| ⚠️ Note: This offer ended on 6 January 2025 and has now been renewed with different gifts. Refer to this post for more details. |

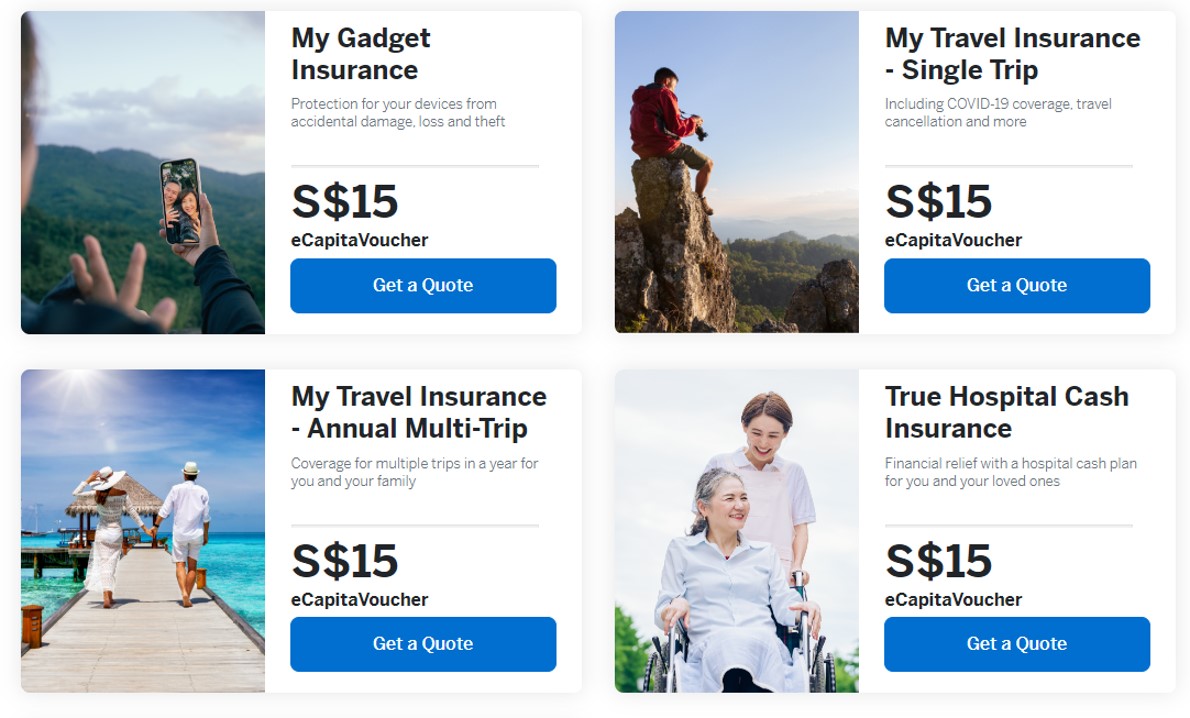

If you’re in the market for a travel insurance policy, American Express has renewed the excellent welcome gifts for its My Travel Insurance plans. You can now enjoy up to S$120 eCapitaVouchers or a Samsonite luggage when you purchase a single-trip or annual policy.

On top of this, you can get an extra S$15 eCapitaVoucher when you make the purchase via my referral link, which means that in some cases, the value of the gifts can be worth more than the policy itself!

AMEX My Travel Insurance offer

|

| Apply here |

| Note: The referral link expires from time to time. If it’s not working, please leave a comment and I’ll get it updated ASAP |

| ⚠️ Note: This offer ended on 6 January 2025 and has now been renewed with different gifts. Refer to this post for more details. |

