In an ideal world, you would be able to split payments across multiple credit cards whenever you pleased.

But real life isn’t so simple. While some stores and websites allow customers to split payments, the general rule is one transaction, one card. That’s unfortunate, because splitting payments enables you to spend the optimum amount on each card, maximising your overall earn rate.

The good news is that even if the merchant doesn’t explicitly allow for splitting of payments, there are some potential workarounds that let you achieve the same end.

Why might you want to split payments?

To optimise sign-up bonuses

Many general spending cards offer lucrative sign-up bonuses, which require making a particular minimum spend within a certain period of approval.

However, their earn rates outside of the sign-up bonus may not be very impressive, so in an ideal situation you’d meet the minimum spend on the dot, then switch to higher-earning cards for the remainder.

For example, suppose I’ve just signed up for a StanChart Journey Card, which at the time of writing offers 20,000 bonus miles with a minimum spend of S$800. I also have an upcoming transaction of S$2,000 to make.

The non-optimised approach would be to put the entire S$2,000 on the StanChart Journey Card.

- The first S$800 earns 20,960 miles because of the StanChart Journey Card’s sign-up bonus

- But the remaining S$1,200 earns just 1,440 miles, based on the StanChart Journey Card’s general spending rate of 1.2 mpd

- Total miles: 22,400

| Spend | Miles | |

StanChart Journey Card StanChart Journey Card |

S$2,000 | 22,400 (20,000 bonus miles & S$2,000 @ 1.2 mpd) |

| Total | S$2,000 | 22,400 |

The optimised approach would be to put S$800 on the StanChart Journey Card, and S$1,200 on the UOB Visa Signature Card:

- The first S$800 earns 20,960 miles because of the StanChart Journey Card’s sign-up bonus

- The remaining S$1,200 earns 4,800 miles based on the UOB Visa Signature’s earn rate of 4 mpd for contactless payments

- Total miles: 25,760

| Spend | Miles | |

StanChart Journey Card StanChart Journey Card |

S$800 | 20,960 (20,000 bonus miles & S$800 @ 1.2 mpd) |

UOB Visa Signature UOB Visa Signature |

S$1,200 | 4,800* (S$1,200 @ 4 mpd) |

| Total | S$2,000 | 25,760 |

| *Assuming local contactless spend |

||

To optimise specialised spending bonuses

There’s no shortage of specialised spending cards in Singapore, which offer up to 4 mpd on specific categories or modes of spend.

| 💳 Specialised Spending Cards |

||

| Card | Earn Rate | Cap |

Citi Rewards Card Citi Rewards CardApply |

4 mpd1 | S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd2 | S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd3 | S$1K per c. month Review |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd4 | S$1.1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd5 | S$1K per c. month Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd6 | S$2K per c. month Review |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd7 | S$1.1K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd8 | S$2K per s. month Review |

| 1. All online transactions except in-app mobile wallet and travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 2. All online transactions (T&Cs) 3. Online transactions for shopping, dining and transportation (T&Cs) 4. Clothes, bags, shoes and shopping (T&Cs) 5. Pick 1: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 6. Pick 2: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 7. For in-person mobile contactless spending, and online shopping & entertainment (T&Cs) 8. For in-person contactless spending, foreign currency transactions and petrol. Min spend of S$1K per s. month applies (T&Cs) |

||

The problem with specialised spending cards is that the 4 mpd rate is typically capped at S$1,000 to S$2,000 of spending per month. Once you exceed that limit, the earn rate drops sharply to just 0.4 mpd, making them unsuitable for large purchases.

To illustrate, suppose I’m buying a S$2,000 laptop online.

The non-optimised approach would be to put the entire S$2,000 on the DBS Woman’s World Card.

- The first S$1,500 earns 6,000 miles because of the DBS Woman’s World Card’s bonus earn rate of 4 mpd for online spending

- But the remaining S$500 earns just 200 miles, based on the DBS Woman’s World Card’s regular earn rate of 0.4 mpd beyond the bonus cap

- Total miles: 6,200

| Spend | Miles | |

DBS Woman’s World Card DBS Woman’s World Card |

S$2,000 | 6,200 (S$1,500 @ 4 mpd & S$500 @ 0.4 mpd) |

| Total | S$2,000 | 6,200 |

The optimised approach would be to put S$1,500 on the DBS Woman’s World Card, and S$500 on the Citi Rewards Card.

- The first S$1,500 earns 6,000 miles because of the DBS Woman’s World Card’s bonus earn rate of 4 mpd for online spending

- The remaining S$500 earns 2,000 miles based on the Citi Rewards Card’s bonus earn rate of 4 mpd for online spending

- Total miles: 8,000

| Spend | Miles | |

DBS Woman’s World Card DBS Woman’s World Card |

S$1,500 | 6,000 (S$1,500 @ 4 mpd) |

Citi Rewards Card Citi Rewards Card |

S$500 | 2,000 (S$500 @ 4 mpd) |

| Total | S$2,000 | 8,000 |

To leverage credit balances across multiple banks

Another use case for splitting payments is to “combine” your credit limits across banks.

