Apple’s latest iPhone 16 starts taking pre-orders from 8 p.m Singapore time tonight, ahead of its 20 September 2024 release date.

I have very little idea what’s changed from the previous iteration, though I gather from the hype that Apple Intelligence will put an end to world conflicts and male pattern hair loss (both of which may be related), so at least there’s that.

In any case, you’re not here for the tech commentary- you’re wondering how to get the most miles out of this bad boy, which will set you back anywhere from S$1,299 to S$2,499.

| 🍎 Apple iPhone 16 Prices | ||||

| Storage | Model | |||

| 16 | 16+ | 16 Pro | 16 Pro Max | |

| 128GB | S$1,299 | S$1,399 | S$1,599 | – |

| 256GB | S$1,449 | S$1,549 | S$1,749 | S$1,899 |

| 512GB | S$1,749 | S$1,849 | S$2,049 | S$2,199 |

| 1TB | – | – | S$2,349 | S$2,499 |

The way I see it, you should be at the very least be earning 3 mpd on this purchase, though with the right kind of stacking, that figure could go as high as 8 mpd.

Baseline: Don’t earn fewer miles than this!

Let’s start with what I call “baseline miles”, because no matter where you ultimately end up buying your iPhone, you should not be earning fewer miles than this.

Buy iPhone online

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd MCC 5732* |

Max. S$1K per c. month. Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd MCC 5732* |

No cap. Must spend at least S$800 on SIA Group in m. year Review |

| *And other whitelisted MCCs, refer to T&Cs for the full details. Most retailers which sell iPhones should code under MCC 5732. |

||

Buy iPhone in-store

| Card | Earn Rate | Remarks* |

UOB Pref. Plat Visa UOB Pref. Plat VisaApply |

4 mpd | Use mobile payments, max S$1.1K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd | Use contactless payments, min S$1K max S$2K per s. month Review |

| *Mobile payment= Add card to Apple/Google Pay and tap phone to pay Contactless payment= Tap physical card or add card to Apple/Google Pay and tap phone to pay |

||

Given that this will be a big-ticket purchase, you’ll definitely want to ascertain the MCC before buying, if you’re using an MCC-sensitive card like the KrisFlyer UOB Credit Card or HSBC Revolution.

Fortunately, there’s three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

You might be wondering where the UOB Lady’s Cards are. MCC 5732 does not fall under any of the card’s bonus categories, but that doesn’t mean you can’t use it. All we need to do is change the MCC to something else via KrisShop or HeyMax and pick the right bonus category. I’ve covered how to do this in the sections below.

It’s also worth checking whether you qualify for any sign-up bonuses, because a four-digit purchase is going to put you some way towards achieving it. I’ve just published a round-up of the latest credit card welcome offers on the market, so be sure to check out the post below.

Up to 5 mpd with Kris+

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Kris+ lets you earn additional miles at participating merchants, on top of credit card rewards. This includes several retailers where the iPhone will be on sale.

1 mpd from Kris+

The following electronics retailers are offering an incremental 1 mpd on all purchases, including Apple iPhones.

| Retailer | Earn Rate |

|

2 miles per S$2 |

|

3 miles per S$3 |

| 1 mile per S$1 |

Don’t forget to transfer any miles earned to KrisFlyer within 21 days of the transaction, in their entirety. If you wait longer than 21 days, or use Kris+ to spend any portion of the miles earned, the remaining balance will be stuck inside Kris+.

Up to 4 mpd from credit card

Kris+ transactions code as online, and maintain the MCC of the underlying merchant.