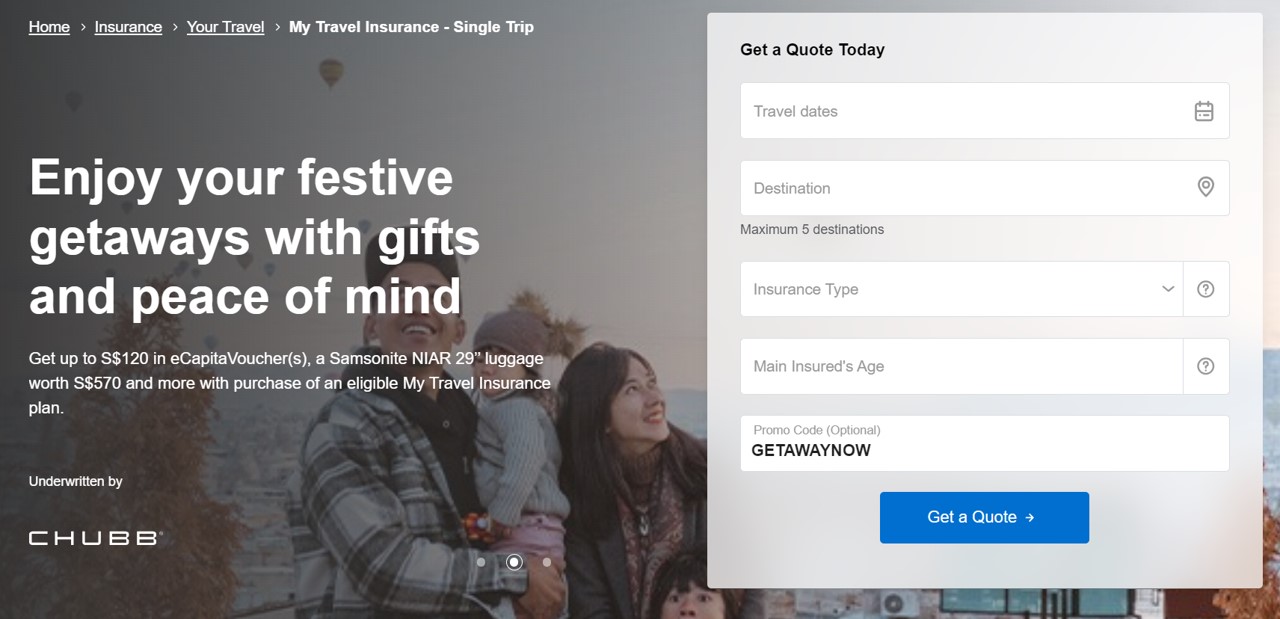

From 1 October to 6 January 2025, customers who purchase a My Travel Insurance policy with the code GETAWAYNOW can enjoy the following welcome gifts:

| Single-Trip | Annual Multi-Trip | |

| Essential | – | – |

| Standard | S$20 eCV | S$80 eCV |

| Superior | S$40 eCV |

|

| *Applies to both Worldwide (ex USA, Canada and Cuba) and Worldwide (ex Cuba) |

||

In addition to this, American Express cardholders who purchase their plans (whether single-trip or annual) via my referral link will enjoy an extra S$15 eCapitaVoucher.

For avoidance of doubt, you’ll receive one welcome gift and one referral gift per policy purchased, so for example, someone who buys 2x single-trip Superior plans will get 2x S$40 eCapitaVoucher + 2x S$15 eCapitaVoucher .

In terms of coverage, the My Travel Insurance Superior plan offers up to S$500,000 coverage for accidental death and permanent disablement, up to S$2 million for overseas medical expenses or personal liability, S$20,000 for travel cancellation or curtailment, S$1,000 of rental car excess, as well as COVID-19 protection.

Miles chasers will be pleased to know that the plan also offers up to S$20,000 coverage for the loss of frequent flyer points, in the event your inability to travel leads to them being forfeited (e.g. if you book a KrisFlyer Spontaneous Escapes award, which cannot be refunded, or if you’ve booked a hotel with points and are outside the free cancellation window).

Terms & Conditions

Below you’ll find links to the factsheet, policy wording, FAQs and T&Cs for this offer.

- My Travel Insurance Factsheet

- My Travel Insurance Policy Wording

- My Travel Insurance FAQs

- My Travel Insurance Promotion

Gifts from purchase of the policy be fulfilled within eight weeks of purchasing the plan.

The bonus eCapitaVouchers from the referral programme will take up to 12 weeks for fulfillment.

How to purchase a plan

| ⚠️ Note: This offer ended on 6 January 2025 and has now been renewed with different gifts. Refer to this post for more details. |

When you click on my referral link, you’ll be prompted to enter your AMEX card number. This will confirm which reward you qualify for.

After that, you’ll be able to select the plan you wish to purchase (My Travel Insurance Annual Multi Trip in this case). Click on that and proceed as per usual.

