3,500 points = 1,015 miles

Here’s the fun part. If you have a SC Visa Infinite or X Card, all your rewards points can be redeemed at the 2,500 points = 1,000 miles rate. You can see this illustrated in the screenshot below, where the 100 points on my Rewards+ card are pooled with those from the X Card.

This means that if you have the SC Smart Card or SC Rewards+ Card, you can boost the value of your miles by simply adding a free SC X Card to the mix.

| Without Visa Infinite | With Visa Infinite | |

SC Rewards+ Card* SC Rewards+ Card* |

2.9 mpd on FCY spend | 4 mpd on FCY spend |

SC Smart Card^ SC Smart Card^ |

5.6 mpd on fast food, streaming, SimplyGo | 7.7 mpd on fast food, streaming, SimplyGo |

| *Capped at S$2,222 per membership year ^Valid till 31 Dec 2023 |

||

Frankly I wouldn’t bother with the SC Rewards+ Card, but the SC Smart Card (perpetual fee waiver) could be a good option now that the 7.7 mpd earn rate on fast food, streaming entertainment and SimplyGo has been extended till 31 December 2023.

It’s a free metal card

Does a metal card matter? That depends who you ask. Some find it the height of frivolity, others genuinely desire it as a status symbol.

I don’t judge; I just want to point out that with the annual fee waiver, the SC X Card would be the first free metal card on the Singapore market. Even if we’re talking debit cards, the Revolut Metal has a S$19.99 monthly subscription fee, and the Crypto.com metal Visa cards require you to stake volatile crypto.

Of course, it’s always possible that with the annual fee waiver, SC makes the switch back to plastic (see below), so don’t let this be the only reason you get the card.

What about the income requirement?

Some of you may be reading the above and wondering why I’m comparing the SC X Card to cards in the S$30,000 segment. Isn’t the minimum income requirement S$80,000?

Officially, yes. But I’ve seen a few data points of people getting approved in the S$30,000 to S$80,000 range, which leads me to believe they’re not being strict about this anymore.

If you think the SC X Card might be right for you (words I never thought I’d type!), there’s absolutely no harm throwing your hat into the ring by submitting an application- the worst they can say is no.

Are there changes afoot?

All of the above is written with the assumption that SC X Card’s CVP won’t change, and while I’ve seen no evidence to the contrary on the website, there’s two things to note.

The first is the possibility that X Cards issued under the fee waiver scheme will come in plastic.

That’s happened before in 2019, although the reason was a shortage of card stock rather than anything else. Metal cards do entail a substantial production cost (compared to plastic cards at least), so I find it hard to believe that SC would just give them away for free.

The second, more crucial question is whether the X Card will remain a Visa Infinite.

To the best of my knowledge, Visa does not allow card issuers to offer a Visa Infinite Card at the S$30,000 income mark, unless there’s further requirements like a minimum AUM (as is the case for the OCBC Premier VOYAGE).

If SC maintains the official income requirement at S$80,000 (while still accepting applicants below this on the sly), there probably won’t be any issues. But if they lower the offical income requirement to S$50,000, even S$30,000, it’s unlikely this will remain a Visa Infinite. And if that means cardholders are no longer entitled to the 2,500 pts: 1,000 miles conversion rate, then we’d be back to square one.

Of course, I don’t see how SC can expect the X Card to be competitive with earn rates below 1.2/2.0 mpd, but then again these are the same guys who thought a S$695.50 card with close to zero benefits would take the market by storm, so…

Conclusion

The SC X Card now offers a first year fee waiver, and given their penchant for waiving subsequent years’ fees as well, this might actually be a great general spending card.

You get a (possibly) metal card with 1.2/2.0 mpd earn rates, a very generous rounding policy, many transfer partners, and two free Priority Pass visits.

Would I pay S$695.50 for that? Heck no. But free? Free is good.

Free is good.

Free is good.

Free is good

Free is good

Free is good.

good, it’s free.

Free is good.

Friend is food

Would anyone know if the fee waiver is given to existing cardholders as well?

asking this also

Existing as in existing X Card holders or existing SCB cardholders?

If the latter, I can confirm yes, fee waiver will be given.

If the former, see https://milelion.com/2021/07/27/surprise-again-standard-chartered-x-card-waives-3rd-year-annual-fee/

Good not cheap

Cheap not good

Fish are friends, not food

So basically just apply for free for the 2 PP visits then ditch the card?

it is 2022, not 2002, who would like to carry a metal card? all digital payments already!

Use it to impress a date or family at dinner

Exactly, some gal was gushing that her friend used a metal card to pay and was like that friend must be rich or wat

DP: fee waiver option is metal card and proper atas box

just got my X card via fee waiver option as well. Can verify this

thanks guys! sounds awesome.

how to recycle/reuse this box? damn wasteful leh. there isn’t enough empty space to use as storage

I got the second-most atas box – it doesn’t have the lights! 🙁

I called in to cancel the X card because the app did not allow me too despite having no outstanding balance.

the cso informed me that my cancellation was blocked because I had to first pay the annual fee. fwiw, my card is due in July.