When Citibank launched Citi PayAll in November 2018, it completely upended the miles game in Singapore.

Yes, earning miles on bill payments wasn’t exactly new — CardUp and ipaymy had already been on the market for a few years — but Citi PayAll was substantially undercutting them. There was a mandate from on high to push adoption, and that translated into a virtual blank cheque for promotions.

Over the years we saw bonus miles, cash rebates, Grab vouchers, and all sorts of things that pushed the cost per mile lower and lower (I believe the record is 0.42 cents per mile). Add the fact that Citi had 11 airline and hotel transfer partners, and it was truly the best of times.

I suppose, in retrospect, it was always inevitable that Citi would one day turn off the spigot. The first sign came in April 2023, where the service fee was hiked from 2% to 2.2%. Then last week, Citi hiked the service fee for the second time in two years to 2.6%.

Granted, Citi just launched a promotion for income tax season which reduces the cost per mile to 1.31-1.62 cents, but this will end on 31 July 2024, while the 2.6% service fee is here to stay.

So outside of promotions, should you still consider using Citi PayAll?

Citi PayAll’s revised service fee

|

| Citi PayAll |

By way of recap, the Citi PayAll service fee has been increased to 2.6%, effective 22 April 2024 10 a.m.

With the revised service fee, the cost per mile (barring promotions) ranges from 1.63 to 6.5 cents.

| Card | Earn Rate | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 1.63¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 2.00¢ |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 2.17¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 6.50¢ |

Since the Citi ULTIMA is reserved for a select few, you’re realistically looking at either 2 cents (Prestige) or 2.17 cents (PremierMiles) per mile (if you’re using the Citi Rewards with PayAll outside a promotion, I really have nothing to say).

All other PayAll limits and caps remain the same. I’ve summarised these in my detailed guide to Citi PayAll.

How does this compare to other payment facilities?

With the revised 2.6% service fee, Citi PayAll just isn’t all that compelling compared to the competition anymore.

| 🧾 List of Payment Facilities |

||

| Bank | Admin Fee | CPM |

Direct |

1.75-2.25% |

1.1-1.83¢ |

Link LinkDirect |

1.9% | 1.36-1.9¢ |

Link LinkDirect |

2.6% |

1.63-2.17¢ |

Direct |

2.5% | 1.67¢ |

Indirect |

1.7-2.2% | 1.7-2.2¢ |

Indirect |

1.9% |

1.9¢ |

| Direct = Bank pays the recipient on your behalf Indirect = Bank deposits funds into your account; you are responsible for paying the recipient |

||

For example, with CardUp’s more-or-less evergreen promotions on rent (1.79%), recurring (1.85%) and one-off (2.25%) payments, you can buy miles in the 1.1 to 1.83 cents range.

Alternatively, those with StanChart cards can consider SC EasyBill, which supports tax, education, insurance and rent payments. With its 1.9% fee, you’ll be paying 1.58 cents (SC Journey) or 1.36 cents (SC Visa Infinite, assuming the 1.4 mpd rate is triggered).

In fact, even if you don’t have any bills to pay, you could simply purchase miles from the UOB Payment Facility at 1.7 cents (UOB Reserve), 2 cents (UOB Visa Infinite Metal Card) or 2.1 cents (UOB PRVI Miles & KrisFlyer UOB), still less than the 2.17 cents that Citi PremierMiles Cardholders would pay.

Long story short, Citi PayAll isn’t going to be the same juggernaut it used to be, and in the absence of promotions, you should be looking at alternatives.

What about transfer partner variety?

One of Citi’s long-running advantages is its transfer partner variety. With 11 airline and hotel transfer partners, the ThankYou points or Citi Miles generated through PayAll can be used for much more than just KrisFlyer.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

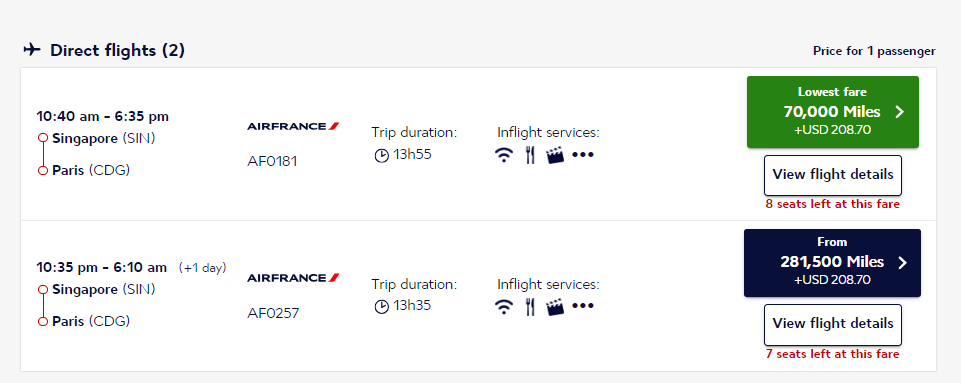

For instance, it’s possible to find one-way Business Class awards from Singapore to Europe through Flying Blue from just 70,000 miles, which assuming a cost per mile of 2-2.17 cents works out to S$1,400-S$1,519- still good value, but obviously not as cheap as before.

