Here’s The MileLion’s review of the Citi PremierMiles Card, launched all the way back in July 2007 and still going strong.

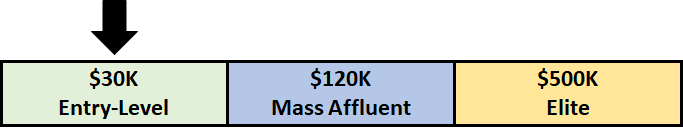

Initially positioned as a premium product with a minimum income requirement of S$80,000 (cardholders were even invited to join Citigold for a year, with a reduced AUM requirement!), this eventually gravitated towards the mass market, and today is available to anyone who meets the MAS-mandated minimum of S$30,000 per annum.

But unless you’re a snob, more accessible doesn’t mean less desirable. With a solid welcome offer, a wide variety of transfer partner and lounge access, the Citi PremierMiles Card can be a very compelling tool in your miles kit regardless of SES.

However, with the nerfing of Citi PayAll, I wouldn’t consider this card to be anywhere as essential as this time last year.

|

|

| Citi PremierMiles Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| The Citi PremierMiles Card’s transfer partner variety, lounge access and travel insurance make it a solid option, though it’s lost its Citi PayAll trump card. | |

| 👍 The good | 👎 The bad |

|

|

| Full List of Credit Card Reviews | |

Overview: Citi PremierMiles Card

Let’s start this review by looking at the key features of the Citi PremierMiles Card.

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$196.20 (First Year Free) |

Min. Transfer |

10,000 Citi Miles (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

11 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2 mpd | Lounge Access? | Yes: 2x Priority Pass |

| Special Earn | 7 mpd on Agoda 10 mpd on Kaligo |

Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Citi PremierMiles Card was originally issued on the AMEX, Mastercard and Visa networks. However, the AMEX version was discontinued in 2019, and since April 2020 all new cards have been issued on the Mastercard network only.

Existing Citi PremierMiles Visa Cards remain valid, and will continue to be replaced/renewed unless you expressly consent to switch to the Mastercard version.

| ❓ What happens to my Citi Miles if I switch? |

| If you switch from the Visa to the Mastercard, any Citi Miles accrued on the Visa will be automatically transferred to the new Mastercard account. |

In any case, there’s very little difference between the Mastercard and Visa. We’ll be referring to the Mastercard version in this review, but everything said here applies to the Visa as well unless explicitly stated.

How much must I earn to qualify for a Citi PremierMiles Card?

The Citi PremierMiles Card has a minimum income requirement of S$30,000, the MAS-mandated minimum.

If you don’t meet the income requirement, it may be possible to place a S$10,000 fixed deposit with Citibank and get a secured version of the card, with a credit limit of roughly 80-90% of the fixed deposit amount. Visit a Citibank branch if you’d like to explore this option.

How much is the Citi PremierMiles Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$196.20 (or waived, with smaller welcome bonus) |

Free |

| Subsequent | S$196.20 | Free |

The Citi PremierMiles Card has an annual fee of S$196.20 for the principal cardholder, and no fee for supplementary cards.

Cardholders can request a waiver of the first year’s annual fee, although this means they will only be eligible for a smaller sign-up bonus (see next section). Assuming you meet the definition of a new-to-bank customer, I’d strongly recommend paying the first year’s annual fee to enjoy the bigger sign-up bonus.

Annual fee waivers are at the discretion of Citi, and in my personal experience are fairly easy to obtain.

Should a waiver not be granted, paying the annual fee gets you 10,000 miles in return, which means buying miles at ~1.96 cents each. That’s certainly not the lowest price you can buy miles for, though it could still be worth it for some depending on how much you value a mile.

