Citi has launched a new overseas spending promotion for its PremierMiles cardholders, which offers up to 4 mpd on in-person foreign currency (FCY) spending from now till 31 January 2024.

The minimum spend and cap for this offer is set at S$5,000 per calendar month, and there’s no cap on the maximum number of eligible cardholders.

There’s also a separate, capped FCY spending offer for Citi Prestige Cardholders of up to 4.5 mpd, which I’ve covered in a separate post.

Earn up to 4 mpd on FCY spending

Registration

To register for this offer, the principal cardholder must send the following SMS to 72484.

|

| 📱 SMS to 72484 |

| CITIPMCFX<space>Last 4 digits of your Citi PremierMiles Card e.g. CITIPMCFX 1234 |

There is no cap on the maximum number of registrations. You are only considered enrolled once you receive a confirmation SMS from Citi.

Once registration is completed, you will be eligible to participate from the start of that month onwards (e.g. registration on 15 December 2023 means that your spending from 1 December 2023 to 31 January 2024 will be entitled to earn up to 4 mpd).

Minimum spend

Once registered, Citi PremierMiles Cardholders must spend at least S$5,000 in a given calendar month to qualify for the 4 mpd FCY earn rate in that calendar month.

The minimum spend consists of all SGD and FCY retail purchases, whether online or offline, excluding the following:

| ❌ Excluded Transactions |

| (i) any Equal Payment Plan (EPP) purchases; (ii) refunded/disputed/unauthorised/fraudulent retail purchases; (iii) Quick Cash and other instalment loans; (iv) Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes; (v) bill payments made using the Eligible Card as a source of funds; (vi) late payment fees; (vii) any other form of service/ miscellaneous fees; or (viii) Citi Payall transactions where the customer is not charged the Citi Payall service fee |

For avoidance of doubt, Citi PayAll transactions will count towards the minimum spend, provided you pay the service fee. Citi PayAll is currently running a promotion till 29 February 2024 which offers 1.8 mpd on all payments, reducing the cost per mile to 1.2 cents. You can read more about that in the post below.

Citi PayAll offering 1.8 mpd on all payments; buy miles at 1.2 cents each

You can choose to participate in all three months of this offer by meeting the minimum spend in each month, or just selected months if you wish.

Qualifying spend

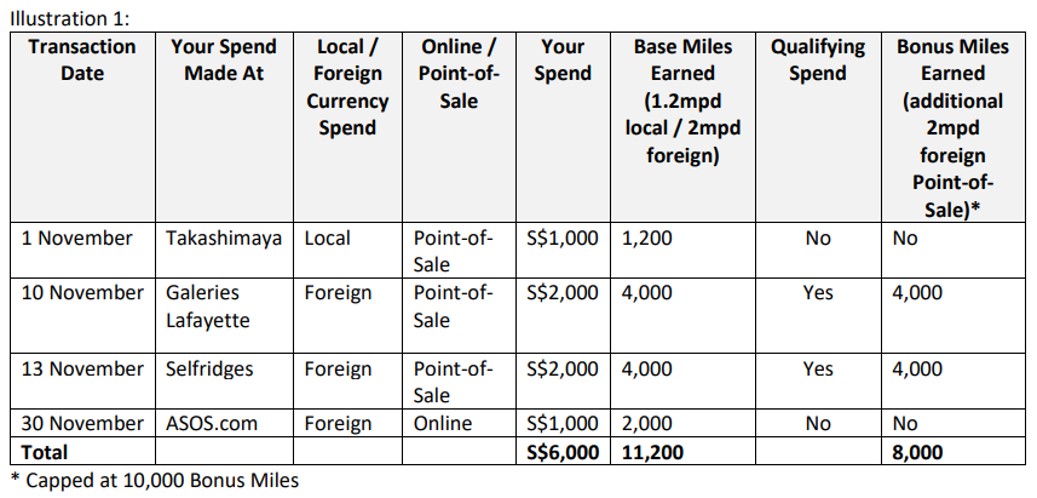

Citi PremierMiles Cardholders who meet the minimum spend will earn an extra 2 mpd (in the form of an extra 2 Citi Miles per S$1) on all in-person overseas spend. This, combined with the regular base rate of 2 mpd, gives a total of 4 mpd.

| Base | Bonus | Total | |

| FCY Spend | 2 mpd | 2 mpd | 4 mpd |

The bonus component is capped at 10,000 Citi Miles (10,000 miles) per calendar month, which means you’d max out the offer with a monthly spend of S$5,000.

Once again, a reminder that only in-person FCY spend is eligible for the bonus miles. Online FCY spend will not earn any bonuses, though it will count towards the S$5,000 minimum spend to unlock the offer.

Qualifying spend excludes the usual suspects such as charitable donations, education, and insurance premiums.

