Back in 2017, UOB partnered up with Singapore Airlines to launch the KrisFlyer UOB Account, dubbed “a new way to bank and fly”.

I took one look at the details and was instantly smitten. I mean, how could you not love a poorly-conceived bank account with no interest, a miserly miles cap, and lacklustre Scoot benefits, heavily shilled by clueless media outlets and even more clueless influencers?

UOB didn’t share my opinion, naturally, and doubled down. This sparked a prolonged game of whac-a-mole where every few months, a different media outlet would get paid to wax lyrical about the account, and every few months I’d have to write a spirited rebuttal. Isn’t courtship fun?

I don’t know whether UOB ever achieved the S$1.5 billion in deposits they were targeting for this account. What I do know is that not a single cent of yours should be among that number, because the KrisFlyer UOB Account remains as much of a dud as it was eight years ago.

How the KrisFlyer UOB Account works

The first thing to understand about the KrisFlyer UOB Account is that you don’t earn miles passively like you would interest. For example, you could put S$1 million in your KrisFlyer UOB Account and earn absolutely no miles, if you don’t do anything else.

| ⚠️ Exception: Fresh Funds Promo |

|

From time to time, UOB may run fresh funds promotions that award KrisFlyer miles for topping up a KrisFlyer UOB Account, without the need to spend. The current offer awards up to 180,000 KrisFlyer miles for depositing fresh funds and a maintaining them for four months:

Outside of these promotions, you must spend on your UOB cards to earn any miles from the KrisFlyer UOB Account. |

Instead, placing money in the KrisFlyer UOB Account gives you the opportunity to earn bonus miles based on your spending on eligible debit or credit cards, namely:

- KrisFlyer UOB Debit Card

- KrisFlyer UOB Credit Card

- UOB Privilege Banking Card

- UOB PRVI Miles AMEX

- UOB PRVI Miles Mastercard

- UOB PRVI Miles Visa

- UOB Reserve Card

- UOB Visa Infinite Metal Card

- UOB Visa Infinite Card

For example, if I spend on my UOB PRVI Miles AMEX in SGD, I will earn:

- A base reward of 1.4 mpd from my UOB PRVI Miles AMEX

- A bonus reward of 5-6 mpd from my KrisFlyer UOB Account

| Without Salary Crediting | With Salary Crediting | |

| UOB PRVI Miles AMEX | 1.4 mpd | 1.4 mpd |

| KrisFlyer UOB Account | 5 mpd | 6 mpd |

| Total | 6.4 mpd | 7.4 mpd |

| To unlock the salary crediting bonus, you must credit a minimum salary of S$1,600 to the KrisFlyer UOB Account |

||

The miles earned from the KrisFlyer UOB Account will be automatically credited to your KrisFlyer membership account in the following calendar month, within the first seven working days.

The catch: 5% cap on MAB

Now, I know what you’re thinking: an extra 5-6 mpd? That’s insane! Where has this been all my life and why didn’t you tell me about it earlier?!