This would be MCC 5732 Electronics Stores for the three Kris+ retailers mentioned above, so you can use the following cards for up to 4 mpd.

| 💳 Best Cards for Kris+ (MCC 5732 Electronics) |

||

| Card | Earn Rate | Remarks |

Citi Rewards + Amaze Citi Rewards + AmazeApply |

4 mpd | Max. S$1K per s. month. Do not use Citi Rewards Card alone- no bonuses Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd |

Max. S$1K per c. month Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | No cap Review |

Up to 8 mpd with KrisShop

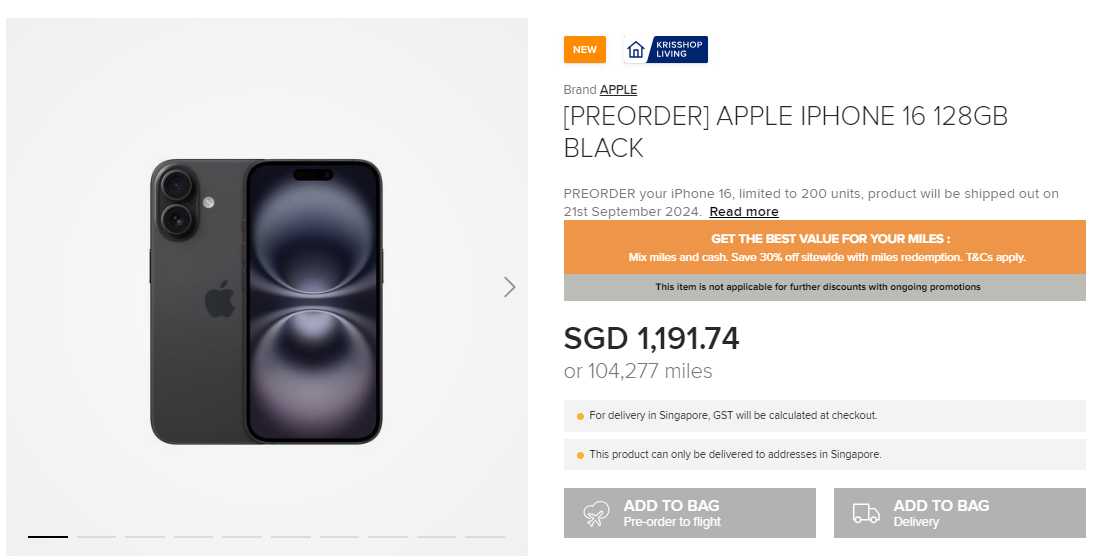

The iPhone 16 is available for pre-order on the KrisShop website (and before you get excited about the price, remember that it’s before 9% GST).

Up to 4 mpd from KrisShopper

| KrisShopper Tier | Qualifying Spend | Earn Rate |

Non-KrisShopper Non-KrisShopper |

N/A | 1.5 mpd |

Member Member |

N/A | 2 mpd |

Insider Insider |

S$5,000 | 2.5 mpd |

| S$10,000 | 3 mpd | |

Ambassador Ambassador |

S$15,000 | 4 mpd |

| *Qualifying spend includes purchases on KrisShop.com, KrisShop on Kris+, KrisShop on KrisWorld, Inflight purchases on Singapore Airlines. Excludes GST, duties and delivery charges | ||

The thing to remember here is that KrisShopper does not award miles on GST, so if your iPhone 16 costs S$1,191.74 + S$107.25 GST, for example, you’ll only earn the 1.5-4 mpd on S$1,191.74.

This means your effective earn rate will be slightly less than the figures mentioned above.

| ✈️ 30% off KrisFlyer miles redemptions |

|

From now till 30 September 2024, KrisShop is offering 30% off KrisFlyer miles redemptions for all items, including the Apple iPhone. Do note that this is not a discount on the price per se. Instead, it boosts the value per mile from 0.8 cents to 1.14 cents each. I would still prefer to redeem an award flight, but if you have expiring miles and no plans to travel, then I guess this would be one of the better ways of cashing them out. |

Up to 4 mpd from credit card

KrisShop purchases code as online transactions under MCC 5309 Duty Free Stores, so you can use the following cards for up to 4 mpd.

| 💳 Best Cards for KrisShop/Krisshop on Kris+ (MCC 5309 Duty Free Stores) |

||

| Card | Earn Rate |

Cap |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | S$1K per c. month with Travel as bonus category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire CardApply |

