It’s been a terrible 2023 so far for AMEX HighFlyer Cardholders, who in the space of a few months have seen the once-venerable card suffer body blow after body blow.

The first year fee waiver is gone, the GrabPay-AXS-HighFlyer holy trinity is nerfed, and the GrabPay-HighFlyer option will end from 4 April 2023. Oh, and just for good measure, American Express will exclude insurance, public hospitals and utilities transactions from that date too.

This begs the question: what should you do with your AMEX HighFlyer Card come renewal? And if you don’t have one yet, is it worth sneaking in before the deadline?

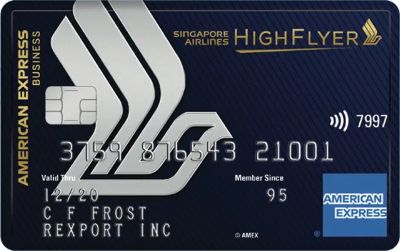

Overview: AMEX HighFlyer Card

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$301.79 |

Min. Transfer | N/A |

| Miles with Annual Fee |

None | Transfer Partners | HighFlyer |

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn | 1.8 mpd | Points Pool? | N/A |

| FCY Earn | 1.8 mpd | Lounge Access? | Yes |

| Special Earn | 2.5 mpd on SIA tickets + 6 mpd from HighFlyer | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

As recently as mid-2022, the AMEX HighFlyer Card was an absolute no-brainer to get.

By spending S$5,000 in the first 3 months of approval, you’d get 40,000 bonus HighFlyer points, an Accor Plus Explorer membership with a free hotel night, two free lounge passes, and a ticket to free miles on income tax and other AXS payments. Oh, and did I mention the first year’s annual fee was waived?

The main barrier was the need for an ACRA registration number, but so lucrative was the offer, I know more than a few individuals who decided this was the time to formalise their side-hustle!

Then American Express started winding down the party. First, it required the annual fee to be paid in order to enjoy the 40,000 points sign-up bonus. Then, it removed the first-year fee waiver option altogether.

But the real killer came on 16 January 2023, when GrabPay removed support for AXS transactions. That killed off a huge use case for the AMEX HighFlyer Card, since it was basically a way of earning free miles on income tax payments, insurance premiums, MCST fees, and basically anything that could be paid via AXS.

Even with that gone, you could still earn some free miles, insofar as Mastercard was accepted. Simply top up your GrabPay account and use the GrabPay Mastercard for hospital bills, school fees, town council fees, utilities etc.

That will end on 4 April 2023, when American Express closes the door on GrabPay top-ups altogether. In fact, the exclusion list for the AMEX HighFlyer Card is going to start looking like any other American Express card, with insurance, public hospitals and utilities also excluded from rewards.

What to do now?

Scenario 1: If you don’t have an AMEX HighFlyer Card yet

|

| Apply Here |

If you don’t have an AMEX HighFlyer Card, there’s still a case for getting approved ASAP, before GrabPay top-ups get nerfed.

In your first year, you pay a S$301.79 annual fee and get:

- Accor Plus Explorer membership with 1 free hotel night

- 2 lounge visits

- 40,000 HighFlyer Points with min. S$5,000 spend in first 3 months of approval

To the extent you can meet that S$5,000 spend with GrabPay top-ups (or any other transaction that normally wouldn’t earn points with your other cards), then I think you still end up ahead.

Just note that those choosing the GrabPay top-up route should ensure they have an outlet to spend those funds in the near future, because topping up incurs opportunity cost in the form of foregone interest.

Scenario 2A: If you have an AMEX HighFlyer Card and get an annual fee waiver

If you get an annual fee waiver, you’d be silly to cancel because you still receive the Accor Plus Explorer membership and two free lounge visits.

Keep the card and count your lucky stars.

Scenario 2B: If you have an AMEX HighFlyer Card and can’t get the annual fee waived

If you cannot get your annual fee waived, the question becomes rather simple: will you pay S$301.79 for an Accor Plus Explorer membership?

This normally retails for S$418, and comes with:

- 1 free hotel night, redeemable at more than 1,000 hotels across Asia Pacific

- Up to 50% off dining at more than 1,400 restaurants across Asia Pacific

- 15% off drinks bill in Asia Pacific

- 10% off public room rate

- Red Hot Room sales with up to 50% off

- Accor Live Limitless Silver status

If that’s appealing to you, then paying S$301.79 sure beats paying S$418. If not, then it’s time to say goodbye.

I suppose you could also factor in the value of two lounge visits, but those are fairly easy to get with other annual fee waived cards.

What am I doing?

Here’s a quick summary of how much value I derived from my AMEX HighFlyer Card in 2022.

