Last month we learned that that the Maybank Horizon Visa Signature Card would receive a major revamp from 1 November 2023, the highlight of which was a uncapped 2.8 mpd on all foreign currency transactions, and 2.8 mpd on up to S$10,000 of air tickets each month.

Now that November has arrived, it turns out that Maybank has another surprise up their sleeve: an uncapped 3.2 mpd on all FCY transactions and a capped 3.2 mpd on air tickets for up to four months, valid for both new and existing Maybank Horizon Visa Signature Cardholders.

This makes it the highest uncapped general spending card for FCY transactions, and is well worth considering for the year-end travel period. Even better, a Maybank spokesperson has confirmed that the 3.2 mpd rate applies to commonly excluded transactions such as private hospitals and education, so long as it’s in FCY!

If you don’t have a Maybank credit card yet, there’s also a welcome offer of S$60 cash from SingSaver, plus 10,000 KrisFlyer miles, American Tourister Luggage, Apple AirPods 3rd Gen or S$200 cashback from Maybank for spending at least S$600 per month for two consecutive months after approval, which I’ll cover in a separate article.

Maybank Horizon Visa Signature 3.2 mpd promo

|

| Apply Here |

New and existing Maybank Horizon Visa Signature Cardholders can now enjoy a 3.2 mpd earn rate on FCY spend (both in-person and online) and air tickets, subject to a minimum spend of S$800 in a calendar month.

| New cardholders | Existing cardholders | |

| Card Approval | 1 Nov 2023 to 31 Mar 2024 | Before 1 Nov 2023 |

| Spend Period | 3-4 months (Approval month + 3 full calendar months) |

3 months (1 Nov 2023 to 31 Jan 2024) |

| Min. Spend | S$800 per calendar month | |

| FCY Spend (no cap) |

3.2 mpd |

|

| Air Tickets (S$10K per calendar month) |

3.2 mpd |

|

There is no cap on the 3.2 mpd earn rate for FCY spend, though there is a cap of S$10,000 per calendar month on the 3.2 mpd earn rate for air tickets.

New cardholders

New cardholders are defined as those who receive approval for a Maybank Horizon Visa Signature Card between 1 November 2023 to 31 March 2024 (both dates inclusive).

They will earn the upsized 3.2 mpd rate on FCY and air ticket transactions for the month of approval, plus another three full calendar months.

| Card Approval | 3.2 mpd Period |

| 1-30 November 2023 | Approval date till 29 February 2024 |

| 1-31 December 2023 | Approval date till 31 March 2024 |

| 1-31 January 2024 | Approval date till 30 April 2024 |

| 1-29 February 2024 | Approval date till 31 May 2024 |

| 1-31 March 2024 | Approval date till 30 June 2024 |

This of course assumes the minimum retail spend of S$800 is met each calendar month.

Depending on when your approval comes in, therefore, your 3.2 mpd period is anywhere between 3-4 months.

I would recommend timing your application so it coincides with the period where you expect to make the most FCY spend. Such is the nature of this promotion that even if you have no travel plans for December 2023, you could delay your application and make use of the promotion as late as June 2024!

Existing cardholders

Existing cardholders are defined as those who received approval for a Maybank Horizon Visa Signature Card prior to 1 November 2023.

In this case, you’ll earn 3.2 mpd for three months from 1 November 2023 to 31 January 2024, assuming the minimum retail spend of S$800 is met each calendar month.

