Here’s The MileLion’s review of the Maybank Visa Infinite, which once upon a time was probably the best-kept secret of the $120K segment.

Cardholders received unlimited Priority Pass visits, two complimentary airport limo transfers or JetQuay access with a minimum spend of just S$3,000, free points conversions, and could even earn miles on charitable donations, insurance premiums and utility bills. All this and a first year annual fee waiver– what a steal!

Today, however, the Maybank Visa Infinite’s stock has fallen so far it’s probably best kept a secret, if you get what I mean. You still get a first year fee waiver, but both the airport lounge and limo benefits have been nerfed considerably. And while its foreign currency (FCY) earn rate has been buffed, the same is true for the Maybank Horizon Visa Signature and World Mastercard, both of which are much more accessible.

Maybank Visa Infinite Maybank Visa Infinite |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

|

| What do these ratings mean? |

|

| While it’s nice to have a first year fee waiver and miles for insurance premiums, there’s little else the Maybank Visa Infinite does that other cards can’t do better. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Maybank Visa Infinite

Let’s start this review by looking at the key features of the Maybank Visa Infinite.

|

|||

| Apply | |||

| Income Req. | S$150,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$654 (FYF) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | Up to 3.2 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

| *10,000 miles for KrisFlyer; 5,000 miles for Cathay and MAS, 2,000 points for Air Asia |

|||

Maybank actually offers three different Visa Infinite cards:

- Maybank Visa Infinite

- Maybank Diamanté Visa Infinite

- Maybank Diamanté Metal Visa Infinite

This article focuses on the plain vanilla Maybank Visa Infinite.

The invite-only Diamanté cards require a Maybank Private Client relationship with a minimum of US$1 million AUM, and come with additional perks like 12 no-spend limo rides, six meet and greet services, and unlimited lounge access.

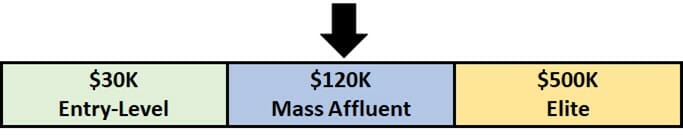

How much must I earn to qualify for a Maybank Visa Infinite?

When the Maybank Visa Infinite first launched in 2012, it had a minimum income requirement of S$200,000 per year. That’s now been cut to S$150,000, which is still 25% higher than the usual S$120,000 you’d expect for cards in this segment. It’s not clear how strictly Maybank enforces this requirement, however.

In case you were wondering whether it’d be possible to qualify with an income of S$30,000 p.a. provided you’re a Maybank Privilege Banking customer, the answer is no. Maybank Privilege Banking customers receive the Maybank Privilege Horizon Visa Signature Card instead, which is a very different type of product.

How much is the Maybank Visa Infinite’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Waived | Free |

| Subsequent | S$654 | Free |

It may surprise you to know that when the Maybank Visa Infinite first launched, it had an eye-watering annual fee of S$1,400. That’s now been reduced to S$654 and, unusually for its segment, is waived in the first year.

No miles are offered upon approval or renewing this card. The subsequent years’ annual fees will be automatically waived with a minimum spend of S$60,000 in a membership year.

All supplementary cards are free (though they don’t offer any substantive benefits either).

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | Up to 3.2 mpd | N/A |

SGD/FCY Spend

Maybank Visa Infinite Cardholders earn miles according to the table below.

| Spend (per calendar month) |

SGD | FCY |

| S$3,999 or less | 1.2 mpd | 2 mpd |

| ≥S$4,000 | 1.2 mpd | 3.2 mpd |

The local earn rate is fixed at 1.2 mpd.

The overseas earn rate is usually 2 mpd, but is increased to 3.2 mpd for cardholders who spend at least S$4,000 in a calendar month. There is no cap on the maximum miles that can be earned.

