Back in May 2023, Standard Chartered decommissioned the X Card and replaced it with the Journey, turning the page on one of the most unintentionally hilarious chapters in Singapore card history.

|

||

| Apply (Fee Waiver) | ||

| Apply (Fee Paying) | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 | S$194.40 (FYF option) |

3.5% |

| Regular Earn | Bonus Earn | Cap |

| Local: 1.2 mpd FCY: 2 mpd |

3 mpd on transport, food delivery, groceries | S$1K per statement month |

While the X Card was overpriced and underwhelming, the Journey is a much more competitive offering. Cardholders earn 1.2/2 mpd on local/FCY spend, as well as 3 mpd on transport, food delivery and groceries.

The bonus rates were positioned as a limited-time offer, set to lapse on 31 December 2023. However, Standard Chartered has removed the expiry wording from the T&Cs altogether, which I guess makes this evergreen!

StanChart Journey Card bonuses now permanent

StanChart Journey Cardholders will earn 7.5 points per S$1 spent (3 mpd) on selected bonus categories, capped at S$1,000 per statement month.

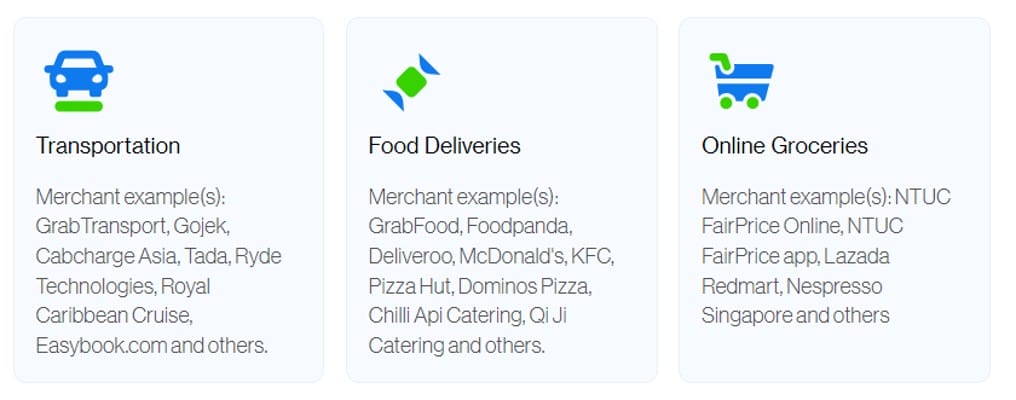

The bonus categories are often confusing to cardholders, and it’s easy to see why. On Standard Chartered’s website, bonus categories are listed as:

- Transportation

- Food Deliveries

- Online Groceries

However, these are somewhat incomplete labels. I’ve taken the liberty of expanding them based on the actual MCC ranges for greater clarity:

| Category | Examples (non-exhaustive) |

| Groceries (MCC 5411) |

NTUC FairPrice Online, Lazada Redmart |

| Bakeries (MCC 5462) |

Bengawan Solo, Polar Puffs & Cakes, Chateraise |

| Misc. Food Stores (MCC 5499) |

Bottles and Bottles, Famous Amos, Irvins Salted Egg |

| Liquor, Wine or Beer Stores (MCC 5921) |

1855 The Bottle Shop, The Oaks Cellars, Grand Cru |

| Food Delivery* (MCC 5811, 5812, 5814) |

GrabFood, Deliveroo, Foodpanda |

| Transport^ (MCC 4111, 4121, 4789) |

Grab rides, Comfort taxi, gojek |

| Cruise Liners (MCC 4411) |

Royal Caribbean, Princess Cruises, Norwegian Cruise |

| *Despite the name, the bonus would be equally applicable in situations where a restaurant has online ordering for dine-in (e.g. scan a QR code menu and pay online before receiving your food) ^Not Bus/MRT, as this is a contactless spend, not online |

|

Do note that the examples are not exhaustive; all that matters is:

- the MCC falls within the approved range

- the transaction is online

- the transaction is in SGD

Any transactions beyond the S$1,000 monthly cap will earn 1.2 mpd.

SC Journey Card welcome offer

|

| Apply (Fee Waiver) |

| Apply (Fee Paying) |

| ❓ New-to-bank Definition |

| New-to-bank customers are defined as those who do not currently hold a principal Standard Chartered card, and have not in the 12 month period before application. Debit cards, supplementary cards and corporate cards do not count. |

If you count as a new-to-bank customer with Standard Chartered, SingSaver is offering a choice of the following welcome gifts when you sign up for a Journey Card:

- 4x Apple AirTags, or

- S$80 cash

This offer is available regardless of whether you apply for the fee paying or fee waiver option. Applications must be submitted by 7 January 2024, with a minimum spend of S$250 in the first 30 days of approval.

An additional S$20 cashback will be awarded by Standard Chartered for cardholders who spend at least S$20 with Shopee, Lazada, Taobao, ezbuy, Qoo10, Carousell or Netflix within 30 days of approval.

On top of this, customers who apply by 15 January 2024 will also be eligible for a welcome bonus of up to 45,000 miles, broken down as follows:

| Rewards Points | KrisFlyer Miles | |

| Pay S$194.40 annual fee (optional) |

25,000 | 10,000 |

| Spend S$3,000 in first 60 days of approval | 87,500 | 35,000 |

| Total | 112,500 | 45,000 |

A minimum spend of S$3,000 within 60 days of approval is required. For more details on this offer, refer to the post below.

Conclusion

StanChart Journey Cardholders will continue to enjoy 3 mpd on groceries, transport and food delivery for 2024 and beyond, capped at S$1,000 per statement month.

To be clear, you could certainly earn more with alternate cards. It’s possible to get 4-6 mpd depending on which category we’re dealing with. However, if you like Standard Chartered’s range of transfer partners, or are simply in it for the welcome offers, then these would be the right categories to spend on.

does airline falls within the mcc code of transport?

Seems a little troublesome to have the online requirement for the bonus points. Doesn’t this mean that I can’t use the card directly at places like Fairprice, BreadTalk, etc. one will need to do some kind of workaround like paying through the app…assuming they have an app or online portal in the first place. (Idk if BreadTalk has one)

the online requirement is indeed annoying, as it means that it’s impossible to earn bonuses at certain merchants that don’t have online options (e.g. neighbourhood bakery)

Wish the 0% FCY became evergreen instead.

At least it’s a good way to round up the SCB mileage balance to a redeemable amount.