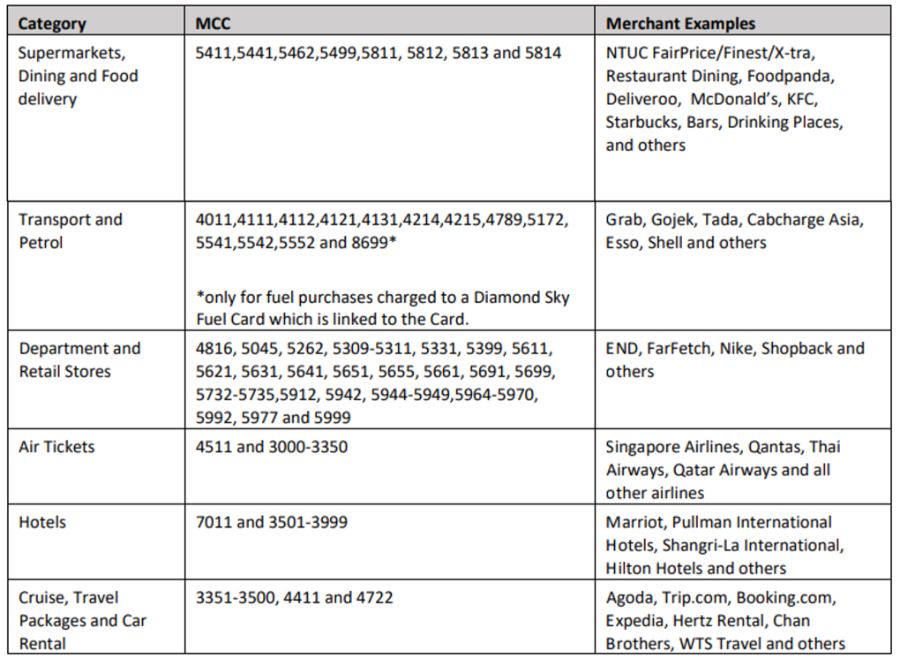

How are FCY spend and air tickets defined?

Maybank defines FCY spend as card retail transactions posted in foreign currencies, regardless of whether they’re online or in-person.

| ⚠️ Important Note |

| I have confirmed with a Maybank spokesperson that foreign currency spending on insurance, charitable donations, education, utilities, and private hospitals is also eligible to earn 3.2 mpd, if charged in FCY. |

Air ticket spend is classified as transactions posted in Singapore dollars (if you have air tickets in FCY, they fall under the previous paragraph, with no cap) under the MCCs 4511 and 3000-3350. This includes Singapore Airlines, Scoot, British Airways, Cathay Pacific, Qatar Airways and pretty much every major airline out there.

If you need to check the MCC of a particular merchant before spending, here’s three ways of doing so:

What counts towards the S$800 min. spend?

Maybank keeps a list of transactions that will not count towards the minimum spend or TREATS points issuance in its T&Cs, from the bottom of page 1 onwards (Maybank, annoyingly, does not number its bullet points).

Key transactions to note are:

- Government services

- Betting or gambling transactions

- Brokerage or securities transactions

- Stored value top-ups like GrabPay or YouTrip

Maybank is one of the few banks that still awards points for education, insurance, medical bills and utilities, albeit at a reduced rate of 0.24 mpd.

It also has a bit of a unique policy when it comes towards transaction versus posting dates, but it’s one that works in your favour.

- Retail transactions charged to a Card made within a calendar month that are successfully posted to a Card Account prior to the 6th day of the following calendar month, will be counted towards the minimum spend of the month that the retail transactions are made.

- Retail transactions charged to the Card which made within a calendar month but are only posted to a Card Account after the 6th day of the following month will be counted towards the following month’s minimum spend

Basically, so long as your transaction posts by the 6th day of the following calendar month, that transaction will count towards the minimum spend and bonus cap for the month it was made.

Terms & Conditions

The T&Cs of this 3.2 mpd offer can be found here.

How does this compare to other cards?

For the period of the promotion, the Maybank Horizon Visa Signature becomes the highest-earning uncapped general spending card for FCY spending.

| 💳 FCY Earn Rates by Card (For general spending cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

Maybank Horizon Maybank HorizonApply |

3.2 mpd | Min. S$800 spend per c. month |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | Review |

HSBC TravelOne HSBC TravelOneApply |

2.4 mpd | Review |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS)Apply |

2.3 mpd | Review |

HSBC Visa Infinite HSBC Visa InfiniteApply |

2.25 mpd | With min. S$50K spend in previous m. year Review |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

2.24 mpd | |

DBS Vantage DBS VantageApply |

2.2 mpd | Review |

OCBC VOYAGE OCBC VOYAGEApply |

2.2 mpd | Review |

OCBC 90°N Card OCBC 90°N CardApply |

2.1 mpd | Review |

| All other options earn 2 mpd or less | ||

Its closest competitor is the StanChart Visa Infinite with 3 mpd on FCY spend, but this:

- Has a higher FCY fee of 3.5% (compared to 3.25% for Maybank)

- Requires a higher minimum spend of S$2,000 per statement month (compared to S$800 for Maybank)

- Has an income requirement of S$150,000 (compared to Maybank’s S$30,000)

- Has a non-waivable annual fee of S$594 (compared to Maybank with the first three years free)

That said, we need to keep in mind that there are a lot of ways to earn 4-6 mpd on FCY spend, albeit with a cap.