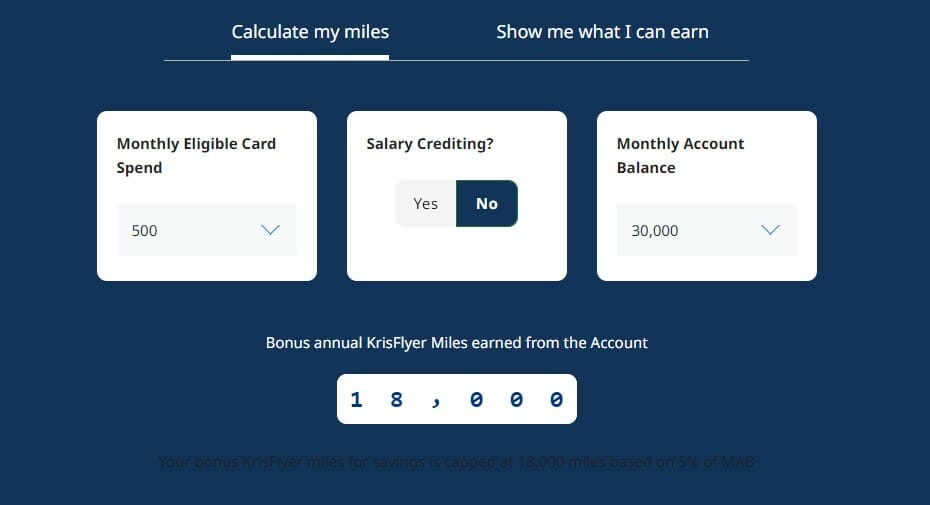

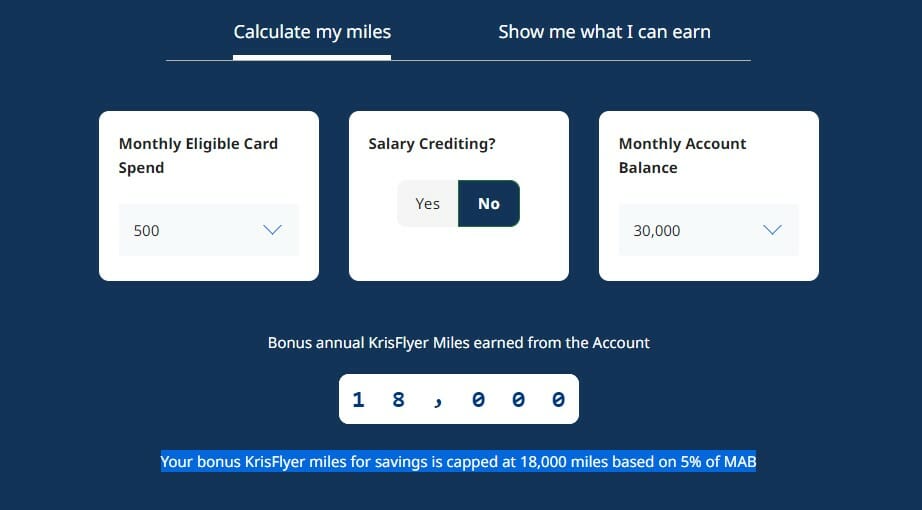

Well, I haven’t told you about the KrisFlyer UOB Account’s big catch: the maximum miles you can earn each month are capped at 5% of your Monthly Average Balance (MAB).

Some illustrations are provided below.

| MAB | Monthly Cap (5% of MAB) |

Card Spending Cap | |

| No Salary Credit (5 mpd) |

With Salary Credit (6 mpd) |

||

| S$1,000 | 50 miles | S$10 | S$8.33 |

| S$10,000 | 500 miles | S$100 | S$83.33 |

| S$20,000 | 1,000 miles | S$200 | S$166.67 |

| S$50,000 | 2,500 miles | S$500 | S$416.67 |

| S$100,000 | 5,000 miles | S$1,000 | S$833.33 |

For example, if your MAB is S$1,000 (the minimum required to earn miles), you can earn at most 50 miles (5% of S$1,000) from the KrisFlyer UOB Account each month. Assuming you don’t credit a salary (5 mpd), the account would stop rewarding you after spending just S$10 (50/5 mpd) on your cards!

Even with a larger MAB like S$50,000, only the first S$500 of spending will be rewarded with 5 mpd. For any spend in excess of that amount, the base reward on your credit card is all you’re going to earn.

Now, suppose you put that S$50,000 in a Mari Savings Account instead, which offers 2.5% p.a. interest (it’s actually 2.7% p.a. now, but the rate decreases to 2.5% p.a. from 1 January 2025 so let’s use that). After a year, you’ll earn an extra S$1,250 (actually more, but let’s ignore compounding).

Compare that to the KrisFlyer UOB Account, where your maximum return, assuming you max out the cap each month, is 30,000 miles and S$25 (from 0.05% p.a. of interest, woohoo!).

| KrisFlyer UOB Account | Mari Savings Account | |

| After 1 year | 30,000 miles + S$25 | S$1,250 |

I personally value a mile at 1.5 cents each, so the return from the KrisFlyer UOB Account is a mere S$475, 62% lower than the Mari Savings Account! You’d have to value a mile at more than 4 cents each to be on par, much less come out ahead.