For example, if you had a credit limit of S$5,000 with Bank A and S$5,000 with Bank B, you wouldn’t be able to make a purchase of S$10,000 unless it were possible to split payments.

Obviously, I wouldn’t recommend doing this if it means overextending yourself, but I figured I’d mention it for completeness.

How can you split payments?

Split payments via gift cards

Buying gift cards allows you to effectively break up a transaction into two or more different modes of payment. For example, if I have a payment of S$3,000 to make with Merchant X, I could buy 3x S$1,000 gift cards for Merchant X, each using a different credit card.

Some of the bigger gift card aggregators in Singapore can be found below (the merchants shown are indicative; refer to the websites for the full list).

MCC 5311 MCC 5311MCC 5399 Amazon processes transactions over a range of MCCs, so use a card that awards bonuses for general online spend |

|

|

|

|

|

| *Admin fee of up to 5% applies to purchases | |

|

|

MCC 5812 MCC 5812MCC 5814 MCC 5311 ShopBack processes transactions over a range of MCCs, so use a card that awards bonuses for general online spend |

|

|

|

MCC 5947 MCC 5947 |

|

|

|

In addition to these aggregators, other merchants like Harvey Norman, Hipvan, Trip.com and Traveloka also sell gift cards directly under their regular MCCs.

Wherever you buy from, I’d highly advise checking the MCC before purchasing, to make sure it’s rewards-eligible.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Here’s a simple illustration of how gift cards help you maximise rewards.

Suppose I want to purchase a S$3,000 sofa from IKEA. If I were to buy the item directly in-store, the best outcome I could hope for would be to pay with the UOB Visa Signature Card (contactless payment), which would earn 8,400 miles (S$2,000 @ 4 mpd, S$1,000 @ 0.4 mpd).

|

| 👍 250 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 250 Max Miles as a welcome bonus |

| 250 bonus Max Miles |

But instead, I could buy 3x S$1,000 gift cards from HeyMax (MCC 5311):

- Gift Card #1: 6,000 miles (OCBC Rewards @ 6 mpd- limited-time buff till 30 June 2025)

- Gift Card #2: 4,000 miles (Citi Rewards Card @ 4 mpd)

- Gift Card #3: 4,000 miles (DBS Woman’s World Card @ 4 mpd)

This gives me 14,000 miles in total!

As an added bonus, HeyMax also awards its own Max Miles loyalty currency on gift card purchases, which can be transferred at a 1:1 ratio to more than two dozen airline and hotel loyalty programmes.

Split payments via Atome

If gift cards aren’t an option, another way of splitting payments is through a BNPL platform like Atome.

| ❓ What about other BNPL platforms? |

|

With Rely, Hoolah, Pace, and ShopBack Pay all leaving the Singapore market, there isn’t much choice left. Singtel PayLater is largely limited to their own ecosystem, and Grab PayLater requires payment via a GrabPay balance- which you won’t earn any credit card points for topping up. SPayLater has 1% monthly interest for some merchants, and a S$1 handling fee for manual repayments, so it’s not something I actively use. |

Going back to our IKEA sofa example, instead of spending the S$3,000 in a single transaction, I could opt to use Atome and be charged:

- Month 1 (upfront): S$1,000

- Month 2: S$1,000

- Month 3: S$1,000

Each month’s instalment is within the bonus cap for the various specialised spending cards like the Citi Rewards and HSBC Revolution, allowing you to earn 4 mpd on the entire S$3,000. Atome also lets you switch your payment card for the 2nd and 3rd instalment if you wish, so you don’t have to use the same card every month.