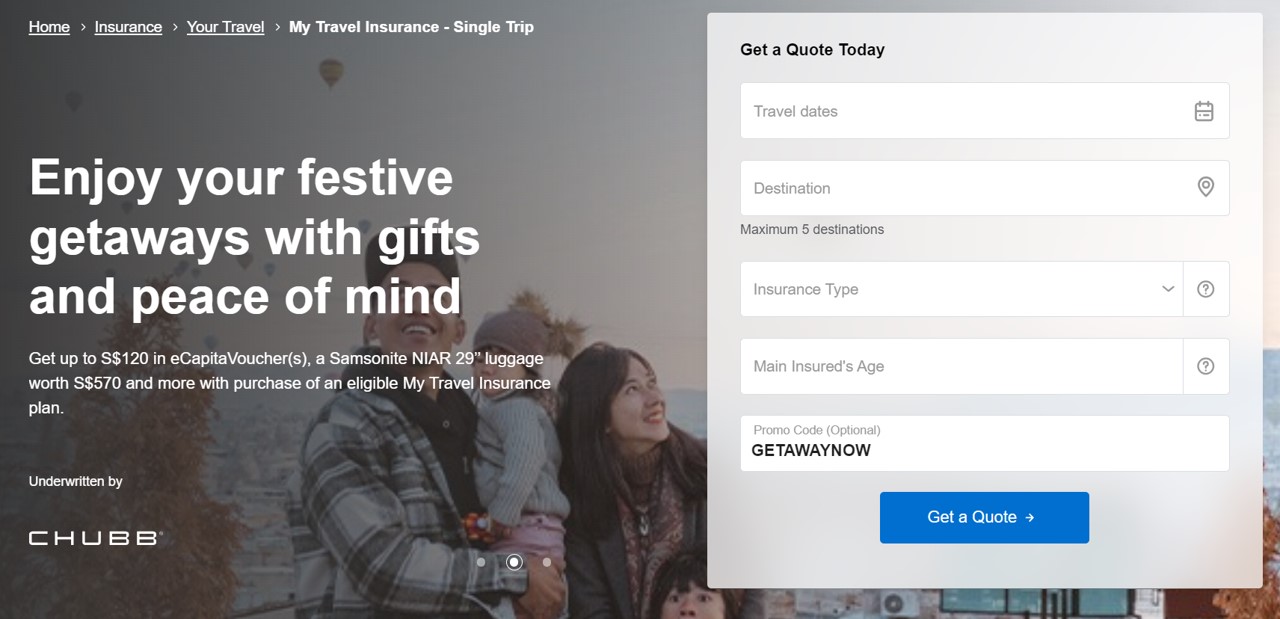

The promo code field will be automatically populated with GETAWAYNOW, and you’ll see that the regular gifts still apply, just as if you were going via the public website.

Do you earn miles or points on your purchase?

While American Express no longer awards points for insurance payments in general, there’s an exception carved out for “payments made for insurance products purchased through American Express authorised channel”.

My assumption would be that My Travel Insurance purchases qualify, and if that’s the case you’ll be able to earn your usual general spending rate, on top of the gifts.

| Card | Earn Rate |

AMEX HighFlyer Card AMEX HighFlyer Card |

1.8 mpd Not participating in the referral programme |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

1.3 mpd |

AMEX PPS Credit Card AMEX PPS Credit Card |

1.3 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd |

AMEX Centurion AMEX Centurion |

0.98 mpd |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd |

Conclusion

|

| Apply here |

| Note: The referral link expires from time to time. If it’s not working, please leave a comment and I’ll get it updated ASAP |

American Express has extended its welcome gifts for customers who purchase a My Travel Insurance plan, with an extra $15 eCapitaVoucher via the referral programme.

With both COVID-19 and loss of miles and points covered under this policy, it’s a deal well worth considering if you’re in the market for a travel insurance plan.

what happens if i already have the Accor Membership from the Krisflyer Amex card? will i just be upgraded or will i have 2 Accor memberships then?

you can only have one accor plus membership. you can give the extra one to a family member or friend.

In fact, can have two, but using 2 different email addresses.

yeah but a bit wasted i think. might as well give the privileges to a family member/spouse so they can enjoy the 50% off dining and red hot rooms etc without being tied to you.

Is the AMEX Highflyer excluded from earning miles with this,?

see no reason why highflyer won’t earn (though caveat: i haven’t tested personally). will add it to the table.

Note, however, that it is not included as a valid card under the Referral/Referee programme, so I think you will not get the $15 e-voucher.

yes, good point. stick to the krisflyer or platinum cards then.

I remember seeing an EDM awhile back saying that it is now included.

If I use my Amex card to purchase individual policies for others, e.g. family members, will each policy get a reward? Or will I get the reward only if I’m the insured in the policy?

Do we get both luggage and Accor plus?

Hi, does anyone know if TCM expenses is covered under post journey medical expenses? Thanks

My best advice is that one should not just get any travel insurance based on what travel benefits they give you such as hotel membership or some vouchers. You need to know their coverage, what are included or excluded, how good they are in processing your claims. The whole purpose of travel insurance is to protect you during travel. When you get into a sticky situation and spent a lot of money on medical expenses overseas where you have no state mandated health coverage and the insurance do not honour your claims…you be in a lot of trouble. So read the terms and conditions. If you need a legal route, you are against a corporation that have all the legal resources to protect them. So look before you leap. The devil is in the details.