The minimum spend can be in SGD, FCY, or any combination of the two. Upsized earn rates apply from the very first S$1 of spend, and not just the incremental spending. For example:

- A cardholder who spends S$3,900 in FCY would earn 7,800 miles (S$3,900 @ 2 mpd)

- A cardholder who spends S$4,000 in FCY would earn 12,800 miles (S$4,000 @ 3.2 mpd)

The local earn rate is very pedestrian, but the overseas earn rate is much more compelling, especially since it’s uncapped.

| 💳 FCY Earn Rates by Card (For cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

DCS Imperium Card DCS Imperium CardApply |

4 mpd | By invite only. Min. S$4K FCY spend per c. month Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd | Min. S$4K spend per c. month. 2.8 mpd with min. S$800 spend per c. month Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd | Min. S$4K spend per c. month Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd | No min. spend Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min. S$800 spend per c. month Review |

HSBC Premier Mastercard HSBC Premier MastercardApply |

2.76 mpd | No min. spend. Min. S$200K AUM with HSBC Premier Review |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

2.4 mpd | No min. spend. 3 mpd for IDR, MYR, THB, VND Review |

HSBC TravelOne Card HSBC TravelOne CardApply |

2.4 mpd | No min. spend Review |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

2.4 mpd | No min. spend Review |

| All other options earn below 2.4 mpd | ||

However, I should point out that the Maybank World Mastercard would be a better option for overseas spending.

Like the Maybank Visa Infinite, it offers an uncapped 3.2 mpd with a minimum monthly spend of S$4,000. However, it also offers an uncapped 2.8 mpd with a minimum spend of S$800. In other words, it’s more “forgiving” should you fall short of the S$4,000 minimum spend. Moreover, its S$261.60 annual fee is waived for the first year, and unlike the Maybank Visa Infinite, can be very easily waived in the second and subsequent years.

Alternatively, you can also earn 4 mpd on FCY spending with the Maybank XL Rewards Card, UOB Visa Signature, and other specialised spending cards. However, these earn rates will either be capped, or only apply to specific MCCs. Read the article below for more information.

The Maybank Visa Infinite has an FCY fee of 3.25%, so using it overseas represents buying miles at around 1.02 cents (3.2 mpd) or 1.63 cents (2 mpd) each, which is decent in my book.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

When are TREATS Points credited?

For SGD spend, base TREATS Points (1.2 mpd) are credited when your transaction posts, which generally takes 1-3 working days.

For FCY spend, base TREATS Points (2 mpd) are credited when your transaction posts, which generally takes 1-3 working days. Bonus TREATS Points (1.2 mpd) are credited the following month, subject to meeting the minimum spend.

How are TREATS Points calculated?

Here’s how you can work out the TREATS Points earned on your Maybank Visa Infinite Card.

For SGD spend

| Base Points (3X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 15 |

For FCY spend

Spend <S$4,000 per calendar month

| Base Points (5X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 25 |

Spend ≥S$4,000 per calendar month

| Base Points (5X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 25 |

| Bonus Points (3X) |

Sum up all eligible transactions. Divide by 5, then multiply by 15. Round to the nearest whole number |

The minimum spend to earn points is S$5, whether in local or foreign currency.

These S$5 earning blocks further compound its already poor earn rates, causing the Maybank Visa Infinite to perform significantly worse than competitors, especially on smaller transactions.

Maybank Visa Infinite Maybank Visa Infinite1.2 mpd |

Citi Prestige Citi Prestige1.3 mpd |

|

| S$5 | 6 miles | 6.4 miles |

| S$9.99 | 6 miles | 11.6 miles |

| S$15 | 18 miles | 19.6 miles |

| S$19.99 | 18 miles | 24.8 miles |

| S$25 | 30 miles | 32.4 miles |

| S$29.99 | 30 miles | 37.6 miles |

If you’re an Excel geek, here are the formulas you need to calculate points:

For SGD spend

| Base Points (3X) | =ROUND (ROUNDDOWN(X/5,0)*15,0) |

| Where X= Amount Spent | |

For FCY spend

Spend <S$4,000 per calendar month

| Base Points (5X) | =ROUND (ROUNDDOWN(X/5,0)*25,0) |

| Where X= Amount Spent | |

Spend ≥S$4,000 per calendar month

| Base Points (5X) | =ROUND (ROUNDDOWN(X/5,0)*25,0) |

| Bonus Points (3X) |

=ROUND(Y/5*15,0) |

| Where X= Amount Spent, Y= Sum of Eligible Trxns | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

Maybank’s 5 million point cap

While this won’t be an issue for 99.9% of cardholders, it’s worth noting that Maybank limits cardholders to accumulating a maximum of 5,000,000 TREATS points (2,000,000 miles) at any time. This cap applies across all Maybank cards.