4 mpd | S$2K per c. month with Travel as bonus category |

DBS WWMC DBS WWMCApply |

4 mpd |

S$1.5K per c. month |

Citi Rewards Citi Rewards Apply |

4 mpd* |

S$1K per s. month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | S$1.1K per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | S$1K per c. month |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd | S$1.1K per c. month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | None |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

2 mpd |

None |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

2 mpd | None |

| S. Month= Statement Month | C. Month= Calendar Month *0.4 mpd if KrisShop on Kris+. Circumvent this by pairing with Amaze |

||

Do note that KrisShop is also offering a bonus 2,000 KrisFlyer miles for Mastercard customers who spend a minimum of S$1,000 on Apple iPhones by 30 September 2024 (or when 2 million miles are given away, whichever comes first).

Up to 7.5 mpd with HeyMax

|

| 👍 700 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 700 Max Miles as a welcome bonus after adding a card, purchasing a voucher and viewing the redemption page |

| 700 bonus Max Miles |

MCC lookup platform HeyMax also sells vouchers, where purchases earn Max Miles that can be converted to 27 airline and hotel loyalty programmes.

Up to 1.5 mpd from HeyMax

The following HeyMax merchants should eventually stock the iPhone 16:

- Shopee: 0.35 mpd

- Lazada: 0.5 mpd

- Courts: 1 mpd

- Amazon SG: 1.4 mpd

- Qoo10 (um, maybe not): 1.5 mpd

Up to 6 mpd from credit card

HeyMax voucher purchases code as online transactions under MCC 5311 Department Stores, so you can use the following cards for up to 6 mpd.

| 💳 Best Cards for HeyMax gift cards (MCC 5311 Department Stores) |

||

| Card | Earn Rate | Remarks |

OCBC Rewards OCBC RewardsApply |

6 mpd | Max S$1K per c. month |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month, must choose Fashion as bonus category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire CardApply |

4 mpd | Max S$2K per c. month, must choose Fashion as bonus category |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max S$1.1K per c. month |

KrisFlyer UOB KrisFlyer UOBApply |

3 mpd | Min S$800 spend on SIA Group in a membership year required |

Other tips

Optimise bonus caps with BNPL and gift cards

Given the hefty price of the iPhone 16, it’s highly likely you’ll bust the bonus cap on some of the 4 mpd cards out there.

For example, if I were to buy an iPhone 16 Pro Max 1TB at S$2,499 with the DBS Woman’s World Card, only the first S$1,500 would earn 4 mpd. The remainder earns 0.4 mpd, which means 6,400 miles in total, or an effective earn rate of 2.56 mpd.

But there’s ways of circumventing this. Assuming the store doesn’t let you split the cost over different cards, you could try Atome, which partners with KrisShop, iStudio and Singtel. This breaks the transaction into three interest-free monthly instalments, while changing the MCC to MCC 5999 Misc. and Specialty Retail.

My S$2,499 payment would then become S$833 per month, well within the bonus cap of various specialised spending cards.

Here’s a summary of the best cards to use for Atome.

| 💳 Best Cards for Atome (MCC 5999) |

||

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1.5K per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd* | Max S$1.1K per c. month |

KrisFlyer UOB KrisFlyer UOBApply |

3 mpd* | Min S$800 spend on SIA Group in a m. year |

| *While MCC 5999 is on the whitelist, there have been several reports that Atome does not earn bonus miles with UOB cards so proceed at your own risk! | ||

| ⚠️ Trigger payments manually! |

|

There are reports of cardholders not earning points on the 2nd and 3rd payments with BNPL platforms. This might be because the way the platform processes subsequent instalments does not satisfy the “online” parameter required to earn bonuses with certain cards. To avoid this issue, my advice would be to trigger payments manually each month instead of letting them happen automatically. |

Alternatively, you can purchase gift cards from a platform like Wogi (MCC 5947 Card Shops, Gift, Novelty and Souvenir Shops), which sells Best Denki, Challenger, eCapitaVouchers and more.