Sign-up bonus

New-to-bank

From now till 31 July 2024, new-to-bank Citi PremierMiles Cardholders can choose between two sign-up offers:

- 8,000 bonus miles with a minimum spend of S$800, with a first year fee waiver

- 30,000 bonus miles with a minimum spend of S$800, with payment of the S$196.20 annual fee

| ❓ New-to-bank Definition |

| New-to-bank customers are defined as those who do not currently hold a principal Citi card, and have not in the 12 month period before application. Debit cards, supplementary cards and corporate cards do not count. |

The S$800 must be spent within the first 2 months after approval, otherwise known as the qualifying period. The qualifying period runs from the approval date and two full calendar months following that. For example, those approved on 15 August 2023 will have until 31 October 2023 to meet the minimum spend.

In other words, you actually have 2-3 months to hit the minimum spend, and should apply as early in the month as possible to maximise your time.

For the full details, refer to the following post.

Existing

If you already hold any principal Citi credit card, or cancelled one in the past 12 months, there is no sign-up bonus available to you. You will automatically be granted a first year fee waiver.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 1.2 mpd | 2 mpd | 7 mpd on Agoda 10 mpd on Kaligo |

SGD/FCY Spending

Citi PremierMiles Card members earn:

- 1.2 Citi Miles for every S$1 spent in Singapore Dollars (SGD)

- 2 Citi Miles for every S$1 spent in foreign currency (FCY)

1 Citi Mile is worth 1 airline mile, so that’s an equivalent earn rate of 1.2 mpd for local spending, and 2.0 mpd for FCY spending.

These were once respectable rates for its segment, but in recent times, the HSBC TravelOne Card, DBS Altitude Card and OCBC 90°N Card have leapfrogged the PremierMiles.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2 mpd* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2 mpd* |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

| *In June and Dec only, otherwise 1.1 mpd | ||

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 3.25% fee, using your Citi PremierMiles Card overseas represents buying miles at 1.63 cents each.

Bonus miles on Kaligo & Agoda

|

| Citi x Kaligo |

| T&Cs |

Citi PremierMiles Cardholders who make hotel bookings through Kaligo by 31 December 2024 will earn an uncapped 10 mpd. The booking can be made for any future stay date.

|

| Citi x Agoda |

| T&Cs |

Citi PremierMiles Cardholders who make hotel bookings through the special Citi x Agoda landing page by 31 December 2024 (with stay date up till 30 April 2025) will earn an uncapped 7 mpd.

Do note that hotel prices for bookings made through Kaligo or the Citi x Agoda website may be inflated, compared to other channels (what’s going on is that Kaligo/Agoda are simply rebating some of the commission they receive from the booking in the form of miles).

It might still be worth it, depending on the price difference and how much you value a mile. Think of it like buying additional miles when booking a hotel.

While both of these offers technically have end dates, they have been perpetually renewed for the past few years and can be considered evergreen until further notice.

When are Citi Miles credited?

Citi Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are Citi Miles calculated?

Here’s how you can work out the Citi Miles earned on your Citi PremierMiles Card.

| Local Spend | Round down transaction to nearest S$1, then multiply by 1.2 Round to the nearest whole number |

| FCY Spend |

Round down transaction to nearest S$1, then multiply by 2.0 Round to the nearest whole number |

This means the minimum spend required to earn miles is S$1. Because of this rounding policy, the Citi PremierMiles Card can potentially outperform a “higher-earning” card like the UOB PRVI Miles Card, depending on transaction size.

Citi PremierMiles Citi PremierMilesEarn rate: 1.2 mpd |

UOB PRVI Miles UOB PRVI MilesEarn rate: 1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 11 miles | 6 miles |

| S$15 | 18 miles | 20 miles |

| S$19.99 | 23 miles | 20 miles |

| S$25 | 30 miles | 34 miles |

| S$29.99 | 35 miles | 34 miles |

| S$35 | 42 miles | 48 miles |

| S$39.99 | 47 miles | 48 miles |

If you’re an Excel geek, here’s the formulas you need to calculate:

| Local Spend | =ROUND (ROUNDDOWN (X,0) *1.2,0) |

| FCY Spend |

=ROUND (ROUNDDOWN (X,0) *2,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for Citi Miles?