Likewise, there’s also sweet spots to be found with Qatar Airways Privilege Club and British Airways Executive Club (they’re basically the same, since miles can be converted at a 1:1 ratio between programmes).

| ✈️ One-way Business Class Awards |

||

| Destination | Cost | Carrier |

| Koh Samui (Economy) |

6,000 | Bangkok Airways |

| Kuala Lumpur | 12,500 | Malaysia Airlines |

| Doha | 50,000 | Qatar |

| Helsinki | 62,500 | Finnair |

| Athens, Bucharest, Sofia, Thessaloniki | 70,000 | Qatar |

| Barcelona, London, Frankfurt, Paris, Zurich | 75,000 | Qatar |

| Houston, New York | 95,000 | Qatar |

But here’s the thing: you might not need to go through Citi PayAll to purchase miles with these programmes, since they periodically sell their miles with bonuses that bring down the price significantly.

For instance, Flying Blue often runs a 100% bonus, which reduces the cost per mile to 1.5 US cents (2.04 SG cents). Qatar Privilege Club’s sales can lower the cost per mile to around 1.53 US cents (2.07 SG cents).

Under the previous 2.2% service fee, you could still generate miles via PayAll below these thresholds (1.69 cents for Prestige, 1.83 cents for PremierMiles). But with the revised fee, Citi PremierMiles Cardholders would find it cheaper to wait for a promotion and buy direct.

What about welcome offers?

The increased service fee may kill the case for day-to-day use, but given that Citi PayAll transactions count towards qualifying spend for welcome offers (provided the service fee is paid), there could still be a case here.

To illustrate, the Citi Prestige Card is currently offering a welcome bonus of 50,000 miles to new cardholders who pay the S$545 annual fee and spend at least S$2,000 within 2-3 months of approval.

Assuming you make the entire S$2,000 spend on Citi PayAll transactions:

- You’ll pay S$52 in service fees (2.6% x S$2,000)

- You’ll receive 2,600 miles (1.3 x S$2,000)

- Factoring in the annual fee and welcome bonus miles, your total outlay will be S$597 (S$545 + S$52) and the total return will be 52,600 miles (50,000 + 2,600)

This works out to 1.13 cents per mile, which is really not too bad considering the other perks the card comes with, like limo rides and airport lounge access.

Alternatively, the Citi PremierMiles Card is currently offering a welcome bonus of 30,000 miles to new cardholders who pay the S$196.20 annual fee and spend at least S$800 within 2-3 months of approval.

Assuming you make the entire S$800 spend on Citi PayAll transactions:

- You’ll pay S$20.80 in service fees (2.6% x S$800)

- You’ll receive 960 miles (1.2 x S$800)

- Factoring in the annual fee and welcome bonus miles, your total outlay will be S$217 (S$196.20 + S$20.80) and the total return will be 30,960 miles (30,000 + 960)

This works out to 0.70 cents per mile, which is pretty great.

| ❓ What about CardUp? |

| Come to think of it, you could also have used CardUp in these situations, which would have achieved the same end for a lower admin fee. |

But keep in mind these are once-off bonuses. When the time comes to renew the card, I don’t think Citi PayAll would factor into my decision, given the new revised service fee.

What about cash flow?

Citi PayAll can still be a useful tool for conserving your cashflow.

This involves taking the “no fee, no rewards” option, and making payment as close to the start of your statement period as possible. Since Citi gives cardholders a 25-day period to pay their bill from the end of the statement period, you could enjoy up to 50+ days interest-free. Think of it like an interest-free float for you to do as you please.

For more information on how this works, refer to the post below.

Conclusion

Citi PayAll now has a 2.6% service fee, which increases the cost per mile to at least 2 cents for everyone except ULTIMA cardholders. I suspect for the vast majority of people this means it’s a no go outside of promotions, as it could even be cheaper to buy miles directly from the airlines themselves.

That said, there’s still a case to be made for using PayAll to meet the minimum spend for a welcome offer, or the no-fee variant to stretch your cashflow.

Will you continue to use Citi PayAll?

Hi Aaron, can you also share what are the sweet spots of those airline royalty programs?

It’s a NO from me.

I use Cardup with DBS Vantage now

I second that. It’s a NO from me. Especially when you overlay that with the fact that it is not quite that easy to get a Business Saver these days…

The availability of Business Saver is a key point actually. You could argue that even if you are paying 2.6% for Payall, the cost of the miles is cheaper than a commerical business class ticket and so on this basis it could be argued the 2.6% is still worth it. However when you consider that you may end up with relatively expensive miles that you can’t make use of, it pushes the decision to be clearly a NO. Although you never know, with all these people ceasing to use City Payall, maybe there will be slightly better availability for those… Read more »

No for me too.

It’s a no from me too- have used them for my tax and rent for the past 4 years

Have they hiked the fee for existing arrangements set up on a monthly basis? (Ie rent was set up monthly for 2 years)

Existing recurring payments will be grandfathered in at the old 2.2pc rate. But once you cancel and set up again it will be 2.6pc

Thank you!

No. Stupid decision. Bound to drive off customers. I’ll be canceling my card.

It’s a no from me too, I’ve always used them for rent and Income tax.

I will probably pay some of my tax bill fill cardup and then just look for buying miles directly from the airlines during their promotions.

Good whilst it lasted but I hit my limit when it went to 2.2%, I won’t pay anything extra.

My use case is a little different as I’m using to pay for home tuition on per visit basis. Cardup requires invoice which unfortunately tuition teachers don’t have. Alternatively will use UOB Payment Facility once i hit the 2x payment per month limit on CitiPay All

Using CardUp mostly nowadays.

For NTUC Income insurance premium, i think the only option is Citi’ Payall

Cardup does not support payment for NTUC Income premiums.

Cardup + Vantage

As someone who knows about card interchange mechanics, I fail to understand WHY Citibank would raise the fee and see throngs exit PayAll. It’s just a misjudged cash grab by Citi. After all, a PayAll payment is just an internal debit on the card without using MC or Visa clearing.

Greed.