Would like to point out that the coverage for loss of frequent flyer points is only applicable for very exceptional events leading to cancellation of the flight (eg. Natural disasters, riots, hospitalised etc). Listed in p.24/clause 15 of the policy wording.

i don’t think you’re reading that correctly. Clause 15 lists many other reasons resulting in travel cancellation, including:

(i) the Insured Person dying or becoming ill or sustaining Bodily Injury rendering the Insured Person unfit to travel in the

opinion of a Physician;

(ii) the death, of the Insured Person’s Family Member or Travel Companion, or Bodily Injury or Sickness of such person

necessitating him to be Confined to a Hospital;

(iii) compulsory jury service, subpoena or hijack of the Insured Person, Family Member or Travel Companion;

(iv) cancellation of scheduled Public Conveyance services consequent upon Strike, Riot or Civil Commotion;

(v) the Insured Person’s residence becoming uninhabitable due to natural disasters (including but not limited to fire, storm, or

flood) occurring such that the Insured Person’s presence is required on the premises on the Scheduled Departure Date;

(vi) due to natural disasters (including but not limited to typhoon, earthquake, hurricane, cyclones, tornados, flood, fire,

volcanic eruptions, landslide, tsunami or other convulsion of nature) which prevents the Insured Person from continuing

with the scheduled trip

I believe the list only applies to a very small percentage of claims because such events are usually quite severe and doesn’t cover more common stuff such as missed connections, flight delays etc. Still useful nevertheless when it happens.

but if you have a missed connection or flight delay, how does that necessitate claiming compensation for the loss of your miles and points?

to be clear: you’re still covered for missed connections or flight delays if your trip was booked with miles or points. clause 15 is talking about reasons that would allow you to claim the LOSS of miles and points.

Is the referral link still valid?

refer here: https://www.americanexpress.com/en-sg/insurance/referral/invitation/18e31109-512a-4637-b552-695c9046ee57/

Hi, it says the referral link has expired when I clicked on it. Thanks.

try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/18e31109-512a-4637-b552-695c9046ee57/

thanks!

Afraid I clicked on the new link and it’s still expired 🙁

try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/cef0c903-1e66-40cd-8af4-5968911dae9e/

still doesnt work bro

have just fixed it: https://www.americanexpress.com/en-sg/insurance/referral/invitation/ad1f7e8c-30b6-43e3-98b2-544b32dbfcc0/

Must the start date of the policy be before 30 September to enjoy the gifts?

nope. policy date can be any time.

promo code applied successfully. but the last page where i had to make payment.. seems to be hanging?

Hi Aaron, the referral link doesn’t seem to work, could you please update it

it’s still working for me: https://www.americanexpress.com/en-sg/insurance/referral/invitation/ad1f7e8c-30b6-43e3-98b2-544b32dbfcc0/

I think your referral link has expired

updated now: https://www.americanexpress.com/en-sg/insurance/referral/invitation/c660bed5-c928-448b-bb9b-17cbfa62c5f7/

thanks!

The APAC Superior annual Asia Pacific plan for one adult, now costs S$768.

Increase from $453? Please advise.

Hey Aaron, I bought the travel insurance through your link on 6 Aug but have not received any follow-up on the luggage yet. Can you help to check pls. Thank you.

hi jon, you’ll need to contact AMEX for all fulfillment matters

Just received their email on the redemption. Thanks Aaron.

link seems to be broken

try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/88f7e57b-e8b1-448e-bfac-c8f26df96830/

Nope…still not working.

Link expired

amex is having a problem with these links now. have sent them a mail, see if it gets resolved

your link expired

try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/7b32572e-4007-4b71-a75a-65661f6b86b9/

The cost of a superior plan to Malaysia is $40 and we can get back $40+$15 in eCapitaVouchers…It seems like there is the opportunity to churn the $15 per policy.

Think the referral link has expired

working fine for me. try this :https://www.americanexpress.com/en-sg/insurance/referral/invitation/26c53a1f-0814-4beb-93b2-1deacf3ee0b8/

Think the link expired, couldn’t purchase today

have updated it to https://www.americanexpress.com/en-sg/insurance/referral/invitation/ff9f6e29-3fa0-484b-992b-726d1d391032/

thanks!

link expired.

thanks! have updated: https://www.americanexpress.com/en-sg/insurance/referral/invitation/e614c414-392e-420f-81f4-ebe69b8dadc7/