AMEX HighFlyer Card AMEX HighFlyer Card |

|

| Perk | Value |

| 2 lounge visits | S$0 |

| Accor Plus Explorer membership | S$418 |

| “Free miles” |

S$1,277 |

| Total | S$1,695 |

As always, I need to emphasise that value is subjective. You won’t value things the same way I do, so the above table is far from prescriptive.

In any case, the first two figures are fairly straightforward.

- I don’t assign any value to the lounge visits because I already have unlimited lounge visits thanks to my AMEX Platinum Charge

- I’m taking the Accor Plus membership at face value because I’d probably have bought one anyway

It’s the “free miles” that need some explaining. Over the course of 2022, I charged roughly S$65,000 worth of GrabPay top-ups and other transactions that would normally be excluded by other credit cards (and before you say “isn’t the annual limit for GrabPay top-ups S$30,000?”, there’s nothing stopping you from topping up a partner’s account).

At a flat earn rate of 1.8 points/S$1, that’s 117,000 HighFlyer points.

Since you can only cash out 30,000 HighFlyer points to miles per year per account, I’m valuing 30,000 of those at 1.5 cents each (my KrisFlyer mile valuation), and the remaining 87,000 at 0.95 cents each (the value you’d get when redeeming them for SIA tickets- even though I’m not planning to liquidate them at that value, just think of it as being conservative).

If you have other ways of cashing out more HighFlyer points (e.g. family members involved in the business who you can add as corporate travellers, feel free to apply the 1.5 cents (or whatever your valuation for KrisFlyer miles is) figure to 60,000,90,000, 120,000 or 150,000 HighFlyer points, as need be.

And since I got my annual fee waived anyway, well, you can see how this all worked out rather nicely.

Now, how does the picture change with no annual fee waiver and no more “free miles”? Well, I’m basically in scenario 2B: do I want to pay S$301.79 for a S$418 Accor Plus Explorer membership?

That sounds good on paper, but for S$594 I could get a DBS Vantage Card with:

- 25,000 miles per year

- Accor Plus Explorer membership

- 10 free lounge visits

The 25,000 miles would be worth S$375, which means the cost of the Accor Plus Explorer membership is effectively S$219 (before taking into account the value of the sign-up bonus, which I’m not eligible for- your math may be different).

On the flip side, there is a higher cash outflow involved (S$301.79 vs S$594), and since I’m not really in the market to buy more miles, I might lean towards the HighFlyer Card.

Conclusion

The AMEX HighFlyer Card has had an incredible few years, but the curtain comes down on 4 April 2023 when GrabPay top-ups get nerfed.

In a way, it’s not that surprising. For most of 2021 and 2022, the deal really felt too good to be true, and I wondered how American Express was making the math work on their side. I guess we now have an answer, but man, was it a fun ride while it lasted.

Existing AMEX HighFlyer Cardholders- what’s your plan?

The thing is for us side hustlers we’ll probably have to fork out the annual renewal fee to ACRA before knowing if AMEX is alright to waive the annual fee. If the latter is not possible I’d strongly consider just taking my side hustle off the books.

I didn’t spend much last year on the card, but they offered me 25,000 Highflyer points (worth $238) for paying the renewal fee of $301.80, so I decided to keep for another year.

How did you get the offer?

Amex wouldn’t waive my annual fee. CSO accepted my counter offer to cancel all my amex cards. Amex doesn’t seem to have a retention team.

They do, just not to you

Spend more lah sure can one.

I charged 50k and they didn’t waive the fee. CSO said the new policy is no longer based on quantum of spend 🙂

Same here, I’ve spent more than $50K and they refused to waive off so I’m cancelling the card.

They have arguably the best retention offers among credit cards in Singapore. The problem is you’re not a customer worth retaining.

Yeah I only spent about 40K through amex last year. I’ll happily spend it on other credit cards and then sign up with amex in the future when they have an attractive offer. I have no problem churning and no problem taking advantage of whatever enticements these companies offer. I was surprised that amex didn’t even try to retain me as a customer when refusing a fee waiver resulted in cancellation of all my amex cards.

I am out..

If I get a waiver, I’ll keep it, if not, it’s bye bye highflyer card.

Question is what will happen to the highflyer points should you decides not to renew the card? Since there is a limit you can transfer out as KF. Can the highflyer account with sia still exist without the amex card?

No impact.

Any idea if they terminate accor membership immediately with the card or let the membership year run the full duration? I signed up for accor halfway through the amex year

truth to be said, it’s still a great card for its annual fee. There’s basically no flaws with the card, just some restrictions recently. People

will get adjusted to it. Amex should reward you handsomely for writing such an article for people applying through your link 🙂 or probably that’s your ultimate objective

I was talking to the CSO and even requested upper management approval for the AF waiver but still declined. Called my account manager and apparently she mentioned that if your spendings are mainly on GPay top ups, very likely that will be the reason for not waiving the AF. So byebye Amex HF.

Anymore updates recently on renewal?