For example, I could buy S$1,500 worth of eCapitaVouchers with my DBS Woman’s World Card and S$1,000 worth of eCapitaVoucher with my Citi Rewards Card, staying within the bonus caps for both.

Here’s a summary of the best cards to use for Wogi.

| 💳 Best Cards for Wogi (MCC 5947) |

||

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1.5K per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max S$1.1K per c. month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | Min S$800 spend on SIA Group in m. year |

AMEX x Apple Rewards Store

|

| AMEX Apple Rewards Store |

American Express offers an online Apple Rewards Store where Membership Rewards points can be used to offset purchases at a rate of S$6 per 1,000 MR points (versus S$4.80 per 1,000 points normally).

Based on the conversion rates to miles, this is equivalent to accepting a value of:

- AMEX Platinum Charge/Centurion: 0.96 cents/mile

- All other AMEX cards: 1.08 cents/mile

Truth be told, it’s not a fantastic valuation, so I wouldn’t recommend it unless you’re flush with MR points.

Use the DBS yuu Card for 18% rebates

I know we’re supposed to be talking about miles, but if you’re buying an iPhone from a Singtel Shop or Singtel Exclusive Retailer, paying with the DBS yuu Card would earn 18% rebates in the form of yuu Points.

|

|

| Apply (AMEX) | |

| Apply (Visa) | |

| Points | Remarks |

| Base 10 points per S$1 spent (equivalent to 5% rebate) |

|

| Bonus 26 points per S$1 spent (equivalent to 13% rebate) |

|

| Note: The amounts above include the base 1 point per S$1 (0.5%) from the yuu Rewards app | |

The 18% rebate is capped at S$600 per calendar month, but by getting both the AMEX and Visa versions, you can effectively double your rebate cap. Any amount in excess of S$600 will still earn an uncapped 5% rebate, which isn’t too shabby either.

If you’re planning to dull the upfront pain of a new iPhone by buying an (overpriced) monthly plan, you can also earn 18% rebates on your monthly Singtel bill by paying with the yuu Card at Singtel kiosks.

Extra 2-6 mpd with the UOB Lady’s Cards

Every time you see the UOB Lady’s Cards mentioned above, don’t forget that you can earn an extra 2-6 mpd by opening a UOB Lady’s Savings Account.

Realistically though, an extra 2 mpd is all that makes sense given how the bonus miles are awarded.

Conclusion

The latest Apple iPhone 16 will put a dent in your wallet, but at least it’ll pad your miles account. The key here is to look for stacking opportunities, and to split up the amount via gift cards, BNPL, or simply paying with multiple cards in-store so you can optimise your bonus caps.

And here I am still waiting for the Pixel 9 Pro…

How about redeeming expiring miles on KrisShop for the iPhone 16? Worth it? 😀

Ha, ha, ha! We all know the ONLY thing you’re waiting for is for the BlackBerry KEYone to have an HSBC Revolution-like resurrection… when in reality such phones have been killed off (again like the Revolution!).

what about apple pay online? visa signature?

since when visa signature offer bonus for apple pay?

Hi, would be interested in an article for when buying through Telco.

Hi! do you know if we were to buy directly from Shopee/ Lazada, does it earn us the miles (ref UOB Lady’s solitaire category: Fashion). Read from some other articles that

Shopee: MCC 5699

Lazada: MCC 5311

Which would be covered under the “Fashion” category.

Hi Aaron, could you confirm if Atome payment qualifies for Citi Rewards 10X points? I read that MCC 5999 is not included in the list for points and and I’ve read from your past post “What’s the best credit card for Buy Now Pay Later (BNPL) platforms?” from 3 years ago that says the same thing.

What’s the right way to do it then? Thanks!

Cannot even see the iPhone 16/ MacBook on Krisshop for travellers

Hi, if I’m buying through Krishop, it will be 1.5mdp for me. Can I stack with UOB krisflyer care and earn a 3mpmd?

This will add up to 4.5mpd ? Does this work?