The full list of ineligible transactions for Citi Miles can be found in the general Citi rewards T&Cs.

I’ve highlighted a few noteworthy categories below:

- Quasi cash transactions (MCC 6529-6540)

- Utilities payments (MCC 4900)

- Insurance (MCC 6300)

- Real Estate Agents and Managers (MCC 6513)

- Hospitals (MCC 8062)

- Educational Institutions (MCC 8211-8299)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Government Services (MCC 9000-9999)

- Top-ups to prepaid accounts like GrabPay and YouTrip

For the avoidance of doubt, Citi PremierMiles Cardholders will earn rewards for CardUp transactions, though they may prefer to use Citi PayAll instead.

Citi PremierMiles Cardholders will also earn miles when they pair their card with Amaze, but since Amaze converts all transactions to SGD, they’ll be earning at the 1.2 mpd local rate.

What do I need to know about Citi Miles?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | No | S$27.25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 Citi Miles (10,000 miles) |

11 | 24-48 hours (for KF) |

Expiry

Citi Miles never expire, so long as your card account is kept open. This isn’t a license to hold on to them indefinitely (since all airline frequent flyer programmes will, over time, devalue), but does give you some breathing room.

Pooling

Citibank has a policy of not pooling points across cards.

If you have 12,000 Citi Miles on the Citi PremierMiles Card and 25,000 ThankYou points on the Citi Rewards Card, you will have to pay two separate conversion fees. This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Partners and Transfer Fee

Citibank offers a wide variety of transfer partners, with 11 airline and hotel loyalty programmes to choose from. This includes some programmes with good value sweet spots like British Airways Executive Club, Qatar Privilege Club and Turkish Miles&Smiles.

Points transfer at a 1:1 ratio, with a minimum transfer block of 10,000 miles.

| Frequent Flyer Programme | Conversion Ratio (Citi Miles: Partner) |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

|

10,000: 10,000 |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

|

10,000: 10,000 |

| 10,000: 10,000 |

Transfers cost S$27.25 per programme, regardless of how many points are transferred.

Transfer Times

Citibank tells customers that points transfers will take 14 business days, but in reality it’s usually 24-48 hours for KrisFlyer, or 2-4 working days for other programmes.

If you need your points credited instantly, you can move them via Kris+ at a rate of 4,000 Citi Miles = 3,400 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

There are pros and cons to this:

Pros

- Minimum conversion block is reduced to 4,000 Citi Miles, versus 10,000 Citi Miles if converting via Citibank’s rewards portal

- Transfers from Citi to Kris+ and Kris+ to KrisFlyer are instant

Cons

- Those 4,000 Citi Miles would normally be worth 4,000 KrisFlyer miles, so a 15% haircut is incurred

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer Citi Miles to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than seven days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Other card perks

Two free lounge visits

|

| Registration |

The Citi PremierMiles Card offers cardholders two free visits per calendar year, via Priority Pass.

Note that the allowance is tracked by calendar year. This is notably different from most other travel cards, which award free lounge visits by membership year.

In other words, if you get a Citi PremierMiles Card towards the end of the year, you could enjoy four lounge visits in quick succession (e.g. in December then January, since your allowance resets on 1 January).

Only the principal cardholder is entitled to this benefit. Lounge entitlements can be shared with a guest, but once you exhaust your free visits you’ll be charged US$32 per additional visit.