Top-of-mind options include the UOB Visa Signature Card, the Citi Rewards Card (paired with Amaze), and the UOB Lady’s Cards. Refer to the article below for a rundown of the options.

Therefore, you should ensure you’ve maxed out those other cards first, before using the Maybank Horizon Visa Signature to soak up what’s leftover.

Don’t forget that there’s also other good FCY spend promos as we enter the final months of 2023, such as:

- StanChart Journey Card (uncapped 2 mpd, no FCY fees)

- Citi PremierMiles Card (capped 4 mpd with 3.25% FCY fee)

- Citi Prestige Card (capped 4.5 mpd with 3.25% FCY fee)

Some offers may require registration or minimum spends, so refer to the respective links for the full details.

Maybank Horizon Visa Signature changes now live

|

|||

| New T&Cs | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 mo. |

| Annual Fee | S$180 |

Fee Waiver | First 3 years free |

If you missed last month’s article on the changes to the Maybank Horizon Visa Signature, here’s a brief recap of how things work now.

The key factor is whether you spend less than S$800 or S$800 and more per calendar month.

Cardholders who spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

Cardholders who spend less than S$800 per calendar month will earn at one of three different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

Maybank has carved out a separate tier for education, insurance, medical and utilities. These will earn just 0.24 mpd, which I suppose is better than the nothing that most other banks offer.

Maybank has also added an extensive list of local transactions that will earn 1.2 mpd.

Any local transaction that does not fall into the MCCs above will earn 0.4 mpd, while all FCY transactions will earn 1.2 mpd.

Cardholders who spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 3.2 mpd* |

| FCY | All FCY spend | 3.2 mpd |

| *Capped at S$10,000 per calendar month |

||

Cardholders who spend at least S$800 per calendar month will earn at one of four different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

- 2.8 mpd

What’s changed between this and the previous section is that cardholders will earn 3.2 mpd on air tickets (temporarily upsized from the usual 2.8 mpd), capped at S$10,000 per calendar month. Any spending beyond this will earn 1.2 mpd.

They will also earn an uncapped 3.2 mpd on FCY spend (temporarily upsized from the usual 2.8 mpd), regardless of whether it’s online or offline.

Conclusion

|

| Apply Here |

The Maybank Horizon Visa Signature Card is shaping up to be quite a compelling offering as we head into the peak travel period. With an uncapped 3.2 mpd on FCY transactions, this can be a potential fallback option for those who have maxed out the 4-6 mpd earn rates on other cards.

You can also enjoy 3.2 mpd on up to S$10,000 of air tickets, freeing up the bonus caps on cards you would have otherwise used.

While there is a minimum spend of S$800 per month required for both, chances are that if the “uncapped” feature is what attracts you, then a minimum spend won’t be an issue.

Don’t forget that there’s also a welcome gift for new-to-bank customers to look forward to of 10,000 miles, luggage, AirPods or S$200 cashback, which I’ll cover in a separate post tomorrow.

Given all that’s happened, I feel the Maybank Horizon Visa Signature warrants a credit card review post of its own, so stay tuned for that too!

is it be better than amaze+UOB Priv Miles?

Horizon is 3.2 miles for 3.25% fee, so close to 1cpm. Amaze + UOB Priv Miles gives 1.4 miles for ~1.8% fee. But Amaze also gives you 0.5 cents of Instapoint rebate per dollar spent. If you can follow all the rules to optimize the Instapoint rebate, your fees come down to ~1.3%, so roughly 1cpm too.

I think Horizon is easier, as Instapoint rules are not that straightforward to maneuver (min/max spend, need to be redeemed in multiples of $20).

thanks bro recently in korea amaza charges me 2.7%

On a value CPM would it be better value than 2.4 mpd under Journey card with the FX rebate over the “No FX fee period”?

Journey is 2.0 mpd with full FX fee rebate (usually 3.5%) in Nov-Dec. With Horizon visa, you’ll pay 3.25% fee for 3.2 mpd. So 3.25 cents for 1.2 additional miles. So you’re paying 2.71 CPM if you use Maybank Horizon Visa instead of SCB Journey this Nov-Dec.

The risk with Journey is that you may have quite a bit of orphan points stuck in it (unless you calibrate your FX spend over the next 2 months carefully) as it is not a particularly useful card outside these 2 months.