You would need to spend a lot — and I really mean a lot — to breach this cap, but it’s not outside the realm of possibility. Still, even if your spending was high enough to reach the limit, it’s just a simple matter of transferring some points out before spending more.

This clause can be found at point 2.8 of the general TREATS T&Cs.

What transactions aren’t eligible for TREATS Points?

A full list of transactions that do not earn points can be found in the T&Cs at point 2.2.

I’ve highlighted a few noteworthy categories below:

- Betting and gambling transactions

- Brokerage and securities transactions

- Charitable donations

- Government services

- Prepaid account top-ups, e.g. GrabPay and YouTrip

- Utilities bills (from 1 December 2025)

The Maybank Visa Infinite will earn points on commonly-excluded categories such as hospitals and education, and even up to S$3,000 of insurance premiums per calendar month.

Is that reason enough to get this card?

Well, put it this way. Where FCY hospital and education expenses are concerned, the Maybank World Mastercard can offer 2.8-3.2 mpd, without the hefty annual fee.

|

|

|

| Maybank Visa Infinite | Maybank World MC | |

| Annual Fee | S$654 (FYF) |

S$261.60 (FYF) |

| Hospitals | 1.2 mpd 3.2 mpd | 0.4 mpd 3.2 mpd |

| Education | 1.2 mpd 3.2 mpd | 0.4 mpd 3.2 mpd |

| Insurance Premiums | 1.2 mpd 3.2 mpd | N/A N/A |

| SGD FCY | ||

So I’d sooner take the Maybank World Mastercard, unless you’re spending big on:

- Insurance premiums, in SGD/FCY

- Hospitals, in SGD

- Education, in SGD

Even if you’re spending in SGD, the incremental earn rate offered by the Visa Infinite is 0.8 mpd. Assuming you value a mile at 1.5 cents, you’d need to spend more than S$54,500 on these categories just to break even on the S$654 annual fee (working: S$654/0.015/0.8).

What do I need to know about TREATS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

N/A |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 4 | 1-3 working days (to KF) |

Expiry

While TREATS Points normally expire after 12-15 months, Maybank Visa Infinite cardholders are automatically enrolled into the Rewards Infinite programme. This means their TREATS Points never expire.

Pooling

TREATS Points pool with other Maybank cards. If you have 20,000 TREATS Points on the Maybank Visa Infinite, and 5,000 TREATS Points on the Maybank Horizon Visa Signature, you can redeem 25,000 TREATS Points in a single conversion.

This also means that if you cancel your Maybank Visa Infinite Card, you won’t lose your accumulated TREATS Points unless it happens to be your very last TREATS-earning card.

Transfer Partners & Fees

TREATS Points can be transferred to four airline partners at the following ratios.

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000: 10,000* | |

| 12,500: 5,000 | |

|

12,500: 5,000 |

|

4,000: 2,000 |

Malaysia Airlines Enrich and airasia rewards are close to worthless in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

Unfortunately, Maybank no longer waives the points conversion fee for Maybank World Mastercard and Maybank Visa Infinite Cardholders, ever since April 2025. Cardholders will pay a S$27.25 fee per conversion.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-2 working days.

Other card perks

Four complimentary lounge visits

The Maybank Visa Infinite used to offer unlimited Priority Pass lounge visits. However, from 1 August 2023 that allowance was cut to just four.

Lounge visits are issued to principal cardholders only, and cannot be shared with guests. This is simply not good enough compared to other cards in the $120K segment.

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE Card OCBC VOYAGE Card |

Dragon Pass Lounge only |

∞ | 2 |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Dragon Pass | ∞ + 1 guest* | N/A |

Citi Prestige Card Citi Prestige Card |

Priority Pass | 12 Multi Guests |

N/A |

DBS Vantage Card DBS Vantage Card |

Priority Pass | 10 Multi Guests |

N/A |

StanChart Visa Infinite StanChart Visa Infinite |

Priority Pass | 6 1x Guest |

N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 No Guests |

N/A |

AMEX Platinum Reserve AMEX Platinum Reserve |

N/A | N/A | N/A |

| *Will be reduced to 12 visits per calendar year from 1 June 2026 |

|||

Complimentary airport limo or hotel day-pass

Principal Maybank Visa Infinite Cardholders who spend at least S$3,000 in a given calendar month will be entitled to either:

- 1 complimentary one-way airport limo transfer, or

- 1 complimentary day pass to gym and pool at PARKROYAL COLLECTION Marina Bay

A maximum of eight limo rides or six day passes can be booked per calendar year.