Here’s how this compares to other cards in its segment.

| Card | Network | Free Lounge Visits (per year) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

Plaza Premium | 4X |

HSBC TravelOne Card HSBC TravelOne Card |

DragonPass | 4X |

Citi PremierMiles Citi PremierMiles |

Priority Pass | 2X |

DBS Altitude DBS Altitude |

Priority Pass | 2X (Visa Version Only) |

StanChart Journey Card StanChart Journey Card |

Priority Pass | 2X |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

N/A | N/A |

BOC Elite Miles BOC Elite Miles |

N/A | N/A |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

N/A | N/A |

OCBC 90°N Card OCBC 90°N Card |

N/A | N/A |

UOB PRVI Miles UOB PRVI Miles |

N/A | N/A |

Buy miles with Citi PayAll

|

| Citi PayAll |

Citi PayAll is a platform that allows Citibank cardholders to pay various types of bills and earn rewards points. 23 different categories of payment are currently supported:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 (each category) |

|

Outstanding balance with IRAS |

You’ll need to pay an admin fee, but historically speaking, Citi PayAll has run promotions that upsized the earn rate or threw in additional Grab vouchers, making it almost too good to be true- once up on a time we were buying miles at just 0.8 cents each!

Unfortunately, Citi has dialed back the generosity. Its recent promotion for income tax season reduced the cost per mile to “only” 1.31 to 1.62 cents apiece, while the PayAll service fee has been hiked to 2.6%.

Given the standard Citi PremierMiles earn rate of 1.2 mpd, this means you’ll now be paying 2.17 cents per mile outside of a promotion. That’s way too high in my opinion (at the previous 2.2% fee the cost was 1.83 cents per mile, which was already pushing it).

For what it’s worth, Citi PayAll transactions will count towards the minimum spend for welcome offers and other promotions, provided the service fee is paid.

I’ve written a comprehensive guide to Citi PayAll, so be sure to check out the article below.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | S$1,000,000 |

| Medical Benefits | S$40,000 |

| Travel Inconvenience |

|

| Policy Wording | |

Complimentary travel insurance is offered by numerous cards, but not all policies are made equal. Some offer bare bones coverage, others are much more comprehensive.

Fortunately, the Citi PremierMiles Card falls into the latter category. Its HL Assurance-underwritten policy offers up to S$1,000,000 for accidental death and permanent disablement, S$40,000 for medical expenses, S$100,000 for emergency medical evacuation, and coverage for travel inconveniences like lost or delayed luggage.

COVID-19 medical expenses and hospital allowance are also provided for.

Coverage is activated when you use your Citi PremierMiles Card to pay for your round-trip airfare, or to pay for the taxes and surcharges on an award ticket.

Terms and Conditions

Summary Review: Citi PremierMiles Card

|

|||

| Apply Here | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

Last year, I argued that the Citi PremierMiles Card just about snuck into the “take it” category, but a large part of that was owing to the insane Citi PayAll promotions we were seeing.

With those looking like a thing of the past, and the service fee now at an all-time-high of 2.6%, this drops squarely into the “take it or leave it” bracket, like any other general spending card.

On the plus side, it offers non-expiring Citi Miles that transfer to 11 different airline and hotel partners, two lounge visits per year, and reasonably good travel insurance. However, this is tempered by the fact that the earn rates are middling and Citi doesn’t pool points.

All in all, I don’t think I’d consider it essential anymore. If you’re after transfer partners, you’re better off spending with the Citi Rewards Card and its 4 mpd for almost all online transactions, and if it’s lounge visits you’re after, the HSBC TravelOne Card offers double the allowance and a bigger welcome offer for the same annual fee.

So that’s my review of the Citi PremierMiles Card. What do you think?

It’s a shame that the new cards are all issued under MC no more under visa network…. No chance for grab top up points 🙁

Lounge for 1st year only. Thereafter if U pay the card annual fee maybe U entitle to the lounge.

You get the 2 lounge visits every year regardless of whether you pay af

Hi Aaron, I was wondering, if we do not want miles for annual fee, can we get a waiver for annual fee?

Yes, worked for me for the past 6 years. Though I had to formally request to cancel the card one year before the waiver was granted.

sure, at citi’s discretion

Yes, I’ve been doing for the past few years.

I was also able to get the annual fee waived and keep the miles because I was charging a fair bit on the card.

YMMV

This series is great! What other cards are in the pipeline?

a lot…although i’m holding off on the hsbc and boc cards until they make their T&C changes. i’m feeling dbs altitude and uob prvi miles for the next 2.