Excluded spend

i. annual fees, interest charges, late payment charges, GST, cash advances, instalment/easy/extended/equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by Citibank);

ii. funds transfers using the card as source of funds;

iii. bill payments (including via Citibank Online or via any other channel or agent);

iv. payments to educational institutions;

v. payments to government institutions and services (including but not limited to court

cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra government purchases);

vi. payments to insurance companies (sales, underwriting, and premiums);

vii. payments to financial institutions (including banks and brokerages);

viii. payments to non-profit organizations;

ix. betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel;

x. any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts;

xi. transit-related transactions;

xii. transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank, as sent out in www.citibank.com.sg/rwdexcl (this list of excluded Merchant Categories or merchants may be updated from time to time at our discretion and Eligible Cardmembers shall refer to this list for any updates); OR

xiii. Dynamic Currency Conversion transactions, which refers to card transactions (including online and overseas transactions) where final transaction amount is converted into Singapore dollars via dynamic currency conversion (a service offered at certain ATMs and merchants which allows a cardmember to convert a transaction denominated in a foreign currency to Singapore Dollars at the point of withdrawal/sale).

| ⚠️ It won’t work with Amaze |

| Amaze converts all FCY transactions into SGD, so you will not earn the bonus on Amaze transactions charged to your Citi PremierMiles Card. However, Amaze transactions will count towards the S$5,000 minimum spend. |

Minimum spend and qualifying spend is determined by transaction date based on Singapore timing (GMT+8), so exercise caution if you’re spending overseas on the last day of the month!

Minimum spend vs qualifying spend

Since these two concepts are sometimes confused, I figured it be good to have a brief section explaining the difference between minimum spend and qualifying spend.

The S$5,000 minimum spend required to unlock this offer can also be part of qualifying spend. For example, if I were to spend the equivalent of S$5,000 in-person overseas, I would earn 4 mpd on the entire amount, since the minimum spend has been met and the spend is also qualifying.

However, minimum spend may also not be part of qualifying spend. For example, if I were to spend S$5,000 in Singapore, I would then qualify to earn 4 mpd on up to S$5,000 of in-person overseas spending- but not on the S$5,000 already spent (since it’s non-qualifying).

While supplementary cardholders don’t enjoy a separate bonus cap, their spending will be combined with that of the principal cardholder in determining minimum and qualifying spend.

When will bonus points be credited?

Citi PremierMiles Cardholders will initially receive the regular 2 mpd earn rate for all FCY transactions.

The bonus 2 mpd awarded under this promotion will be credited (in the form of Citi Miles) according to the following timeline

| Qualifying Spend made in | Bonus Miles credited in |

| 1-30 November 2023 | 1-29 February 2024 |

| 1-31 December 2023 | 1-31 March 2024 |

| 1-31 January 2024 | 1-30 April 2024 |

Terms & Conditions

The T&Cs for this offer can be found here.

What can I do with Citi Miles?

Citi Miles do not expire, and Citi PremierMiles cardholders get access to 10 different frequent flyer programs and one hotel partner.

Points can be transferred to miles in blocks of 10,000 Citi Miles (10,000 miles). There are some great sweet spots with programmes like British Airways Executive Club, Turkish Miles&Smiles, and Qatar Privilege Club.

| Partner | Transfer Ratio (Citi Miles: Partner) |

|

10,000:10,000 |

| 10,000:10,000 | |

| 10,000:10,000 | |

|

10,000:10,000 |

|

10,000:10,000 |

|

10,000:10,000 |

|

10,000:10,000 |

|

10,000:10,000 |

|

10,000:10,000 |

|

10,000:10,000 |

| 10,000:10,000 |

A S$27 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige & Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

How does this compare to Amaze?

As with every FCY spending promo, the inevitable question is: how does this compare to Amaze?

Here’s my quick thoughts:

| Amaze | Citi PM Offer | |

| Earn Rate | 4-6 mpd + InstaPoints | 4 mpd |

| Eligible Spend | In-person or online | In-person only |

| FCY Fee | ~2% (implicit) | 3.25% |

| Min. Spend (monthly) |

N/A | S$5K |

| Cap (monthly) |

S$1-3K, depending on card | S$5K |

| Bonus Miles Crediting | Instantly or by the following month, depending on card | Wait 3 months |

I think the Amaze is probably a superior option, provided you pair it with the right card. You’re looking at 4-6 mpd with an implicit FCY fee of ~2%, versus 4 mpd with a 3.25% FCY fee. There’s also no minimum spend necessary, and your bonus miles will arrive earlier.

However, the Citi offer could still come in useful if you burst the 4-6 mpd caps on the cards that you’d pair with Amaze. Think of it as a secondary sponge, a useful fallback option for big spenders.

Conclusion

|

|||

| Apply Here |

From now till 31 January 2024, Citi PremierMiles Cardholders can register to earn up to 4 mpd on in-person overseas spending. A minimum spend and cap of S$5,000 per calendar month apply.

There is no registration cap for this offer, unlike the Citi Prestige’s FCY promo, but it’s also more restrictive because only in-person overseas spending counts.

Hopefully you’ll have a trip planned!

A minimum spend and cap of S$5,000 per calendar month apply.

There is no cap for this offer, unlike the Citi Prestige’s FCY promo

so is there a cap or no cap for Citi PM FCY promo?

sorry, that should say there is no REGISTRATION cap.

In-person transactions. Means paying via Applepay is Eligible right

Don’t forget – SCB’s Journey no FCY promo starts today!

Apply via the links in this website ☺️

Aaron, Do you know if this stacks with the agoda/Kaligo promotions? In some cases, I was eligible for the 7mpd even where the qualifying payment was made in person on hotel property pursuant to a booking made thru agoda’s citi page. Wonder if this can boost the mpd on that. Seems like there is no express mutual exclusion in that regard…

Can I confirm that utilities bills can be used for “minimum spend” purpose?