Do note that the minimum spend excludes payments to insurance companies, even though these transactions are otherwise eligible to earn rewards.

Airport limo

The Maybank Visa Infinite has a relatively favourable airport limo benefit, as S$3,000 is a lower spending requirement than the Citi Prestige or OCBC VOYAGE (and prior to July 2023 the same spending got you two rides!).

Hotel day pass

Day passes are valid for use at the PARKROYAL COLLECTION Marina Bay, and grant access to the pool and gym for a day.

However, the requirement to make a booking at least two weeks in advance means you can’t use this as a spur-of-the-moment thing, which greatly diminishes its usefulness.

Golf benefits

The Maybank Regional Golf programme offers principal Maybank Visa Infinite Cardholders complimentary green fees at more than 100 participating golf clubs across 19 countries.

Cardholders must spend at least S$2,000 in the previous calendar month to enjoy this benefit, and can book a maximum of two flights per month per cardholder. In Singapore, the participating clubs are:

- Sembawang Country Club

- Warren Golf & Country Club (min. 3 golfers)

- Orchid Country Club (min. 3 golfers)

- 1 additional club (not named)

Golf perks offered by other credit cards normally require a paying guest, but no such requirement exists for Maybank Visa Infinite Cardholders who book clubs in Singapore, Malaysia, Indonesia and the Philippines.

The T&Cs of the Maybank Regional Golf programme can be found here.

For avoidance of doubt, this is a separate perk from the generic Visa Infinite golf benefit, which has no minimum spend requirement.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | N/A |

| Others | Missed Connection: S$400 Luggage Delay: S$400 Lost Luggage: S$1,000 |

| Policy Wording | |

Maybank Visa Infinite Cardholders receive complimentary travel insurance when they charge their full travel fares to their card. Unfortunately, coverage will not apply in situations where you redeem miles for an award ticket, and charge the taxes and fees to your Maybank Visa Infinite Card.

This features up to S$1,000,000 of coverage for accidental death or total permanent disablement, S$400 for luggage delays or missed connections, and S$1,000 for luggage loss.

However, there is no coverage for medical expenses or emergency medical evacuation. Because of this, I highly advise that you purchase comprehensive travel insurance elsewhere.

Visa Infinite benefits

As a Visa Infinite card, Maybank Visa Infinite cardholders enjoy the following additional perks.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

More details on these benefits can be found in the post below.

Terms & Conditions

Summary Review: Maybank Visa Infinite

|

|||

| Apply |

The Maybank Visa Infinite has a few things going for it: the first year fee waiver, a relatively low spend for an airport limo ride, and points for commonly-excluded transactions like insurance premiums, hospital bills and education.

However, I couldn’t justify paying S$654 for it, not when the Maybank World Mastercard does just as well — arguably even better actually — for FCY spending. Insurance premiums alone won’t be enough for an annual fee waiver (S$3,000 @ 12 months is only 60% of the S$60,000 required), and they don’t count towards the minimum spend for limo rides anymore. Add the annoying S$5 earn blocks, removal of free points conversions, and paltry four lounge visits, and it’s just very hard to make any sort of case for this card.

So that’s my review of the Maybank Visa Infinite. What do you think?

DBS Vantage

DBS Vantage

“^From second year onwards, with min S$50,000 spend in the previous membership year, otherwise (or if first year) 1 mpd (SGD) and 2 mpd (FCY)”

The minimum spend is $60,000 in membership year.

incorrect. the min spend for those rates is $50k per membership year- refer to hsbc website.

Sadly, another nerf for complimentary parking at JetQuay, as per https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/vi-privilege-tnc.pdf

“complimentary car parking will be temporarily unavailable after September 2024.”