Next review: DBS Altitude card please! 😀

Appreciate this review!

Hi Aaron,

U have any article that shares how to get the best deal out of which transfer partner for premier miles?

https://milelion.com/2019/06/03/british-airways-new-avios-chart-is-out-and-heres-how-the-sweet-spots-have-changed/

https://milelion.com/2018/12/24/good-value-star-alliance-bookings-with-turkish-airlines-miles-and-smiles/

https://milelion.com/2018/06/26/finding-the-sweet-spots-among-etihads-23-award-charts/

i just noticed that there is no more Sign-Up Bonuses if u sign up through Singsaver…..

not correct- sign-up bonus continues to be available via Singsaver

edit: the sign up bonus for new-to-bank customers where you pay the annual fee and get up to 40k (37.3k now) miles is valid via SS

the other offer where you ask for a waiver and get up to 10k miles is not

Drop me an email via contact us and I’ll ask Singsaver to look at your case

Do you mean the 1st year annual fee waiver offer where you get 13200 bonus miles does not stack with singsaver bonus?

My first CC and I still use it frequently.

Are we able to earn miles paying insurance through ipaymy?

Updates to Citi Asia miles?

Noticed this in the Citi PM T&C: asia miles is 1 Citi Mile = 0.4 Asia Miles

4.3 The cardmember can use Citi Miles to redeem for FFP miles/points at the redemption rate of 1 Citi Mile = 1 FFP mile (except for Asia Miles FFP where the redemption rate is 1 Citi Mile = 0.4 Asia Miles).

this is from the 2012 T&Cs file.

Do grab top ups using premiermiles Visa still earn miles?

hi Aaron, since PM card is transitioning from Visa to MC, upon card expiry and renewal, will citi keep our miles and uphold the never expire miles?

if your card is switched from visa to mc, your points will be transferred accordingly

Does this card award miles for grab top ups and paying grB transactions?

Hi Aaron,

Is paying the annual fee for the 10000 miles worthed it? I mean if we earn 1.2mpd wouldn’t paying $193 = 231 miles only? I know I’m thinking too simply but I really do not understand. Some other review sites say these 10000 miles only have a value of $100 but for example if I buy spend $100 locally on retail wouldn’t that get me 102 miles only? Appreciate if you could help enlighten me

Thank you for the update. Anyone has experience booking hotel through Kaligo with Citibank card? My hotel bookings were in early March but the 10 miles has yet to be given out. As of now, I only received the base points of 1.2miles.

I use this card for Kaligo a lot. You have to phone in every time to ask them to credit the bonus milesbut they do award 10Mpd, provided you booked through their dedicated link

Is this statement really correct? “Existing Visa cards can continue to be used until expiry. ”

I had an expiring Citi Visa card. I called to ask for a Visa card replacement and they gave one to me with no problems. The CSO told me that unless the customer gave the consent for a Mastercard replacement, they would still give out Visa.

My expired Visa card was automatically replaced with a new one. For what it is worth, I have both the Mastercard and Visa version—the former paired with Amaze as a card of last resort.

do they pool?

Which is more lucrative, running it through Amaze card to pay in SGD or charge it directly in FCY for this card?

Am I required to pay the annual fee for the first year in order to receive the 10,000 miles?

is there a cap to the number of miles per month/transection?

ie is this card good for adhoc large spends

Does adding Citi Premier to Apply Pay means no miles can be earned?

Citi not pooling points is a huge neg for them. Would get more of their cards if this was made possible.

Hi Aaron, CitiBank has extend the sign up bonus to 31st July 2024. https://www.citibank.com.sg/pdf/credit-cards/travel/premiermiles-card/welcome-offer.pdf

thanks, will update the post

Citi credit cards have very frequent unauthorized use. I have reported more than 5 times within 6 months. Anyone have this problem? Now I have to lock my cards in app and unlock to use it, very troublesome

Is there any point to getting this card if you already have a Citi Prestige?