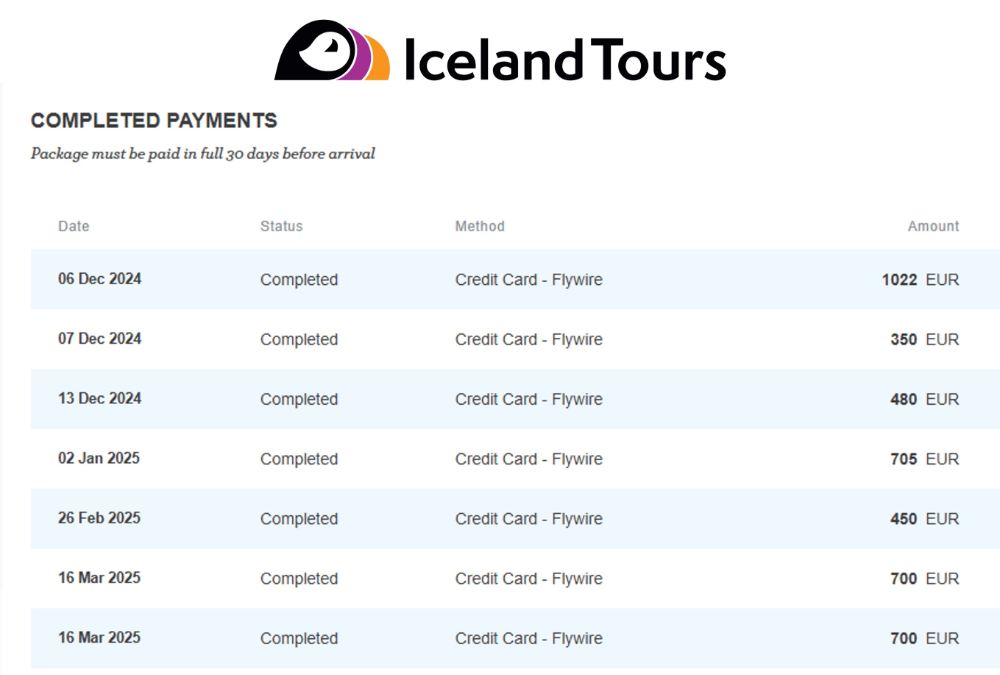

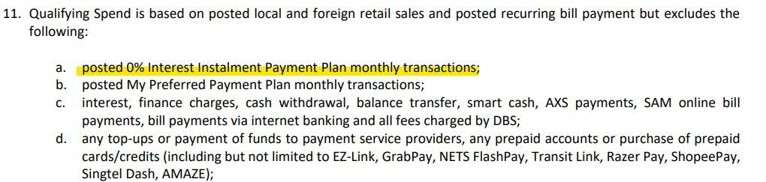

| ❓ Aren’t instalments ineligible for points? |

|

The T&Cs of credit card rewards programmes typically exclude instalments from earning points. But when banks say “instalments”, they’re referring to their in-house instalment plans. Atome spend is not treated the same way. |

While Atome will automatically bill your card each month, it’s best practice to trigger the 2nd and 3rd payments manually (which can be done via the Atome app, under the Bills section). It’s been reported that automatic payments may be seen by the bank as recurring billing arrangements, which are ineligible for points.

I’ve written a separate article about the best cards to use for Atome.

Conclusion

Splitting payments is how you optimise the spend on your credit cards, ensuring that each incremental dollar earns as high a reward as possible.

If the merchant doesn’t let you pay with more than one credit card, two workarounds include buying gift cards, or using a BNPL service. The latter also serves as a “time machine”, shifting this month’s expenses to be utilised against future months’ bonus caps.

Any other ways you know of splitting payments?

You should also list the drawbacks. Eg buying gift cards greatly reduces your refund potential (as you’ll get the gift card or credit back, and not a refund onto your card), you may lose the ability to use chargeback protections if something goes wrong (you’ll be wholly reliant on the merchant or the marketplace to resolve your issue) and you may not get any insurances (eg travel, purchase protection) that comes with your card.

This is quite helpful since iPhone 15 is going to be released soon. Does anyone know what’s the best way to buy a new iPhone?

Atome BNPL at iStudio, that has been my go-to option for all Apple devices purchases.

How about Krisshop?

I’ve never made any purchases at Krisshop before but the critical component is your credit card pairing with Atome itself given its Atome which will bill your credit card

Thanks for sharing, Eric. Which card do you use for Atome? Read in another thread comments Citi no longer rewards 4mpd for MCC 5999(used by Atome)

@Karl – I’ve been using HSBC Revolution on Atome to reap the 4miles/dollar benefit. From an individual stand point, I’ve never had issues of missing miles dispute via using this Revolution-Atome pairing to date and my last Atome payment in June 2023. That said, we all know banking terms and conditions are so fickle, I do advocate each to check before making the purchase.

also can use UOB Visa Signature to pay using paywave (as long iphone between 1-2k)

Is it possible to utilize BNPL services for flight bookings? I think you can buy flights with Atome on Klook and Trip.com, but then the drawback is… I’m not sure if you can claim frequent flyer miles for those flights then.

yes you can claim FF, you just need to enter your detail in the airline booking

Hi Aaron,

Wanted to ask regarding the Citi Rewards Thankyou 10x points.

If I purchase online from iShopChangi and pay using Atome (installments), installments from Atome is paid using Citi Rewards Card, does it count towards the point accumulation?

The reason I want to Atome is because there is 10% voucher if use Atome to pay.

Thank you in advanced.

I made a purchase with shopee paylater but later realised I received no points from citi rewards points. When I asked customer service, i found it was coded as MCC 6540 so citi doesn’t award points