Maybank just changed their benefits for VI. Probably need to revise your article.

yup, saw it! those benefits only take effect from 1 january 2025, so will leave it till then.

however, my quick take is that nothing has changed. this merely means the Maybank VI now matches the maybank world mastercard, but that should have been the bare minimum. I still don’t see any reason to pay the annual fee

Latest nerf: No more complimentary limos for insurance spend wef 1 Jan 2025. Triple confirmed by CSO when I tried to book a limo last month, even though the new T&Cs still hasn’t been uploaded and the current version on Maybank’s website (Nov 2024 version) still provides otherwise.

However the CSO said that insurance spend still accrues TREATS points, at the base rate of 1.2mpd (and remains capped at $3k per mth).

https://www.maybank2u.com.my/maybank2u/malaysia/en/personal/announcements/2024/april/airmiles-conversion-revision.page I think you’d need to update your blog. Since last May, it’s 10 points for 1 mile, nowhere near 1.2mpd!

Hi Aaron,

How do you get 1.2 MPD when this Maybank website says its 10,000 points to 1,000 miles since May 2024?

https://www.maybank2u.com.my/maybank2u/malaysia/en/personal/announcements/2024/april/airmiles-conversion-revision.page

Thanks

James

hint: check the URL.

LOL

Jetquay benefit has been axed as of 1Jan 2025

They waived off my annual fee for my 2nd year but they said I won’t get the 4x lounge access because they waived. So still worth to get it for insurance premiums.

This is a saver, I don’t mind trading my lounge access for annual fees.

Looks like they’ve recently excluded charitable donations and insurance premiums from points / miles eligibility.

Continued nerfing underway:

https://www.maybank2u.com.sg/en/personal/about_us/important-notices/2025/revision-maybank-tp-rewards-programme-general-tnc.page

“With effect from 1 April 2025, Maybank TREATS Points Rewards Programme General Terms and Conditions will be revised. The key revisions are summarised below:

A S$25 conversion fee will be applicable for Maybank World Mastercard and Visa Infinite Cardmembers for redemption of air miles.

Frequent Flyer Program (FFP) fee waiver will continue to be applicable to Maybank Diamanté Metal Visa Infinite and Maybank Diamanté Visa Infinite Cardmembers.

S$25 FFP fee will be applicable for all other cards.”

Personally I like this card because it can do a 2 things quite well at the same time: Uncapped 3.2mpd FCY (above S$4K) spend AND you auto qualify for the limo ride (S$3K spend), what’s not to like? Yes, there are other cards that can trump these benefits independently, but both together? The only card that comes close, is the UOB Prvi Amex, with a slightly narrower and lower ASEAN earn-rate, and if we really want to nit-pick, the free limo is of a “less posh” grade of non-Alphards. Yes, first world problems but we are all here to talk… Read more »

Has the limo benefit changed? I booked the limo around mid of this year and I still got the Alphard car for both the outgoing and return journey (min spend $6000).

No, Maybank VI still gets the Alphards. I was referring to the UOB Prvi Amex, getting the less posh non-Alphards as free limo benefit.

Hi Aaron, Do insurance premiums in FCY count for the 4K retail transactions min spend to activate bonus points?

Maybank no longer accepts government hospital spend for qualifying spend for limousine. Spent $3000 at NUHS app and was told that it is excluded from limousine spend. I went through the T&C and cannot find any mention of this exclusion.

FYI, my latest NUHS transaction was coded as 9399 as per Maybank. Under Maybank T&C clause 2.2, it will not qualify for limousine.

On a separate note, Aaron – you may have to update the Maybank VI as excluding public hospitals on your “What card do I use for…” section.

So the thing is that hospital transactions, even public ones, normally code as 8062. 9399 is quite rare- what specifically were you doing at NUHS? was it the pharmacy? that one is known to code as 9399. or was it payment via the healthhub/nuhs app? that one has recently become 9399

It was to pay for medications via NUHS app.

I managed to get only 1 limo for 2 adults, 3 children traveling from SFO tonight with a ton of bags. No luck with 2nd limo for now. No luck with UOB KF grab vouchers too.

I guess will just have to take a grab alone from airport to home and work. Let’s hope the business lounge at SFO is half decent.

ok that explains it. NUHS app MCC recently changed to 9399. but public hospitals in general, where transactions code as 8062, are still ok