And that, in a nutshell, is why the KrisFlyer UOB Account is so bad. Sure, the 5/6 mpd earn rates are attention-grabbing, but what use is that when the cap is so low?

I wonder how many accountholders realise this, because UOB says the nice part loud and the nasty part quiet (as you’d expect any bank to do, really). I mean, it wasn’t too long ago that the product page for the KrisFlyer UOB Account disclosed its cap like this.

What’s that you say? You can’t see anything? Well I don’t blame you, because it’s printed in black, on a dark blue background. It’s only when you highlight the text that the cap appears.

This “formatting issue” has since been rectified, but even if we’re charitable and call it an innocuous oversight rather than anything sinister, it’s a microcosm for the KrisFlyer UOB Account as a whole: it looks good on the surface, but scary things lurk in the shadows!

Is there a way of gaming this?

Feel free to skip this section if it’s confusing, but for those with a decent amount of capital, there is a way to “win” the KrisFlyer UOB Account- at least for the first month.

This takes advantage of the fact that the MAB is calculated like this:

| Sum of day-end balance in KrisFlyer UOB Account ÷ Number of calendar days in each calendar month |

| Source: UOB FAQs |

In the account opening month, the MAB will be derived based on the number of calendar days from the account opening date till the end of the calendar month.

For example:

- You open your account on 20 April 2025

- You deposit S$20,000 on 20 April 2025 and maintain the balance until 30 April 2025

- MAB for April 2025 is S$20,000 [(20,000 x 11)/11] (there’s 11 calendar days from 20 April 2024 to 30 April 2025, not 10; the day of opening also counts)

Do you see where I’m going with this? If someone had a lot of cash sitting around, he could open a KrisFlyer UOB Account on the last working day of the month, park the money inside, earn bonus miles from card spending, then yank the money once the following month begins (maybe leave S$1,000 inside to avoid the S$2 fall below fee) and put it to better use.

If timed correctly, the opportunity cost would be minimal, because the S$350,000 was in the KrisFlyer UOB Account for such a short period.

Let’s illustrate this with some figures:

- I open a KrisFlyer UOB Account on Wednesday, 30 April 2025 and immediately deposit S$350,000 inside

- My MAB for the entire month of April would be S$350,000, which allows me to earn up to 17,500 bonus miles (5% of S$350,000) from the KrisFlyer UOB Account on my spending across eligible cards, from 1-30 April 2025 (not just from the date the account was opened).

- At a 5 mpd rate (no salary crediting), that works out to S$3,500 of spend

- On Thursday, 1 May 2025, I withdraw S$349,000 (leaving S$1,000 inside to avoid the fall-below fee)

Because the cap is fixed at 5% of MAB, the more capital you have to deploy, the bigger the number of miles you can earn. It’s a cheap (or rather, expensive) thrill for sure, but if you’ve got the capital, why not?

Now, if you want to do this, a few precautions to note. You should open your account on the last working day of the month, before 10.30 p.m, and fund it immediately.

|

Inward Funds Transfer via FAST/PayNow performed after 10.30pm on a business day (Mondays to Saturdays, excluding Sundays and Public Holidays) will carry the value date of the next business day. Inward Fund Transfers received on a non-business day (Sundays, Public Holidays) will similarly carry the value date of the next business day. Such transfers may lower your MAB, and you are encouraged to review the transaction details on Personal Internet Banking / TMRW App regularly and make funds top up if necessary to maintain your MAB at the preferred level |

|

| Source: UOB FAQs (for the Lady’s Savings Account, but similar logic would apply to the KrisFlyer UOB Account) | |

Any later and the funds, even though they may be deposited instantly, will carry the value date of the next working day which falls in the following calendar month (and your MAB for the current month will be zero).

Also note that account openings may not be instant outside of working hours, so if you were to do this, do it early in the day.

Finally, I want to emphasise again that this is a purely one-time opportunity, only available in the opening month. In the following months, there’s a much higher opportunity cost of parking funds in the UOB KrisFlyer Account, because the MAB is based on the entire month.

What about the KrisFlyer UOB Debit Card?

All KrisFlyer UOB Accountholders automatically receive a KrisFlyer UOB Debit Card.

Cardholders will receive a one-time bonus of 3,000 KrisFlyer miles when they make their first transaction of at least S$5, but aside from this, there’s little reason to put any spending on this card at all.

Why? The earn rates are mediocre, to say the least:

- 1 mpd on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

- 0.4 mpd on all other spend

You could be earning up to 4 mpd on those purchases with the right credit cards, so there’s only three scenarios where I could see someone spending with a KrisFlyer UOB Debit Card.

You don’t qualify for a credit card

If you’re a student, retiree, or someone without a fixed income, then a credit card may be out of the question, and a debit card the next-best solution.

That said, if you’re asset rich but income poor, you could always open a secured credit card with UOB and get access to much more rewarding cards, like the UOB Preferred Platinum Visa or UOB Lady’s Card.

You’re interested in better FX rates

KrisFlyer UOB Accountholders can convert SGD into 10 major foreign currencies, and hold them in their wallet for overseas spend via the KrisFlyer UOB Debit Card.

| 🌎 UOB Mighty FX Supported Currencies | |

|

|

| *Unavailable for POS/online transactions and overseas ATM cash withdrawals |

|

When you swipe your KrisFlyer UOB Debit Card overseas, funds will be deducted from the relevant wallet. This is conceptually similar to Revolut or YouTrip,

I’m all for better FX rates, but you don’t actually need a KrisFlyer UOB Account to do this. You could just as well get a UOB FX+ Debit Card and pair it with a UOB One Account, which earns up to 4% p.a. on a balance of up to S$150,000.

KrisFlyer UOB Debit Cardholders will still earn the usual 0.4 mpd on overseas spend, and receive a 200 KrisFlyer miles reward for every conversion of S$1,000, capped at four conversions per calendar year.

However, these won’t be enough to offset the foregone interest and miserly earn rates of the KrisFlyer UOB Account, and much better alternatives exist.

You’re spending on insurance premiums

Whether through oversight or design, the KrisFlyer UOB Debit Card still earns 0.4 mpd on insurance premiums. 0.4 mpd is close to nothing, but since insurance is excluded from rewards by almost every card on the market, you might as well take it.

Other KrisFlyer UOB Account benefits

KrisFlyer UOB Accountholders enjoy additional privileges with Scoot, Grab and Changi WiFi.

However, I want to point out that the same or better benefits can be enjoyed with the KrisFlyer UOB Credit Card, which I actually rate as a much better option to its debit card brethren.

Scoot Privileges

KrisFlyer UOB Debit Cardholders enjoy the following benefits when booking Scoot tickets with their card.

| ✈️ Scoot Privileges for KrisFlyer UOB Cards |

||

| For Principal Cardholder | For Companions (on same booking) |

|

| Free Priority Check-in and Boarding | ✅ | ✅ |

| Extra 5kg Luggage Allowance (with purchase of min. 20 kg allowance) |

✅ | ❌ |

| Free Standard Seat selection | ✅ | ✅ |

To enjoy these benefits, be sure to book your Scoot tickets via this dedicated portal.

2x S$10 Grab voucher to/from Changi Airport

KrisFlyer UOB Debit Cardholders will receive a biannual S$10 Grab voucher valid for rides to/from Changi Airport.

This can be redeemed once per half yearly (i.e. Jan to Jun/ Jul to Dec), with the promo code KFUOB.

S$10 off Changi WiFi

KrisFlyer UOB Debit Cardholders will receive an annual S$10 ChangiWiFi voucher.

Cardholders can generate an e-redemption code by sending the following SMS to 77862.

| 📱 SMS to 77862 |

| KFUOB<space>16 digit card number |

Terms & Conditions

Why not consider the UOB Lady’s Savings account?

If you really want a bank account that earns you miles, why not look at the UOB Lady’s Savings Account instead?

This bank account (which despite the name, is open to both men and women) awards UOB Lady’s Cardholders with bonus UNI$ based on their MAB.

| MAB | UNI$ from Lady’s Savings Account | UNI$ from Lady’s or Lady’s Solitaire Card | Total |

| <S$10K | N/A | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| S$10,000 to S$49,999 | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| S$50,000 to S$99,999 | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| S$100K and more | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

For example, a UOB Lady’s Solitaire Cardholder who has an MAB of S$10,000 would earn an extra 5X UNI$ (2 mpd), on top of the regular 10X UNI$ (4 mpd) earned from spending on his/her bonus categories.

There is a cap on the bonus miles you can earn, but it has nothing to do with the MAB. Instead, the maximum bonus miles you can earn from the UOB Lady’s Savings Account follows the cap on your UOB Lady’s Card:

- UOB Lady’s Card: S$1,000 per calendar month

- UOB Lady’s Solitaire Card: S$2,000 per calendar month

Like the KrisFlyer UOB Account, you only earn a miserly 0.05% p.a. interest on the MAB, but unlike the KrisFlyer UOB Account, the miles you earn can actually offset the forgone interest. Refer to the articles below for more details.

UOB Lady’s Savings Account: Is 6 mpd worth a S$10,000 deposit?

Conclusion

The KrisFlyer UOB Account is so hilariously inept at the thing it’s supposed to be good for — earning miles — that it’s almost endearing.

It’s not like UOB doesn’t know how to make good bank accounts. Even after its interest rate nerf, I’m still a big fan of the UOB One Account, which earns me an easy 4% p.a. on S$150,000. Likewise, I also make use of the UOB Lady’s Savings Account to maintain a 6 mpd earn rate with my UOB Lady’s Solitaire.

In contrast, the KrisFlyer UOB Account feels like it’s targeting those who don’t know any better, and perhaps in that sense, it’s apt that UOB chose lifestyle influencers to fire the opening salvo.

So long as the 5% MAB cap is in place, the opportunity cost will be too high, and the payoff too low. There is simply no reason why anyone who qualifies for a credit card should be using this to earn miles.

The “fresh funds” promo is interesting. If $300k can generate 180k KF miles in 3 months and with each mile valued at 1.5cts then my shonky maths makes that a 6% return, about double the current earning rate as a fixed deposit or something similar.. Have a missed any gotcha’s with this…?

Just remember to take the balance out when the lock-in period is over. Their hope is that you forgot about it and leave the money there after the lock-in period.

How did you get 6%?

180k miles at 1.5cpm is $2700 which is 0.9% returns from a 300k investment. Since this is over 3 months, annualised, the return will be about 3.6%

it’s 4 months not 3 isn’t it? that’s what the website says anyway.

Article says maintaining the fresh funds for 4 months. So the annualised return is just 2.7%.

Oops. Said my maths was shonky.! Thank you for pointing out my errors. Even at 2.7% I am still quite tempted….

Yes… and with 300K MAB you can also earn 15k miles from spendings per month.. plus the default 0.25% interest, it’s good for a four month lock-in.

I just opened this krisflyer uob account because I have an upcoming USD 10k payment to be made, and I thought I could at least get some krisflyer miles from the transaction, since I couldn’t find any other way of getting cashback or miles from a foreign currency transaction without incurring foreign transaction fees. Would you have any better suggestions on how to make my USD 10k spending more “worthwhile”?

milelion, thank you for your open sharing. as I have a hefty mortgage repayment every month ($x000), I was hoping to use cardup to somehow zeng out miles. which miles credit card would you recommend? I read through your 2023 cardup writeup and looked at the cards listed and narrowed down to the UOB Prvi miles Visa cards (1.4mpd) and UOB Krisflyer Credit card (1.2mpd) (NOT the debit card that you were discussing above). for the Krisflyer credit card, I will not be joining the UOB Krisflyer bank account. I am more inclined to try out first on UOB kris… Read more »